Tech Stocks May Lead Early Pullback On Wall Street

17 Julho 2024 - 10:10AM

IH Market News

The major U.S. index futures are currently pointing to a sharply

lower open on Wednesday, with stocks likely to give back ground

after trending higher over the past few sessions.

Tech stocks may lead an early pullback on Wall Street after a

report from Bloomberg said President Joe Biden’s administration is

considering tougher trade rules against companies in its chip

crackdown on China.

Bloomberg said the administration has told allies that it’s

considering using the most severe trade restrictions available if

companies continue giving China access to advanced semiconductor

technology.

Citing people familiar with recent discussions, Bloomberg said

the U.S. is mulling whether to impose a measure called the foreign

direct product rule, which lets the country impose controls on

foreign-made products that use even the tiniest amount of American

technology.

The downward momentum on Wall Street also comes after former

President Donald Trump suggested Taiwan should pay the U.S. for

defense, claiming the country took “about 100%” of America’s chip

business.

Extending the upward move seen over the two preceding sessions,

stocks moved mostly higher during trading on Tuesday. The Dow led

the charge, surging to a new record closing high.

The Dow jumped 742.76 points or 1.9 percent to 40,954.48, the

S&P 500 climbed 35.98 points or 0.6 percent to a new record

closing high of 5,667.20 and the Nasdaq rose 36.77 points or 0.2

percent to 18,509.34.

The strength on Wall Street partly reflected a positive reaction

to some of the latest earnings news, with Dow component

UnitedHealth (NYSE:UNH) moving sharply higher after reporting

second quarter earnings that exceeded analyst estimates.

Bank of America (NYSE:BAC) also moved notably higher after the

financial giant reported better than expected second quarter

earnings.

Shares of Morgan Stanley (NYSE:MS) also turned positive after

seeing initial weakness after the company reported better than

expected second quarter earnings.

Traders also reacted positively to the latest U.S. economic

news, including a Commerce Department report showing U.S. retail

sales came in unchanged in the month of June.

The Commerce Department said retail sales came in flat in June

after rising by an upwardly revised 0.3 percent in May.

Economists had expected retail sales to come in unchanged

compared to the 0.1 percent uptick originally reported for the

previous month.

Excluding a sharp drop in sales by motor vehicle and parts

dealers, retail sales climbed by 0.4 percent in June after inching

up by 0.1 percent in May. Ex-auto sales were expected to creep up

by 0.1 percent.

“Judging by the positive market reaction to the US retail sales

data, it appears that investors are focusing on the economic

strength for now, while also maintaining a strong belief that

monetary policy starts to ease after the summer,” said Dan

Coatsworth, investment analyst at AJ Bell.

The Labor Department also released a report showing import

prices in the U.S. were unexpectedly flat in the month of June.

The report said import prices were unchanged in June after

dipping by a revised 0.2 percent in May. Economists had expected

import prices to rise by 0.2 percent compared to the 0.4 percent

decrease originally reported for the previous month.

Meanwhile, the Labor Department said export prices declined by

0.5 percent in June after falling by a revised 0.7 percent in

May.

Export prices were expected to edge down by 0.1 percent compared

to the 0.6 percent decrease originally reported for the previous

month.

Housing stocks showed a substantial move to the upside on the

day, with the Philadelphia Housing Sector Index spiking by 5.3

percent to a record closing high.

Optimism about the outlook for interest rates contributed to the

strength in the sector despite a report from the National

Association of Home Builders showing an unexpected dip in

homebuilder confidence in the month of July.

Gold stocks are also saw significant strength amid a sharp

increase by the price of the precious metal, driving the NYSE Arca

Gold Bugs Index up by 3.4 percent. The index reached a more than

two-year closing high.

Considerable strength was also visible among airline stocks, as

reflected by the 3.3 percent surge by the NYSE Arca Airline Index.

Banking, biotechnology and telecom stocks also saw notable strength

on the day, moving higher along with most of the other major

sectors.

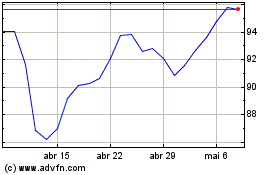

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

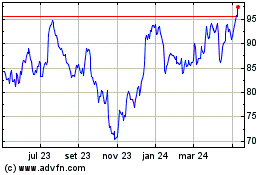

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024