U.S. Stocks Show Notable Turnaround Amid Rebound By Nvidia

19 Março 2024 - 5:35PM

IH Market News

After coming under pressure early in the session, stocks showed

a significant turnaround over the course of the trading day on

Tuesday. The major averages climbed well off their worst levels of

the day and into positive territory.

The major averages reached new highs for the session going into

the close of trading. The Dow (DOWI:DJI) advanced 320.33 points or

0.8 percent to 39,110.76, the S&P 500 (SPI:SP500) climbed 29.09

points or 0.6 percent to 5,178.51 and the Nasdaq (NASDAQI:COMP)

rose 63.34 points or 0.4 percent to 16,166.79.

The turnaround on Wall Street partly reflected a rebound by

Nvidia (NASDAQ:NVDA), as the AI darling’s performance has recently

been a key driver of activity on Wall Street.

After tumbling as much as 3.9 percent early in the session,

shares of Nvidia are currently jump by 1.1 percent on the day.

The recovery by Nvidia came after traders digested news out of

the chipmaker’s first-ever GTC Conference on Monday, when the

company unveiled its latest line of AI chips, called Blackwell.

Meanwhile, traders also continued to look ahead to the Federal

Reserve’s highly anticipated monetary policy announcement on

Wednesday.

While the Fed is widely expected to leave interest rates

unchanged, the central bank’s accompanying statement and economic

projections could have a significant impact on the outlook for

rates.

Recent hotter-than-expected inflation readings have reduced

optimism about the likelihood of the Fed’s first rate cut coming in

June.

On the U.S. economic front, a report released by the Commerce

Department showed a substantial rebound in new residential

construction in the U.S. in the month of February.

The Commerce Department said housing starts spiked by 10.7

percent to an annual rate of 1.521 million in February after

plunging by 12.3 percent to a revised rate of 1.374 million in

January.

Economists had expected housing starts to surge by 7.1 percent

to a rate of 1.425 million from the 1.331 million originally

reported for the previous month.

The report also said building permits shot up by 1.9 percent to

an annual rate of 1.518 million in February after dipping by 0.3

percent to a revised rate of 1.489 million in January.

Building permits, an indicator of future housing demand, were

expected to jump by 1.7 percent to a rate of 1.495 million from the

1.470 million originally reported for the previous month.

Sector News

Oil service stocks moved significantly higher over the course of

the session, driving the Philadelphia Oil Service Index up by 2.2

percent to its best intraday level in well over four months.

The rally by oil service stocks came amid an increase by the

price of crude oil, with crude for April delivery climbing $0.75 to

$83.47 barrel.

The substantial rebound by housing starts also contributed to

considerable strength among housing stocks, as reflected by the 1.7

percent gain posted by the Philadelphia Housing Sector Index.

Steel, natural gas and biotechnology stocks also moved notably

higher, while gold stocks saw continued weakness amid a modest

decrease by the price of the precious metal.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance during trading on Tuesday.

Japan’s Nikkei 225 Index climbed by 0.7 percent, while China’s

Shanghai Composite Index slid by 0.7 percent.

Meanwhile, the major European markets all moved to the upside

over the course of the session. While the French CAC 40 Index

advanced by 0.7 percent, the German DAX Index and the U.K.’s FTSE

100 Index rose by 0.3 percent and 0.2 percent, respectively.

In the bond market, treasuries regained ground after trending

lower over the past several sessions. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, fell by

4.3 basis points to 4.297 percent.

Looking Ahead

Trading activity on Wednesday may be somewhat subdued in the

lead up to the Fed’s monetary policy announcement at 2 pm ET.

Source: RTTNEWS

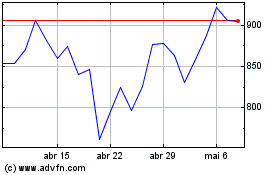

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024