United Parcel Service (NYSE:UPS) – United

Parcel Service will sell its Coyote Logistics unit to RXO for

$1.025 billion. The transaction will be financed through equity and

debt, including significant investments from MFN Partners and Orbis

Investments. The sale allows UPS to focus more on its core

business.

Under Armour (NYSE:UAA) – Under Armour agreed

to pay $434 million to settle a 2017 class-action lawsuit, accused

of misleading shareholders about its revenue growth to meet Wall

Street expectations. The settlement avoids a trial set for July 15.

The shares fell 3.43% in pre-market trading.

Apple (NASDAQ:AAPL) – Apple’s antitrust dispute

with the European Union is escalating, with the European Commission

issuing a new warning that could lead to more fines for Apple. The

company is accused of illegal practices in the App Store,

especially for limiting how developers direct users to offers

outside the store. The EU is now investigating App Store fees, and

Apple could face fines of up to 10% of its global annual revenue.

Recently, Apple announced it would delay the launch of three new AI

features in the EU due to interoperability requirements imposed by

the Digital Markets Act (DMA). The company expressed concerns that

such requirements could compromise user data privacy and security.

Shares fell 0.14% in pre-market trading.

Meta Platforms (NASDAQ:META) – Meta Platforms

is discussing integrating its generative AI model into Apple’s new

AI system for iPhones. Apple seeks to incorporate AI technologies

from various companies, expanding its industry partnerships,

including negotiations with startup Anthropic and search company

Perplexity. Shares rose 0.70% in pre-market trading.

Alibaba (NYSE:BABA), JD.com

(NASDAQ:JD) – Apple added Chinese online retail giants Taobao (a

unit of Alibaba) and JD.com to the list of apps compatible with its

new mixed reality headset Vision Pro. Taobao will offer virtual

experiences like car test drives and makeup simulations, while

JD.com will allow product visualization in home environments

through its JD.Vision app. In pre-market trading, Alibaba shares

fell 0.10% while JD.com shares rose 0.50%.

Amazon (NASDAQ:AMZN) – Amazon plans to revamp

its Alexa service by introducing generative AI and two service

levels. A possible monthly cost of about $5 would be charged for

the premium version. This project, internally called “Banyan,” is

the first major update since Alexa’s introduction in 2014.

Additionally, Formula 1 will introduce a new artificial

intelligence called “Statbot” during the Spanish Grand Prix,

created in partnership with Amazon. This system will use race data

to provide real-time analysis and trivia, aiming to enhance viewer

experience and engagement. Shares fell 0.12% in pre-market

trading.

Spotify (NYSE:SPOT) – Spotify launched a new

streaming plan in the US for $10.99 per month, offering the

benefits of a premium plan except for audiobook listening. This

follows a price increase in its premium plans to improve the

company’s financial margins.

Nvidia (NASDAQ:NVDA) – Nvidia signed a deal to

deploy its AI technology in the data centers of the

telecommunications group Ooredoo in five Middle Eastern countries.

This agreement marks Nvidia’s first large-scale launch in the

region and will allow Ooredoo to offer exclusive AI services to its

customers. After becoming the world’s most valuable company,

Nvidia’s shares fell 6.7% over the past two sessions, losing more

than $220 billion in market value. In 2024, Nvidia shares rose

156%, and CEO Jensen Huang sold 720,000 shares between June 13 and

21 for $94.6 million. Shares fell 1.7% in pre-market trading.

Broadcom (NASDAQ:AVGO), Taiwan

Semiconductor Manufacturing Co (NYSE:TSM) – China’s

ByteDance, owner of TikTok, is working with Broadcom to create a

5-nanometer artificial intelligence (AI) processor. This custom

chip will help ByteDance secure a stable supply of advanced

semiconductors amid trade restrictions between the US and China.

The production of this chip will be outsourced to Taiwan’s TSMC,

adhering to US export regulations. Broadcom shares rose 0.60% in

pre-market trading, while TSMC shares fell 1.3%.

Trump Media & Technology Group (NASDAQ:DJT)

– On Friday, the company announced it expects to generate more than

$69.4 million from the activation of warrants last Thursday and

Friday. Recently, the Securities and Exchange Commission approved

the necessary documents for the company to resell its shares and

warrants. Trump Media also projected it could raise up to $247

million if all available warrants were activated. Shares of Trump

Media rose 6.6% before the market opened.

Alaska Air Group (NYSE:ALK) – The union

representing Alaska Airlines flight attendants reached a tentative

contract agreement with the airline. Details will be reviewed by

union leadership before being submitted for ratification by

members.

American Airlines Group (NASDAQ:AAL) – American

Airlines flight attendants, represented by a union, are considering

striking after negotiations failed to reach a new agreement. They

are divided on key issues such as wage increases and retroactive

pay. The strike could occur after a 30-day “cooling-off” period if

negotiations declare an impasse. Shares rose 0.09% in pre-market

trading.

Boeing (NYSE:BA) – The US Department of Justice

has yet to decide whether to prosecute Boeing for violating the

terms of a 2021 agreement related to two fatal 737 MAX crashes.

Boeing, which paid $2.5 billion to resolve the previous criminal

investigation, claims it complied with the agreement. Shares fell

0.63% in pre-market trading.

Tesla (NASDAQ:TSLA) – Tesla and opponents of

Elon Musk’s $56 billion compensation package are in court. Tesla

argues that shareholder approval should validate the package, while

shareholders contend that the vote has no legal effect and that the

only option is to appeal to the Delaware Supreme Court.

Additionally, Musk’s lawyers argue that recent approval of the pay

package should delay a hearing on attorney fees due to its

implications in ongoing litigation. They requested the postponement

of the hearing set for July 8. Shares fell 0.17% in pre-market

trading.

Fisker (NYSE:FSR) – Electric vehicle startup

Fisker is heading for liquidation after filing for bankruptcy, with

lawyers anticipating a creditor dispute over who gets paid first.

The company plans to liquidate its assets, including 4,300

vehicles, after failing to secure additional funding.

Lockheed Martin (NYSE:LMT) – China imposed

sanctions on Lockheed Martin subsidiaries and their senior

executives, including the president, in response to US arms sales

to Taiwan. These sanctions include asset freezes and entry bans for

the affected executives.

American Express (NYSE:AXP) – American Express

is acquiring restaurant reservation platform Tock for $400 million

to expand its presence in the restaurant sector, which generated

$100 billion in spending on its cards last year. The acquisition

follows the purchase of Resy in 2019 and aims to enhance benefits

for its customers.

Morgan Stanley (NYSE:MS) – Morgan Stanley faces

a lawsuit from the heirs of a deceased client. They accuse the bank

of failing to act in the best interest of clients by paying only

0.01% interest on their uninvested cash. The lawsuit argues that

the bank should offer a higher interest rate as established by SEC

regulations.

Citigroup (NYSE:C) – Citigroup named Matthew

Hung as the new head of corporate banking for Hong Kong, replacing

Joy Cheng. The move is part of a global restructuring of Citi to

streamline operations and will take effect on August 19. Hung joins

from HSBC, where he managed corporate coverage in Hong Kong.

Mitsubishi UFJ Financial Group (NYSE:MUFG) –

Japan’s Financial Services Agency ordered MUFG to improve

compliance measures after finding violations of “firewall”

regulations, which prohibit sharing customer data between banks and

brokerages within the same group without consent. Due to these

violations, where customer data was improperly shared and the bank

offered preferential loan conditions to encourage business with its

brokerages, the regulator required MUFG to identify the causes of

the problems and present action plans to prevent future

infractions.

LPL Financial (NASDAQ:LPLA) – A former LPL

broker in Florida, Nathaniel Adams, was suspended for two months

and fined $5,000 by Finra after improperly sending personal

information of about 2,300 clients to his wife and a contact at

LPL. By sending a spreadsheet with sensitive client data, including

information about people he did not work with, he violated privacy

policies.

Carlyle Group (NASDAQ:CG) – Carlyle Group is

moving forward with the sale of the Italian fashion brand Twinset,

requesting non-binding offers and aiming for a valuation of around

300-350 million euros. The company chose Rothschild as a financial

advisor to facilitate the process. Carlyle Group increased its

stake in Twinset from 72% in 2012 to 90% in 2015, acquiring full

control in 2017. Sale attempts in 2020 were halted by the pandemic.

The fashion brand struggles to reach pre-Covid profit and revenue,

with a profit of 34 million euros in 2023.

Walmart (NYSE:WMT), Capital

One (NYSE:COF) – Walmart resolved its lawsuit against

Capital One over their exclusive credit card issuance partnership,

which ended after disagreements over customer service quality. The

terms of the settlement were not disclosed, and the case was

dismissed by Judge Katherine Polk Failla.

PepsiCo (NASDAQ:PEP), Britvic

(LSE:BVIC), Carlsberg (TG:CBGB) – PepsiCo agreed

to remove a clause from its bottling agreement with Britvic, making

it easier for Carlsberg to present a more attractive acquisition

proposal after two rejected offers. Removing the clause could

facilitate a new offer from Carlsberg for Britvic.

Darden Restaurants (NYSE:DRI) – Olive Garden,

owned by Darden Restaurants, opts not to offer significant

discounts as a strategy to attract customers, unlike competitors

like McDonald’s and Burger King. The company prioritizes

sustainable profitable growth over aggressive promotions, focusing

on maintaining stable prices despite inflation.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

Mexican Grill will conduct a 50-for-1 stock split on June 26,

making its shares more accessible to retail investors and

employees. This applies to all Chipotle common shares outstanding

as of June 18. Although shareholders will have more shares, the

total investment value does not change. This is the company’s first

stock split.

AMC Entertainment Holdings (NYSE:AMC) – AMC is

in negotiations with creditors to reduce its $4.5 billion debt and

extend near-term maturities. These talks aim to restructure the

$2.8 billion due in 2026, including a $1.9 billion loan and

second-lien notes. The decision is still pending. Shares fell 2.20%

in pre-market trading.

Madison Square Garden Entertainment (NYSE:MSGE)

– James Dolan had his contract as executive chairman and CEO of

Madison Square Garden Entertainment renewed for another three

years, until June 30, 2027. He will receive an annual base salary

of at least $1.5 million, a target bonus of 200% of his salary, and

annual long-term awards of at least $8.6 million.

Altria (NYSE:MO) – The US Food and Drug

Administration (FDA) approved the sale of four menthol-flavored

e-cigarettes from Altria, marking the first time the agency has

allowed e-cigarettes with a flavor other than tobacco. Shares rose

0.11% in pre-market trading.

Eli Lilly (NYSE:LLY) – Eli Lilly announced on

Friday that it is seeking FDA approval to expand the indications

for its weight-loss drug Zepbound to also treat sleep apnea.

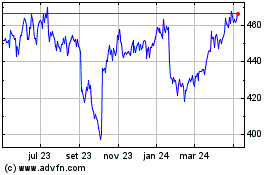

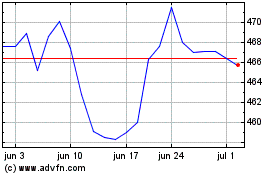

Lockheed Martin (NYSE:LMT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Lockheed Martin (NYSE:LMT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025