Paramount Global (NASDAQ:PARA) – National

Amusements ended negotiations with Skydance for a merger with

Paramount Global, with terms not agreed upon. The dispute involved

share control and finances. Continuing current operations without

significant changes is unsustainable, pressuring Redstone to find

another sale offer. Meanwhile, Paramount outlined a plan to reduce

debt and seek streaming partnerships, preparing for an independent

future.

Apple (NASDAQ:AAPL) – Apple shares reached a

record high, rising 7.3% on Tuesday, driven by announcements of new

AI features. Analysts revised share price targets upward,

anticipating increased sales due to these innovations. In addition

to incorporating OpenAI’s advanced AI technologies into its Siri

assistant, technical details indicate Apple is also using AI

hardware from Google, specifically TPUs, to enhance its AI models,

underscoring the strategic importance of the partnership with

Google. Meanwhile, four new U.S. states joined the Department of

Justice lawsuit against Apple, accusing it of monopolistic

practices in the smartphone markets. The lawsuit highlights how the

company allegedly raises prices for consumers and imposes

restrictive contractual conditions on developers.

Alphabet (NASDAQ:GOOGL) – Google’s Alphabet

unit will launch an anti-theft feature for Android phones in

Brazil, using artificial intelligence. Three types of locks will be

available, including suspicious movement detection and remote

locking. In 2022, nearly 1 million cell phone theft cases were

reported in Brazil.

Berkshire Hathaway (NYSE:BRK.A) – Despite the

strong rise in Apple shares on Tuesday, Berkshire Hathaway shares

did not follow suit. While Berkshire is one of Apple’s largest

shareholders, its shares did not recover, possibly due to declines

in the financial sector, where Berkshire also has significant

exposure.

Amazon (NASDAQ:AMZN) – Amazon announced an

additional $1.4 billion investment in its Housing Equity Fund to

support the creation of 14,000 affordable housing units in Seattle,

Nashville, and Washington. This new contribution raises the

company’s total commitment to housing to $3.6 billion.

Meta Platforms (NASDAQ:META) – Analysts

speculate that Meta Platforms may be the next company to conduct a

stock split, being the only one of the so-called “Magnificent

Seven” that has never done so. With shares trading above $500 and a

450% increase since the 2022 low, Meta is seen as ready for a stock

split.

Accenture (NYSE:ACN) – Angie Park will assume

the role of CFO of Accenture in December, succeeding KC McClure.

With nearly 30 years at the company, Park has previously served as

CFO in the Technology Services and Investor Relations divisions.

The company also announced other internal appointments while facing

a reduction in revenue forecasts.

Spotify (NYSE:SPOT) – Spotify will launch a new

premium plan later this year, offering higher-quality audio and new

playlist tools. According to Bloomberg, this addition will likely

cost an extra $5 per month for existing users, aiming to increase

margins following a recent premium plan price hike.

Tesla (NASDAQ:TSLA)- Elon Musk, CEO of Tesla,

withdrew his lawsuit against OpenAI and its CEO, accusing them of

deviating from the original nonprofit AI mission. The lawsuit was

dismissed without prejudice, allowing for a possible reopening.

Musk founded his own AI startup, xAI, after the dispute.

Additionally, Musk faces accusations from an institutional

shareholder of insider trading by selling Tesla shares and

profiting billions. The lawsuit alleges Musk artificially inflated

stock prices by hiding investment plans in Twitter. He is also

accused of diverting resources and employees from Tesla to his

other ventures. Meanwhile, JPMorgan analysts said that Tesla

investors expecting a lucrative robotaxi deal soon will likely be

disappointed. Although a robotaxi concept is expected on August 8,

it is unlikely to generate significant revenue in the coming years

due to production and regulatory challenges.

General Motors (NYSE:GM) – GM reduced its

electric vehicle production forecast for 2024, focusing on the

profitability of gasoline-powered models. Additionally, the company

announced a new $6 billion share buyback plan, seeking to return

capital to shareholders after recent challenges, including the

United Auto Workers (UAW) strike and issues in its autonomous

vehicle unit, Cruise.

VinFast Auto (NASDAQ:VFS) – The Vietnamese

electric car manufacturer is advancing its expansion in Asia

despite the global slowdown in electric vehicle demand and a slow

start in the U.S. Founder Pham Nhat Vuong plans to open a factory

in India six months ahead of schedule and start construction on

another in Indonesia within the next two months, demonstrating

determination to expand operations.

Boeing (NYSE:BA) – In May, Boeing delivered 24

commercial aircraft, half the number delivered in the same period

last year, due to a slower production line and a renewed focus on

quality after an incident. Of the deliveries, 19 were MAX jets,

reflecting a 45% decline compared to the previous year. The company

also received four new orders for the 787-10 Dreamliner model from

Eva Air, totaling 142 new orders in 2024. After accounting

adjustments, Boeing recorded 130 net adjusted orders to date.

Additionally, the company announced the opening of a new

engineering facility in Daytona Beach, Florida, planning to hire

about 200 engineers this year. The facility will focus on

engineering for military programs, advanced technology, and

prototyping, with plans for expansion in the coming years.

Alaska Airlines (NYSE:ALK) – Alaska Airlines

lost a $160 million trademark appeal case with the Virgin Group.

The London court ruled that Alaska must pay annual royalties of $8

million until 2039, even though it no longer uses the Virgin brand.

The appeal was rejected.

Virgin Galactic (NYSE:SPCE) – Virgin Galactic

shares rose 12.3% on Tuesday, marking their biggest daily gain

since May 28. This increase followed a 5.1% drop the previous day

and follows the success of the company’s last commercial

spaceflight of the Unity spacecraft.

GameStop (NYSE:GME) – On Tuesday, GameStop

announced the completion of a market share offering, raising $2.14

billion in gross revenues. After rising 23% yesterday, the shares

are down 4.4% in pre-market trading.

Rentokil Initial (NYSE:RTO) – Shares of the

pest control company rose 12.6% in pre-market trading following

confirmation from Nelson Peltz’s Trian Partners of its substantial

position in the company, now ranked among the top ten

shareholders.

WeWork (NYSE:WE) – David Tolley stepped down as

CEO of WeWork after the company emerged from bankruptcy. John

Santora, experienced in the real estate sector, took over. Under

Tolley’s leadership, the company reduced its portfolio,

renegotiated leases, and secured new capital, but its valuation

dropped significantly after restructuring.

KKR & Co (NYSE:KKR) – KKR & Co agreed

to acquire a significant stake in Quick Quack Car Wash for $850

million. Founders and Seidler Equity Partners will remain

invested.

Bank of New York Mellon (NYSE:BK) – The Bank of

New York Mellon is adopting “BNY” as its new nickname, marking a

change after 240 years of history. This change reflects the

expansion of its business beyond custody, including financial

services and investments, while retaining the corporate name as The

Bank of New York Mellon Corporation.

JPMorgan Chase (NYSE:JPM) – According to

Bloomberg, when JPMorgan transferred loss risks on loans through

SRT trades, part of those risks ended up in rival banks. These

banks lent money to SRT investors, keeping the associated risks

within the banking system. This contradicts the goal of such

trades, which is to distribute risk outside the banking sector,

worrying regulators and revealing flaws in the structure of these

transactions.

UBS Group AG (NYSE:UBS) – UBS’s acquisition of

Credit Suisse, two of the largest Swiss banks, raises concerns

about the concentration of power and potential consequences for the

Swiss financial market. Credit Suisse played a vital role in

financing Swiss exports. With fewer financing options available,

especially for small businesses, there is a fear that costs will

increase. Regulators are closely monitoring the situation due to

implications for competition and consumers.

Affirm Holdings (NASDAQ:AFRM) – Affirm

announced that its “buy now, pay later” services will be available

for Apple Pay users in the U.S. later this year, allowing

installment payments for purchases made online or via app on iPhone

and iPad devices. The company anticipates that this partnership

will not significantly impact its revenues in 2025.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson agreed to pay $700 million to settle investigations

by 42 U.S. states and Washington, DC, over the safety of its talc

products, accused of causing cancer. The company denies wrongdoing

but faces thousands of lawsuits related to talc.

Earnings

Oracle (NYSE:ORCL) – Oracle reported adjusted

fourth-quarter earnings of $1.63 per share on revenue of $14.29

billion, while analysts expected earnings of $1.65 per share on

revenue of $14.55 billion. Despite posting fourth-quarter fiscal

results below analysts’ expectations, the technology company

announced significant cloud deals with Google and OpenAI. The

positive impact of new partnerships boosted investor confidence,

and shares rose 8.7% in pre-market trading.

Rubrik (NYSE:RBRK) – In the first quarter, the

cloud data management and data security company reported an

adjusted loss per share of $1.58, up from a loss of $1.48 in the

same quarter last year. Revenue of $172.2 million increased 38%

year-over-year. Analysts expected a loss of $1.84 per share on

revenue of $171.5 million. For the second quarter, Rubrik expects

to see a loss per share of 48 to 50 cents on revenue of $195

million to $197 million, in line with estimates.

Casey’s General Stores (NASDAQ:CASY) – Casey’s

reported earnings per share of $2.34, beating the estimate of

$1.72, and representing a 57% year-over-year increase. Net sales

increased 5.6% to $3.60 billion, above expectations of $3.47

billion. Same-store sales rose 5.6%. Casey’s announced a 16.3%

increase in its quarterly dividend to $0.5 per share, payable on

August 15 to investors registered on August 1. For fiscal year

2025, CASY expects same-store sales to increase by 3% to 5% and

operating expenses to increase by 6% to 8%.

Mama’s Creations (NASDAQ:MAMA) – Mama’s

Creations reported earnings per share of 1 cent and revenue of

$29.80 million in the first quarter. Analysts estimated earnings

per share of 2 cents and revenue of $26.13 million. The shares fell

2.9% in pre-market trading.

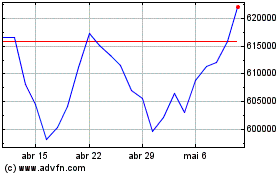

Berkshire Hathaway (NYSE:BRK.A)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Berkshire Hathaway (NYSE:BRK.A)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024