U.S. Stock Futures Rise Amid Focus on Fed Chairman Powell’s Speech, Oil Prices Fall

09 Julho 2024 - 7:56AM

IH Market News

U.S. index futures are up in pre-market trading this Tuesday,

with investors looking to sustain the all-time highs of the S&P

500 and Nasdaq. Attention is focused on the speech by Federal

Reserve Chairman Jerome Powell.

At 6:17 AM, Dow Jones futures (DOWI:DJI) rose 55 points, or

0.14%. S&P 500 futures advanced 0.23%, and Nasdaq-100 futures

gained 0.36%. The 10-year Treasury yield was at 4.29%.

In the commodities market, oil prices are falling due to

concerns about Hurricane Beryl, which has closed refineries and

ports in the U.S. Gulf of Mexico, and the expectation that a

possible ceasefire agreement in Gaza could reduce worries about

disruptions in the global crude oil supply. West Texas Intermediate

crude for August fell 0.36% to $82.03 per barrel. Brent crude for

September fell 0.30% to $85.49 per barrel.

The most-traded iron ore contract on the Dalian Commodity

Exchange (DCE) fell 0.48% to $114.68 per metric ton. The benchmark

SZZFQ4 iron ore contract for August on the Singapore Exchange rose

0.2% to $108.6 per ton.

On the U.S. economic agenda for Tuesday, Federal Reserve

Chairman Jerome Powell’s testimony to Congress is scheduled.

Powell’s statements may guide investors on the start of the

monetary easing cycle. Traders are pricing in approximately a 70%

probability of two rate cuts this year, with the first expected in

September, according to Bloomberg data.

Asia-Pacific markets rose on Tuesday after the S&P 500 and

Nasdaq hit record highs. In Japan, the Nikkei 225 and Topix reached

new peaks, rising 1.96% and 0.97%, respectively. South Korea’s

Kospi advanced 0.34%, while Hong Kong’s Hang Seng increased by

0.1%. In China, the CSI 300 and Shanghai Composite rose 1.12% and

1.26%, respectively. China will release inflation data on

Wednesday. In India, the Nifty 50 and BSE Sensex hit new highs.

Australia’s ASX 200 rose 0.86% despite a drop in consumer

confidence. Consumer confidence fell by 1.1%, but business

confidence rose to +4.

Among individual stocks, Samsung Electronics

(KOSPI:005930) shares rose 0.46% despite a union strike.

Hyundai (KOSPI:005380) avoided a strike with a

wage agreement, but its shares fell 3%. Turkey’s industry and

technology minister announced that BYD

(USOTC:BYDDY) will invest $1 billion in the country.

European markets were down on Tuesday morning, with oil and gas

stocks leading the losses. BP (LSE:BP.) was down

3.7% due to an expected impact on second-quarter profits. While the

UK’s FTSE 100 was up 0.10%, Paris’s CAC 40 was down 0.63%,

reflecting political uncertainties in France following the

elections.

U.S. stocks closed mixed on Monday, with the Nasdaq and S&P

500 reaching records while the Dow fell slightly. The Dow fell

0.08%, while the S&P 500 rose 0.10% to 5,572.85 points, and the

Nasdaq advanced 0.28% to 18,403.74 points. Initial optimism about

interest rates waned throughout the day as investors awaited

economic data and the Federal Reserve Chairman’s testimony.

The Conference Board’s Employment Trends Index fell to 110.27 in

June, down from a revised 111.04 in May, indicating a slowdown in

hiring in the second half of the year. Communication networks and

semiconductor and hardware stocks boosted the Nasdaq, with

Nvidia (NASDAQ:NVDA) and Advanced Micro

Devices (NASDAQ:AMD) standing out, while companies like

Nike (NYSE:NKE) and McDonald’s

(NYSE:MCD) recorded declines.

On the quarterly earnings front, Byrna

Technologies (NASDAQ:BYRN) and Helen of

Troy (NASDAQ:HELE) are set to report before the market

opens.

After the close, numbers are awaited from Smart Global

Holdings (NASDAQ:SGH), Kura Sushi USA

(NASDAQ:KRUS), and Saratoga Investment Corp

(NYSE:SAR).

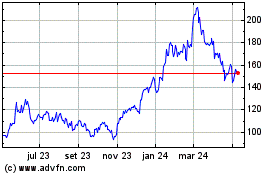

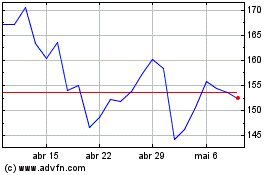

Advanced Micro Devices (NASDAQ:AMD)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Advanced Micro Devices (NASDAQ:AMD)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024