Bitcoin surpasses $71,000 and targets new record

Bitcoin (COIN:BTCUSD) surpassed the $71,000 mark today, reaching

an intraday high of $71,804.13, marking its highest price since May

21. The cryptocurrency is currently trading up 0.7% at $71,115 at

the time of writing.

According to technical analyses from CoinGecko, the

cryptocurrency is approaching its final resistance before reaching

a new all-time high. Expectations indicate possible upward

movements. Fernando Pereira, an analyst at Bitget, noted that the

weekly volatility of Bitcoin is at historically low levels and is

uncertain whether the movement will be bullish or bearish. However,

he indicated imminent significant price movements soon, with the

current consolidation phase nearing its end. “The weekly realized

volatility of BTC is at extremely low levels (22%), levels that, in

the past, have triggered very strong price movements. Whether it

will be bearish or bullish, an aggressive move in Bitcoin is close,

and the consolidation is just days away from ending,” said

Pereira.

U.S. Bitcoin ETFs see second-largest capital injection in a single

day

On June 4, U.S. Bitcoin ETFs recorded their second-largest daily

inflow in history on Tuesday, with over $886 million. This increase

is driven by renewed institutional interest and the recovery of

Bitcoin’s price above $70,000. The approval and listing of

regulated Bitcoin funds in various countries also contributed to

the rise in institutional investment in cryptocurrencies.

Fidelity’s ETF (AMEX:FBTC) led with inflows of $378.7 million,

while BlackRock’s ETF (NASDAQ:IBIT) had inflows of $274.4 million.

Spot Bitcoin ETFs now hold over $60 billion in BTC.

Cryptocurrency market faced a decline in trading volumes in May

According to CCData’s May 2024 report, the cryptocurrency market

saw a significant reduction in spot and derivatives trading

volumes, dropping 20.1% to $5.27 trillion. This decline follows the

Bitcoin halving in April, directly affecting transactions. Despite

the overall decrease, the Ether (COIN:ETHUSD) derivatives segment

demonstrated resilience, growing significantly after the unexpected

approval of spot ETFs by the SEC, indicating a possible increase in

institutional demand for crypto assets.

Marathon Digital sold more than 60% of the Bitcoin mined in May

Marathon Digital (NASDAQ:MARA), a cryptocurrency mining company,

revealed the sale of 390 Bitcoin in May, equivalent to more than

63% of its monthly production. With an impressive cash balance of

$290.4 million, the company now aims to expand its operations

globally. Meanwhile, competitors like Riot Platforms and CleanSpark

(NASDAQ:CLSK) are recalibrating their strategies post-Bitcoin

halving, focusing on efficiency and business expansion.

Riot Platforms affected by short seller criticism

Bitcoin miner Riot Platforms (NASDAQ:RIOT) suffered a 2% drop

during Wednesday’s trading following criticism from Kerrisdale

Capital, which stated it would sell RIOT shares in favor of Bitcoin

(COIN:BTCUSD). Kerrisdale accused RIOT of burning cash and

misleading retail shareholders through its market financing

strategy. This is not the first time Kerrisdale has targeted

crypto-related stocks, having recently aimed at MicroStrategy

(NASDAQ:MSTR).

Aave community pushes for fee changes after annual revenue hits new

highs

The annualized revenue of the DeFi protocol Aave (COIN:AAVEUSD)

surpassed $80 million, prompting community members to seek a

proposal for fee changes. With deposits exceeding $20 billion, the

protocol’s growth reflects the resurgence of the DeFi sector, with

Aave leading as the largest crypto lending platform. This high

revenue underscores the need for initiatives to redistribute

generated fees among platform participants.

Paris update boosts Tezos scalability to millions of TPS in L2

The Paris update of Tezos (COIN:XTZUSD), launched on June 5,

aims to enhance the network’s scalability. Tezos-based Layer 2 (L2)

scaling solutions can now achieve a throughput of millions of

transactions per second (TPS). With a transaction finalization time

of 500 milliseconds and data publishing latency on the main L1 in

approximately 10 seconds, Etherlink has become cheaper and offers

an improved user experience compared to Arbitrum and Optimism.

Base witnesses explosive growth

The Base, an Ethereum Layer-2 network backed by Coinbase Global

(NASDAQ:COIN), is experiencing rapid growth, especially after the

launch of its Smart Wallet. Registering the highest daily

transactions among Ethereum Layer-2 networks, Base is becoming a

popular choice among users. Its total value locked (TVL) reached

$7.64 billion, approaching Optimism. The recent introduction of

Coinbase’s Smart Wallet aims to simplify the use of

cryptocurrencies, including Base.

Paxos launches yield-generating stablecoin USDL in UAE

The cryptocurrency platform Paxos announced the creation of the

Lift Dollar (USDL), a yield-generating dollar-backed stablecoin,

regulated in the United Arab Emirates. The novelty was developed by

Paxos International and regulated by Abu Dhabi’s FSRA, promising a

daily return to investors and positioning itself as a safe

alternative to traditional savings products.

Binance seeks to dismiss collusion charges in the UK

Binance has asked the UK’s Competition Appeal Tribunal to

dismiss the main allegations in a collusion case involving the

delisting of the BSV token (COIN:BSVUSD) in 2019. BSV accuses

Binance and three other exchanges of anti-competitive behavior,

alleging potential damages of £9 billion. Binance argues that BSV

holders could have reinvested in other cryptocurrencies, according

to Reuters. The trial continues until June 7.

Tether invests $18.75 million in XREX Group

Stablecoin issuer Tether (COIN:USDTUSD) announced an $18.75

million investment in the Taiwan-based cryptocurrency exchange XREX

Group. The partnership aims to facilitate cross-border payments and

develop regulatory tools to detect illicit use of stablecoins. The

initiative follows Tether’s recent agreement with Bitdeer

Technologies Group (NASDAQ:BTDR) for a private sale of up to $150

million in shares of the Bitcoin mining company.

Ironblocks launches firewall to prevent smart contract hacks

The security platform Ironblocks introduced a new “firewall”

aimed at strengthening security in DeFi, offering a free tool for

developers to protect their smart contracts. According to CEO Or

Dadosh, the service allows for the implementation of various

security policies, monitoring suspicious transaction attempts. This

launch represents a strategic step to minimize growing hacking

risks in the sector, which caused estimated losses of $60 million

in April alone.

Tether CEO warns of potential security breach in the cryptocurrency

industry

On June 5, Paolo Ardoino, Tether’s CEO, warned of a potential

security breach in a cryptocurrency mailing list provider. He

mentioned concerns about fraudulent emails promising crypto

airdrops and advised users to exercise caution. Companies like

CoinGecko also issued similar warnings, discouraging interaction

with suspicious links. Bobby Ong, CoinGecko’s COO, highlighted the

severity of the incident, warning of possible phishing emails

related to a purported CoinGecko token launch.

DMM Bitcoin plans recovery after $320 million hack

After the theft of $320 million in Bitcoin, the Japanese

exchange DMM Bitcoin announced plans to raise $320 million (50

billion yen) to compensate affected users. The company will seek

funds by acquiring Bitcoin from parent company DMM.com and through

loans. The investigation into the incident, classified as the

eighth-largest cryptocurrency hack, is ongoing, with the company

ensuring it will inform the public of any new details as they

become available.

UAE approves regulations for stablecoins and CBDCs

The Board of Directors of the Central Bank of the UAE (CBUAE)

ratified a new supervision and licensing system for stablecoins

during a meeting in Abu Dhabi. The measure, part of the Financial

Infrastructure Transformation (FIT) Program, aims to promote

digital transactions and the digital economy. Additionally, the

CBUAE announced plans to issue a Central Bank Digital Currency

(CBDC) to enhance cross-border payments and national financial

competitiveness. The Dubai Financial Services Authority also

updated its rules to recognize stablecoins, allowing investments in

unrecognized crypto tokens.

U.S. lawmakers urge Biden to intervene in Tigran Gambaryan case

A group of U.S. lawmakers, led by Michael McCaul (R-Texas),

urged President Joe Biden to intervene in the case of Tigran

Gambaryan, a Binance executive detained in Nigeria. They urged

Biden to treat the case as a hostage situation and bring Gambaryan

back to the U.S. The executive faces charges of money laundering

and tax evasion in Nigeria.

Donald Trump’s cryptocurrency portfolio reaches a peak of $32

million

According to Arkham Intelligence, Donald Trump’s cryptocurrency

portfolio saw a notable increase in the last three months, reaching

$32 million, primarily driven by memecoins. His largest holding is

in the TROG token, valued at $21 million. However, much of his

wealth is illiquid due to the lack of market depth in some assets,

posing potential challenges for realizing its total value. Trump

also holds Ethereum (COIN:ETHUSD), Wrapped Ethereum (WETH), and

other notable tokens such as TRUMP (COIN:TRUMPUSD), MVP

(COIN:MVPUSD), and BABYTRUMP.

HyperPlay and MetaMask join forces to facilitate blockchain game

discovery

The Web3-integrated game store HyperPlay has partnered with the

digital asset wallet MetaMask to simplify blockchain game

discovery. MetaMask’s game directory will be incorporated into

MetaMask’s portfolio, creating a centralized hub for discovering

and managing game assets. The goal is to enhance the Web3 user

experience and facilitate in-game transactions. HyperPlay, known

for its 0% fee and title aggregation, now offers players direct

access to MetaMask-compatible games, simplifying interactions with

encrypted wallets and expanding interoperability between games.

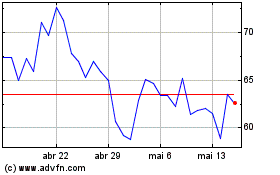

Bitcoin SV (COIN:BSVUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bitcoin SV (COIN:BSVUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025