Tesla Falls 7% on Profit Miss, Deutsche Bank Down 8% on Loss, Alphabet Drops 3% – Earnings Recap

24 Julho 2024 - 6:47AM

IH Market News

Tesla (NASDAQ:TSLA) – Tesla reported adjusted

earnings per share of 52 cents, below the expected 62 cents.

Revenue was $25.50 billion, surpassing the forecast of $24.77

billion. Automotive sales fell 7%, totaling $19.9 billion. Tesla

projects lower growth for 2024 and a focus on cost reduction.

Shares fell 7.3% pre-market.

Alphabet (NASDAQ:GOOGL) – Alphabet exceeded

second-quarter expectations with adjusted earnings per share of

$1.89 and revenue of $84.74 billion, while analysts tracked by LSEG

predicted $1.84 in revenue of $84.19 billion. Google Cloud earned

$10.35 billion, against the forecast of $10.20 billion. Search ad

revenue was $48.5 billion, higher than the forecast of $47.6

billion. YouTube revenue of $8.66 billion, despite increasing from

the previous quarter, was below the estimate of $8.93 billion.

Shares fell 3.2% pre-market.

Deutsche Bank (NYSE:DB) – In the second

quarter, Deutsche Bank reported a loss of 143 million euros, better

than the forecast of 145 million, due to a provision of 1.3 billion

euros (or 1.41 billion dollars) for a Postbank lawsuit. This was

the first quarterly loss after 15 quarters of profit. Investment

banking revenues rose 10%, but retail and corporate revenues fell.

Shares fell 8.2% pre-market.

Texas Instruments (NASDAQ:TXN) – Texas

Instruments reported earnings per share of $1.22, surpassing LSEG’s

consensus estimate of $1.17. The company’s revenue was $3.82

billion, in line with analysts’ forecasts. Shares rose 2.2%

pre-market.

Seagate Technology (NASDAQ:STX) – Seagate

reported earnings of $1.05 per share, excluding items, with revenue

of $1.89 billion. Analysts surveyed by LSEG estimated EPS of 75

cents and revenue of $1.87 billion. The company attributed its

stronger performance to an improvement in the cloud environment.

Shares rose 5.4% pre-market.

Visa (NYSE:V) – Visa reported adjusted earnings

of $2.42 per share, in line with expectations. Revenue was $8.90

billion, slightly below the estimate of $8.92 billion. Payment

volume grew 7%, and processed transactions increased 10%. The

company noted a slowdown in volume growth in the US in July

compared to June. Shares fell 2.6% pre-market.

Capital One Financial (NYSE:COF) – In the

second quarter, Capital One reported a 5% increase in revenue,

reaching $9.51 billion, below analysts’ expectations from LSEG.

Adjusted earnings per share were $3.14, below the consensus of

$3.42. The bank increased its reserves to cover potential credit

losses.

Chubb (NYSE:CB) – Chubb reported mixed results

in the second quarter. Adjusted earnings per share were $5.38,

surpassing the consensus estimate of $5.14 per share. Quarterly

revenue was $12.29 billion, below the consensus estimate of $13.04

billion.

Enphase Energy (NASDAQ:ENPH) – Enphase reported

adjusted earnings of 43 cents per share, 5 cents below LSEG’s

consensus estimates. Revenue was $304 million, short of analysts’

forecast of $310 million. However, the company reported

better-than-expected margins and projected third-quarter revenues

between $370 million and $410 million, exceeding analysts’ estimate

of $404 million. Shares rose 5.2% pre-market.

Mattel (NASDAQ:MAT) – In the second quarter,

Mattel reported adjusted earnings of 19 cents per share, above

analysts’ estimates from LSEG of 17 cents per share. Revenue was

$1.08 billion, slightly below the forecast of $1.1 billion. Mattel

reiterated its fiscal year outlook and highlighted its gross margin

expansion.

Cal-Maine Foods (NASDAQ:CALM) – In the fiscal

fourth quarter, Cal-Maine reported earnings of $2.32 per share,

below FactSet’s estimate of $2.41. Sales were $640.8 million, also

below the estimate of $652.3 million. The largest US egg producer

attributed the results to the avian flu outbreak, which impacted

its performance.

International Business Machines (NYSE:IBM) –

IBM’s second-quarter results will be released on Wednesday after

the market closes. IBM shares may benefit from low expectations as

the company navigates mixed demand for IT services. Analysts

predict revenue of $15.62 billion and adjusted earnings per share

of $2.18 for the second quarter. Shares fell 0.4% pre-market.

GE Vernova (NYSE:GEV) – GE Vernova’s

second-quarter results, expected to be released before the market

opens on Wednesday, may surprise, given the uncertainty. The

company, recently spun off from GE Aerospace, has no previous

results for comparison, increasing the difficulty of Wall Street’s

prediction. The expectation is that the company will report EBITDA

of $442 million and earnings per share of 73 cents, with sales of

$8.3 billion. Volatility is expected due to recent issues in the

Vineyard wind power project.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

will release its second-quarter results on Wednesday with

optimistic forecasts. Analysts expect earnings per share of 32

cents and revenues of $2.94 billion, as Chipotle restaurant visits

have increased significantly, indicating strong same-store sales

performance. Shares rose 0.5% pre-market.

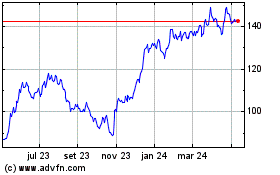

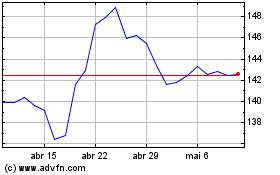

Capital One Financial (NYSE:COF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Capital One Financial (NYSE:COF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024