Costco Wholesale (NASDAQ:COST) – Costco has

increased its membership fees by $5 for annual members, while the

top-tier plan sees a $10 increase. This is the first fee hike since

2017. Shares rose 2.90% in pre-market trading.

ON Semiconductor (NASDAQ:ON), Microchip

Technology (NASDAQ:MCHP) – Morgan Stanley analysts

downgraded ON Semiconductor from “Equal Weight” to “Underweight,”

reducing the price target from $70 to $65. Microchip Technology was

also downgraded from Overweight to Equal Weight. ON Semiconductor

shares fell 2.73% in pre-market trading.

WD-40 Company (NASDAQ:WDFC) – WD-40

outperformed expectations in the third fiscal quarter, earning

$1.46 per share on $155 million in revenue, surpassing analysts’

expectations of $1.39 per share and $145.8 million in revenue,

according to FactSet. Shares rose 12.67% in pre-market trading.

Microsoft Corp. (NASDAQ:MSFT) – Microsoft

avoided an EU antitrust investigation by negotiating a deal with

CISPE, withdrawing complaints about software licensing that

hindered migration to other cloud providers. The agreement, which

benefits only CISPE members and excludes AWS, aims to increase

competitiveness in the European cloud market. Shares fell 0.05% in

pre-market trading.

Apple (NASDAQ:AAPL) – Apple plans to ship 90

million units of the iPhone 16 in the second half of this year,

representing a 10% increase over the previous year. The company is

betting on new AI features to drive demand, aiming to outpace

competition and improve sales after a challenging year. The

anticipated sales revolution of the $3,500 Vision Pro mixed reality

headset has yet to materialize since its US launch in February.

Forecasts indicate a 75% drop in domestic sales this quarter, but

international releases and a more affordable model in 2025 could

reignite interest. Shares fell 0.21% in pre-market trading.

Samsung Electronics (KOSPI:005930) – Samsung

Electronics is ramping up its bid to rival Apple in wearables by

launching a smart ring and a new high-end wearable similar to the

Apple Watch Ultra. The $400 Galaxy Ring monitors fitness and sleep

with skin temperature and female menstrual cycle sensors, while the

$650 Galaxy Watch Ultra offers sleep apnea detection and a two-day

battery life. Samsung sees adding AI features as key to reclaiming

its title as the world’s leading foldable device maker, said mobile

chief TM Roh. The new Galaxy Z Flip 6 and Galaxy Z Fold 6, launched

in Paris, stand out for AI integration for differentiation and

sales growth, including an auto-interpreter for calls on social

apps like WhatsApp and WeChat.

Advanced Micro Devices (NASDAQ:AMD) – AMD

acquired Silo AI for $665 million to bolster its position in

artificial intelligence. Silo AI, Europe’s leading private AI lab,

will bring expertise in advanced models, helping AMD compete with

Nvidia in graphics chips and AI solutions. Shares fell 0.22% in

pre-market trading.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – TSMC hit an all-time high on Thursday after announcing

strong second-quarter revenues, driven by high demand for AI

applications. With a market value exceeding 28 trillion Taiwan

dollars, TSMC leads as Asia’s most valuable company. In the US, the

company briefly reached a market value of one trillion on

Wednesday. Shares rose 1.06% in pre-market trading.

Alphabet (NASDAQ:GOOGL),

HubSpot (NYSE:HUBS) – Investors value Alphabet at

$2.3 trillion due to its status as an internet search giant and AI

innovator. However, Needham & Co. analysts claim YouTube’s true

value, estimated at at least $455 billion, is not fully recognized

within Alphabet’s conglomerate structure. A spinoff could unlock

this hidden value, benefiting investors interested in YouTube’s

leadership in streaming and Alphabet’s AI expansion. In another

move, Alphabet dropped its acquisition of HubSpot, ending one of

the year’s largest potential deals. HubSpot shares fell 13.34% on

Wednesday, reflecting the end of negotiations. Alphabet’s decision

was influenced by intensifying US antitrust scrutiny, despite

initial interest earlier this year. Alphabet shares fell 0.10% in

pre-market trading.

Intuit (NASDAQ:INTU) – Intuit laid off 1,800

employees to restructure and focus on AI products, not aiming for

cost cuts but replacing underperforming staff and reallocating

strategic resources. The company plans to rehire for critical

positions and expand global operations.

Paramount Global (NASDAQ:PARA) – Ingrid

Ciprian-Matthews will leave her role as President of CBS News amid

a restructuring at Paramount Global, which is set to merge with

Skydance Media. She will remain as a senior advisor for the 2024

presidential election coverage until her departure. Shares rose

0.51% in pre-market trading.

Confluent (NASDAQ:CFLT) – Hemanth Vedagarbha,

Confluent Inc.’s global head of sales, left the company during its

transition to a cloud-based sales model and consumption-based

pricing. This shift aims to align with market trends and focus on

customer usage for revenue, reflecting a strategic pivot as the

company expands its cloud offerings.

PriceSmart (NASDAQ:PSMT) – PriceSmart reported

adjusted earnings per share of $1.08 for the third fiscal quarter,

while analysts surveyed by FactSet predicted $1.01 per share.

Additionally, the company’s revenue reached $1.23 billion,

exceeding the consensus estimate of $1.21 billion.

Walmart (NYSE:WMT) – Walmart announced the

construction of five new distribution centers in the United States,

equipped with advanced technology to streamline the distribution of

perishable goods to its 4,600 stores. These centers will specialize

in temperature-sensitive products like milk, meat, vegetables, and

fruits, distinguishing them from conventional distribution centers

that maintain products in a dry, ambient environment. In Chile,

Walmart workers’ union went on strike Wednesday after failed

negotiations for a new collective agreement. The strike involves

over 14,000 workers, affecting operations in supermarkets,

including the Lider chain. Shares rose 0.70% in pre-market

trading.

Domino’s Pizza (NYSE:DPZ) – Domino’s Pizza

received an upgrade from Baird this week. Despite a general decline

in fast-food stocks attributed to aggressive discounting and

reduced profit margins, this dip is seen as a buying opportunity

for Domino’s. The company plans global expansion and improvements

in digital sales through new offers and delivery apps, aiming for

solid, sustainable revenue and profit growth in the coming

years.

PepsiCo (NASDAQ:PEP) – PepsiCo will soon

release its latest quarterly results. Analysts expect the company

to earn $2.16 per share for the period, with sales of $22.6

billion, a 1.4% increase from the previous year. Shares rose 0.67%

in pre-market trading.

Visa (NYSE:V), Mastercard

(NYSE:MA) – BofA Securities analysts downgraded Visa and Mastercard

from “Buy” to “Neutral” due to a volatile regulatory environment.

Price targets were adjusted, with Visa at $297 and Mastercard at

$480. On Wednesday, Visa shares fell to $263.00, and Mastercard

shares dropped to $433.64. Visa shares are stable, while Mastercard

shares rose 0.18% in pre-market trading.

HSBC (NYSE:HSBC), First Citizens

BancShares (NASDAQ:FCNCA) – A federal judge in California

dismissed most of First Citizens’ $1 billion lawsuit against HSBC,

accusing the bank of recruiting over 40 Silicon Valley Bank

employees after its collapse. The judge found that many of the

allegations did not occur in California and that there was

insufficient evidence of illegal conspiracy to recruit employees

and steal trade secrets.

UBS Group AG (NYSE:UBS) – UBS agreed to pay

$850,000 to settle charges of inadequate supervision of a

registered representative who misappropriated $7.2 million from

clients for unauthorized investments. After reimbursing clients $17

million, UBS updated its surveillance system to more effectively

detect unauthorized activities without admitting guilt.

Inter & Co. (NASDAQ:INTR) – Alexandre

Riccio was appointed as the head of Inter & Co. in Brazil,

while CEO João Vitor Menin focuses on the group’s global expansion.

Riccio, with over 10 years at the Brazilian bank, will oversee

local operations, allowing Menin to focus on international

operations from Miami.

Archer-Daniels-Midland (NYSE:ADM) –

Archer-Daniels-Midland named Monish Patolawala, former CFO of 3M,

as its new CFO on Wednesday while facing multiple US government

investigations over accounting irregularities. The change comes

after ADM corrected six years of financial data due to misrecorded

sales between business units.

BHP Group (NYSE:BHP) – Australia’s BHP Group

will temporarily suspend its nickel operations at Nickel West and

the West Musgrave project starting in October due to low prices and

global oversupply. The company plans to review the suspension by

February 2027 and will invest $300 million annually to support a

possible resumption of operations.

Honeywell International (NASDAQ:HON),

Air Products & Chemicals (NYSE:APD) –

Honeywell acquired Air Products’ LNG processing technology assets

for $1.81 billion, strengthening its LNG sector offerings. The

purchase price corresponds to approximately 13 times the estimated

2024 EBITDA. The all-cash transaction aims to expand its heat

exchanger portfolio and bolster its position in the global energy

market. In other news, a US appeals court ruled that Honeywell did

not violate anti-discrimination laws by firing a white engineer who

refused to participate in mandatory diversity, equity, and

inclusion training. The court found no evidence that Honeywell

retaliated against the employee, who skipped the training video

assuming it would be discriminatory. The ruling upheld the initial

dismissal of the lawsuit by the trial judge.

JetBlue Airways (NASDAQ:JBLU), United

Airlines (NASDAQ:UAL) – JetBlue Airways requested that the

US Department of Transportation disqualify United Airlines from

gaining one of five new round-trip flights from the congested

Washington Reagan National Airport. JetBlue argues that United’s

proposed pre-7 a.m. flight to Los Angeles should be rejected as it

is prohibited by Congress.

Delta Air Lines (NYSE:DAL) – Delta will soon

release its second-quarter results. Analysts expect revenue of

$15.45 billion and earnings of $2.37 per share, down from $2.68 the

previous year. Shares rose 0.77% in pre-market trading.

Boeing (NYSE:BA) – Boeing CEO Dave Calhoun

apologized and promised to follow government rules after the

National Transportation Safety Board (NTSB) criticized the company

for releasing non-public information and speculating about the

causes of an air incident involving a 737 MAX. The NTSB limited

Boeing’s access to information and participation in a future

hearing due to the investigation rules violation. Shares rose 0.42%

in pre-market trading.

Tesla (NASDAQ:TSLA) – Tesla increased the

prices of its Model 3 cars in European countries like Germany, the

Netherlands, and Spain by about €1,500 ($1,622) due to EU tariffs

on electric vehicles made in China, responding to subsidies deemed

unfair by the European Commission. On Wednesday, Tesla shares

extended their winning streak to the 11th consecutive day, closing

with a slight 0.4% increase at $263.26. After a rocky start with

declines, shares rebounded throughout the day, registering a 2%

gain by midday. Additionally, Morgan Stanley raised its valuation

for Tesla’s energy storage business, anticipating a global surge in

energy demand driven by AI growth, potentially expanding Tesla’s

market share in this segment. Shares fell 0.55% in pre-market

trading.

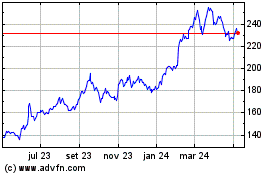

Toyota Motor (NYSE:TM) – Toyota, known for its

continuous improvement (kaizen) method, now focuses on hybrids to

boost sales. Considering the slowdown in electric vehicles, Toyota

promotes hybrid models as the standard in the US. With plans to

electrify its entire lineup globally by 2023, the strategy aims to

maintain competitiveness and align with emission targets.

Additionally, Toyota joined a group of major automakers supporting

IONNA, an EV charging company building a high-power charging

network in North America. The initiative aims to compete with

Tesla’s Supercharger network, offering access to Toyota and Lexus

customers.

Becton Dickinson & Co. (NYSE:BDX) – Becton

Dickinson & Co. shares recovered 1.1% on Wednesday after the

FDA addressed supply issues with blood culture bottles. The company

had faced consecutive declines, but after measures to increase

supply, including resuming production with a former supplier,

shares appreciated.

SCWorx (NASDAQ:WORX) – Former SCWorx Corp CEO

was convicted of investor fraud after falsely announcing the

company would become a major supplier of rapid Covid-19 tests at

the pandemic’s start, according to the US Department of Justice.

Marc Schessel, 64, was found guilty of two counts of securities

fraud for claiming the company would buy and resell at least 48

million test kits, despite knowing it was false.

10x Genomics (NASDAQ:TXG),

Illumina (NASDAQ:ILMN) – As a smaller competitor,

10x Genomics’ shares plummeted after Illumina, a leader in genetic

sequencing, acquired Fluent BioSciences, a direct competitor.

Illumina’s move into single-cell analysis, leveraging its widely

used sequencing machines, poses a significant challenge for 10x

Genomics, despite both companies relying on Illumina’s

platforms.

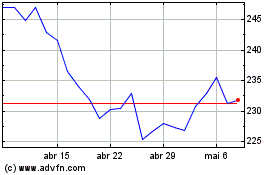

Toyota Motor (NYSE:TM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Toyota Motor (NYSE:TM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024