Cardano prepares for the Voltaire era with Chang fork

Charles Hoskinson, founder of Cardano (COIN:ADAUSD), announced

that the blockchain is about to reach its most significant

milestone with the Chang fork, which will usher in the “Voltaire

Era.” This update, scheduled for June, will introduce essential

tools for the network’s self-sustainability, allowing for proposed

and voted improvements by participants. A new treasury system will

finance ongoing development. With this, Cardano will become fully

decentralized, community-governed, and ready for global growth.

Fireblocks collaborates with Coinbase for cryptocurrency operations

security

Fireblocks is collaborating with Coinbase International Exchange

(NASDAQ:COIN), which offers perpetual futures and spot trading for

institutional and retail clients outside the US. Fireblocks

customers can connect their Coinbase accounts, securing withdrawals

and deposits with governance rules. Coinbase International received

a license from the Bermuda Monetary Authority in May 2023.

Fireblocks uses MPC technology for security and rigorous governance

of exchange operations.

Buying opportunity for Bitcoin and Ether after US economic data,

says QCP Capital

Bitcoin (COIN:BTCUSD) traded around $69,828 in the last 24 hours

after remaining stable over the weekend. Last Friday, Bitcoin faced

a $400 million drop, falling from over $71,000 to below $69,000 due

to employment data showing a surprising increase in job numbers but

also a slight rise in the unemployment rate, causing uncertainty

before crucial economic decisions. Futures contracts fell from $99

billion to $60 billion, indicating reduced trader bets.

Singapore-based QCP Capital identified a “buy-the-dip” opportunity

for Bitcoin and Ether (COIN:ETHUSD). With market volatility, the

firm noted an increase in Bitcoin options purchases, suggesting

confidence in the price recovery of these cryptocurrencies.

Volatility is expected to rise this week with the release of the

CPI on Wednesday.

Bitcoin ETFs achieve record demand and investments

Last week, US Bitcoin ETFs received $1.8 billion, marking a

record 18 consecutive days of high demand. The trading volume of

these funds grew by 55%, reaching $12.8 billion. Notably, they

acquired about 25,700 BTC, equivalent to the new Bitcoin supply

during the period, indicating a market squeeze. Managing over $70

billion in assets, ETFs are solidifying Bitcoin as a recognized

institutional asset class, encouraging further investments as

global markets adapt.

Bitcoin ETFs spark a silent revolution in the financial market

Recent records reveal that 534 major institutions now include

Bitcoin (COIN:BTCUSD) in their portfolios, reflecting widespread

institutional adoption. Spot Bitcoin ETFs have become an attractive

option for these investors due to their ease of integration with

traditional financial systems, despite certain limitations.

Solana expels validators involved in sandwich attacks

The Solana Foundation (COIN:SOLUSD) permanently expelled several

validators for conducting sandwich attacks against retail users. A

sandwich attack manipulates cryptocurrency prices by placing a buy

order before and a sell order after another user’s transaction.

This artificially inflates the price, allowing the attacker to

profit while the target user pays an unfavorable price. Tim Garcia

from Solana’s validator relations team confirmed that the

foundation identified operators using mempool activities to

facilitate these attacks, involving price manipulation and profit

at the expense of retail investors. The crypto community criticized

the measure, pointing to centralization of the network.

MATIC faces downward pressure and tests critical support

The price of MATIC, the currency of the Polygon platform

(COIN:MATICUSD), fell by 5.3% in the last week, approaching the

lower limit of its trading channel established since April. With

the current price at $0.63, the lowest since October 2023, MATIC

may be about to drop below its critical support of $0.64.

Persistent selling pressure and predominantly negative market

sentiment increase the risk of further declines unless the bulls

can reverse this trend and strengthen the support.

Polkadot expands leadership in tokenization and strengthens DeFi

with million-dollar investment

Polkadot is standing out in the real-world asset (RWA)

tokenization space, with the potential to lead the market.

Polkadot’s framework is designed for interoperability and

scalability, ideal for tokenizing various assets such as real

estate and commodities. With the recent publication of the JAM

Whitepaper (Polkadot 2.0), the platform aims to further reinforce

its position in the RWA market. Additionally, several projects

within the Polkadot ecosystem focus on practical RWA applications,

contributing to the expansion of this technology in the crypto

economy.

Furthermore, the Polkadot Treasury allocated 2 million DOT

(COIN:DOTUSD), equivalent to $14.4 million, to strengthen the DeFi

Hydration project. This funding aims to enhance the liquidity and

efficiency of the Omnipool platform, which allows users to

provision liquidity unilaterally. Implemented in two phases, the

allocation includes generous rewards for liquidity providers,

aiming to attract new resources and improve the liquidity layer of

the Polkadot 2.0 ecosystem.

Ripple expands cooperation with the National Bank of Georgia for

economic digitalization

Ripple (COIN:XRPUSD) is intensifying its collaboration with the

National Bank of Georgia to explore the digitalization of the local

economy. In a recent meeting with bank and Ripple executives,

advancements in financial technology and digitalization were

discussed. This partnership includes Ripple’s contribution to the

digital lari pilot project, a central bank digital currency (CBDC).

Besides Georgia, Ripple is also involved in similar projects in

several other countries, highlighting its growing role in

supporting global CBDC development.

The role and challenges of stablecoins in the cryptocurrency market

Stablecoins are crucial for transactions in the digital economy,

mimicking conventional currencies like the dollar, without the

volatility of cryptocurrencies. They generate profits for issuers

by investing in safe assets but do not share these profits with

holders. With rising interest rates, there is increasing pressure

to share these gains. New competitors are offering more equitable

models, challenging giants like Tether and Circle, and promoting

innovation in using stablecoins for efficient payments. Companies

like Ondo, Mountain, Agora, and Paxos are challenging the status

quo of traditional stablecoins, promising to distribute returns to

users. For instance, Paxos (COIN:PAXGUSD) recently launched the

Lift Dollar, a yield-generating stablecoin regulated by the United

Arab Emirates, increasing competition in the market.

HSBC China offers eCNY services for corporate clients

The Chinese branch of HSBC (NYSE:HSBC) now offers e-CNY

services, becoming the first foreign bank to provide services

related to the People’s Bank of China’s digital yuan for corporate

and retail clients. HSBC corporate clients can link their bank

accounts to digital yuan accounts. HSBC helped an educational group

accept e-CNY payments at six branches located in Shanghai, Beijing,

Guangzhou, Jiaxing, and Suzhou.

Fidelity International explores asset tokenization with JPMorgan’s

blockchain technology

Fidelity International, a London-based fund manager, used

JPMorgan’s (NYSE:JPM) blockchain technology, Onyx Digital Assets,

to tokenize shares of a money market fund. This action was executed

instantly, connecting the fund’s transfer agent to the Tokenized

Collateral Network, which facilitates transactions between

collateral receivers and providers. Tokenization, which seeks to

represent real assets in a digital format, is a growing trend among

banks, offering cost efficiencies and reducing operational

risks.

UwU Lend exploitation results in $19.3 million loss in crypto

assets

The UwU Lend lending protocol was compromised, resulting in a

loss of $19.3 million, as reported by security firms like Arkham.

The exploitation involved diverting crypto assets, including

wrapped ether and wrapped bitcoin, as well as stablecoins, which

were subsequently sold on Uniswap. The cause of the incident is

still under investigation, and UwU Lend announced on X that it

plans to reimburse affected users. The protocol’s founder, Michael

Patryn, has a controversial history, including connections to the

collapse of Quadriga CX.

Squads Labs raises $10 million and launches smart wallet for iOS

Squads Labs, focused on facilitating digital asset transactions

and management, raised $10 million in Series A funding led by

Electric Capital, with participation from RockawayX, Coinbase

Ventures, L1 Digital, and Placeholder. The company, which already

offers a Solana-based wallet for businesses, unveiled Fuse, a new

smart wallet for individuals, available for public testing on iOS.

The funding will be used to enhance technology and products, as

well as expand the team.

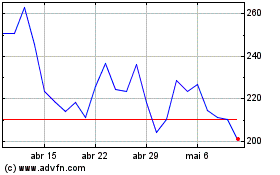

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024