U.S. Stocks Move Back To The Upside Following Yesterday’s Downturn

12 Julho 2024 - 5:44PM

IH Market News

Following the substantial downturn seen over the course of the

previous session, stocks moved back to the upside during trading on

Friday. With the upward move on the day, the Dow and the S&P

500 reached new record intraday highs.

The major averages gave back ground going into the close but

remained firmly positive. The Dow advanced 247.15 points or 0.6

percent to 40,000.90, the Nasdaq climbed 115.04 points or 0.6

percent to 18,398.45 and the S&P 500 rose 30.81 points or 0.6

percent to 5,615.35.

For the week, the Dow shot up by 1.6 percent, the S&P 500

jumped by 0.9 percent and the Nasdaq increased by 0.3 percent.

The rebound on Wall Street came as traders looked to pick up

stocks at somewhat reduced levels following the steep drop seen on

Thursday, which partly reflected a rotation out of leading tech

stocks like Nvidia (NASDAQ:NVDA).

Shares of Nvidia jumped by 1.5 percent on the day after the AI

darling plunged by 5.6 percent in the previous session.

Traders also remained optimistic about the outlook for interest

rates even though the Labor Department released a report showing

producer prices in the U.S. increased by slightly more than

expected in the month of June.

The Labor Department said its producer price index for final

demand rose by 0.2 percent in June following a revised unchanged

reading in May.

Economists had expected producer prices to inch up by 0.1

percent compared to the 0.2 percent dip originally reported for the

previous month.

The report also said the annual rate of producer price growth

accelerated to 2.6 percent in June from an upwardly revised 2.4

percent in May.

The annual rate of producer price growth was expected to creep

up to 2.3 percent from the 2.2 percent originally reported for the

previous month.

Despite the advance by the broader markets, shares of Wells

Fargo (NYSE:WFC) moved sharply lower after the company reported

weaker than expected net interest income for the second

quarter.

Financial giants JPMorgan Chase (NYSE:JPM) and Citigroup

(NYSE:C) also moved to the downside after reporting their second

quarter results.

Sector News

Networking stocks extended the strong upward move seen during

Thursday’s session, driving the NYSE Arca Networking Index up by

1.6 percent to its best closing level in over two years.

Considerable strength also remained visible among housing

stocks, as reflected by the 1.6 percent gain posted by the

Philadelphia Housing Sector Index. The index ended the day at a

nearly two-month closing high.

Semiconductor stocks also saw significant strength after falling

sharply on Thursday, with the Philadelphia Semiconductor Index

climbing by 1.3 percent.

Steel, oil service and computer hardware stocks also showed

notable moves to the upside, moving higher along with most of the

other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance during trading on Friday.

Japan’s Nikkei 225 Index plummeted by 2.5 percent, while Hong

Kong’s Hang Seng Index surged by 2.6 percent.

Meanwhile, the major European markets all moved to the upside on

the day. While the French CAC 40 Index shot up by 1.3 percent, the

German DAX Index jumped by 1.1 and the U.K.’s FTSE 100 Index rose

by 0.4 percent.

In the bond market, treasuries showed a lack of direction after

moving sharply higher in the previous session. Subsequently, the

yield on the benchmark ten-year note, which moves opposite of its

price, edged down by less than a basis point to 4.189 percent.

Looking Ahead

Next week’s trading may be impacted by reaction to reports on

retail sales, industrial production, import and export prices and

housing starts.

Earnings news is also likely to attract attention, with Goldman

Sachs (GS), Bank of America (BAC), Morgan Stanley (MS),

UnitedHealth (UNH), Netflix (NFLX) and American Express (AXP) among

the companies due to report their quarterly results.

SOURCE: RTTNEWS

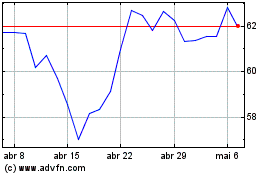

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

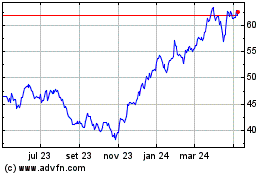

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024