Bitfarms calls shareholder meeting in response to Riot Platforms’

acquisition attempt

Bitfarms (NASDAQ:BITF), a cryptocurrency mining company, has

scheduled a shareholder meeting for October 29 in response to a

$950 million acquisition bid by Riot Platforms (NASDAQ:RIOT). Riot,

which has already attempted to replace Bitfarms’ board members to

advance its acquisition bid, faces resistance from Bitfarms, which

is employing strategies to protect its interests. The meeting was

called to discuss these actions amid growing tensions between the

two companies.

Iris Energy stock volatility following short-sale report

Shares of Bitcoin mining company Iris Energy (NASDAQ:IREN)

experienced volatility on Friday, with the stock price opening at

$11.07, dropping to a low of $10.87, and then rising nearly 10% to

a high of $12.28. A report from Culper Research accused the company

of being “extremely overvalued.” The report criticized IREN for not

adequately investing in high-performance computing (HPC)

infrastructure despite announcing large plans for the sector.

Culper also highlighted the discrepancy between IREN’s declared

development costs and the actual market costs for HPC data centers.

Despite this, Bernstein Research noted that most of the on-site

expansion is dedicated to Bitcoin mining, for which the existing

infrastructure is adequate, significantly contributing to the

company’s value.

XRP rises, Filecoin falls

Ripple (COIN:XRPUSD) stands out with a growth of over 4% in the

last 24 hours. This increase follows the announcement by CME and CF

Benchmarks about the introduction of indices and reference rates

for XRP. Ripple CEO Brad Garlinghouse sees this development as a

significant boost for institutional adoption of XRP. Meanwhile,

Filecoin (COIN:FILUSD) experiences a 1.7% drop, with the current

price at $4.01, despite efforts to improve decentralized AI

development by leveraging the network’s storage and computing

capabilities in partnership with SingularityNET (COIN:AGIUSD). The

collaboration begins with using the Lighthouse SDK for metadata

storage and evolves into creating a Knowledge Graph, enhancing

security and data management.

Cryptocurrencies to reach one billion users by 2026

Cryptocurrency adoption is projected to reach one billion users

by 2026, a significant increase driven by popularization and

growing numbers of holders. Pavlo Denysiuk, CEO of Lunu, during the

NFT Fest 2024, highlighted that the number of cryptocurrency users

could triple in the next two years. This growth will be facilitated

by integrating infrastructures in common commercial locations, such

as Starbucks (NASDAQ:SBUX), simplifying the use of cryptocurrencies

as a payment method.

Bitcoin reaches $58,000 driven by strong US PPI data

Bitcoin (COIN:BTCUSD) is trading up 1.3% at $58,125 in the last

24 hours on July 12, reacting to the US Producer Price Index (PPI)

data, which exceeded expectations with an annual increase of 2.6%,

against the expected 2.3%, and 0.1% above the previous month. This

increase suggests more persistent inflation, contrasting with the

Consumer Price Index (CPI) data released yesterday. Bitcoin’s

appreciation occurred alongside a rise in US stocks, while the

dollar showed a slight decline.

Revelation of old Bitcoin Core vulnerabilities and new disclosure

policy

Developers of Bitcoin Core, the main software for transactions

on the Bitcoin network based on open-source code, recently

disclosed 10 vulnerabilities affecting previous versions of their

software, coinciding with the implementation of a new disclosure

policy to increase transparency and communication about such flaws.

This change comes after criticism about the lack of clarity in

previous disclosures, leading to the false perception that Bitcoin

Core is immune to bugs. The vulnerabilities, varying in severity,

highlight the importance of keeping the software updated to protect

the network against potential attacks.

German government resumes Bitcoin sale

The German government resumed the sale of its Bitcoin

(COIN:BTCUSD) reserves on July 12, distributing 3,200 BTC through

multiple transactions to exchanges such as Bitstamp, Kraken, and

Coinbase, and to unknown addresses. This action is part of an

ongoing effort to divest seized Bitcoins, having already sold 88.4%

of an initial total of 50,000 BTC. The German government now holds

6,894 BTC, representing 13.8% of the initially seized total.

Meanwhile, El Salvador continues to acquire 1 BTC per day,

approaching the German Bitcoin holdings.

Bitcoin ETFs attract significant investments, except Grayscale

On July 11, Bitcoin exchange-traded funds (ETFs) continue to

attract capital, with inflows of $78.9 million, extending the

streak to the fifth consecutive day of positive flows. Leading

these inflows, BlackRock’s ETF (NASDAQ:IBIT) recorded $72.1

million, with the fund totaling $18.1 billion. Following were

Fidelity (AMEX:FBTC) and Bitwise (AMEX:BITB), with inflows of $32.7

million and $7.5 million, respectively. Grayscale’s ETF (AMEX:GBTC)

was the only one facing outflows ($37.7 million), indicating a

divergent performance in the sector.

Dough Finance loses $1.8 million in flash loan attack

Dough Finance (COIN:DOUGHUSD), a decentralized finance (DeFi)

platform, was the victim of a flash loan attack resulting in the

loss of $1.8 million in digital assets. Web3 security firm Cyvers

detected suspicious transactions and, while confirming the safety

of Aave pools, identified that the stolen assets were converted

from USDC to Ether, totaling 608 ETH. The exploitation was made

possible by validation failures in a Dough Finance smart

contract.

SEC concludes investigation into Hiro and Stacks blockchain without

punitive actions

The US Securities and Exchange Commission (SEC) concluded its

more than three-year investigation into blockchain software

developer Hiro Systems (formerly Blockstack) and the Stacks

blockchain, without recommending any enforcement actions. This

outcome is considered highly favorable for the company in the

current US regulatory environment. After three years of

investigation, the decision not to recommend enforcement actions

marks another success for the cryptocurrency sector against

regulatory challenges, continuing a positive trend also seen in the

recent case of stablecoin company Paxos. Stacks’ native token

(COIN:STXUSD) rose 5.6% in the last 24 hours.

MakerDAO plans to invest $1 billion in tokenized US Treasury bonds

MakerDAO, responsible for the $5 billion stablecoin DAI

(COIN:DAIUSD), plans to invest $1 billion of its reserves in

tokenized US Treasury bonds. This move has attracted attention from

major names like BlackRock (NYSE:BLK), Superstate, and Ondo

Finance, eager to participate in the proposal. The initiative marks

a new phase in MakerDAO’s reserve strategy and a significant boost

for the tokenized real-world asset market, as these bonds offer a

low-risk investment option for blockchain-based funds.

DWS plans to launch first regulated euro stablecoin in 2025

Asset manager DWS, in partnership with AllUnity, plans to launch

the first regulated euro-denominated stablecoin in 2025, according

to Stefan Hoops, the company’s CEO. The stablecoin will be

regulated by BaFin, the German financial authority, and aims to

meet the initial demand of crypto investors, gradually expanding to

other areas such as continuous industrial payments via the Internet

of Things. Frankfurt-based AllUnity is still awaiting regulatory

approval from BaFin.

Blockchain initiatives advance in the UK and EU: DAOs and

sustainability in focus

The UK Law Commission recently published a document detailing

how existing laws can be adapted for Decentralized Autonomous

Organizations (DAOs). The study indicates that a new specific legal

entity for DAOs is not currently necessary due to the lack of

definition about their characteristics and structures. However, the

document recommends that the Companies Act 2006 be reviewed to

incorporate DAO technologies into corporate governance and adjust

anti-money laundering regulations.

Meanwhile, the European Union reaffirmed its partnership with

ChromaWay, aiming to develop sustainable blockchain-based

solutions. This collaboration was reinforced after an effective

presentation by ChromaWay at an EU meeting, highlighting

significant progress in decentralized applications, focusing on

Digital Product Passports and intellectual property rights

management.

Analysis of the US Republican Party’s proposal on CBDCs

In its 2024 platform, the US Republican Party expressed concern

about the development of a central bank digital currency (CBDC),

fearing it could enable invasive state surveillance. The proposal

questions the security of a CBDC in light of advances in quantum

computing, which could compromise the currently used encryption,

leaving the monetary system and personal data vulnerable to

external attacks. Tests and pilot projects have used technologies

still susceptible to such threats. The platform suggests the urgent

need to develop and implement post-quantum technology to protect

the future of the US monetary system and financial privacy, despite

legislative efforts to prohibit CBDC development.

ZAP raises $15.1 million to expand token distribution on Ethereum

ZAP (COIN:ZAPUSD), a token distribution protocol on the Ethereum

Layer 2 Blast network, has raised $15.1 million in three recent

funding rounds. The platform, which aims to automate token

distribution based on user contributions, plans to raise up to $50

million with the completion of an ongoing vault sale. This funding

strategy aims to support the protocol’s growth and future

expansion, including adding new functionalities and expanding to

other blockchains.

Partior raises $60 million in funding round

Partior, a global fintech specializing in blockchain payments,

raised over $60 million in a Series B funding round led by Peak XV

Partners, formerly known as Sequoia Capital India & SEA. The

round also included new investors such as Valor Capital and Jump

Trading, along with support from established shareholders like

JPMorgan, Standard Chartered, and Temasek. The funds will be

invested in developing new functionalities for its interbank

platform, such as intraday foreign exchange swaps and the

integration of new currencies, aiming to improve real-time

cross-border payment clearing and settlement.

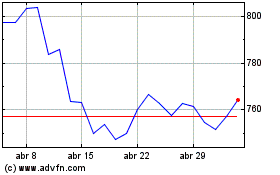

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024