Interactive Brokers (NASDAQ:IBKR) – Interactive

Brokers revealed a loss of $48 million due to an error on the New

York Stock Exchange that temporarily showed a 99% drop in the stock

prices of some companies, including Warren Buffett’s Berkshire

Hathaway. The broker attempted to claim compensation for the loss,

but the NYSE denied the request.

Amazon (NASDAQ:AMZN) – Amazon shares closed up

3.9% on Wednesday, reaching $193.61 and boosting its market value

to over $2 trillion. Reaching the $2 trillion market cap is a

testament to Amazon’s resilience and adaptability in the

competitive tech market. The company took more than four years to

achieve this milestone, having first reached the $1 trillion mark

in 2018 and again in 2020. Amazon plans to launch a section on its

shopping site with cheap items that will be shipped directly from

warehouses in China to international consumers. According to The

Information, this section will offer unbranded fashion, home items,

and daily necessities, with delivery expected within 9 to 11 days.

Additionally, the Amazon Web Services conference was interrupted by

protesters demanding the cancellation of a $1.2 billion contract

with the Israeli government, shared with Google. They accused

Amazon of complicity in genocidal events in the conflict with

Hamas, considered a terrorist organization by the EU and the US.

Amazon shares fell 0.05% in pre-market trading.

Nvidia (NASDAQ:NVDA) – Nvidia CEO Jensen Huang

credited the company’s success in the artificial intelligence chip

market to a strategic decision made over a decade ago, which

included billion-dollar investments in AI and building a strong

team of engineers. He highlighted Nvidia’s transition from focusing

on gaming to data centers and AI as essential for its growth.

Nvidia shares fell 1% in the previous regular trading session and

were down 1.1% in pre-market trading on Thursday.

Alphabet (NASDAQ:GOOGL), CME

Group (NASDAQ:CME) – Google is testing facial recognition

in Kirkland, Washington, for office security. The system compares

facial data from cameras with employee badge photos to detect

unauthorized presences, aiming to maintain security. Collected data

is not stored, and employees can opt out. Additionally, Google and

CME Group are creating a new cloud computing network to transfer

futures and options trading to the cloud. The data center will be

built near CME’s current center in Aurora, Illinois, to minimize

disruptions to clients. The 10-year alliance began in 2021, with

Google investing $1 billion in CME. Alphabet shares rose 0.1% in

pre-market trading.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media shares closed nearly 8% higher on Wednesday,

recovering after an initial drop of more than 6% the same day. The

positive move in the shares comes since last Friday, after a sharp

decline following the SEC’s declaration that additional shares of

the company were effective. Shares rose 2.6% in pre-market

trading.

Infosys (NYSE:INFY) – Infosys CEO Salil Parekh

resolved allegations of not implementing adequate internal controls

to prevent insider trading at the company during a 2020 contract.

Parekh agreed to pay 2.5 million rupees (about $30,000) to settle

the dispute with the Indian market regulator. Shares rose 1.5% in

pre-market trading.

Honeywell (NASDAQ:HON) – After a period of

underperformance, Honeywell International shares may be ready for a

rebound. The company, known for its leadership and strong balance

sheet, faced difficulties due to the pandemic. With new annual

profit growth targets and more accessible stock valuation,

Honeywell is positioned to regain its success under the leadership

of Vimal Kapur. Honeywell aims for annual profit growth of 10%,

looking to revitalize the company after an average annual profit

growth of just 3% from 2018 to 2023, a period during which its

shares rose only 24%.

Nokia (NYSE:NOK) – Nokia announced it will sell

its submarine networks business, ASN, to the French state for 350

million euros ($374 million), but this will not alter its financial

forecasts. The sale, expected to be completed between late 2024 and

early 2025, will reduce Nokia’s network infrastructure group’s

sales by 1 billion euros. Shares rose 1.4% in pre-market

trading.

Citigroup (NYSE:C) – Citigroup warned employees

to avoid confrontations with protesters at its New York

headquarters as climate and pro-Palestinian activists try to block

the entrance. The bank’s Security and Investigation committee

advised employees to follow safety and local police guidance. In

other news, Peter Cai, Citigroup’s head of risk data, analytics,

reporting, and technology, left the bank. This is the latest in a

series of executive departures since the company’s reorganization

began in September, amid challenges with risk management and data

governance. Shares rose 0.5% in pre-market trading.

UBS Group AG (NYSE:UBS) – UBS is pressing the

Swiss government for clarity on how much more capital it will need

to hold following its purchase of Credit Suisse, amid concerns that

negotiations could drag on for months, causing investor

uncertainty. It is still unclear whether the additional $15 to $25

billion in capital mentioned by the finance minister in April is

over and above the $19 billion already committed due to the

increased size of the bank.

Mizuho Financial Group (NYSE:MFG) – Mizuho

Financial Group has become the latest Wall Street firm to establish

its base in the Middle East in Saudi Arabia. The Japanese bank

recently received a license from the Saudi Ministry of Investment

to set up its regional headquarters in Riyadh. The firm is

complying with the Saudi requirement to do business with government

entities, which requires a regional base with at least 15

employees.

Carlyle (NASDAQ:CG), KKR &

Co (NYSE:KKR), Discover Financial

(NYSE:DFS) – Carlyle and KKR won a bid for a $10 billion student

loan portfolio from Discover Financial, as reported by the

Financial Times. The joint offer outbid competitors Sixth Street,

BlackRock, and the Canada Pension Plan Investment Board, selling

the portfolio above face value.

Bain Capital (NYSE:BCSF) – Bain Capital, CVC

Capital Partners, and Francisco Partners are considering bids for

Orisha, a French software company valued at up to $2.1 billion. TA

Associates, which invested in Orisha in 2021, plans to retain a

stake alongside a new owner. The bids are in the submission phase

for the Paris-based company.

Blackstone (NYSE:BX) – Blackstone, the private

equity firm, completed the acquisition of Village Hotels, which

operates 33 mid-range hotels in the UK, marking a strengthening of

its presence in the lucrative hospitality sector, which has

outperformed the broader commercial real estate market.

Toyota Motor (NYSE:TM) – Toyota is recalling

145,254 vehicles in the US due to side airbags that may not deploy

properly, according to the National Highway Traffic Safety

Administration. In some vehicles, the driver’s side airbag may not

deploy as intended and could partially deploy out of an open

window.

Honda (NYSE:HMC) – Honda launched an updated

version of its Freed minivan in Japan, including a two-motor

hybrid, as pure electric cars lose popularity. With promising

initial sales and an annual target of 700,000 units, Honda aims to

lead with hybrids until 2030 while also preparing to invest in

EVs.

Tesla (NASDAQ:TSLA) – Tesla shares fell 0.8% in

pre-market trading. Tesla investors are weighing upcoming delivery

results against other factors that could impact the stock’s

performance. Projections for the second quarter of 2024 indicate

deliveries of approximately 440,000 vehicles, down from 466,000 the

previous year, with recent estimates pointing to around 422,000

cars, reflecting a year-over-year decline of more than 10%. Stephen

Gengaro, an analyst at Stifel, initiated coverage of Tesla stock

with a buy recommendation and a price target of $265. He highlights

Tesla’s leadership position in the electric vehicle sector,

comparing it to major tech companies. Despite the recent slowdown

in sales, Gengaro foresees improvement for Tesla, driven by

expanding charging infrastructure, launches of more affordable

models, and technological advancements. In other news, SpaceX plans

to sell insider shares at $112 each in a tender offer, raising its

valuation to nearly $210 billion, up from $180 billion in December.

This decision reflects strong investor demand, setting a new record

for the valuation of a private company in the US, still below

ByteDance’s $268 billion.

Rivian (NASDAQ:RIVN) – Rivian shares fell 0.3%

in pre-market trading. Despite a 30% jump on Wednesday, driven by

Volkswagen’s planned $5 billion investment, the company is still

90% below its peak valuation of $153 billion in November 2021. Its

current valuation is about $15 billion, a difference of roughly

$138 billion. According to Reuters, engineers in California

received camouflaged Audis from Germany earlier this year to test

the integration of Rivian’s advanced technology into the vehicles.

This testing explored the feasibility of future Volkswagen EVs

benefiting from Rivian’s innovations, culminating in Volkswagen’s

significant investment in the startup.

Zeekr (NYSE:ZK) – From May 2023 to April 2024,

electric vehicle sales in Russia increased by about 350%

year-over-year, with more than 20,500 EVs sold. Chinese brands

accounted for more than half of these sales. Zeekr, a premium

Chinese brand, particularly stood out, selling over 8,000 cars

since June last year, despite not having an official presence in

Russia. This growth comes as Western manufacturers withdrew from

the Russian market due to the conflict in Ukraine, allowing Chinese

manufacturers to capture a significant market share.

Boeing (NYSE:BA) – A Boeing executive disclosed

non-public information from an NTSB investigation into a 737 MAX

incident, violating regulations, according to Reuters. The NTSB,

highlighting that Boeing is well aware of the rules, limited its

access to information and will report the case to the US Department

of Justice. Additionally, Boeing is resuming wide-body jet

deliveries to China, which had been halted due to a Chinese

regulatory review. Boeing 737 MAX deliveries are expected to

restart as early as next month. Shares rose 0.7% in pre-market

trading.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines continues to face pricing issues in the second quarter,

despite expectations of record summer travel demand in the United

States. Southwest Airlines shares fell on Wednesday after the

company lowered its expectations for second-quarter RASM,

anticipating a decline of 4% to 4.5%, compared to the previous

forecast of a 1.5% to 3.5% decline. Additionally, the stock’s value

has dropped 25% over the past two years and has been targeted by

activist investor Elliott Management, which has called for changes

in leadership and the board. Shares fell 0.3% in pre-market

trading.

Delta Air Lines (NYSE:DAL) –

Delta Air Lines opened a new VIP lounge at John F. Kennedy

International Airport in New York, offering a luxury experience

with design elements inspired by the Brooklyn Bridge and Missoni

accessories. The space includes a wellness area with massage chairs

and nap pods. This lounge is part of Delta’s strategy to position

itself as the premier luxury airline in the US, with plans to open

similar lounges in Boston and Los Angeles later this year.

RTX Corp (NYSE:RTX) – RTX Corp subsidiary

Collins Aerospace is in talks with NASA to withdraw from its

contract to build new space suits for astronauts on the

International Space Station, a setback as the agency faces issues

with its decades-old extravehicular activity suits. Collins has

encountered difficulties and delays in developing the program and

is discussing with NASA how to end its role in the project.

BP Inc (NYSE:BP) – Murray Auchincloss, the new

CEO of BP, has imposed a hiring freeze and paused new offshore wind

projects to focus more on oil and gas. These changes respond to

investor dissatisfaction with the company’s previous strategy to

transition to renewable energy, which was not generating expected

returns quickly. Shares rose 0.8% in pre-market trading.

BHP Group (NYSE:BHP) – In the first half of

2024, financial advisory fees for mergers and acquisitions in Asia

reached an 11-year low of $1.5 billion amid a reduced business

landscape. Among the affected deals, mining company BHP Group

abandoned its $49 billion plan to acquire rival Anglo American,

further reducing investment banking revenue opportunities in the

region. Shares fell 1% in pre-market trading.

International Paper (NYSE:IP),

Suzano (NYSE:SUZ), DS Smith

(LSE:SMDS) – International Paper shares fell 14.85% in pre-market

trading after Suzano, the Brazilian company and the world’s largest

pulp producer, announced the end of talks to acquire the

Memphis-based paper manufacturer. Reports indicate Suzano had

proposed buying International Paper for approximately $15 billion.

Meanwhile, International Paper revealed this week that its pending

acquisition of British packaging company DS Smith, valued at more

than $7 billion, passed a significant US regulatory hurdle.

Novo Nordisk (NYSE:NVO) – Novo Nordisk

announced it will record an impairment loss of about $816.72

million in the second quarter of 2024 after the failure of the

phase 3 CLARION-CKD study to meet its primary goal. Shares rose

0.5% in pre-market trading.

GSK (NYSE:GSK) – A CDC committee recommended

RSV vaccines only for people aged 75 and older and for adults aged

60 to 74 at risk. This limits the expected coverage for younger

patients, affecting GSK’s sales expectations. Shares fell 1% in

pre-market trading.

Grail Inc (NASDAQ:GRAL) – Grail shares began

trading on Nasdaq on June 25 after the company spun off from

Illumina due to concerns from the European Commission over market

dominance in early cancer detection testing. Shares opened at

$18.35, dropping to as low as $15.84, and closed at $17. The

spin-off was approved in April 2024, with each Illumina shareholder

receiving one Grail share for every six Illumina shares. Illumina

retains a 14.5% minority stake in Grail. Grail focuses on

developing the Galleri blood test for early cancer detection,

facing strong market competition. On Wednesday, shares closed at

$16.73. Shares are stable in pre-market trading.

Merck (NYSE:MRK) – Over the years, Merck has

conducted numerous clinical studies for Keytruda, its

groundbreaking cancer immunotherapy. These studies secured

regulatory approval for the drug for 17 types of cancer, making it

one of the world’s most important medications, with sales of $25

billion in 2023, representing 40% of Merck’s total revenue.

Medtronic (NYSE:MDT), HP Inc.

(NYSE:HPE) – Karen Parkhill, CFO of Medtronic, will leave the

medical device manufacturer to join HP Inc. as CFO. Her departure

comes at a crucial time for the PC industry, which is seeking

recovery after a long post-pandemic downturn.

GameStop (NYSE:GME) – GameStop’s trading volume

fell to its lowest level in nearly eight weeks on Wednesday,

continuing to calm after the recent meme stock frenzy. Volume was

17.43 million, the lowest since May 2, well below the 65-day

average of 47.57 million. GameStop shares fell 0.5% in pre-market

trading.

Nike (NYSE:NKE) – Nike may be close to

overcoming a prolonged period of weak sales and market share loss.

First, it will face an earnings report that many on Wall Street

predict will be mediocre. The company will report numbers after the

market closes, and analysts expect revenues of $12.9 billion for

the last quarter, in line with the previous year, and earnings of

84 cents per share, up from 66 cents previously. For the full year,

earnings are expected to be $3.70 per share, with total sales of

$51.6 billion. Shares rose 0.1% in pre-market trading.

Birkenstock (NYSE:BIRK) – German sandal maker

Birkenstock announced that a $756 million secondary offering was

priced at $54 per share by an entity associated with L Catterton. L

Catterton, backed by Bernard Arnault and LVMH, will reduce its

stake in Birkenstock to 73.2%, with Birkenstock not selling shares

or receiving funds from the offering. Shares rose 0.5% in

pre-market trading.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

Mexican Grill shares rose 0.3% after its first stock split since

its debut on the New York Stock Exchange. The 50-for-1 split

adjusted the price to $65.66, making the shares more accessible to

retail investors and potentially increasing demand. Shares rose

0.5% in pre-market trading.

McDonald’s (NYSE:MCD) – McDonald’s executive

Joe Erlinger stated that the McPlant test in the US was

unsuccessful, as customers are not seeking plant-based options or

salads at the chain’s restaurants. The McPlant test in San

Francisco and Dallas ended in 2022. Instead, McDonald’s is focusing

on offering more chicken options, which are more affordable and

popular with consumers.

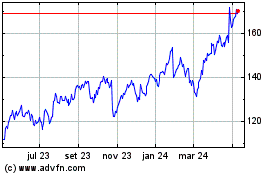

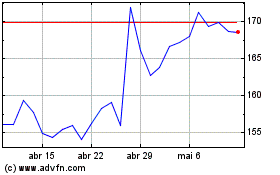

Alphabet (NASDAQ:GOOGL)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Alphabet (NASDAQ:GOOGL)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024