Visa Analysis: U.S. Rings in Holiday Retail Spending Growth

23 Dezembro 2024 - 8:30AM

Business Wire

Visa, a global leader in digital payments, today announced its

first Retail Spend Monitor from Visa Consulting & Analytics

(VCA). This year, Visa’s preliminary insights indicate that the

overall holiday retail spend in the U.S. increased 4.8% year over

year. This is across all forms of payment, including cash and check

and is not adjusted for inflation.

"This holiday shopping season, we’re seeing increasing consumer

confidence as people sought out in-store experiences – and went

online – to purchase gifts and celebrate the holidays with friends

and family,” said Wayne Best, chief economist at Visa. “This

spending growth demonstrates the adaptability of both consumers and

retailers and the overall strength of the economy.”

Unwrapping the highlights:

- Consumers headed back to stores: Out of total holiday

retail spend in the U.S., 77% of total payment volume was in store

versus 23% online, showing the in-store experience remains

important for the consumer. Total retail spend in stores grew at a

rate of 4.1% (versus 1.6% last year).

- Online retail shopping continues to grow: Online retail

shopping increased by 7.1% (versus 10.3% last year), showing

consumers continue to rely on its convenience and ease during the

holiday season.

- Consistent electronics sales growth: The electronics

sector growth rate increased to 4.2% versus 2.8% last year.

- Clothing and accessories are in season: This holiday

season saw a 5.0% rise in sales (versus 2.4% last year) for

clothing and accessories.

- Making homes cozier for the holidays: Building materials

sales increased by 4.7% (versus a negative 3.9% last year),

indicating consumers turned their attention to their homes this

year.

- A global spending season: Across the globe, holiday

shoppers demonstrated positive activity. Brazil saw a 12.2% year

over year increase, while South Africa experienced a 7.0% growth in

spending. Both regions enjoyed double-digit growth across all five

merchant categories. The U.K. joined the trend with a 2.3% rise,

and Australia saw a 7.4% increase in overall spend.

- Fraudsters are doubling down: Earlier this month, Visa

reported that it blocked nearly double the amount of suspected

fraud in 2024 versus 2023 during Black Friday and Cyber Monday

weekend.

The VCA Retail Spend Monitor reflects the total retail sales

activity for the seven-week period starting on November 1 and uses

a subset of Visa payments network data in the U.S.1 coupled with

survey-based estimates for other forms of payment.

The VCA Retail Spend Monitor is produced by Visa Consulting

& Analytics, a global network of more than 1,500 consultants,

economists, data scientists, and product designers working across

75 countries. In the last year, VCA delivered more than 3,000

consulting engagements, nearly double from the year prior, that

helped clients realize an estimated $5 billion in incremental

revenue as a result.

“With Visa Consulting & Analytics expertise and the power of

VisaNet’s data –– representing 234 billion transactions a year, 639

million transactions every day –– our clients make informed

business decisions that power their growth,” said Kate Manfred,

North America head of advisory services at Visa. “Comprehensive

analysis like the Retail Spend Monitor provides insights into

consumer spending behaviors and trends that aid retailers in

strategic planning and market positioning.”

To learn more about how Visa Consulting & Analytics can help

clients turn data and insights into actionable business decisions,

visit here.

About Visa

Visa (NYSE: V) is a world leader in digital payments,

facilitating transactions between consumers, merchants, financial

institutions and government entities across more than 200 countries

and territories. Our mission is to connect the world through the

most innovative, convenient, reliable and secure payments network,

enabling individuals, businesses and economies to thrive. We

believe that economies that include everyone everywhere, uplift

everyone everywhere and see access as foundational to the future of

money movement. Learn more at Visa.com.

The views, opinions, and/or estimates, as the case may be

(“views”), expressed herein are those of the Visa Consulting &

Analytics team and do not necessarily reflect those of Visa

executive management or other Visa employees and affiliates. This

content is intended for informational purposes only and should not

be relied upon for operational, marketing, legal, technical, tax,

financial or other advice and do not in any way reflect actual or

forecasted Visa operational or financial performance. Visa neither

makes any warranty or representation as to the completeness or

accuracy of the views contained herein, nor assumes any liability

or responsibility that may result from reliance on such views.

These views are often based on current market conditions and are

subject to change without notice.

____________________________

1 The analysis is based on a subset of U.S. Visa payments

network data at retail merchants but excludes auto, gasoline,

restaurants and other categories.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241223673631/en/

Stephanie Barnes press@visa.com 628.278.9327

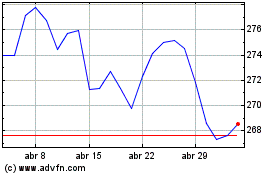

Visa (NYSE:V)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Visa (NYSE:V)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024