Bitcoin recovers slightly; hash rate drop indicates possible miner

capitulation

After a negative day for the crypto sector, Bitcoin

(COIN:BTCUSD) recovered by 0.60% on Friday morning, priced at

$67,122.71 in the last 24 hours.

Regarding the recent dynamics in the Bitcoin mining market, the

hash rate has dropped to around 600 exahashes per second,

suggesting a possible capitulation period for some miners after 18

months of steady growth. This decline in mining activity, which

reflects a lower difficulty in mining Bitcoin, may indicate that

mining companies are beginning to sell their BTC reserves, although

capitulation is not entirely confirmed by the selling

movements.

The “Miner Net Position Change” indicator, which tracks the net

balance of Bitcoin miners, provides insights into their market

expectations. When the balance is positive, it usually indicates

that miners are holding Bitcoin, likely because they expect the

price to increase. Conversely, a negative balance suggests they are

selling, perhaps to cover operational costs or because they foresee

a price drop.

Fernando Pereira, an analyst at Bitget, reinforces the

observation that although there are signs of selling, the situation

is not alarming but requires vigilance to understand if this trend

will persist and potentially signal more significant market

changes. “The indicator shows a distribution from miners that is

not one of the largest recently, but it deserves attention if it

prolongs or increases in volume. However, this is not an effective

reversal signal, especially when compared to the last cycle, where

miners were buying at the all-time high and selling at the all-time

low,” said Pereira.

In other related news, a new report from Greenpeace USA

criticizes large financial institutions on Wall Street for

financing the Bitcoin mining industry, which generates high carbon

emissions. Greenpeace calls for more transparency and

responsibility regarding the climate impacts of these investments.

The report highlights names like BlackRock (NYSE:BLK) and Vanguard

as major financiers of this activity, pointing them out as

responsible for enormous amounts of CO2.

Bernstein predicts Bitcoin to reach $1 million by 2033

Bernstein has started covering MicroStrategy (NASDAQ:MSTR),

highlighting its optimistic projections for Bitcoin (COIN:BTCUSD),

noting that it could reach $1 million by 2033 and $200,000 by 2025.

MicroStrategy, the largest corporate holder of Bitcoin, owns 1.1%

of the global supply of the cryptocurrency. The company,

transformed in four years, is seen as an active model of Bitcoin

accumulation compared to passive ETFs.

Sharp drop in Bitcoin ETFs after day of gains

On June 13, US spot Bitcoin ETFs experienced a sharp reduction

in their positions after a day of significant gains. Recent data

indicates withdrawals worth $226.2 million, a stark contrast to the

$100.8 million inflows the previous day. Fidelity’s ETF (AMEX:FBTC)

led the outflows with $106.4 million. Only BlackRock’s ETF

(NASDAQ:IBIT) showed new inflows, standing out in the prevailing

trend of outflows.

Analyst explains slowdown in Bitcoin adoption

Jurrien Timmer of Fidelity Investments analyzed the recent

slowdown in Bitcoin adoption, despite considering it “exponential

gold.” He notes that the growth of the Bitcoin network has not kept

pace with its price gains, creating a significant divergence.

Timmer attributes this dynamic to growth influenced by the coin’s

scarcity, monetary and fiscal policies, and market sentiment. This

divergence may be the key to understanding why Bitcoin has not

reached new all-time highs recently.

Bitfarms expands operations in Pennsylvania as Riot intensifies

acquisition attempt

Bitfarms (NASDAQ:BITF), a leading Bitcoin mining company,

announced the expansion of its operations to Sharon, Pennsylvania.

The new site will allow the development of up to 120 megawatts of

energy capacity. This expansion, located at the PJM

interconnection, will provide Bitfarms with access to competitive

electricity rates, strengthening its market position and increasing

its geographical diversification as the company aims for an

operational capacity of 8 EH/s by 2025.

Additionally, Riot Platforms (NASDAQ:RIOT) acquired an

additional 1,432,063 shares of Bitfarms at $2.70 each, totaling

approximately $3.87 million. With this purchase, Riot now holds

about 14% of Bitfarms’ shares, part of its hostile takeover attempt

of the company. Recently, Bitfarms implemented a “poison pill” to

protect itself, responding to Riot’s aggressive approach, which

criticized this defensive strategy.

Massive exploit on Holograph results in 7-million-dollar token loss

Holograph, an advanced platform for token transfers between

different blockchains, was targeted by a cyber attack, leading to

the loss of 1 billion HLG tokens, valued at around $7 million.

Following the attack, the value of the HLG token plummeted 80% in

one day, with partial subsequent recovery. An unidentified attacker

compromised the platform’s Holograph Operator Contract, creating

fraudulent tokens. Although the flaw has been fixed, the team is

working with exchanges to block affected accounts and is

cooperating with authorities. Additionally, some of the stolen

tokens were converted and dispersed through addresses linked to

services that promote anonymity, complicating the recovery of the

funds.

Cryptocurrency scam via LinkedIn leads to $310,000 loss for

investor

According to Cointelegraph, an investor was scammed out of

$310,000 after interacting with a cryptocurrency trading platform

called Ethfinance, discovered through a random LinkedIn invitation.

The individual was lured to the platform with promises of

substantial profits through cryptocurrency trading and transferred

the amount from their DeFi wallet to Ethfinance. When attempting to

withdraw their capital and accumulated profits, the investor was

told they needed to add additional funds to complete a “smart

contract” and make the withdrawal. The investor chose not to send

more money and was consequently blocked from accessing their

account, which was subsequently locked. The Washington State

Department of Financial Institutions identified the incident as a

potential “advance fee fraud,” a scheme where victims are persuaded

to pay upfront fees for promises of financial returns that never

materialize.

Tax charges against Binance executives dropped in Nigeria

Tax charges against Binance executives Tigran Gambaryan and

Nadeem Anjarwalla in Nigeria have been dropped by the Federal

Inland Revenue Service (FIRS). Now, Binance, represented locally,

is the only defendant in the case. Gambaryan, currently ill and

unable to attend court, and Anjarwalla still face a separate money

laundering case. Nigerian authorities adjusted the charges after

considering that the executives do not have significant

decision-making power in the company.

Biden proposes significant changes in financial regulatory

leadership

President Joe Biden has announced a series of nominations that

could change the leadership of the major financial regulatory

bodies in the US. Among the nominations, Christy Goldsmith Romero,

current CFTC commissioner, is proposed to lead the FDIC, replacing

Martin Gruenberg. Additionally, CFTC Commissioner Kristin Johnson

is being considered for Deputy Secretary of the Treasury, and

Caroline Crenshaw is expected to continue at the SEC. These changes

come amid intense scrutiny of cryptocurrency policies during an

election year.

Taiwan establishes advocacy body for cryptocurrency sector

Taiwan has officially launched the Association of Virtual Asset

Service Providers, a coalition of 24 entities in the crypto sector,

to facilitate collaboration between the private sector and the

government in regulating the industry. The association, approved by

the Ministry of the Interior in March 2024, will initially focus on

creating a comprehensive self-regulation code, addressing aspects

such as industry classification, consumer protection, and

transaction monitoring.

Trezor launches new services to improve cryptocurrency wallet

usability

Trezor is enhancing the usability of cryptocurrency wallets with

the launch of Trezor Expert, a personalized onboarding service, and

a new hardware wallet, the Trezor Safe 5. Trezor Expert offers

individualized support to help users set up and manage their

self-custodial wallets, promoting greater security and privacy. The

Trezor Safe 5, in turn, brings advancements in security and ease of

use, including a new backup system and a touch interface.

Growing interest in CBDCs, BIS survey indicates

A recent survey by the Bank for International Settlements (BIS)

revealed that a record 94% of central banks are investigating the

implementation of central bank digital currencies (CBDCs). This

interest has increased compared to the 90% recorded in 2021. The

survey highlighted that central banks consider it more likely to

issue CBDCs for institutional use than for the general public in

the next six years.

Beeple releases artwork inspired by memecoins featuring Iggy Azalea

and Andrew Tate

Influential digital artist Beeple has unveiled his new work

“Mother and Daddy (2024),” which reimagines Grant Wood’s classic

“American Gothic,” incorporating controversial figures like Iggy

Azalea and Andrew Tate. This piece reflects the intersection of

celebrity culture and digital finance, with a critical focus on the

globalization of American capitalism. The work is accompanied by a

conceptual document that delves into the impact of memecoins and

the cultural influence of Tate and Azalea.

Paradigm raises $850 million for new crypto and blockchain

investment fund

Venture capital firm Paradigm has finalized raising an $850

million fund for early-stage investments in cryptocurrency and

blockchain projects. This fund is one of the largest for the crypto

sector to date and reflects the company’s continued confidence in

the transformative potential of crypto and blockchain technology,

as highlighted by co-founder Matt Huang. Paradigm has already

invested in major names like Coinbase and Uniswap.

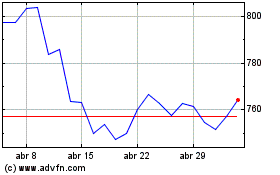

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024