US Index Futures Steady, Oil Prices Dip Amid China Slowdown, Key Earnings Reports Ahead

16 Julho 2024 - 7:12AM

IH Market News

U.S. index futures are mostly steady in pre-market trading on

Tuesday, following a record Dow Jones closing for the 20th time

this year on the previous day.

At 5:36 AM, Dow Jones futures (DOWI:DJI) rose 33 points, or

0.08%. S&P 500 futures gained 0.02%, and Nasdaq-100 futures

increased by 0.01%. The 10-year Treasury yield stood at 4.176%.

In the commodities market, oil prices fell due to an economic

slowdown in China, raising doubts about demand despite the growing

possibility of the Fed starting to cut rates as early as September.

West Texas Intermediate crude for August dropped 0.84% to $81.22

per barrel. Brent crude for September fell 0.75% to around $84.21

per barrel.

On the U.S. economic agenda for Tuesday, the Department of Labor

will publish import and export prices for June at 8:30 AM.

Simultaneously, retail sales for the same month will be

revealed.

Asia-Pacific markets showed mixed performance on Tuesday.

Japan’s Nikkei 225 and India’s Nifty 50 reached record highs. The

Nikkei 225 rose 0.2% while the Topix gained 0.34%. The Nifty 50

climbed 0.20%. Hong Kong’s Hang Seng fell 1.52%, impacted by the

consumer sector. South Korea’s Kospi increased by 0.18%, while the

Kosdaq dropped 1.56%. China’s CSI 300 rose 0.63%, and the Shanghai

Composite edged up 0.08%. Australia’s S&P/ASX 200 declined by

0.23% after hitting a historic high.

With weak Chinese GDP, Goldman Sachs (NYSE:GS)

and JPMorgan (NYSE:JPM) revised their growth

forecasts downward. Additionally, investors are closely watching

China’s Third Plenary Session, a meeting addressing local

government debt and the development of the manufacturing sector.

Among individual stocks, Singapore’s Temasek

(TG:A2SANF) plans to invest up to $10 billion in India, focusing on

sectors like financial services and healthcare, while remaining

cautious about China. Insurer Ping An

(USOTC:PIAIF) saw its shares plummet after canceling $102.6 million

in A-shares.

European markets are trading lower, reflecting concerns over

economic and political conditions in the region, with declines

across all sectors. There are no major data releases in Europe on

Tuesday. Among individual stocks, notable decliners included

Hugo Boss (TG:BOSS), down more than 8% after the

company cut its sales forecast due to macroeconomic challenges. In

contrast, Ocado (LSE:OCDO) is up 15% after

reporting a smaller half-year loss and raising its full-year

expectations. Investors are awaiting the latest quarterly results

from Swedbank (LSE:81BO).

On Monday, U.S. stocks rose, with the Dow Jones and S&P 500

hitting new records. The Dow gained 210.82 points, or 0.53%, to

40,211.72. The S&P 500 added 15.87 points, or 0.28%, closing at

5,631.22. The Nasdaq rose 74.12 points, or 0.4%, to 18,472.57.

Optimism about Federal Reserve rate cuts and the prospects of

Donald Trump’s victory in the upcoming elections boosted the

market.

The New York Federal Reserve Bank report showed regional

manufacturing activity contracted further in July, with the index

dropping to -6.6. Additionally, Fed Chairman Jerome Powell stated

that recent data reinforces confidence that inflation is

approaching the bank’s 2% target, which could lead to rate cuts. He

emphasized that the last three inflation readings were crucial for

this outlook but avoided predicting the timing of rate reductions.

Powell also mentioned a shift in focus, balancing concerns about

the labor market and inflation.

On Monday, Trump chose JD Vance as vice president, highlighting

the importance of the role after a disastrous debate by Biden.

Vance attributed an assassination attempt on Trump to President Joe

Biden’s campaign rhetoric.

In the quarterly earnings front, before the market opens,

Bank of America (NYSE:BAC), Morgan

Stanley (NYSE:MS), Charles Schwab

(NYSE:SCHW), State Street (NYSE:STT), PNC

Financial (NYSE:PNC), Mercantile Bank

Corporation (NASDAQ:MBWM), UnitedHealth

Group (NYSE:UNH), Progressive (NYSE:PGR),

and Angiodynamics (NASDAQ:ANGO), among others,

will report.

After the market closes, results from Interactive

Brokers (NASDAQ:IBKR), J.B. Hunt

(NASDAQ:JBHT), AEHR Test Systems (NASDAQ:AEHR),

Hancock Whitney (NASDAQ:HWC), Fulton

Financial (NASDAQ:FULT), Omnicom Group

(NYSE:OMC), Pinnacle Financial Partners

(NASDAQ:PNFP), Equity Bancshares (NYSE:EQBK), and

Great Southern Bank (NASDAQ:GSBC), among others,

will be anticipated.

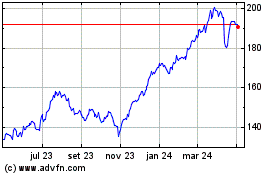

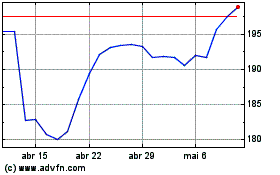

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024