Tesla (NASDAQ:TSLA) – The Tesla Model Y was

included for the first time on a list of plug-in electric and

hybrid vehicles that a local government in China can acquire as a

service car. This information was disclosed by the official Chinese

media, The Paper, highlighting that the Jiangsu provincial

government published the list on June 6. Tesla is scheduled to

release its results on July 17. According to an analysis by

MacroMicro, Tesla’s shares generally show a pattern of decline in

the two weeks before releasing their quarterly results, followed by

a recovery in the two weeks afterward. This pattern, observed since

Tesla entered the S&P 500, reflects efforts to manage investor

expectations before earnings reports, especially important for

companies compared to the index. The shares rose 2.2% in pre-market

trading.

Macy’s (NYSE:M) – Arkhouse Management and

Brigade Capital Management have increased their offer to buy Macy’s

for about $6.9 billion, as reported by the Wall Street Journal. The

new proposal is to acquire the Macy’s shares they do not yet own

for $24.80 each, up from the $24 per share offered in March. Macy’s

shares rose 2.6% in pre-market trading.

Walmart (NYSE:WMT) – A U.S. appeals court has

ruled that Walmart must face a lawsuit alleging that it frequently

charges higher prices at checkout than advertised on store shelves,

potentially violating state consumer protection laws with “bait and

switch” practices. The shares rose 0.2% in pre-market trading.

Amazon (NASDAQ:AMZN) – Jeff Bezos, founder and

executive chairman of Amazon, intends to sell nearly $5 billion in

company shares, as announced in a regulatory filing after the stock

value reached a record high. Following this sale, Bezos will retain

approximately 8.8% of the equity, remaining active in leading Blue

Origin. Additionally, Amazon has decided to halt the development of

Astro for Business, a security robot for small and medium

businesses, opting to focus on home robots. Initially introduced

for residential use in 2021, Astro for Business was expanded last

November to serve sectors like retail, manufacturing, and

healthcare. In another move, Amazon has partnered with the

Australian government to implement a cloud data system for highly

sensitive information. With an investment of $1.3 billion (A$2

billion) over ten years, the project aims to enhance cyber

capabilities and security collaboration with the United States,

benefiting Australia’s Defense sector by creating three new data

centers. In the retail sector, Saks Fifth Avenue is acquiring

Neiman Marcus with support from Amazon.com. This transaction will

result in the formation of Saks Global, a merger of retail and real

estate assets, while the brands will continue operating under their

original names. Amazon.com will acquire a minority stake in Saks

Global and collaborate on innovations for customers and brand

partners after the transaction is completed. The shares rose 0.2%

in pre-market trading.

Baidu (NASDAQ:BIDU) – The leading internet

search company in China has introduced its latest advanced language

model, Ernie 4.0 Turbo, aimed at corporate clients. The model is

priced at 30 yuan ($4.13) per 1 million input tokens and 60 yuan

per 1 million output tokens. Previous Ernie models will see a price

reduction of up to 83%. According to the company, the average daily

use of Ernie increased by 150% in the second quarter compared to

the previous quarter. The shares fell 1.3% in pre-market

trading.

Netflix (NASDAQ:NFLX),

Paramount (NASDAQ:PARA), Disney

(NYSE:DIS) – Major U.S. streaming services are asking a Canadian

court to amend the new 5% tax on their revenues in the country,

imposed by Prime Minister Justin Trudeau, to remove the obligation

to fund local news. The Motion Picture Association-Canada,

representing Netflix, Paramount, and Disney, contests the mandatory

contribution to the independent news fund, arguing it is

discriminatory and inappropriate.

General Motors (NYSE:GM) – GM agreed to pay a

$145.8 million fine and forfeit credits worth hundreds of millions

of dollars after a U.S. government investigation found excessive

emissions in about 5.9 million vehicles. The EPA discovered that

the vehicles emitted an average of more than 10% CO2 than initially

reported by GM. The shares are stable in pre-market trading.

Toyota Motor (NYSE:TM) – Toyota Motor confirmed

it has not identified any new irregularities beyond those already

reported in its vehicle certification applications. The company

completed a comprehensive ten-year investigation into the

certification process and communicated the results to Japan’s

Ministry of Transport.

Honda Motor (NYSE:HMC) – Japanese financial

groups like Tokio Marine, Sompo, and MS&AD will sell Honda

Motor shares worth $3.3 billion (535 billion yen) to end

cross-shareholdings. Mitsubishi UFJ and Mizuho will also join the

sale, reflecting a broader move for corporate governance reform in

Japan. In other related news, Honda is considering collaborating

with Nissan to use standardized automotive software and develop a

charging infrastructure for electric vehicles, according to the

Nikkei newspaper. These measures could reduce costs and increase

competitiveness in the growing global electric car market.

Fisker (NYSE:FSR) – Fisker asked a bankruptcy

judge to approve the sale of over 3,000 Ocean electric SUVs for

about $14,000 each to leasing company American Lease. This $46.25

million sale will help alleviate Fisker’s financial troubles, which

it faces after cutting prices to generate capital during its

bankruptcy.

Ryanair Holdings (NASDAQ:RYAAY) – Some Ryanair

pilots have requested the right to refuse flights to Tel Aviv due

to concerns about flying to the country during conflicts. They have

asked the company to review the crew policy for flights to Israel,

seeking a process similar to other airlines like Lufthansa and

EasyJet. The shares rose 0.6% in pre-market trading.

OpenAI – A hacker accessed OpenAI’s internal

messaging systems and stole details about the company’s AI

technology design last year, according to the New York Times. The

hacker obtained information from an online forum where employees

discussed OpenAI’s latest technologies but did not access the

systems where the company develops its AI, including ChatGPT.

Meta Platforms (NASDAQ:META) – Threads, the new

platform from Meta Platforms and rival to X (formerly Twitter), has

reached over 175 million monthly active users, according to CEO

Mark Zuckerberg. Key metrics such as daily active users and average

time spent per user have not yet been disclosed. Despite quickly

reaching 100 million users, Threads faces challenges in retention

and engagement. Unlike other social networks, Threads does not have

advertising and thus generates little or no revenue for Meta. The

shares rose 0.3% in pre-market trading.

Alphabet (NASDAQ:GOOGL) – Alphabet is licensing

technology from its agriculture startup, Mineral, to fruit producer

Driscoll’s Inc., while winding down the startup’s operations.

Mineral, originated from Alphabet’s moonshot technology lab X, now

independent, struggled to find a viable business model in the

highly competitive agricultural industry. The shares rose 0.3% in

pre-market trading.

Ericsson (NASDAQ:ERIC) – Ericsson announced it

will record a non-cash impairment of $1.09 billion in the second

quarter of 2024 due to the acquisition of Vonage in 2021. The

acquisition, one of the largest in Ericsson’s history, was valued

at $6.2 billion to diversify its operations. The shares fell 0.2%

in pre-market trading.

PayPal (NASDAQ:PYPL) – The Federal Court of

Australia ruled that PayPal’s local unit used an unfair clause in

its standard contracts with small businesses, which did not notice

overcharging errors. The clause was deemed unfair because it

required customers to accept the fees as correct if they did not

notify PayPal of errors within 60 days, according to the Australian

Securities and Investments Commission (ASIC). The shares fell 0.2%

in pre-market trading.

Coinbase Global (NASDAQ:COIN),

Robinhood Markets (NASDAQ:HOOD),

MicroStrategy (NASDAQ:MSTR) – After the price of

Bitcoin plummeted below $55,000, cryptocurrency-related companies

fell in pre-market trading. Coinbase dropped 6.8%, while Robinhood

and MicroStrategy fell 3.1% and 8.8%, respectively.

State Street (NYSE:STT), UBS Group

AG (NYSE:UBS) – U.S. bank State Street was chosen to

custody the Swiss federal government’s multibillion-dollar

compensation fund, previously held by UBS. The transfer of the

AHV/IV/EO fund, valued at over $44.48 billion (40 billion Swiss

francs), is expected to be completed by the end of this year. UBS

shares rose 0.5% in pre-market trading, while State Street shares

are stable.

KKR & Co (NYSE:KKR),

Instructure (NYSE:INST), Thoma

Bravo (NASDAQ:ZCKZYX), Bain Capital

(NYSE:BCSF) – Private equity firms KKR and Francisco Partners are

competing to acquire Instructure, a U.S. educational software

provider valued at $3.4 billion. Both have advanced to the final

round of bids and are expected to submit binding offers next week.

There is no certainty that Thoma Bravo, which owns 83% of

Instructure, will agree to sell it, and other bidders may emerge.

Additionally, KKR agreed to acquire U.S. sports uniform and

yearbook maker Varsity Brands from Bain Capital for about $4.75

billion, including debt. KKR plans to offer equity to employees as

an incentive, a practice traditionally reserved for senior

executives.

Shell (NYSE:SHEL) – Shell announced it will

record an impairment of up to $2 billion following the sale of its

Singapore refinery and the halt in the construction of one of

Europe’s largest biofuel plants in Rotterdam due to unfavorable

market conditions. The British company expects a financial impact

on its second-quarter results. Shell’s New York-listed shares rose

1.3% in pre-market trading.

Teck Resources (NYSE:TECK),

Glencore (LSE:GLEN) – The Canadian government

approved Glencore’s acquisition of Teck Resources’ metallurgical

coal unit for $6.93 billion, with stringent conditions to preserve

jobs. To gain approval, Glencore agreed to keep Elk Valley

Resources’ Canadian headquarters for at least ten years, ensure

most directors are Canadian, and maintain significant employment

levels for at least five years, according to the country’s Industry

Minister.

Anglo American (USOTC:NGLOY) – The Australian

Mining and Energy Union has reached an agreement with Anglo

American to extend payment until the end of August for workers at

the Grosvenor mine, which was closed this week due to an ongoing

underground fire. The agreement guarantees payment extension from

July 15 to August 31 for all full-time employees and contractors

working at the mine.

Smith & Nephew (NYSE:SNN) – Cevian Capital,

an activist investor, acquired a 5% stake in Smith & Nephew, a

British medical equipment manufacturer. The company faced

challenges, including supply chain issues and declining

profitability in its orthopedics division. Smith & Nephew

shares rose 8.40% in pre-market trading.

AbbVie (NYSE:ABBV) – AbbVie revised downward

its adjusted earnings forecast for 2024 due to significant expenses

related to milestones achieved, research and development, all

associated with strategic acquisitions. After losing the patent for

its main drug, Humira, the company is intensifying efforts to

expand its product portfolio. The new annual adjusted earnings

projection is now $10.61 to $10.81 per share, reflecting an

adjustment from the previous forecast of $11.13 to $11.33 per

share. The shares are stable in pre-market trading.

Novo Nordisk (NYSE:NVO) – Novo Nordisk shares

fell about 3% last Tuesday after a Massachusetts Eye and Ear study,

linked to Harvard, suggested that the drugs Ozempic and Wegovy may

increase the risk of NAION, a rare form of vision loss. The

research revealed a sevenfold higher likelihood of being diagnosed

with this eye condition among users of these medications, although

further confirmation through larger studies is needed. The shares

are up 1.9% in pre-market trading.

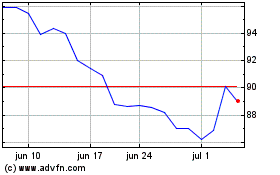

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024