CleanSpark acquires GRIID for $155 million, expands mining

operations

CleanSpark (NASDAQ:CLSK), a Bitcoin mining company, announced

the acquisition of GRIID Infrastructure (NASDAQ:GRDI) for $155

million. The acquisition includes an exclusive hosting agreement,

providing CleanSpark with 20 MW of power. The purchase comes at a

challenging time for Bitcoin miners due to recent cuts in mining

rewards, leading many to diversify into altcoin mining and

technologies like AI. The transaction still requires approval from

GRIID shareholders and other regulatory conditions.

Marathon Digital diversifies with altcoin mining after Bitcoin

halving

Marathon Digital (NASDAQ:MARA), a leading Bitcoin miner by

market value, announced it has started mining the altcoin Kaspa

(COIN:KASUST) to diversify its revenue sources following the recent

Bitcoin halving. In September 2023, the company deployed its first

Kaspa ASIC miners. Marathon acquired approximately 60 PH/s of

mining capacity in Bitmain ASICs, expecting high profit margins.

Currently, half of this capacity is active in Texas, with the rest

expected to be operational by the end of the third quarter. While

Marathon mined $176 million in Bitcoin in the first quarter, by

June 25, the company had already mined 93 million KAS, valued at

approximately $15 million. The price of the Kaspa token rose 6% in

the last 24 hours to $0.180610.

VanEck proposes first Solana ETF in the US despite regulatory

challenges

VanEck, a cryptocurrency asset management company, stirred the

market by applying to launch the first Solana ETF in the US,

following a recent application for an Ethereum ETF. Matthew Sigel,

head of digital asset research at VanEck, announced that the

planned SOL ETF would be listed on the Cboe BZX Exchange. Although

the SEC classifies Solana and other altcoins as securities,

complicating approval, the announcement positively impacted the

market, with Solana (COIN:SOLUSD) appreciating about 9.10% in the

last 24 hours.

The recently proposed ETFs for Ethereum and Solana face

significant challenges due to regulations prohibiting staking,

essential for the operation of these proof-of-stake (PoS) networks.

The exclusion of staking from the ETFs, required to meet regulatory

standards, could paradoxically weaken the networks they aim to

benefit. This could reduce security and increase centralization,

countering the decentralization goal of PoS blockchains.

Additionally, it creates a disconnect between ETF investors and

active network participation, negatively impacting governance and

network health.

State Street and Galaxy Digital launch diversified cryptocurrency

ETFs

State Street Global Advisors, one of the leading ETF issuers,

announced on June 26 a partnership with Galaxy Digital to expand

its offering of cryptocurrency ETFs, covering more than just

Bitcoin. The new fund, the SSGA Active Trust, will be diversified,

investing in various aspects of the cryptocurrency market,

including shares of cryptography companies and exchange-traded

products. This move aims to provide investors with broader access

to the digital assets ecosystem, valued at $2.4 trillion.

US Bitcoin ETFs register inflows on Wednesday

On June 26, recent data from Farside shows an increase in

inflows to Bitcoin exchange-traded funds (ETFs), with an addition

of $21.4 million. This increase suggests renewed investor interest.

Fidelity’s ETF (AMEX:FBTC) led with inflows of $18.6 million,

totaling $9.2 billion. Grayscale’s ETF (AMEX:GBTC) had its first

inflow since early June, while BlackRock’s ETF (NASDAQ:IBIT)

remained stable.

Bitcoin stabilizes around $60,000

Bitcoin (COIN:BTCUSD), which had fallen to around $59,000 on

Monday, saw a stalled recovery, priced at $61,760, a 1.56% increase

in the last 24 hours. Fernando Pereira, an analyst at Bitget,

suggests that the Bitcoin price is expected to remain consolidated

at this level for a while. “After reaching an important support

level of $60,000, sentiment indicators for BTC (such as fear and

greed and funding rate) show neutrality. Meanwhile, we see BTC’s

major moving averages quite distant from the price. This situation

should result in BTC’s price being consolidated around $60,000 for

a few more days“, said Pereira.

On Thursday, the dollar index (DXY) reached 106, the highest

value since May 2, restricting risk appetite. Today, economic data

was released including the US GDP for the first quarter, durable

goods for May, and a weekly unemployment report. Cryptocurrency

investors and traders are attentive to the Biden-Trump presidential

debates, and are expecting May’s PCE inflation data on Friday and

the potential impacts of the November elections on the

industry.

Gradual progress in Ethereum Layer 2 decentralization

Ethereum’s (COIN:ETHUSD) Layer 2 is on its way to complete

decentralization, expected to occur in the coming years, according

to Cointelegraph. Several teams indicate progress towards “Stage 2”

of decentralization, a significant milestone that would drastically

limit the possibility of censorship on the networks. This stage

represents the final implementation of the decentralization goals

proposed by Vitalik Buterin. After prioritizing updates that

improve security and user experience, teams are now focusing on

advancing to this decisive stage of decentralization.

Binance adjusts Link program to eliminate arbitrage gaps

Binance is modifying its Link Program to close a loophole that

allowed some top-tier brokers to capitalize on a differentiated fee

structure. According to reports, these brokers benefited from

significant trading fee discounts, which were passed on or used for

arbitrage on behalf of clients, generating additional profits. This

change aims to ensure greater equality and prevent abuses in the

fee structure. Binance also encouraged users to report any

suspicious activity, reinforcing its commitment to regulatory

compliance.

Coinbase sues SEC and FDIC for access to cryptocurrency documents

Coinbase (NASDAQ:COIN), through History Associates Inc., is

suing the SEC and FDIC for not releasing documents related to

cryptocurrencies under the Freedom of Information Act. The exchange

seeks to clarify regulators’ positions on which digital assets are

considered securities, including Ethereum. The legal action comes

after the SEC indicated the conclusion of its analysis of Ethereum

2.0 as a security, which could make it difficult for the agency to

reject future document requests.

GMX integrates Chainlink Data Streams to accelerate futures trading

GMX, a perpetual futures trading platform, integrated

Chainlink’s (COIN:LINKUSD) Data Streams technology to access market

data more quickly. Unlike “push” systems, which send data

periodically or under certain conditions, the “pull” model used by

Data Streams allows GMX to request and receive market data in

real-time, as needed. This approach ensures data is obtained with

low latency, crucial for the fast-paced futures market.

New regulatory era for cryptocurrencies in the EU with MiCA

implementation

The cryptocurrency environment in the European Union is set to

undergo significant change with the implementation of the Markets

in Crypto-Assets Regulation (MiCA). The new regulations will begin

to take effect in phases, with specific rules for stablecoins

starting June 30 and other measures impacting crypto service

providers expected by December. This regulatory milestone,

pioneering on the continent, aims to establish a uniform standard

for the crypto asset market in the EU, providing greater legitimacy

and security for the industry.

US Supreme Court strikes down SEC’s internal adjudications in

historic decision

The US Supreme Court ruled, by a vote of 6-3, that the SEC’s

practice of using internal judges for enforcement proceedings is

unconstitutional. This decision forces the SEC to conduct all

enforcement proceedings through federal courts, impacting not only

the SEC but potentially other federal agencies that also use

internal administrative proceedings. This decision highlights a

debate over the separation of powers and the constitutional rights

of defendants in fraud cases.

US transfers some of its confiscated Bitcoins to Coinbase Prime

On June 26, the US government transferred 3,940 Bitcoins to

Coinbase Prime, an institutional trading platform of Coinbase

Global (NASDAQ:COIN). The transaction was highlighted by blockchain

analytics firm Arkham Intelligence. These Bitcoins were previously

confiscated from Banmeet Singh, a convicted drug dealer, who lost

over 8,100 Bitcoins after his arrest. The US government’s Bitcoin

reserves total approximately 214,000 units, valued at over $13

billion.

Dfinity launches Utopia, innovative cybersecurity platform for

governments and enterprises

The Dfinity Foundation introduced Utopia, a new platform based

on the Internet Computer Protocol (COIN:ICPUSD), designed to

modernize cybersecurity for governments and business organizations.

Utopia, a serverless private cloud infrastructure, promises to be a

robust solution against cyber threats, enabling secure operations

of artificial intelligence and digital asset management. The

platform aims to provide greater sovereignty to governments,

allowing them to securely and independently maintain sensitive

data.

Sharp increase in cryptocurrency losses due to hacks and scams in

Q2

In the second quarter of this year, the cryptocurrency industry

suffered losses of $572.7 million in 72 incidents of hacks and

scams, a 70.3% increase from the previous quarter and 112% compared

to the same period in 2023. Ethereum and BNB Chain were again the

most targeted networks, as in the first quarter. The significant

increase in losses is primarily related to attacks on centralized

finance infrastructure, which now surpass attacks on decentralized

finance (DeFi). Despite fewer DeFi hacks, two major attacks

accounted for nearly 63% of the total losses this quarter. DMM

Bitcoin represented the largest attack, with over $55 million

stolen from the Turkish cryptocurrency exchange BtcTurk on June 23.

In total, $28.7 million, or 5% of the funds stolen in the second

quarter, were recovered from four exploits: Bloom, ALEX Lab, Gala

Games, and YOLO Games.

Polymarket to contest UMA oracle’s DJT token bet resolution

The decentralized betting platform Polymarket disagreed with UMA

oracle’s decision to resolve a betting market about Barron Trump’s

involvement in the creation of the DJT token as “No”. Polymarket

argues that the decision was incorrect and plans to announce a

short-term solution. The UMA oracle (COIN:UMAUSD), which uses token

holder voting to resolve disputes, initially determined that there

was insufficient evidence of Barron’s involvement. Over $1 million

was bet on this market.

MegaLabs raises $20 million to develop real-time Ethereum protocol

MegaLabs, the entity behind the new Ethereum scaling protocol

called MegaETH, raised $20 million in a seed round led by Dragonfly

Capital. The initiative aims to launch a testnet in the coming

months, promising a “real-time” blockchain capable of processing

100,000 transactions per second with millisecond response times.

The protocol uses a heterogeneous blockchain architecture and an

optimized EVM execution environment to improve performance and

efficiency, inspired by Vitalik Buterin’s scaling vision.

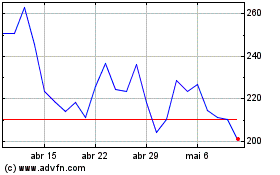

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

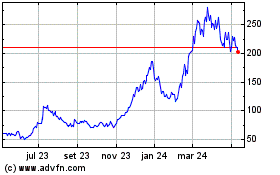

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024