Toyota Motor (NYSE:TM) – Toyota’s global

production fell 12.9% in June to 795,862 vehicles, marking the

fifth consecutive month of decline. The automaker faced

certification issues in Japan and intense price competition in

China, contributing to significant reductions both domestically and

internationally. In other news, Toyota President Akio Toyoda stated

he might not be re-elected if shareholder support continues to

decline. At the last meeting, his support was 72%, down from 85% in

2023. Institutional investor support was especially low at 34%.

Toyota shares rose 1% in pre-market trading.

Delta Air Lines (NYSE:DAL),

Microsoft (NASDAQ:MSTR),

CrowdStrike (NASDAQ:CRWD) – Delta Air Lines will

sue Microsoft and CrowdStrike for a global cyber failure that

caused over 6,000 flight cancellations in July. The airline seeks

compensation for financial impacts and slow service recovery.

CrowdStrike shares fell 4.9% in pre-market trading.

Meta Platforms (NASDAQ:META) – Meta Platforms

will launch AI Studio, a tool that allows users to create and share

custom AI chatbots. In addition to enabling the creation of AI

characters, this tool will help Instagram creators manage automatic

interactions in DMs and story replies. Shares fell 0.1% in

pre-market trading.

Apple (NASDAQ:AAPL), Alphabet

(NASDAQ:GOOGL) – Apple revealed that its AI system, Apple

Intelligence, was trained on Google TPU processors, offering an

alternative to Nvidia for AI training. The company launched a

preview version of Apple Intelligence, which includes new features

for Siri and improvements in natural language processing and image

generation. In pre-market trading, Apple rose 0.2% while Alphabet

rose 0.1%.

Nvidia (NASDAQ:NVDA) – Nvidia launched NIMs

(Nvidia Inference Micro Services) to facilitate the use of

generative AI by businesses, charging for this convenience.

Announced by CEO Jensen Huang at the Siggraph conference, NIMs

integrate with Nvidia AI Enterprise. Nvidia aims to expand AI use

across various industries, highlighting benefits like enhanced

image generation and the creation of virtual worlds. Examples

include Getty Images generating high-resolution images from text

and Shutterstock’s Edify creating 3D images. Apple Vision Pro

allows creating virtual worlds and training robots. Nvidia shares

fell 0.2%.

Adobe (NASDAQ:ADBE) – Adobe’s rival Canva

acquired startup Leonardo.ai to integrate its image and video

generation tools into its products. This acquisition, the second

this year, is a strategy to compete with Adobe in creative

software. Founded in 2022, Leonardo.ai has a team of 120 people and

has created over a billion images.

Hewlett Packard Enterprise (NYSE:HPE),

Juniper Networks (NYSE:JNPR) – Hewlett Packard

Enterprise is set to receive unconditional antitrust approval from

the EU for its $14 billion acquisition of Juniper Networks. HPE

seeks to expand its products and services, especially in artificial

intelligence. The European Commission is expected to decide by

August 1, and the UK regulator is also evaluating the deal.

WPP Plc (NYSE:WPP), BT Group

(LSE:BT.A) – WPP is set to appoint Philip Jansen, former CEO of BT

Group, as its new chairman, succeeding Roberto Quarta. The decision

may be announced this week, as reported by the Financial Times. The

change comes at a critical time for WPP, which faces financial

challenges. WPP shares rose 0.6% in pre-market trading.

Occidental Petroleum (NYSE:OXY),

Permian Resources (NYSE:PR) – Occidental Petroleum

will sell assets in the Delaware Basin to Permian Resources for

$818 million to reduce debt. With these and other divestments,

Occidental expects to raise $970 million this year. The sale

includes 29,500 acres and is expected to close in the third quarter

of 2024. OXY shares fell 0.1% in pre-market trading.

Loews (NYSE:L) – James Tisch will step down as

CEO of Loews after nearly 25 years, with his son Benjamin Tisch

taking over. James will become chairman on December 31. Loews

reported a 2.5% increase in second-quarter profit, driven by

insurance premiums and investment returns.

Tesla (NASDAQ:TSLA) – Morgan Stanley selected

Tesla, replacing Ford, as its top pick in the automotive industry,

highlighting the growth potential of Tesla’s energy sector. Tesla

is expected to excel in the electric vehicle credits market,

despite challenges with profit margins and demand, while Ford

posted disappointing financial results. In other news, Elon Musk

stated that investors won’t understand Tesla without experiencing

the Full Self-Driving (FSD) system. Bloomberg reported that analyst

William Stein tested FSD and nearly had an accident due to system

failures, highlighting that despite some advancements, FSD is not

truly autonomous. Tesla shares rose 1.6% in pre-market trading.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines is eliminating free seating to increase revenue, following

investor pressure and declining profits. The new designated seating

model, including extra space options, may alienate loyal customers

and change the company’s identity but aims to improve

profitability.

Berkshire Hathaway (NYSE:BRK.A), Bank

of America Corp (NYSE:BAC) – Berkshire Hathaway reduced

its stake in Bank of America for the third time in July, totaling

$3 billion, by selling shares worth $767 million between July 25

and 29. Despite this reduction, Berkshire still holds nearly 962

million shares of the bank, valued at $39.5 billion. The sale

reflects a partial withdrawal from a bet that began in 2011.

Wells Fargo (NYSE:WFC) – A US judge ruled that

Wells Fargo must face a lawsuit for allegedly misleading

shareholders about its diversity hiring practices. The bank is

accused of conducting false interviews for non-white and female

candidates without intending to hire them.

Citigroup (NYSE:C), Morgan

Stanley (NYSE:MS) – Recently, Citigroup and Morgan Stanley

sold preferred shares with yields of 7% and 6.625%, respectively.

Citi raised $1.5 billion, while Morgan Stanley raised $1 billion.

Both offerings valued above the initial issuance price, with Citi

issuing $3.8 billion in preferred shares this year.

UBS Group AG (NYSE:UBS) – The Swiss financial

regulator FINMA is meticulously evaluating how UBS selects risky

Credit Suisse clients to avoid old Credit Suisse problems

transferring to UBS post-merger. This supervision includes

verifying UBS’s risk filters and compliance procedures’

effectiveness. UBS shares rose 0.1% in pre-market trading.

Charles Schwab (NYSE:SCHW) – After the latest

earnings report, Charles Schwab shares fell 11%, and analyst

Patrick Moley downgraded his recommendation from “Buy” to

“Neutral.” He reduced the price target from $80 to $64, citing

uncertainties due to changes in the company’s banking

operations.

BHP Group (NYSE:BHP) – Workers at the Escondida

mine in Chile, represented by the union, were called to reject

BHP’s latest contract offer and consider a strike. Voting will be

from Monday to Thursday, and a strike could begin immediately,

affecting copper production. The union seeks better benefits and

conditions for workers. BHP shares fell 2.7% in pre-market

trading.

BHP Group (NYSE:BHP), Lundin

Mining (TSX:LUN), Filo Corp (TSX:FIL) –

BHP and Lundin Mining will buy Filo Corp for $3.25 billion (C$ 4.5

billion), creating a 50/50 joint venture for the Filo del Sol and

Josemaria projects on the Argentina-Chile border. The offer is C$

33 per share, with a 12.2% premium.

Guardant Health (NASDAQ:GH) – The Food and Drug

Administration (FDA) approved Guardant Health’s colorectal cancer

screening blood test. The test, called Shield, is the first of its

kind approved in the US and covered by Medicare, aiming to improve

early detection and survival rates of colorectal cancer.

Bristol Myers Squibb (NYSE:BMY),

Johnson & Johnson (NYSE:JNJ),

AbbVie (NYSE:ABBV), AstraZeneca

(NASDAQ:AZN) – These major pharmaceutical companies stated they do

not expect significant impacts on their businesses after seeing the

proposed US government prices for Medicare drugs, which will take

effect in 2026. The companies consider the prices “okay” and in

line with expectations.

J.M. Smucker (NYSE:SJM) – J.M. Smucker is

considering selling Voortman Bakery, valuing the cookie and wafer

brand at over $350 million. Smucker, which bought Hostess Brands

for $5.6 billion, hired Goldman Sachs to find buyers. Voortman was

acquired by Hostess in 2019 for about $320 million.

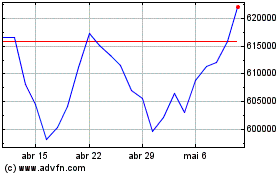

Berkshire Hathaway (NYSE:BRK.A)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Berkshire Hathaway (NYSE:BRK.A)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025