U.S. Index Futures Surge While Wall Street Eyes Rebound on Earnings Focus, Oil Prices Slip

22 Abril 2024 - 9:09AM

IH Market News

U.S. index futures saw significant gains in Monday’s pre-market

trading, signaling a potential stabilization on Wall Street after a

six-session streak of losses for the S&P 500 and the Nasdaq

Composite. Meanwhile, investors are refocusing on corporate

earnings results.

As of 6:09 AM, Dow Jones futures (DOWI:DJI) were up 184 points,

or 0.48%. S&P 500 futures advanced 0.58%, and Nasdaq-100

futures gained 0.74%. The yield on 10-year Treasury bonds was at

4.656%.

In the commodities market, West Texas Intermediate crude for May

fell 0.40%, to $82.81 per barrel. Brent crude for June dropped

0.69%, to around $86.69 per barrel. Iron ore traded on the Dalian

exchange decreased by 0.52%, to $119.08 per metric ton.

On Monday’s economic agenda, investors are waiting for the 8:30

AM reading of the Chicago Fed’s national activity index for

March.

European markets started the week on a high, showing resilience

after a week marked by uncertainties due to tensions in the Middle

East and adjustments in interest rate expectations. Retail sector

stocks are leading the gains, in contrast to the automotive sector,

which is falling. A notable point was the significant appreciation

of Galp Energia (EU:GALP) shares, up 17%, reaching

a 16-year high, driven by promising prospects for a gas project in

Namibia. The absence of major data releases or significant events

kept investors focused on market movements and corporate news.

Asian markets showed notable recovery after initial turbulence

caused by the conflict between Israel and Iran. On Monday,

investors refocused on fundamental economic data, with stability in

China’s lending rates highlighted. Despite the maintenance of

one-year and five-year lending rates, the market reaction was

mixed, with Hong Kong’s Hang Seng index advancing almost 2%, while

China’s CSI 300 fell by -0.67%. In contrast, markets in Japan and

South Korea saw solid gains, with the Nikkei 225 and the Kospi

rising 1% and 1.45%, respectively. The situation of Chinese

electric vehicle manufacturers, such as Li Auto

(NASDAQ:LI), which suffered a significant drop after reducing the

prices of its models, was also a point of attention, highlighting

the volatility and competition in the sector.

On Friday, the U.S. stock market saw a notable split: while the

Dow Jones grew by 211.02 points, driven by robust gains from

American Express (NYSE:AXP) and an increase in oil

prices, the Nasdaq fell by 319.49 points due to heavy losses in

tech giants such as Netflix (NASDAQ:NFLX) and

Nvidia (NASDAQ:NVDA). The latter also reflected

the negative trend in the semiconductor sector. Simultaneously, the

S&P 500 continued its downward trajectory, marking the sixth

consecutive day of losses. Last week, the Nasdaq dropped 5.5% and

the S&P 500 plunged 3.1%, while the Dow edged up 0.01%.

On the quarterly earnings front, reports are scheduled to be

presented before the market opens from Verizon

(NYSE:VZ), Albertsons (NYSE:ACI),

Truist (NYSE:TFC), Zions

Bancorporation (NASDAQ:ZION), Bank of

Hawaii (NYSE:BOH), Washington Trust

Bancorp (NASDAQ:WASH), HBT Financial

(NASDAQ:HBT), AZZ (NYSE:AZZ), Sify

Technologies Limited (NASDAQ:SIFY), JSC Kaspi

kz (NASDAQ:KSPI), among others.

After the close, earnings from Nucor

(NYSE:NUE), Cleveland-Cliffs (NYSE:CLF),

SAP (NYSE:SAP), Cadence Design

Systems (NASDAQ:CDNS), AGNC Investment

Corp (NASDAQ:AGNC), Globe Life (NYSE:GL),

Medpace (NASDAQ:MEDP), Ameriprise

Financial (NYSE:AMP), Packing Corporation

America (NYSE:PKG), Alexandria

(NYSE:ARE), and more are awaited.

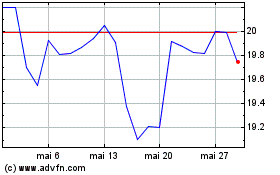

Galp Energia Sgps (EU:GALP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Galp Energia Sgps (EU:GALP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024