Ethereum launches Dencun upgrade to reduce layer 2 transaction

costs

Ethereum (COIN:ETHUSD) introduced the Dencun upgrade on

Wednesday, which implements mechanisms to lower transaction costs

on layer 2 solutions that bundle multiple transactions for the main

network. This change has already shown results, with the average

transaction cost on Optimism (COIN:OPUSD) dropping to about 4

cents, a significant decrease from previous amounts. The upgrade

adds “blobs” for temporary data storage, enabling layer 2 solutions

like Optimism, Arbitrum (COIN:ARBUSD), and zkSync to process

transactions at a lower cost.

Bitcoin volatility spikes on Tuesdays and Wednesdays after ETF

launches

Since the debut of Bitcoin ETFs on January 11, 2024, a distinct

pattern of increased Bitcoin (COIN:BTCUSD) price volatility,

particularly on Tuesdays and Wednesdays, has been observed,

according to an analysis by CryptoSlate. Despite a price increase

on Mondays, the sharp mid-week fluctuations suggest a significant

influence of ETFs and possible leveraged position adjustments. This

phenomenon introduces a new market dynamic, with weekends showing

more stability.

Bitcoin ETFs maintain momentum with significant inflows

On March 13, Bitcoin ETFs saw a continuous increase, with net

inflows of $683.7 million, following the previous day’s growth, as

reported by Bitmex Research. Leading the movement, the iShares

Bitcoin ETF by BlackRock (NASDAQ:IBIT) attracted $586.5 million,

while the Fidelity ETF (AMEX:FBTC) saw inflows of $281.5 million.

The Invesco Galaxy (AMEX:BTCO) managed to halt losses, recording no

net movements after three consecutive days of significant

withdrawals. Meanwhile, VanEck (AMEX:HODL) noted an increase in its

contributions, accumulating an additional $16.5 million in

investments after waiving fees, maintaining the trend of robust

receipts from the previous two days. On the other hand, the

Grayscale ETF (AMEX:GBTC) faced a setback with an increase in

redemptions, resulting in $276.5 million leaving the fund. Other

funds such as those from Bitwise (AMEX:BITB) and ARK Invest

(AMEX:ARKB) also saw notable gains, with the sector showing clear

signs of growing adoption and sustained interest in Bitcoin as an

investment.

Bakkt faces NYSE delisting risk due to falling share price

Bakkt (NYSE:BKKT), a cryptocurrency company linked to the

Intercontinental Exchange (ICE), may be delisted from the New York

Stock Exchange, owned by ICE, due to a decline in its share value.

According to a company statement, the NYSE warned Bakkt for not

meeting the minimum price requirements, with its Class A shares

averaging below $1 for 30 consecutive days until March 12, 2024.

With shares recently closing at $0.5978, Bakkt’s market

capitalization plummeted to $80 million, a steep decline from the

peak of $40 per share in October 2021. Launched in 2019 to offer

Bitcoin custody and trading services for institutions, Bakkt

struggled to expand into the retail market, eventually abandoning

this avenue last year.

Robinhood shares rise with increased February trading volume

Shares of Robinhood Markets (NASDAQ:HOOD) saw a pre-market jump

on Thursday after the company announced significant trading volume

growth in February compared to January. The online trading platform

experienced an increase across all asset categories, with stock

volume growing 36% to $80.9 billion, options rising 12% to $119.1

million, and crypto volumes climbing 10% to $6.5 billion, leading

to a 16% advance in assets under custody, reaching $118.7

billion.

MicroStrategy announces new sale of $500 million in convertible

senior notes

Amidst the crypto market euphoria, MicroStrategy (NASDAQ:MSTR)

stands out with its bold strategy. The company announced its

intention to raise $500 million through the sale of convertible

senior notes, aiming to expand its Bitcoin (COIN:BTCUSD) reserves

as the cryptocurrency reaches new highs. This is the second similar

announcement in a few weeks, reaffirming MicroStrategy’s

commitment, led by Michael Saylor, to heavily invest in Bitcoin.

The company expressed the possibility of using part of the funds to

strengthen its operations and stated that the sale is subject to

changes.

Benchmark initiates coverage of Bitdeer with strong growth outlook

On Thursday, the investment bank Benchmark recommended shares of

Bitdeer Technologies (NASDAQ:BTDR) with a “Buy” rating,

highlighting the potential for appreciation against its current

valuation and growth expectations. The target price was set at $13,

after the stock closed Wednesday with a gain of over 7%, at

$6.74.

Bernstein forecast: Crypto market could triple by 2025

Analysts at Bernstein predict that the cryptocurrency market cap

could reach $7.5 trillion by 2025, driven by unprecedented

institutional adoption. The expected growth will be led by Bitcoin

(COIN:BTCUSD), with a value of $3 trillion, followed by the

Ethereum ecosystem (COIN:ETHUSD) and other major blockchains. They

also see blockchain-based games as a crucial factor and project

significant expansion for Bitcoin ETFs in the US.

BNB Chain launches rollup-as-a-service for L2 expansion on BSC

BNB Chain (COIN:BNBUSD) introduced its rollup service (RaaS) to

foster the development of second-layer blockchain solutions on the

BNB Smart Chain. This service allows decentralized applications and

companies to create their own L2 solutions, with support from

collaborators like AltLayer, NodeReal, and Movement Labs. The

initiative aims to make BNB Chain a central hub for Web3

development, promoting integration and widespread adoption. With

OpBNB Connect, BNB Chain seeks to unite all L2s created on the

platform, forming a cohesive network that favors innovation and the

sharing of benefits among the various L2 solutions. This launch is

part of BNB Chain’s strategic planning for 2024, announced in

January.

Meme coin market shines with a 9% increase

The market value of meme coins grew 9% in the last 24 hours,

standing out in a cryptocurrency market that saw a slight 0.2%

decline in the same period. The top five meme coins contribute 35%

to the total segment’s market cap, now above $66 billion. Popular

coins like Dogecoin (COIN:DOGEUSD), Pepe (COIN:PEPEUSD), Dogwifhat,

and Floki (COIN:FLOKIUST) also saw significant gains. This surge

comes at a time of renewed attention to the sector, driven by Elon

Musk’s comments on Dogecoin and successful promotional

campaigns.

Quantum Blockchain announces ‘Method C’ for AI-driven Bitcoin

mining

Francesco Gardin, leader of Quantum Blockchain Technologies

(LSE:QBT), unveiled ‘Method C’, an innovation in bitcoin mining

that combines AI and machine learning to predict data processes,

aiming for up to a 30% reduction in necessary calculations. This

technique, which improves efficiency and reduces energy

consumption, is in the transition phase from concept to product,

facing integration challenges with existing hardware. With plans

for patent protection and tests on GPUs and ASICs, Quantum seeks to

demonstrate this efficiency to potential partners, promising

significant updates on the performance and practical application of

Method C compared to traditional methods.

Fireblocks and Zodia Markets join forces to boost cross-border

payments

Fireblocks, a digital asset management platform, formed a

partnership with UK-based exchange Zodia Markets to optimize

corporate cross-border payments. The collaboration aims to

accelerate fund transfers using stablecoins, promising greater

efficiency compared to conventional fiat currency methods.

Utilizing Zodia’s digital asset and Fireblocks’ peer-to-peer

transaction technology, the initiative marks a significant

advancement in adopting stablecoins for fast and cost-effective

transfers.

mmERCH secures $6.4 million to revolutionize fashion with Web3

mmERCH, an innovative blockchain-based fashion startup, secured

funding of $6.4 million, reaching a valuation of $25.7 million. The

funding round was led by Liberty City Ventures and included

investments from entities like 6529 Holdings, Christie’s Ventures,

and Flamingo DAO. Colby Mugrabi, founder of mmERCH, highlights that

the company is set to launch a pioneering collection, targeting the

intersection of art, fashion, and technology with unique

“neo-couture” pieces. This move attracted investors from various

sectors, promising to redefine fashion with a blend of creativity,

individuality, and community.

US Treasury tracks $165 million in suspicious crypto transactions

linked to Hamas

The US Treasury Department, tasked with combating terrorism

financing, identified $165 million in potentially Hamas-associated

cryptocurrency transactions. Analyzing suspicious activity reports

from January 2020 to October 2023, the Financial Crimes Enforcement

Network noted that part of this amount might be linked to the

group, which the US recognizes as a terrorist organization. The

investigation is ongoing, with over 200 cryptocurrency addresses

under scrutiny.

Hong Kong flags Bybit as suspect and begins new CBDC test phase

The Securities and Futures Commission of Hong Kong (SFC) flagged

exchange Bybit as suspect, warning about its unlicensed products

and the risk of losses for investors. This step aligns with the

mission to protect investors as the city aspires to be a global

crypto hub. Bybit responded, emphasizing dialogue with regulators

and compliance with local laws, though not providing specific

details. Additionally, the Hong Kong Monetary Authority (HKMA)

announced the progression to the second phase of testing for the

central bank digital currency, e-HKD. Following the completion of

the first phase, which focused on retail payments, offline

payments, and tokenized asset settlement, this new stage will

explore innovative applications of the digital Hong Kong dollar,

including programmability and tokenization. The project also opens

up for new interested participants until May 17.

Crypto.com fined $3.1 million by De Nederlandsche Bank

The De Nederlandsche Bank imposed a fine of approximately $3.1

million (€2.85 million) on Crypto.com for operating without proper

registration in the country for two years. The penalty was applied

to Forix DAX Mt, the Dutch subsidiary of the platform, for not

adhering to local anti-money laundering and terrorism financing

legislation. Despite the fine imposed in October 2023, Crypto.com

contested the decision and has since officially registered with the

Central Bank in July, joining other licensed crypto entities in the

Netherlands.

UK court denies Craig Wright’s claim as Bitcoin creator

The UK Supreme Court concluded that Australian computer

scientist Craig Wright is not the author of the Bitcoin white paper

nor Satoshi Nakamoto, its pseudonymous creator. The decision came

after a legal dispute with COPA, refuting Wright’s claims of being

the mastermind behind Bitcoin between 2008 and 2011. The verdict,

highlighting inconsistencies in Wright’s evidence, reinforces his

non-association with the cryptocurrency’s creation.

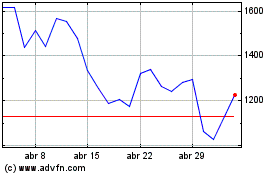

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024