Intel (NASDAQ:INTC) – Intel secured up to $3.5

billion in federal subsidies to manufacture semiconductors for the

U.S. Department of Defense. This information was disclosed by

Bloomberg News after the company signed a binding agreement with

U.S. authorities. Shares rose 3.7% in pre-market trading after

closing up 1.6% on Friday.

Stellantis NV (NYSE:STLA) – Stellantis NV,

Europe’s second-largest automaker, opposes delaying the European

Union’s new emissions targets set to take effect next year. CEO

Carlos Tavares stated it would be unfair to change the rules now,

as the company is prepared to meet the regulations. Shares rose

1.2% in pre-market trading after closing up 0.5% on Friday.

Apollo Global Management (NYSE:APO), BP

plc (NYSE:BP) – Apollo Global Management closed a $1

billion deal with BP to finance its 20% stake in the Trans Adriatic

Pipeline. Apollo will acquire a minority interest in BP’s

subsidiary owning the pipeline, allowing BP to retain control. The

deal, expected in Q4, will aid BP’s divestment plan for 2024. BP

shares rose 0.7% in pre-market trading after closing up 0.8% on

Friday.

Oracle (NYSE:ORCL) – Oracle surprised the

industry by announcing plans for a giant nuclear-powered data

center, capable of consuming more energy than 300,000 homes. Larry

Ellison revealed the company’s intent to use small nuclear reactors

to power the facility. The news excited the nuclear industry,

despite the lack of project details and partners. Shares fell 0.1%

in pre-market trading after closing up 0.4% on Friday.

Amazon (NASDAQ:AMZN), Walmart

(NYSE:WMT) – Samsung, Xiaomi, and other smartphone manufacturers

were accused of colluding with Amazon and Walmart’s Flipkart to

launch products exclusively on their platforms, violating antitrust

laws in India. The Competition Commission of India found evidence

that these practices harmed competition and demanded changes in the

involved companies’ business practices. Amazon shares rose 0.1% in

pre-market trading, while Walmart shares dropped 0.1%.

Walt Disney (NYSE:DIS) – Walt Disney and

DirecTV announced a deal restoring access to channels like ABC and

ESPN for over 11 million DirecTV subscribers after a dispute had

interrupted service. The agreement includes new package options and

Disney’s streaming services. Additionally, DirecTV will have

distribution rights for ESPN’s streaming version. Disney also won

the 2024 Emmy Award for Best Drama for Shogun, which set a record

with 18 awards. Shares rose 0.5% in pre-market trading after

closing up 1.4% on Friday.

Netflix (NASDAQ:NFLX) – Netflix is negotiating

to broadcast live versions of the popular talk show “Hot Ones,”

produced by BuzzFeed. The plan includes live episodes with host

Sean Evans to attract more viewers and expand the platform’s live

programming, which now features sports and wrestling. Shares rose

0.1% in pre-market trading after closing up 1.5% on Friday.

EchoStar (NASDAQ:SATS),

AT&T (NYSE:T) – AT&T and its joint venture

TPG are in early talks to merge DirecTV with Dish’s EchoStar. The

merger would create the largest U.S. pay-TV provider with 16

million subscribers. The deal would face antitrust scrutiny but may

overcome hurdles due to increasing competition. AT&T shares

rose 0.1% in pre-market trading after closing up 0.2% on

Friday.

Trump Media & Technology Group (NASDAQ:DJT)

– On Friday, Donald Trump stated he would not sell his shares in

Trump Media & Technology Group, causing the stock to surge 30%

before closing with an 11.8% gain. Trump owns 57% of the company,

and the rally reflects a recovery after recent losses. Shares rose

3.5% in pre-market trading.

Delta Air Lines (NYSE:DAL) – Delta Air Lines

asked the U.S. Department of Transportation to delay the resumption

of four daily flights to China due to market difficulties. The

airline already operates flights to Shanghai from Seattle and

Detroit but seeks to postpone two daily flights to Shanghai and two

to Beijing. Shares rose 0.2% in pre-market trading after closing up

2.1% on Friday.

United Airlines (NASDAQ:UAL) – United Airlines

signed an agreement with Starlink to provide in-flight internet on

its aircraft. Starlink, part of SpaceX, already has contracts with

other airlines. United plans to begin testing in 2025 and will

offer the service for free on over 1,000 aircraft. Shares rose 0.6%

in pre-market trading after closing up 1.2% on Friday.

Boeing (NYSE:BA) – A strike at Boeing may

extend as workers seek higher wages and better retirement benefits.

Over 30,000 union members rejected an initial contract,

prioritizing wage increases and pension restoration. Boeing and the

union will resume negotiations next week. Shares rose 0.5% in

pre-market trading after closing down 3.7% on Friday.

Ryanair (NASDAQ:RYAAY) – Ryanair’s CEO, Michael

O’Leary, warned that a prolonged Boeing strike could reduce

aircraft deliveries from 25 to 20 by next summer. The low-cost

airline was set to receive 30 737 MAX planes by 2025, but

production issues and the strike have affected these numbers.

Uber Technologies (NYSE:UBER) – Uber announced

an expansion of its partnership with Alphabet to include autonomous

transportation services from Waymo in Austin and Atlanta next year.

Uber will continue integrating electric autonomous vehicles into

its fleet. Additionally, Uber recently lost a legal appeal in New

Zealand, where four drivers were classified as employees rather

than contractors, leading to changes in New Zealand’s labor laws.

Shares rose 0.2% in pre-market trading after closing up 6.5% on

Friday.

US Steel (NYSE:X) – A U.S. national security

panel is reviewing Nippon Steel’s $14.9 billion offer for US Steel.

The Committee on Foreign Investment in the U.S. (CFIUS) will decide

by September 23 whether to recommend approving or blocking the

deal. The decision is politically sensitive, with opposition from

figures like Biden and Trump. Nippon Steel and US Steel sent a

letter to President Joe Biden addressing national security concerns

that could prompt Biden to block the deal.

Alcoa (NYSE:AA) – Alcoa will sell a 25.1% stake

in its Ma’aden joint venture to Saudi miner Ma’aden for $1.1

billion. The transaction includes 86 million shares and $150

million in cash, aiming to simplify Alcoa’s portfolio and increase

financial flexibility.

Archer-Daniels-Midland (NYSE:ADM) – The U.S.

Environmental Protection Agency found that Archer-Daniels-Midland

violated drinking water rules and its underground injection permit

in its Illinois carbon capture project. The company failed to

properly monitor the well, and the injected CO2 flowed into

unauthorized areas, but ADM claims there was no impact on public

health.

HSBC Holdings Plc (NYSE:HSBC) – Georges

Elhedery, HSBC’s new CEO, began a major restructuring after two

weeks in office. Facing revenue declines due to low interest rates,

he aims to cut $2 billion in costs and is considering selling

non-essential businesses. Elhedery, who visited Hong Kong shortly

after taking office, is evaluating changes to the bank’s structure

and executive team, focusing on efficiency and expense reduction.

Shares fell 0.5% in pre-market trading after closing up 0.7% on

Friday.

Goldman Sachs (NYSE:GS) – According to Goldman

Sachs, hedge funds were active in buying shares of financial

institutions last week, at the fastest pace since June 2023.

Despite maintaining global short positions for nine consecutive

weeks, funds focused on long positions in North American and

European financial institutions. Goldman noted that funds were more

active in buying financial sector stocks while moderately selling

consumer finance companies and mortgage-backed securities.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase has

hired Yang Ruo, a former Citigroup banker, to lead its technology,

media, and telecommunications team in China. With extensive

experience in financial leadership, Yang will help expand the

company’s presence in this booming sector. He will report to

Asia-Pacific and China leadership and has a track record of success

at companies like Xiaohongshu and Fosun.

Citigroup (NYSE:C) – Citigroup agreed to sell

its trust services unit to JTC, a financial services firm based in

Jersey. JTC will provide fiduciary and curator services, while Citi

will continue with investment management and other services. The

sale is aimed at helping Citi focus on strategic areas, while JTC

expands its global presence. The deal is expected to close by

mid-2025. Shares rose 0.5% in pre-market trading after closing up

0.6% on Friday.

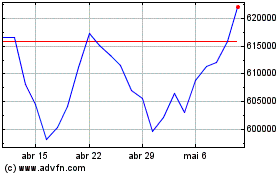

Berkshire Hathaway (NYSE:BRK.B), (NYSE:BRK.A) –

Berkshire Hathaway’s shares are facing their longest losing streak

in over 15 years after a rally that brought its market

capitalization to $1 trillion. Recently, Vice Chairman Ajit Jain

sold $139 million in Class A shares, sparking speculation about

valuation. Additionally, Warren Buffett made an unusual donation of

20 Class B shares, worth about $9,000, to one or two individuals.

While Buffett is known for large donations to foundations like the

Bill & Melinda Gates Foundation, personal donations of this

type are rare. BRK.B shares rose 0.4% in pre-market trading after

closing down 0.7% on Friday.

KKR (NYSE:KKR) – German billionaire Mathias

Doepfner and KKR have reached a preliminary agreement to split up

media giant Axel Springer. KKR is set to gain a majority stake in

the company’s profitable classified ad business. The deal values

Axel Springer at about $14.95 billion, with over $10.77 billion

allocated to the classifieds business. The signing could take

months, but an announcement may come in the coming days.

Bain Capital (NYSE:BCSF) – Bain Capital is

considering selling British insurer Esure and has hired advisors,

including Fenchurch, for the process. Belgian insurer Ageas is

interested in the purchase, primarily because it already uses the

same technology platform as Esure. The company could be worth at

least $1.31 billion.

Icahn Enterprises (NASDAQ:IEP) – Carl Icahn’s

Icahn Enterprises won a lawsuit accusing it of inflating its stock

prices by paying unsustainably high dividends to secure personal

loans. Judge K. Michael Moore ruled that shareholders did not prove

material misrepresentations or intent to defraud. The case

continues, with a new complaint to be filed by October 14. Shares

rose 1.4% in pre-market trading.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens Boots Alliance agreed to pay $106.8 million to settle

claims of fraudulent billing to the U.S. government for uncollected

prescriptions between 2009 and 2020. The company, without admitting

guilt, corrected the error and repaid $66.3 million. The settlement

ends whistleblower lawsuits in three states. Shares rose 0.7% in

pre-market trading after closing up 4.2% on Friday.

Novartis AG (NYSE:NVS) – Novartis’s Kisqali

showed progress in treating breast cancer, reducing the recurrence

risk by 28.5% after four years of treatment. These data are

compared to Eli Lilly’s Verzenio. Kisqali’s approval for

early-stage breast cancer in the U.S. is expected in September.

Despite a smaller reduction compared to Verzenio, the cancer-free

survival rate is higher.

Berkshire Hathaway (NYSE:BRK.A)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Berkshire Hathaway (NYSE:BRK.A)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025