HSBC Holdings (NYSE:HSBC) – HSBC has appointed

Georges Elhedery, its current Chief Financial Officer, as the new

CEO, reinforcing its strategy of continuity and growth. He will

succeed Noel Quinn in September, marking the bank’s third

leadership transition in less than eight years, maintaining its

policy of internal promotion. As the new leader, Elhedery will face

significant challenges, including stimulating growth in a declining

interest rate environment, navigating geopolitical tensions between

China and the West, and managing the persistent loan default crisis

in China, all factors directly impacting the bank’s performance.

Shares fell 0.37% in pre-market trading.

Tesla (NASDAQ:TSLA) – Elon Musk announced he is

moving the headquarters of SpaceX and social media platform X from

California to Texas, citing a new gender identity law in California

as the “final straw.” Musk, who previously moved Tesla’s

headquarters and his residence to Texas, criticized California laws

as harmful to families and businesses. Shares fell 1.45% in

pre-market trading.

ASML Holding NV (NASDAQ:ASML) – ASML saw its

shares drop due to concerns about potential stricter US trade

restrictions against its operations in China, despite a 54%

increase in orders in the last quarter. The Biden administration is

considering further restricting China’s access to advanced

semiconductor technology, potentially impacting ASML’s main market.

Shares fell 6.55% in pre-market trading.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – Donald Trump suggested that Taiwan should pay the US

for its defense, claiming that the island offers no reciprocation

while dominating the chip market. This statement negatively

impacted the shares of Taiwanese chip manufacturer TSMC,

reinforcing geopolitical and economic tensions between the

countries. Shares fell 3.31% in pre-market trading.

Bank of America (NYSE:BAC) – Bank of America is

increasing investments in its trading division, as explained by its

CEO, Brian Moynihan. This area, traditionally volatile, has shown

stability and high profits, exceeding $1 billion per quarter

consecutively. The bank plans to continue allocating more resources

and technology to sustain this growth. Shares fell 0.07% in

pre-market trading.

GitLab (NASDAQ:GTLB) – GitLab, a provider of

cloud-based software development tools with a market value of about

$8 billion, is considering a sale, working with investment bankers

after attracting purchase interest, including from Datadog. The

sale is not certain and could take weeks to finalize. Shares rose

12.51% in pre-market trading.

Alphabet (NASDAQ:GOOGL) – If Alphabet completes

the acquisition of Wiz, an Israeli cloud security company, it will

significantly enhance its security solutions for large enterprises,

increasing competitiveness against giants like Amazon and

Microsoft. This purchase, the largest in Google’s history, aims to

bolster protection against ransomware attacks and elevate

cybersecurity levels. Shares fell 0.93% in pre-market trading.

Microsoft (NASDAQ:MSFT) – The UK’s competition

regulator has initiated an investigation into Microsoft for hiring

former Inflection AI employees and forming partnerships with the

startup. Microsoft, which paid $650 million to Inflection, is under

increasing global scrutiny for anti-competitive practices in AI.

The CMA will decide on a further investigation by September 11.

Shares fell 1.41% in pre-market trading.

Meta Platforms (NASDAQ:META) – The new Ray-Ban

Meta smart glasses, launched in October, surpassed the sales of

previous models in just a few months. These glasses allow live

streaming on Facebook and Instagram and have integrated AI that

provides information about viewed objects. Shares fell 1.30% in

pre-market trading.

Reddit (NYSE:RDDT) – Reddit’s shares fell more

than 3% on Tuesday due to a downgrade by Alan Gould of Loop

Capital, concerned about imminent selling pressure when the lockup

period expires. Gould downgraded the shares from “Buy” to “Hold”

and maintains a price target of $75, citing uncertainties about

future profits despite positive revenue prospects. Shares fell

2.75% in pre-market trading.

Amazon (NASDAQ:AMZN) – Amazon’s Prime Day sales

increased nearly 12% in the first seven hours compared to the

previous year, according to Momentum Commerce. However, Amazon’s

marketing portal for sellers failed on Tuesday night, hindering

some sellers’ ability to adjust ads and keyword bids. Amazon stated

that only a small portion of advertisers was affected and that the

issue is being resolved without impacting ad delivery.

Additionally, the US Federal Trade Commission has requested more

details from Amazon about hiring executives from startup Adept,

reflecting concerns about AI agreements. This informal

investigation examines Amazon’s move to compete with Google and

Microsoft in developing large language models. Shares fell 0.89% in

pre-market trading.

Shopify (NYSE:SHOP) – Shopify’s shares rose

8.6% on Tuesday after BofA Securities upgraded its recommendation

from Neutral to Buy, raising the price target from $78 to $82.

Shares fell 0.04% in pre-market trading.

Yandex (NASDAQ:YNDX) – The Russian tech giant

Yandex has spun off its international businesses in a $5.4 billion

deal, creating the Nebius Group in Amsterdam, led by Arkady Volozh.

Nebius aims to become a European leader in AI infrastructure

development services, now free from ties to Russia. Shares are

stable in pre-market trading.

Warner Bros Discovery (NASDAQ:WBD) – Bank of

America suggested that Warner Bros Discovery could increase its

value by considering strategic options such as a sale. The company

is trying to recover from poor financial performance due to reduced

advertising and Hollywood strikes. Shares fell 0.13% in pre-market

trading.

AT&T (NYSE:T) – Two US senators questioned

AT&T about a cyberattack that compromised data of about 109

million customers. Senators Richard Blumenthal and Josh Hawley

expressed concern about the severity of the privacy breach and the

potential risks associated, including improper access to customer

communication and location information. Shares fell 0.21% in

pre-market trading.

Delta Air Lines (NYSE:DAL) – Fitch Ratings

upgraded Delta Air Lines’ credit rating to investment grade,

highlighting the company’s financial recovery after the pandemic.

During the crisis, the rating had fallen to “junk” due to the

decline in the aviation sector. Since then, Delta has focused on

reducing debt and improving its balance sheet. Shares fell 0.43% in

pre-market trading.

United Airlines (NASDAQ:UAL) – United Airlines

flight attendants will be able to vote in August on a possible

strike if they fail to reach a new contract agreement. The union,

representing 28,000 employees, seeks improvements and has already

requested federal mediation to advance negotiations. Shares fell

1.00% in pre-market trading.

Deere & Co (NYSE:DE) – The agricultural

machinery manufacturer is scaling back its diversity initiatives in

response to conservative criticism. The company announced it will

no longer participate in cultural parades and will focus its

resource groups on professional development and recruitment. This

change follows a similar trend observed in other industry companies

revisiting their diversity and inclusion policies under

conservative pressure.

Lineage – The real estate investment trust

Lineage, focusing on refrigerated storage, is aiming for a

valuation of up to $19.16 billion in its initial public offering in

the United States, marking the largest listing of the year. Backed

by private equity firm Bay Grove Capital, Lineage plans to raise up

to $3.85 billion by selling 47 million shares, with a price range

set between $70 and $82 per share. The offering aims to surpass

Viking Holdings’ recent IPO and establish itself as a market leader

in 2024.

SymphonyAI – The American AI company SymphonyAI

plans to go public in the second quarter of 2025. The listing plan

emerged as SymphonyAI reached $500 million in revenue last year and

achieved profitability after growing revenue at a rate of about

25%, according to CEO Sanjay Dhawan. The company serves clients

like Pepsi and Citadel. Founded by Romesh Wadhwani, SymphonyAI

seeks liquidity and capital for mergers and acquisitions. The

company has 3,000 employees in 30 countries.

Skechers (NYSE:SKX) – Skechers has sued LL

Bean, accusing it of illegally copying patented shoe designs that

generated millions in sales. The footwear company claims that LL

Bean’s Freeport shoes infringe on heel design patents. Skechers is

seeking damages and an end to the sales of the disputed shoes.

Shares fell 0.34% in pre-market trading.

Philip Morris International (NYSE:PM) – Philip

Morris International announced it will invest $600 million to build

a factory in Colorado for the production of Zyn nicotine pouches.

This initiative aims to meet the growing demand for alternatives to

traditional tobacco in the US. The factory, expected to start

operations by 2025, will create 500 jobs.

Sundial Growers (NASDAQ:SNDL) – The Canadian

cannabis company is reducing its workforce by 106 employees to cut

costs amid market oversupply. This measure aims to save $20 million

annually through general expense optimization. The restructuring

will cost $11 million and includes leadership changes at Nova

Cannabis Inc. Shares fell 2.27% in pre-market trading.

Walmart (NYSE:WMT) – In Chile, the Walmart

workers’ union ended a six-day strike and extended its current

labor contract with the company for another 18 months. The decision

came after failed negotiations for wage adjustments and better

benefits, allowing future negotiations to resume. Shares fell 0.37%

in pre-market trading.

GameStop (NYSE:GME) – GameStop saw its shares

rise 5.7% on Tuesday, marking the seventh consecutive day of gains.

Driven by meme trading, the stock has increased 63% this year,

especially after the return of Roaring Kitty in May. The meme

market is known for its volatility, operating more on momentum than

traditional fundamentals. Shares rose 1.19% in pre-market

trading.

Build-A-Bear (NYSE:BBW) – A US judge denied

Build-A-Bear’s request to dismiss a lawsuit accusing the company of

copying Kelly Toys’ Squishmallows, a unit of Berkshire Hathaway.

The decision was based on the similarities between the products,

with Kelly Toys seeking unspecified damages.

Five Below (NASDAQ:FIVE) – Joel Anderson, CEO

of the discount store chain Five Below, decided to step down to

explore new opportunities. Kenneth Bull was named the new president

and interim CEO, taking over immediately. Additionally, the company

lowered its sales and earnings per share projections for the second

quarter. Five Below now expects sales between $820 million and $826

million, down from the $830 million to $850 million forecasted in

June. The company projects EPS of 53 to 56 cents per share. Shares

fell 14.56% in pre-market trading.

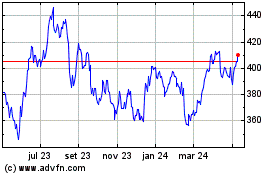

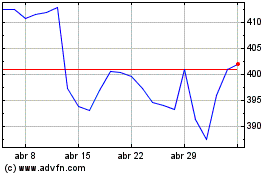

Deere (NYSE:DE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Deere (NYSE:DE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024