U.S. Index Futures Dip Slightly as Investors Await Major Earnings Reports, Oil Prices Edge Up

23 Julho 2024 - 7:04AM

IH Market News

U.S. index futures slightly retreated in pre-market trading on

Tuesday as investors prepare for the release of earnings reports

from major companies.

At 6:17 AM, Dow Jones futures (DOWI:DJI) fell 4 points, or

0.01%. S&P 500 futures lost 0.15%, and Nasdaq-100 futures

dropped 0.29%. The 10-year Treasury yield stood at 4.232%.

In the commodities market, oil prices slightly rose on Tuesday

after falling in the last two sessions, reflecting investor caution

due to the outlook of high supply and weak demand. The U.S.

presidential campaign had little impact, with the focus on market

fundamentals suggesting a potential future oversupply. Inventory

data and attacks in Russia also influence the market.

West Texas Intermediate crude for September rose 0.33% to $78.66

per barrel. Brent crude for September rose 0.41% near $82.74 per

barrel.

On Tuesday’s economic agenda, June’s existing home sales will be

published at 9 AM.

Asia-Pacific markets closed mixed. In Hong Kong, the Hang Seng

fell 0.94%. China’s Shanghai Composite lost 1.65%. In Japan, the

Nikkei 225 retreated 0.01%. In South Korea, the Kospi rose 0.39%,

and the Kosdaq advanced 0.27%. In Taiwan, the Taiex gained 2.76%,

and in Australia, the S&P/ASX 200 grew 0.5%.

In June, Singapore’s consumer price index rose 2.4%, below the

forecast of 2.7%. In South Korea, the producer price index

increased by 2.5%. Shares of Kakao (KOSPI:035720)

fell 4.63% after an arrest warrant was issued for founder Brian

Kim.

European markets are mixed amid regional corporate earnings

reports. The mining sector is performing poorly, while technology

is advancing. Hungary will reveal its latest interest rate

decision, and consumer confidence data will be released in the

Netherlands and Ireland. Among individual stocks,

Porsche (TG:PAH3) shares are down 3.6% after

lowering its 2024 forecasts.

U.S. stocks had a significant rise on Monday. The Dow Jones rose

127.91 points (0.32%) to 40,415.44, the S&P 500 increased 59.41

points (1.08%) to 5,564.41, and the Nasdaq advanced 280.63 points

(1.58%) to 18,007.57. Nvidia (NASDAQ:NVDA) stood

out with a 4.8% increase, recovering after an 8.8% drop last week.

Meta Platforms (NASDAQ:META) and

Alphabet (NASDAQ:GOOGL) also showed strength,

rising over 2% each. However, CrowdStrike (NASDAQ:CRWD) had the

worst performance among S&P 500 stocks, falling 13.5% and

accumulating nearly an 18% loss over the past week, reflecting

ongoing investor concerns.

Joe Biden’s exit from the presidential race also positively

influenced the market. Kamala Harris secured enough delegates for

the Democratic presidential nomination after rapidly mobilizing

support, solidifying herself as the candidate to face Donald Trump.

ActBlue processed over $100 million in donations since Sunday. This

shift revitalized the Democratic campaign against Donald Trump and

JD Vance.

In Tuesday’s earnings reports,

Spotify (NYSE:SPOT), United

Parcel Service (NYSE:UPS), GE

Aerospace (NYSE:GE), General

Motors (NYSE:GM), Coca-Cola (NYSE:KO), Lockheed

Martin (NYSE:LMT), Freeport

McMoRan (NYSE:FCX), Comcast (NASDAQ:CMCSA), Polaris (NASDAQ:PII), Philp

Morris International (NYSE:PM) will report before the

market opens.

After the market closes,

Tesla (NASDAQ:TSLA), Alphabet (NASDAQ:GOOGL), Visa (NYSE:V), Enphase

Energy (NASDAQ:ENPH), Texas

Instruments (NASDAQ:TXN), Seagate

Technology (NASDAQ:STX), Chubb (NYSE:CB), CapitalOne (NYSE:COF), Cal-Maine

Foods (NASDAQ:CALM), Packaging

Corporation America (NYSE:PKG) are expected to

release their numbers.

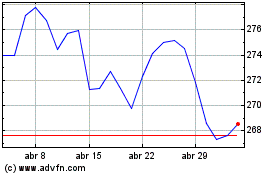

Visa (NYSE:V)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Visa (NYSE:V)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025