U.S. index futures are largely flat in pre-market trading this

Monday, after a strong week on Wall Street, driven by the Federal

Reserve’s 50 basis point interest rate cut. The Dow hit a record

high above 42,000 points, with investors eyeing upcoming economic

data and Fed speeches this week.

At 5:23 AM, Dow Jones futures (DOWI:DJI) rose 6 points or 0.01%.

S&P 500 futures gained 0.08%, and Nasdaq-100 futures advanced

0.15%. The 10-year Treasury yield stood at 3.745%.

In commodities, oil prices rose on concerns about Middle Eastern

conflict potentially disrupting supply. Hezbollah and Israel

exchanged fire on Sunday following intense bombings. Hezbollah

launched rockets at northern Israel, while communication devices

linked to the group were reportedly destroyed by Israel, which has

not confirmed responsibility. Additionally, the recent U.S.

interest rate cuts are fueling expectations of higher demand.

West Texas Intermediate crude for November rose 0.17% to $71.12

per barrel, while Brent for November increased 0.07% to $74.54 per

barrel.

Gold (PM:XAUUSD) is down -0.2% at $2,617.90, after hitting a

record high of $2,631.17 per ounce, spurred by the Federal

Reserve’s rate cuts. Despite strong performance, analysts warned of

potential overbought signals in the market.

On today’s U.S. economic agenda, at 8:00 AM, Atlanta Fed

President Raphael Bostic will speak. At 09:45 AM, preliminary

September PMIs will be released: the services PMI is expected at

55.4, and the manufacturing PMI at 48.4. At 10:15 AM, Chicago Fed’s

Austan Goolsbee will speak, followed by Minneapolis Fed’s Neel

Kashkari at 1:00 PM.

In Asia-Pacific, Australia’s S&P/ASX 200 fell 0.69%, closing

at 8,152.9. In South Korea, the Kospi rose 0.33%, and the Kosdaq

0.91%. Hong Kong’s Hang Seng dipped 0.2% in the final hour of

trading, while China’s CSI 300 rose 0.37%. Taiwan’s index closed up

0.57%.

In India, economic activity grew at its slowest pace in 2024,

with declines in the services and manufacturing sectors, according

to an HSBC survey. The manufacturing PMI dropped to 56.7 (from

57.5), and services PMI to 58.9 (from 60.9). The composite PMI fell

to 59.3 (from 60.7), still indicating expansion. Nonetheless, the

central bank forecasts robust growth above 7% by March 2025.

In China, the youth unemployment rate reached 18.8% in August,

exceeding the July record. Beijing adjusted the methodology to

exclude students, but the rate remains 3.5 times higher than the

general urban unemployment rate of 5.3%. The government is trying

to ease the situation with subsidies and hiring incentives.

Despite calls for rate cuts, the People’s Bank of China kept its

key rates unchanged. To support banking liquidity, it injected

234.6 billion yuan into the system and reduced the 14-day reverse

repo rate to 1.85%, below the 1.95% set in February.

According to Bloomberg, China plans a rare economic briefing by

three financial regulators aimed at boosting growth. Authorities

seek to bolster confidence and demand amid weak economic data and

concerns about meeting the annual growth target of 5%.

Separately, the U.S. is considering banning the import and sale

of Chinese cars equipped with communication software or hardware

and autonomous driving systems.

Additionally, Morgan Stanley advised investors to reassess their

preference for Chinese stocks listed on the mainland versus those

traded abroad, citing reduced purchases by state funds and

expectations of yuan depreciation. The bank noted a diminishing

impetus for national stock selection and forecasted downward

revisions to earnings estimates for A-shares.

In Hong Kong, real estate market sales fell to their lowest

level in two months, with a 53% drop in deals in key housing

estates, even after local banks cut interest rates. Economic

pressure and uncertainty continue to deter buyers, especially from

mainland China.

In Australia, the government is facing resistance to reform the

central bank’s board, with the Greens demanding immediate rate cuts

in exchange for support. Treasurer Jim Chalmers proposed a dual

board, focusing on monetary policy and governance, but the deadlock

persists after the Liberal-National coalition withdrew its

support.

The Reserve Bank of Australia began its policy meeting, with

expectations to keep interest rates at 4.35%. Analysts await signs

of a possible shift in the bank’s hawkish stance, particularly

after the Fed’s 50 basis point rate cut, kicking off a loosening

cycle.

In Japan, markets were closed Monday due to a holiday. The Bank

of Japan kept its interest rate at 0.25% last Friday.

In Singapore, headline and core inflation rose more than

expected in August, hitting 2.2% and 2.7%, respectively,

year-on-year. The overall CPI exceeded the forecast of 2.15% but

was lower than July’s 2.4%, while core CPI surpassed expectations

of 2.6%.

European markets opened largely flat on Monday, with the Stoxx

600 index edging slightly higher. However, the market cooled after

PMI data in Germany and France showed further declines in business

activity, suggesting a technical recession in Germany.

In France, the PMI fell to 47.4, below the forecast of 50.6 and

August’s 53.1, marking an eight-month low. In Germany, the index

dropped to 47.2, lower than August’s 48.4, hitting a seven-month

low. The eurozone’s private sector economy contracted, with the PMI

falling to 48.9 in September, while analysts had expected the

figure to only marginally decrease to 50.5. The ECB may reconsider

rate cuts in light of the economic slowdown.

Among stocks, Commerzbank (TG:CBK) is down 3%

after the German government said it would not sell more shares,

signaling opposition to a takeover. Hugo Boss

(TG:BOSS) fell 4.8% after a downgrade by Bank of America, citing

weak Chinese demand. Rightmove (LSE:RMV) rose 2.2%

after rejecting a new acquisition offer.

U.S. stocks fell on Friday but recovered some losses to close

mixed. The Dow gained 0.09%, reaching a new record. The Nasdaq and

S&P 500 fell 0.36% and 0.19%, respectively. Despite the mixed

performance, the indices posted strong weekly gains.

Last week, the Dow rose 1.6%, while the Nasdaq and S&P 500

advanced 1.5% and 1.4%. The transportation sector fell due to

FedEx (NYSE:FDX) shares, which dropped 15.2% in

reaction to its quarterly performance. Gold and hardware stocks

rose. Traders await new catalysts following the Fed’s rate cut.

On the quarterly earnings front, AAR Corp

(NYSE:AIR) and Red Cat Holdings (NASDAQ:RCAT) will

report their numbers after the market close.

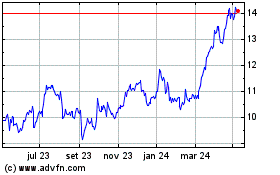

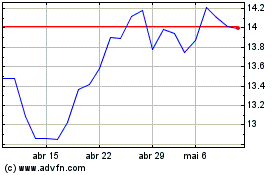

Commerzbank (TG:CBK)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Commerzbank (TG:CBK)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025