Eli Lilly (NYSE:LLY) – Eli Lilly’s experimental

Alzheimer’s drug, donanemab, has received backing from a U.S. FDA

advisory panel. The advisors voted unanimously in favor of the

efficacy and benefits of donanemab for patients with early-stage

Alzheimer’s, despite concerns about side effects. The potential

approval could offer a new treatment option, although competition

with Biogen’s Leqembi remains an unknown. Lilly’s shares rose 2.9%

in pre-market trading.

Rio Tinto (NYSE:RIO) – Rio Tinto will acquire

11.65% of Boyne Smelters from Mitsubishi Corp, increasing its stake

to 73.5%. This acquisition follows the purchase from Sumitomo

Chemical. Mitsubishi is restructuring its aluminum portfolio,

focusing on trade and investments in bauxite, targeting growth

potential in lightweight vehicles.

Apple (NASDAQ:AAPL)- At the developers’

conference, Apple introduced AI innovations such as Apple

Intelligence, aiming to revitalize the loyalty of its vast customer

base and boost iPhone sales amid intense competition and variable

consumer spending. This integration seeks to enhance Siri, allowing

advanced interactions with apps and customization of

communications, while maintaining a strict focus on user privacy.

The technology also requires the new iPhone 15 Pro or Pro Max,

driving a significant upgrade cycle. Additionally, Apple announced

that it would use its own server chips to enhance AI capabilities

in its devices. Shares fell 0.7% in pre-market.

Intel Corp (NASDAQ:INTC) – Intel has suspended

plans for a $25 billion chip factory in Israel, according to

Calcalist. While not confirmed, the company emphasized the need to

adapt large projects to shifting timelines, reaffirming its ongoing

commitment to Israel and its presence there.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – Comparatively, TSMC outpaces China’s Semiconductor

Manufacturing International Corp by nearly two decades, reflecting

TSMC’s lead in chip technology. China seeks to close the gap but

faces technological challenges and U.S. export restrictions.

Tesla (NASDAQ:TSLA) – Tesla’s CEO Elon Musk

threatened to ban Apple devices from his companies if Apple

integrates OpenAI into its operating system, citing security

concerns. Musk also stated that Apple devices would be stored in a

Faraday cage at his facilities to mitigate security risks.

Additionally, investors await the vote on Elon Musk’s compensation

package at Tesla’s annual meeting on Thursday. Options indicate

concern over a potential share price drop if the package is

rejected. The uncertainty about the vote’s impact on leadership and

future company value persists. In other related news, a California

judge rejected Tesla’s attempt to dismiss charges that it

exaggerated its autonomous driving capabilities. The decision

allows enforcement actions based on allegations by the California

Department of Motor Vehicles against the company to proceed.

Toyota Motor (NYSE:TM) – Japan’s Ministry of

Transport has identified six cases of irregularities in Toyota

Motor vehicle certifications, potentially violating United Nations

standards, according to the Yomiuri newspaper. If detected

elsewhere, such irregularities could impact mass production in

Europe and other regions.

Uber Technologies (NYSE:UBER) – A U.S. appeals

court denied an attempt by Uber and Postmates to challenge a

California law that would require treating drivers as employees

rather than independent contractors. The decision upholds the AB5

legislation, aimed at regularizing labor rights in the ride-hailing

sector.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management, after acquiring a significant stake in

Southwest Airlines, demands changes in leadership and the board,

criticizing financial and operational performance. Southwest faces

challenges, including the Boeing crisis. Elliott suggests a

comprehensive analysis and board renewal to boost stock value.

Boeing (NYSE:BA) – Boeing’s Starliner

spacecraft achieved a significant milestone with the successful

delivery of two astronauts to the International Space Station.

However, issues encountered during the journey highlight ongoing

challenges. Boeing faces multiple test milestones before

considering regular missions, despite progress made. In other news,

Boeing secured a significant 737 Max order from El Al Israel

Airlines, valued between $2 billion and $2.5 billion. The planes

will gradually replace older models in the fleet, strengthening

confidence in the aircraft after recent challenges.

Embraer (NYSE:ERJ) – Embraer’s subsidiary Eve

plans to raise funds to finance certification of its electric

flying taxi by 2026. With orders from various countries, including

the USA and Brazil, the company seeks to secure certification while

keeping development on schedule.

Trump Media & Technology (NASDAQ:DJT) –

Shares of Trump Media & Technology closed down 5.6% on Monday

after a new accounting firm reviewed its finances. The auditor

change follows accusations of massive fraud against the previous

auditor, BF Borgers CPA, and its owner Benjamin F. Borgers,

resulting in significant fines and permanent suspensions. Shares

fell 0.2% in pre-market.

UBS Group AG (NYSE:UBS) – The merger between

the Swiss units of UBS and Credit Suisse is set to complete on July

1, according to Sabine Keller-Busse, president of UBS Switzerland.

Following UBS’s acquisition of Credit Suisse due to its collapse,

the integration process is progressing well, consolidating a single

global bank in Switzerland.

BlackRock (NYSE:BLK) – The BlackRock Investment

Institute has cautioned against long-term U.S. Treasury bonds due

to expected broad fiscal deficits, predicting that investors will

demand higher term premiums. BlackRock recommends an “overweight”

stance on short-term bonds given the high-interest rate

environment.

DXC Technology (NYSE:DXC), Apollo

Global Management (NYSE:APO), Kyndryl

Holdings (NYSE:KD) – Apollo Global and Kyndryl Holdings

are negotiating an offer to acquire DXC Technology, with values

between $22 and $25 per share.

Bapcor (ASX:BAP), Bain Capital

(NYSE:BCSF) – Bain Capital has offered to acquire Bapcor for $1.21

billion, offering a 23.9% premium over the last share closing.

Analysts suggest the offer could attract more bidders, highlighting

Bapcor’s strong regional position in the automotive market.

Brookfield Corp (NYSE:BN) – Brookfield Asset

Management sold the Conrad hotel in Seoul for approximately $300

million to ARA Korea REF. This is part of its recent asset sales,

including a stake in the ICD Brookfield Place tower in Dubai,

aiming to reach its $15 billion target for real estate funds.

New York Community Bancorp (NYSE:NYCB) –

Liberty Strategic Capital, led by Steven Mnuchin, revealed a 7.7%

stake in New York Community Bancorp as of June 7. Mnuchin and other

investors injected about one billion dollars into the bank in

March.

Morgan Stanley (NYSE:MS) – Ted Pick, CEO of

Morgan Stanley, revealed that artificial intelligence could save up

to 15 hours a week for financial advisors, enhancing efficiency. AI

will help personalize interactions with clients and tailor

investment products. The bank also plans to expand sophisticated

lending to high-net-worth clients. Additionally, Morgan Stanley

downgraded Indonesian stocks due to fiscal policy uncertainty and a

strong dollar, noting that electoral promises may increase the

fiscal burden. According to the bank, the earnings outlook has also

deteriorated, and a stronger dollar is concerning ahead of

decisions by the Federal Reserve and the Bank of Indonesia.

JPMorgan Chase (NYSE:JPM),

PayPal (NASDAQ:PYPL) – JPMorgan has hired Sri

Shivananda, a former PayPal executive, as its new Chief Technology

Officer (CTO), aiming to boost its technology budget of $17

billion. Shivananda will succeed AJ Lang and will report to Lori

Beer, the CIO of the bank. Other hires aim to strengthen the bank’s

technological capabilities, with the goal of adding value and

attracting talent.

American Express (NYSE:AXP)- Citi analyst Keith

Horowitz began covering American Express on Monday, praising its

management team and long-term growth prospects, but assigning a

neutral rating due to the relatively high valuation of the shares.

He highlights the possibility of above-average growth, especially

in premium and youth segments, driven by inflation in luxury goods

and international expansion.

Rogers Communications (NYSE:RCI),

Warner Bros. Discovery (NASDAQ:WBD),

Comcast (NASDAQ:CMCSA) – Rogers Communications has

secured multi-year deals with NBCUniversal and Warner Bros.

Discovery to bring sports and entertainment content to Canada,

aiming to expand its presence in these segments amid fierce

competition. The company plans to invest in original and

independent content.

CVS Health (NYSE:CVS) – Pharmacies, including

CVS, are facing frequent recalls of private-label drugs, with

third-party factories cited for quality failures. The emphasis on

cost over quality leads to inferior drugs. According to Bloomberg,

the Food and Drug Administration (FDA) rarely inspects these, and

consumers may not be aware of the dangers.

Krispy Kreme (NASDAQ:DNUT) – Truist Securities

upgraded Krispy Kreme to “buy,” highlighting the resilience of the

donut market despite the rise in weight-loss medications. The

partnership with McDonald’s is also seen as a significant boost,

making Krispy Kreme a true national brand.

Yext (NYSE:YEXT) – In the first quarter, Yext

reported a net loss of $3.8 million and revenue of $96 million,

below expectations. Second-quarter revenue forecasts range between

$98 million and $98.4 million, with adjusted earnings per share

between 2 and 3 cents. This projection also fell short of analyst

expectations, who had anticipated an average revenue of $98.4

million and adjusted earnings per share of 9 cents. The company

announced it is restructuring its partnerships and said it would

acquire Hearsay Systems, a platform that helps the financial

services sector engage customers, for about $125 million. Shares

fell 16.1% in pre-market trading.

Calavo Growers (NASDAQ:CVGW) – In the second

quarter, Calavo Growers reported sales of $184.4 million, with a

profit of $6.1 million, or 34 cents per share. Higher avocado

prices boosted the results.

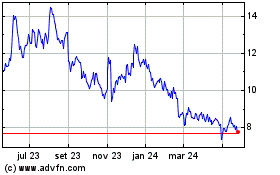

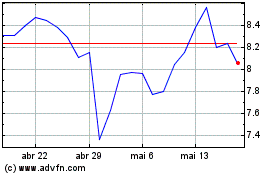

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Warner Brothers Discovery (NASDAQ:WBD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025