U.S. Index Futures Flat Ahead of April CPI Data Release, Oil Prices Drop

15 Maio 2024 - 8:50AM

IH Market News

U.S. index futures are virtually flat in pre-market trading this

Wednesday, with Wall Street awaiting April’s consumer price index

data.

At 7:18 AM, Dow Jones futures (DOWI:DJI) were up 3 points, or

+0.01%. S&P 500 futures rose 0.03%, and Nasdaq-100 futures lost

0.02%. The 10-year Treasury yield stood at 4.41%.

In the commodities market, West Texas Intermediate crude for

June fell 0.53%, to $77.61 per barrel. Brent crude for July fell

0.56%, near $81.92 per barrel. Iron ore traded on the Dalian

exchange fell 1.55%, to $118.82 per metric ton.

On Wednesday’s economic agenda, the April consumer price index

(CPI) reading will be released at 8:30 AM by the Department of

Labor. The May Empire State manufacturing index will be released at

the same time by the Federal Reserve Bank of New York. April retail

sales in the United States will also be released at 8:30 AM by the

Department of Labor. At 10:00 AM, the May homebuilder confidence

index will be released by the National Association of Home Builders

(NAHB) and Wells Fargo. The oil inventory position through last

Friday will be published at 10:30 AM by the Department of Energy

(DoE).

European markets are mixed today, with investors awaiting U.S.

inflation data. Among individual stocks, ABN Amro

(EU:ABN) fell 2.5% despite a 29% rise in first-quarter profits,

while Commerzbank (TG:CBK) rose 3.4% after

better-than-expected profits. Burberry (LSE:BRBY)

fell 3.7% due to a challenging outlook. The UK’s FTSE 100 hit a

record high of 8,474.41 points, driven by a 7.6% rise in

Experian (LSE:EXPN).

Asia-Pacific stock markets closed mixed on Wednesday, reflecting

investor caution ahead of new U.S. inflation data that could

influence interest rate trajectories in the world’s largest

economy. China’s Shanghai SE index fell 0.82%, while Japan’s Nikkei

rose slightly by 0.08%. In Hong Kong, the Hang Seng Index fell

0.22%, while South Korea’s Kospi rose 0.11%. Australia’s ASX 200

also closed higher, posting a gain of 0.35%.

On Tuesday, U.S. stocks fluctuated but mostly closed higher. The

Dow Jones rose 0.32% to 39,558.11 points, the S&P 500 increased

0.48% to 5,246.68 points, and the Nasdaq advanced 0.75% to a record

high of 16,511.18 points. The positive close came as Treasury

yields fell after an initial rise, despite an unexpected increase

in April producer prices.

The producer price index (PPI) for final demand rose 0.5% in

April, after a revised decline of 0.1% in March. Economists had

expected a 0.3% increase, compared to the originally reported 0.2%

increase for March. Annually, producer price growth accelerated to

2.2% in April, from a downward revision of 1.8% in March. While the

report raised uncertainty about interest rates, economists

highlighted the March revisions as a positive sign.

Scheduled to report quarterly earnings before the market opens

are Monday.com (NASDAQ:MNDY),

Dynatrace (NYSE:DT), Hut 8

(NASDAQ:HUT), Dole (NYSE:DOLE), Cresco

Labs (USOTC:CRLBF), Acurx Pharmaceuticals

(NASDAQ:ACXP), MakeMyTrip Limited (NASDAQ:MMYT),

Seanergy (NASDAQ:SHIP), Arcos

Dorados (NYSE:ARCO), Bio-Path Holdings

(NASDAQ:BPTH), among others.

After the close, reports are expected from Cisco

Systems (NASDAQ:CSCO), Grab

(NASDAQ:GRAB), Copa Airlines (NYSE:CPA),

Inotiv (NASDAQ:NOTV), Maxeon

(NASDAQ:MAXN), Iris Energy (NASDAQ:IREN),

Fluent (NASDAQ:FLNT), Consolidated

Water (NASDAQ:CWCO), Kore Group Holdings

(NYSE:KORE), Spero Therapeutics (NASDAQ:SPRO), and

more.

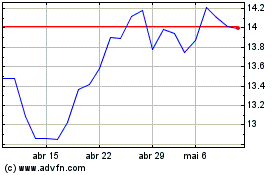

Commerzbank (TG:CBK)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

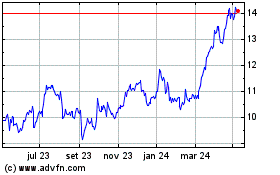

Commerzbank (TG:CBK)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025