Looming Fed Announcement May Lead To Choppy Trading On Wall Street

20 Março 2024 - 10:16AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Wednesday, with stocks likely to show a lack of

direction following the rebound seen over the course of the

previous session.

Traders may be reluctant to make significant moves ahead of the

Federal Reserve’s highly anticipated monetary policy announcement

this afternoon.

While the Fed is widely expected to leave interest rates

unchanged, traders will look to the accompanying statement and

economic projections for clues about the outlook for rates.

CME Group’s FedWatch Tool is indicating a 99.0 percent chance

the Fed will leave rates unchanged today and a 90.7 percent chance

rates will remains unchanged in May.

The outlook for June is more mixed, however, with the FedWatch

Tool indicating a 55.0 percent chance of a quarter point rate cut

and a 39.7 percent chance of an extended pause.

Nonetheless, the tech sector may receive a boost from a surge by

shares of Intel (INTC), with the semiconductor giant jumping by 2.4

percent in pre-market trading.

The advance by Intel comes after the company was awarded up to

$8.5 billion in direct funding from the Biden administration for

commercial semiconductor projects under the CHIPS and Science

Act.

After coming under pressure early in the session, stocks showed

a significant turnaround over the course of the trading day on

Tuesday. The major averages climbed well off their worst levels of

the day and into positive territory.

The major averages reached new highs for the session going into

the close of trading. The Dow advanced 320.33 points or 0.8 percent

to 39,110.76, the S&P 500 climbed 29.09 points or 0.6 percent

to 5,178.51 and the Nasdaq rose 63.34 points or 0.4 percent to

16,166.79.

The turnaround on Wall Street partly reflected a rebound by

Nvidia (NASDAQ:NVDA), as the AI darling’s performance has recently

been a key driver of activity on Wall Street.

After tumbling as much as 3.9 percent early in the session,

shares of Nvidia are currently jump by 1.1 percent on the day.

The recovery by Nvidia came after traders digested news out of

the chipmaker’s first-ever GTC Conference on Monday, when the

company unveiled its latest line of AI chips, called Blackwell.

Meanwhile, traders also continued to look ahead to the Federal

Reserve’s highly anticipated monetary policy announcement on

Wednesday.

On the U.S. economic front, a report released by the Commerce

Department showed a substantial rebound in new residential

construction in the U.S. in the month of February.

The Commerce Department said housing starts spiked by 10.7

percent to an annual rate of 1.521 million in February after

plunging by 12.3 percent to a revised rate of 1.374 million in

January.

Economists had expected housing starts to surge by 7.1 percent

to a rate of 1.425 million from the 1.331 million originally

reported for the previous month.

The report also said building permits shot up by 1.9 percent to

an annual rate of 1.518 million in February after dipping by 0.3

percent to a revised rate of 1.489 million in January.

Building permits, an indicator of future housing demand, were

expected to jump by 1.7 percent to a rate of 1.495 million from the

1.470 million originally reported for the previous month.

Oil service stocks moved significantly higher over the course of

the session, driving the Philadelphia Oil Service Index up by 2.2

percent to its best intraday level in well over four months.

The rally by oil service stocks came amid an increase by the

price of crude oil, with crude for April delivery climbing $0.75 to

$83.47 barrel.

The substantial rebound by housing starts also contributed to

considerable strength among housing stocks, as reflected by the 1.7

percent gain posted by the Philadelphia Housing Sector Index.

Steel, natural gas and biotechnology stocks also moved notably

higher, while gold stocks saw continued weakness amid a modest

decrease by the price of the precious metal.

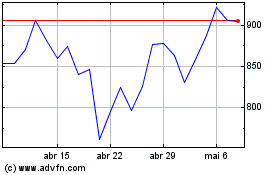

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

NVIDIA (NASDAQ:NVDA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024