Uber Technologies (NYSE:UBER), General

Motors (NYSE:GM) – Cruise, a self-driving car subsidiary

of General Motors, has partnered with Uber to offer rides in its

robotaxis on the platform starting next year. This collaboration

comes as Cruise recovers from an accident in San Francisco,

resuming testing with safety drivers. Cruise agreed to recall about

1,200 robotaxis due to abrupt braking issues after an investigation

by the U.S. National Highway Traffic Safety Administration. Cruise,

although disagreeing with the recall’s necessity, accepted it to

address the problem. Uber’s stock fell 1.0% in pre-market trading,

while GM’s stock rose 0.9%.

Alibaba (NYSE:BABA) – Alibaba’s shareholders

have approved the transition to a primary listing in Hong Kong,

aiming to attract investments from mainland China. This move,

proposed earlier due to U.S.-China tensions, does not involve new

stock issuances. Shares rose 2.3% in pre-market trading.

Altria (NYSE:MO) – Altria increased its

quarterly dividend by 4.1% to $1.02, marking 55 consecutive years

of increases. With shares at $51.83 and a yield of 7.9%, the

company pays out about 80% of its earnings in dividends and aims

for mid-single-digit annual growth through 2028. Shares rose 0.2%

in pre-market trading.

Apple (NASDAQ:AAPL) – Apple will change how

users in the European Union choose default browsers and apps

following regulatory pressure from the EU’s Digital Markets Act. A

new “choice screen” will allow browser selection the first time

Safari is opened. Additionally, more Apple apps can be removed by

users. Shares rose 0.5% in pre-market trading.

Intel (NASDAQ:INTC) – Lip-Bu Tan, a director at

Intel, resigned from the board on August 19, citing “demands on his

time.” Tan, who joined the board in September 2022, leaves after a

poor financial report and a significant drop in stock prices. Intel

faces challenges, including job cuts and a dividend suspension.

Shares rose 1.2% in pre-market trading after closing down 6.1% on

Thursday.

Nvidia (NASDAQ:NVDA) – Despite the anticipated

speech from Federal Reserve Chairman Jerome Powell, investors are

focused on Nvidia’s earnings report. The August 28 results are

expected to show profits and revenue more than doubling from last

year. With shares trading at about 47 times future earnings

estimates, the company is under pressure to justify these

valuations. The Roundhill Magnificent Seven ETF, which includes

Nvidia, is trading at 36 times earnings estimates for 2024, up from

a P/E ratio of 32 in August. In comparison, the S&P 500 is

valued at 23 times earnings forecasts, and the Invesco QQQ Trust is

at 30 times. Nvidia’s shares rose 1.3% in pre-market trading after

closing down 3.7% on Thursday.

Baidu (NASDAQ:BIDU) – Baidu stated that its

leadership position in AI in China gives it an edge to face intense

competition, despite a slight decline in quarterly revenue. The

company highlighted the growth of its Ernie platform, which

processes 600 million daily requests. CEO Robin Li mentioned that

AI competition will be fierce in the coming years. However, Baidu

reported slower growth in rides from its Apollo Go robotaxi

service, with a 26% increase in the first half of 2024 compared to

184% in the same period of 2023. The company averaged 287,500

monthly rides, and its market share in the ride-hailing sector

remains small. Shares fell 1.4% in pre-market trading after closing

down 4.4% on Thursday.

Autodesk (NASDAQ:ADSK) – Starboard Value has

urged Autodesk’s board to reassess Andrew Anagnost’s leadership

following recent accounting issues. The company faces criticism for

questionable accounting practices and delays in financial

reporting, with Starboard demanding changes in management and the

board. Autodesk, with shares at $252.06, is addressing these

concerns as it prepares to announce financial results on August

29.

Paramount Global (NASDAQ:PARA) – Skydance Media

accuses Paramount Global of violating an agreement by extending the

deadline to consider other offers after Edgar Bronfman Jr.

increased his bid to acquire Paramount for $6 billion. The offer

threatens the planned acquisition by David Ellison and Skydance. If

Paramount accepts Bronfman’s offer, it will pay a $400 million

penalty.

Sony Group (NYSE:SONY) – A joint venture

between Sony and Startale announced the launch of Soneium, a Layer

2 blockchain built on Ethereum. Soneium aims to attract developers

in sectors such as entertainment, gaming, and finance, with its

testnet launched in partnership with Astar Network.

Trump Media and Technology Group (NASDAQ:DJT) –

Donald Trump may sell his $2.6 billion stake in Trump Media when

the lockup period ends in September. This could impact the stock

price and investor confidence in the company, especially as its

main draw is his reputation. Trump has not yet disclosed his plans

regarding the sale. Shares rose 2.3% in pre-market trading after

closing down 6.2% on Thursday.

Amazon (NASDAQ:AMZN) – A Washington, D.C.

appeals court reopened the case against Amazon, alleging its

pricing policies illegally harm competition. The previous ruling

that dismissed the case was overturned, with accusations that

Amazon imposes harmful restrictions on suppliers and third-party

sellers. Amazon denies the claims, stating that its policies

benefit consumers. Separately, the U.S. National Labor Relations

Board concluded that Amazon is legally responsible for third-party

delivery drivers in California, in addition to the partner

companies that hire them. Amazon was also accused of illegal

threats and refusal to bargain with the union, potentially

impacting its national operations. Additionally, Chinese entities

are using Amazon’s cloud services and those of other providers to

access advanced U.S. chips and AI, bypassing direct export

restrictions. Documents show that these companies turn to

intermediaries to obtain these technologies. Amazon assures

compliance with U.S. laws and has updated its policies to reflect

the restrictions. Amazon’s cloud division launched a new region in

Malaysia, part of a $6.2 billion investment. The new AWS

infrastructure aims to meet the growing demand for cloud services

in the Asia-Pacific region and is expected to add $12.1 billion to

the local economy, generating over 3,500 jobs by 2038. Amazon’s

stock rose 0.7% in pre-market trading after closing down 2.2% on

Thursday.

Walmart (NYSE:WMT) – Walmart has partnered with

Burger King to offer discounted meal benefits to its members, such

as 25% off digital orders and a free Whopper every three months.

This strategy aims to make Walmart Plus more attractive, better

competing with Amazon Prime. Shares rose 0.3% in pre-market

trading.

Peloton Interactive (NASDAQ:PTON) – Peloton’s

shares closed up 35.42% on Thursday after the company reported an

adjusted loss of 8 cents per share and revenue of $643.6 million,

surprising analysts’ expectations. Shares fell 3.3% in pre-market

trading.

Crocs (NASDAQ:CROX) – Crocs has partnered with

actress Sydney Sweeney, who is now the brand ambassador for

Heydude. Analysts highlighted the partnership’s potential to

attract younger consumers and boost sales, with the collaboration

driving a 4.3% increase in the company’s stock over the past

week.

Brown Forman (NYSE:BF.B) – Brown-Forman, the

maker of Jack Daniel’s whiskey, is suspending its diversity,

equity, and inclusion (DEI) policy in response to conservative

pressure. The company will end the linking of executive

compensation to DEI progress and exit LGBTQ-friendly workplace

rankings, seeking to adjust its strategies to the new market

reality.

Ford Motor (NYSE:F) – Ford canceled its

electric three-row SUV project, initially planned for 2025, in

response to slow consumer adoption of electric vehicles and market

shifts. The company will now focus on hybrid SUVs and delayed the

launch of the new electric F-150 to 2027. This decision reflects a

more cautious strategy, aiming for profitability in a challenging

electric vehicle market. Analysts believe that while painful, this

choice was necessary to avoid larger losses, keeping the focus on

more promising areas like trucks and commercial vehicles. Shares

rose 0.6% in pre-market trading.

Tesla (NASDAQ:TSLA) – China is heavily

investing in humanoid robots, challenging Tesla, according to

Reuters. During a conference in Beijing, more than 20 Chinese

companies showcased robots designed to replace workers in electric

vehicle assembly. Tesla, with its Optimus robot, still leads in AI,

but China aims to cut costs and quickly expand production, reducing

robot costs to $30,000 and producing up to 1,000 units by 2025.

Additionally, the government launched state funds of $1.4 billion

in Beijing and Shanghai for robotics. Goldman Sachs predicted in

January that the global annual market for humanoid robots would

reach $38 billion by 2035. Shares rose 1.5% in pre-market trading

after falling 5.7% on Thursday.

Boeing (NYSE:BA) – NASA will decide this

weekend whether to allow two astronauts to return to Earth aboard

Boeing’s Starliner capsule. The capsule has faced technical issues

since its launch in June, and NASA will review its capability. If

necessary, SpaceX may assist in the astronauts’ return in February

2025.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines is collecting feedback on possibly charging for checked

bags, a currently free benefit. The survey with customers and

loyalty members explores different pricing scenarios, although the

company says there are no immediate plans to change the policy. The

move aims to assess its impact on competitiveness and respond to

activist investor Elliott Investment Management.

Canadian National Railway (NYSE:CNI),

Canadian Pacific Kansas City (NYSE:CP) – The

Canadian government acted swiftly to end a massive rail strike,

asking the Canadian Industrial Relations Board to order an

immediate return to work. The strike involved more than 9,000

workers from the country’s major railways, threatening significant

economic damage. The government also requested binding arbitration

between the unions and companies to resolve the negotiation

deadlock. Canadian National Railway workers will return to work on

Friday, while Canadian Pacific Kansas City’s strike awaits a

decision from the Canadian Industrial Relations Board.

Rio Tinto (NYSE:RIO), Teck

Resources (NYSE:TECK) – Rio Tinto and Teck Resources

warned on Thursday that the labor dispute at Canada’s major

railways could disrupt their operations. Rio Tinto was implementing

contingency plans, such as using its own rail network. Teck said it

was seeking alternative transportation to mitigate the impact on

critical mineral supply chains. Rio Tinto’s shares fell 0.1% in

pre-market trading, while Teck’s shares rose 0.2%.

GE Vernova (NYSE:GEV) – A turbine blade failed

at an offshore wind farm near the northeast coast of England, in

the Dogger Bank, raising safety concerns in the sector. The

incident involved a GE Vernova turbine and is under investigation.

Shares fell 0.5% in pre-market trading.

CME Group (NASDAQ:CME), S&P

Global (NYSE:SPGI) – CME Group and S&P Global are

considering selling the OSTTRA post-trade services joint venture,

valued between $2 billion and $4 billion, including debt. The

companies are in talks with financial advisors to find buyers.

Deutsche Bank (NYSE:DB) – Deutsche Bank still

faces challenges with Postbank despite reaching agreements with

about 60% of claimants alleging undervaluation in the bank’s 2010

acquisition. The bank plans to reduce provisions by $478.93

million, which should improve third-quarter profits. Additionally,

Deutsche Bank suggested it may reconsider share buybacks,

previously ruled out, depending on capital plan reviews in dialogue

with regulators. Shares rose 1.2% in pre-market trading after

closing up 3.4% on Thursday.

Jefferies Financial Group (NYSE:JEF) – A

banking consortium led by Jefferies Financial Group lost about $15

million after having to adjust the terms of a loan for M2S Group.

The loan, intended for an acquisition and refinancing, had to be

sold at a lower price and with a higher margin, reflecting the

impact of adverse market conditions. The loan was initially priced

at 99 cents on the dollar and was sold at 93 cents. The margin over

the reference rate increased from 4.25-4.5 percentage points to

4.75 percentage points. The package also includes a $100 million

credit line.

Morgan Stanley (NYSE:MS) – Jonathan Bloomer,

chairman of Morgan Stanley International, died at 70 in a shipwreck

off the coast of Italy on August 19. His wife, Judy, also died.

They were on a luxury yacht to celebrate the acquittal of Mike

Lynch, for whom Bloomer testified in a fraud trial.

HSBC Holdings (NYSE:HSBC) – Lu Tian, deputy

head of Goldman Sachs’ China unit, is moving to HSBC to replace

Irene Ho as CEO and general manager of securities business in

China.

US Bancorp (NYSE:USB) – Edward Jones is

expanding its partnership with US Bank to offer enhanced checking

accounts and credit cards to its clients starting in 2025. The

initiative aims to diversify its services beyond investments after

abandoning previous plans to launch its own bank and a partnership

with Citigroup.

Blackstone (NYSE:BX) – Effective January 1,

Wesley LePatner will replace Frank Cohen as CEO of Blackstone’s

real estate fund for individual investors. LePatner, who is COO of

BREIT, will succeed Cohen after nearly 30 years. BREIT faces

challenges due to high-interest rates and seeks growth sectors.

AstraZeneca (NASDAQ:AZN) – AstraZeneca warned

it might move its vaccine manufacturing unit from the UK to the

U.S. due to a standoff with the Labour government, which plans to

reduce state aid for the vaccination center. The cut would reduce

the promised subsidy from £90 million to £40 million. The company

says it is in constructive negotiations with the UK government.

Shares rose 0.4% in pre-market trading.

Pfizer (NYSE:PFE), Moderna

(NASDAQ:MRNA) – Updated COVID-19 vaccines from Pfizer and Moderna

were approved by the FDA and will be available starting in 2025.

Vaccination begins earlier than expected, aiming to curb the rise

in cases. Novavax also plans to launch a vaccine but has yet to

receive approval. Demand for vaccines is expected to be lower than

last year. In pre-market trading, Pfizer’s shares rose 0.2%, while

Moderna’s shares rose 1.4%. Moderna’s shares closed down 6.5% on

Thursday.

Zenas BioPharma, Bristol-Myers

Squibb (NYSE:BMY) – Zenas BioPharma, backed by

Bristol-Myers Squibb, has filed for an IPO in the U.S.,

highlighting investors’ growing interest in new IPOs. The

biopharmaceutical company, focused on immunology and inflammation,

has already raised $358.3 million. Losses increased to $65.8

million in the first half of 2023.

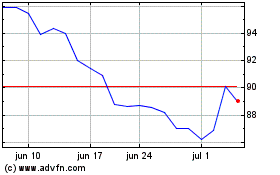

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024