Nvidia Unveils Blackwell: The Next-Gen AI Architecture Powering the Future of Computing

19 Março 2024 - 7:35AM

IH Market News

Nvidia (NASDAQ:NVDA) unveiled its latest advancement in graphics

processor architecture named Blackwell on Monday, marking a

significant leap forward from its existing Hopper technology. This

new development aims to enhance the performance and efficiency of

artificial intelligence (AI) systems, such as OpenAI’s ChatGPT,

cementing Nvidia’s role as a key player in the AI hardware market.

With a market value of $2.195 trillion as of last Friday, Nvidia

stands as the third-largest company globally, trailing only behind

tech giants Apple (AAPL) and Microsoft (MSFT).

The announcement was made at Nvidia’s event in San Jose,

California, which drew an estimated crowd of 20,000 attendees.

Dubbed the GPU Technology Conference (GTC), or “The Woodstock of

Artificial Intelligence” by Bank of America analyst Vivek Arya, the

event highlighted Nvidia’s increasing prominence in the tech

industry.

Nvidia’s Blackwell architecture promises a revolution in

generative AI capabilities, allowing systems to analyze up to 10

trillion parameters simultaneously, with a 25-fold reduction in

energy consumption and cost compared to its predecessors. During

the event, Nvidia CEO and co-founder Jensen Huang hailed the new

technology as the driving force behind a new industrial

revolution.

The Blackwell architecture will power the NVIDIA GB200 Grace

Blackwell, a high-performance computing solution comprising two

Blackwell GPUs and a Grace processor, tailored for server platforms

used in AI model training and execution.

Tech giants such as AWS (Amazon), Microsoft, Google (Alphabet),

and Oracle are among the first to receive Nvidia’s cutting-edge

technology. Additionally, companies like Cisco, Dell, Hewlett

Packard Enterprise, Lenovo, and Supermicro have struck deals to

offer servers equipped with Blackwell GPUs.

Nvidia’s launch comes at a time when AI technology is fueling

unprecedented growth for the company, with record-breaking sales

figures and a surge in market valuation, mirroring the broader tech

industry’s upward trend. In the fourth quarter alone, Nvidia

reported a 265% year-on-year revenue increase to $22.1 billion,

while net income soared to $12.829 billion, a 491% rise.

The AI boom has also prompted Nvidia’s competitors to step up

their game. AMD introduced its MI300 AI chip series in December,

aiming to challenge Nvidia’s dominance, while Intel announced its

Gaudi 3 line, targeting the AI accelerator market later this

year.

Originally founded in 1993, Nvidia was best known for its

graphic processing units (GPUs) popular among gamers. However, the

2000s saw a shift as researchers began leveraging GPUs for parallel

processing in AI applications, a task at which they excelled over

traditional CPUs. Recognizing this potential, Nvidia developed

Cuda, a programming language for GPU-based applications, and

shifted its focus towards high-performance chips for servers,

further establishing its foothold in the AI hardware market.

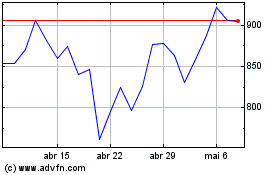

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024