U.S. Stock Futures Rise Ahead Of PPI and Retail Sales; Oil Prices Climb

14 Março 2024 - 8:41AM

IH Market News

U.S. index futures are rising in Thursday’s pre-market, with

investors awaiting producer inflation data and retail sales, which

impact U.S. interest rate projections for the year.

At 06:39 AM, Dow Jones futures (DOWI:DJI) rose 108 points, or

0.27%. S&P 500 futures advanced 0.32%, and Nasdaq-100 futures

gained 0.46%. The yield on 10-year Treasury notes was at

4.194%.

In the commodities market, West Texas Intermediate crude for

April rose 0.84% to $80.39 per barrel. Brent crude for May

increased by 0.70% to around $84.62 per barrel. Iron ore traded on

the Dalian exchange fell 2.62% to $110.99 per metric ton. Iron ore

for April on the Singapore exchange dropped 2.37% to the lowest

level since August 17, at $103.05 a ton.

At 08:30 AM, Thursday’s economic agenda is set to be busy with

the release of the February producer price index, a key indicator

for assessing inflationary pressure at the production level, and

the last major economic data to be released before the Federal

Reserve’s monetary policy meeting next week. At the same time,

unemployment insurance claims for the week ending last Saturday

will be released, providing insights into the health of the labor

market. Also at the same time, the Commerce Department will present

February’s retail sales, with LSEG consensus forecasting a 0.3%

monthly increase and a 1.1% annual increase.

Asia-Pacific stock markets ended Thursday without a clear trend

and with modest movements, echoing the behavior observed on Wall

Street the day before. The session was characterized by the absence

of new stimuli that could guide investors, resulting in cautious

adjustments by them. Japan’s Nikkei index managed a modest recovery

of 0.29%, reaching 38,807.38 points, after days of negative

performance influenced by speculation about a possible change in

the Bank of Japan (BoJ)’s negative interest rate policy, especially

with the approach of the monetary policy meeting. Meanwhile, in

China, markets recorded light to moderate losses, with the Shanghai

Composite and Shenzhen Composite falling respectively 0.18% and

0.59%. The Hang Seng in Hong Kong and the ASX 200 in Australia also

had a challenging day, unlike the Kospi in South Korea, which stood

out with a gain of 0.94%.

European markets are predominantly positive, continuing the

recent upward trend and reaching new unprecedented levels during

the session, especially in the stock markets of Frankfurt and

Paris. Investors remain in a state of anticipation ahead of the

imminent release of crucial economic indicators from the United

States. Notably, Germany’s DAX index climbed to an unprecedented

18,027.56 points, while France’s CAC 40 also broke barriers,

setting a new intraday high by reaching 8,209.98 points.

After recovering on Tuesday, stocks showed mixed performance on

Wednesday. The Dow rose for the third consecutive day, while the

S&P 500 and Nasdaq fell 0.19% and 0.54%, respectively,

influenced by weakness in the technology sector. The lack of

significant economic data kept trading activity moderate.

On the earnings front, Dollar General

(NYSE:DG), Dick’s Sporting Goods (NYSE:DKS),

Futu (NASDAQ:FUTU), Canadian

Solar (NASDAQ:CSIQ), GoHealth

(NASDAQ:GOCO), Solo Brands (NYSE:DTC), among

others, are scheduled to present financial reports before the

market opens.

After the close, the numbers from Adobe

(NASDAQ:ADBE), Blink Charging (NASDAQ:BLNK),

Ulta Beauty (NASDAQ:ULTA),

PagerDuty (NYSE:PD), Smartsheet

(NYSE:SMAR), Rigetti Computing (NASDAQ:RGTI),

Kopin Corporation (NASDAQ:KOPN), Wheaton

Precious Metals (NYSE:WPM), Phreesia

(NYSE:PHR), Vaxart (NASDAQ:VXRT), and more will be

awaited.

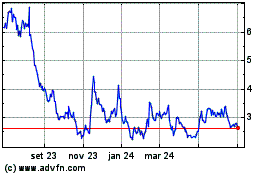

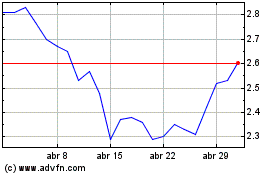

Blink Charging (NASDAQ:BLNK)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Blink Charging (NASDAQ:BLNK)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024