Tesla (NASDAQ:TSLA) – The electric vehicle

manufacturer reported earnings per share of $0.72, exceeding the

estimated $0.58. Revenue was $25.18 billion, slightly below the

expected $25.37 billion. Net income increased to $2.17 billion.

Automotive revenue grew 2%, while energy generation surged 52%. CEO

Elon Musk announced plans to launch autonomous transport services

in California and Texas by 2025. However, Musk acknowledged

regulatory challenges, particularly in California, where companies

like Waymo have spent years obtaining permits. The stock rose 11.2%

in pre-market trading, after closing down 2.0% on Wednesday.

IBM (NYSE:IBM) – The technology and consulting

company reported adjusted earnings of $2.30 per share, beating the

expected $2.23, but revenue grew by just 1.5% to $14.97 billion,

missing forecasts of $15.07 billion. Weak demand for consulting

services, which generated $5.15 billion in revenue, contributed to

the shortfall. IBM posted a net loss of $330 million due to a

pension settlement charge but reaffirmed its 2024 free cash flow

target of over $12 billion. The stock fell 4.3% in pre-market

trading, after closing up 0.2% on Wednesday.

Lam Research (NASDAQ:LRCX) – The semiconductor

equipment manufacturer exceeded Wall Street expectations, reporting

adjusted earnings of $0.86 per share, above the anticipated $0.81,

and revenue of $4.17 billion, surpassing the $4.06 billion

forecast. Net income was $1.12 billion. For the upcoming quarter,

the company projects earnings between $0.77 and $0.97 per share.

The stock rose 6.5% in pre-market trading, after closing down 0.2%

on Wednesday.

Celestica (NYSE:CLS) – The electronic

manufacturing services provider reported third-quarter 2024 revenue

of $2.5 billion, a 22% increase year-over-year. Adjusted earnings

per share were $1.04, up from $0.65 last year. Free cash flow rose

to $74.5 million from $34.1 million YoY, and the adjusted operating

margin climbed to 6.7%. Celestica raised its full-year forecast,

now expecting adjusted EPS of $3.85 and revenue of $9.60 billion.

The stock rose 8.2% in pre-market trading, after closing up 2.6% on

Wednesday.

Newmont (NYSE:NEM) – The world’s largest gold

producer reported third-quarter net income of $922 million, nearly

six times higher than the previous year, though still below Wall

Street expectations. Gold production reached 1.67 million ounces

during the quarter. Newmont produced 2.1 million gold equivalent

ounces and generated $760 million in free cash flow in Q3 2024. The

company also recorded $1.6 billion in operating cash flow and

announced asset sales that could raise up to $1.5 billion.

Additionally, a third-quarter dividend of $0.25 per share was

declared.

ServiceNow (NYSE:NOW) – The enterprise software

developer reported adjusted earnings of $3.72 per share, surpassing

the expected $3.45, with revenue of $2.8 billion, exceeding

forecasts of $2.746 billion. Subscription revenue grew 23%,

reaching $2.72 billion. ServiceNow raised its subscription revenue

outlook for 2024 and appointed Amit Zavery as president, chief

product officer, and COO, effective October 28.

Viking Therapeutics (NASDAQ:VKTX) – The

biotechnology company focused on metabolic therapies reported a net

loss of $24.9 million in Q3 2024, equivalent to $0.22 per share,

slightly higher than the $22.5 million loss in Q3 2023. R&D

expenses increased to $22.8 million, while the company ended the

quarter with $930 million in cash and short-term investments.

Shares rose 5.0% in pre-market trading, after closing down 2.6% on

Wednesday.

T-Mobile (NASDAQ:TMUS) – The 5G telecom and

internet provider reported Q3 2024 earnings of $2.61 per share,

surpassing the expected $2.43. Net income increased 43%, totaling

$3.1 billion, with revenue of $20.2 billion, above the $20 billion

forecast. The company reported 315,000 net postpaid account

additions and 415,000 high-speed internet customers, with a

postpaid phone churn rate of 0.86%, the lowest ever. T-Mobile

raised its guidance for net postpaid customer additions. Shares

rose 2.3% in pre-market trading, after closing up 0.9% on

Wednesday.

Las Vegas Sands (NYSE:LVS) – The global casino

and resort operator reported Q3 2024 net revenue of $2.68 billion,

below the $2.781 billion estimate. Net income of $353 million and

earnings per share of $0.38 were lower compared to last year.

However, the company rewarded shareholders with $450 million in

share buybacks and raised its annual dividend to $1.00. The Las

Vegas Sands also announced plans to expand its Marina Bay Sands

resort in Singapore with an $8 billion investment, more than

doubling the initial $3.4 billion estimate. The new property will

feature a luxury hotel and a 15,000-seat arena, with an opening

planned for 2031, pending government approval.

Mattel (NASDAQ:MAT) – The global toy maker

reported Q3 2024 adjusted earnings of $1.14 per share, beating

estimates of $0.95. Net revenue was $1.84 billion, slightly below

the $1.86 billion forecast. Despite strict cost controls, sales

fell 4%, and the company lowered its full-year sales outlook due to

weak toy demand.

United Rentals (NYSE:URI) – The largest

industrial equipment rental company missed third-quarter earnings

expectations, posting $11.80 per share, below the expected $12.48.

Quarterly revenue grew by 7.4% to $3.46 billion, but missed

estimates of $4.01 billion. Lower margins were impacted by the slow

recovery of non-residential construction and supply chain issues.

United Rentals revised its full-year revenue forecast to a midpoint

of $15.2 billion, aligning with LSEG estimates.

Ameriprise Financial (NYSE:AMP) – The financial

services and wealth management provider reported an 11% increase in

Q3 2024 earnings, with adjusted earnings per share of $8.10, or

$828 million, exceeding last year’s $6.96. Assets under management

rose 22% to $1.5 trillion, driven by net inflows and market

appreciation. Fee revenues increased by 12.5%, totaling $2.57

billion.

LendingClub (NYSE:LC) – The online lending

platform reported Q3 2024 earnings per share and revenue of 13

cents and $201.9 million, respectively, surprising FactSet’s

consensus estimates of 7 cents per share and $190.4 million. Loan

originations increased to $1.9 billion, while total assets grew by

25%, reaching $11 billion. Shares rose 6.3% in pre-market trading,

after closing up 0.5% on Wednesday.

Western Union (NYSE:WU) – The international

money transfer company reported adjusted earnings of 46 cents per

share on revenue of $1.04 billion, beating analysts’ expectations

of 44 cents per share and $1.03 billion in revenue. The company

projects annual earnings between $1.70 and $1.80 per share.

Whirlpool (NYSE:WHR) – The global appliance

manufacturer reported third-quarter diluted ongoing earnings per

share of $3.43, driven by a 5.8% EBIT margin. This beat the $3.19

estimate, according to LSEG. Net revenue was $3.99 billion, an

18.9% decline year-over-year. GAAP diluted earnings per share were

$2.00, with a 2.7% net margin.

Molina Healthcare (NYSE:MOH) – The government

healthcare services provider reported adjusted earnings of $6.01

per share and revenue of $10.34 billion. The results exceeded

LSEG’s consensus estimates of $5.81 EPS and $9.91 billion in

revenue. Revenue grew 21%, and net income was $326 million.

Teck Resources (NYSE:TECK) – The Canadian

mining company reported Q3 2024 adjusted earnings of C$0.60 per

share, beating the estimate of C$0.37. Copper production increased

by 60%, totaling 115,000 tonnes, with an average price of $4.21 per

pound. The company lowered its full-year copper production forecast

to 420,000–455,000 tonnes.

Equinor (NYSE:EQNR) – The Norwegian oil and gas

producer reported adjusted earnings of $6.89 billion in Q3 2024,

below expectations of $7.08 billion, and down 13% from last year

due to lower oil prices and production. The company revised its

annual capital expenditure to $12-13 billion and lowered its

renewable energy production growth forecast to 50%. Shares rose

2.8% in pre-market trading, after closing down 1.5% on

Wednesday.

Barclays (NYSE:BCS) – Barclays reported Q3 2024

pre-tax profit of $2.85 billion (£2.2 billion), beating the £1.968

billion expectation and last year’s £1.9 billion. Its investment

banking revenue grew by 6%, with a 133% increase in advisory fees

and a 48% rise in debt capital market revenues. Net interest income

guidance was revised upward, with expectations to exceed £11

billion in 2024. However, corporate banking revenue dropped by 21%,

due to an £85 million loss in its leveraged finance portfolio.

Shares rose 4.3% in pre-market trading, after closing down 2.2% on

Wednesday.

More Highlights

Apple (NASDAQ:AAPL) – Apple is gearing up to

launch new MacBook Airs with M4 chips in early 2025, following the

introduction of new Macs next week. The 13-inch and 15-inch models

will retain their current design but offer improved performance and

AI capabilities. Additionally, Apple plans to update other devices

like MacBook Pros, Mac minis, iPads, and introduce a revamped

iPhone SE. Apple has reduced Vision Pro production due to falling

sales after initial enthusiasm. Priced at $3,500, the device faces

competition from cheaper options like Meta’s Quest 3. Production

could halt by November, with a more affordable model expected in

2025. Shares rose 0.3% in pre-market trading, after closing down

2.2% on Wednesday.

Nvidia (NASDAQ:NVDA) – Nvidia expanded

partnerships with Indian companies, such as Reliance, and launched

a lightweight AI model for the Hindi language, aiming to tap into

the growing local market. During the Mumbai AI summit, CEO Jensen

Huang highlighted that Nvidia will significantly expand its

computing infrastructure in India. Shares rose 1.5% in pre-market

trading, after closing down 2.8% on Wednesday.

Intel (NASDAQ:INTC) – Intel won another round

in its dispute with the European Union over a $1.1 billion (€1.06

billion) antitrust fine. The EU court ruled that regulators failed

to prove Intel offered illegal discounts to PC makers. However,

Intel still faces a separate €376 million fine focused on prior

anti-competitive practices. Shares rose 0.6% in pre-market trading,

after closing down 1.9% on Wednesday.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – TSMC halted shipments to an unnamed customer after

discovering its chips were used in a Huawei product, potentially

violating U.S. restrictions. TSMC launched an investigation and

notified U.S. and Taiwanese governments. Shares fell 0.2% in

pre-market trading, after closing up 1.2% on Wednesday.

Roblox (NYSE:RBLX) – Roblox is implementing

reforms following criticism over child safety and the arrests of

abusers who used the platform. Now, users under 13 will need

parental permission to access chat features, and children under 9

will require approval to play games with moderate violence. The

changes aim to make the platform safer.

NextEra Energy (NYSE:NEP) – NextEra Energy is

studying the potential reactivation of its Duane Arnold nuclear

plant in Iowa due to increased energy demand from AI data centers

and electrification. The company is discussing the project with

regulators and sees potential to restart the reactor at a

competitive cost. Shares rose 2.8% in pre-market trading, after

closing down 16.3% on Wednesday.

Shell plc (NYSE:SHEL) – Shell announced

Wednesday that its Shell Energy North America (SENA) unit acquired

RISEC Holdings, which owns a 609-megawatt plant in Rhode Island.

The deal secures SENA long-term supply in the deregulated New

England market, where it already has a full power purchase

agreement for RISEC. Shares rose 1.1% in pre-market trading, after

closing down 0.7% on Wednesday.

Boeing (NYSE:BA) – Boeing CEO Kelly Ortberg

stressed the need for a “fundamental cultural shift” after the

company posted quarterly losses of $6 billion. Boeing has amassed

nearly $8 billion in losses for the year, pushing the company to

improve liquidity and stabilize operations. Ortberg also noted that

Boeing’s defense business, despite issues with over-budget

contracts like the KC-46 tanker and Air Force One, remains crucial

to the company’s future. Boeing workers rejected a new contract

proposal, prolonging a five-week strike. With 64% voting against,

employees are demanding a 40% pay raise and the return of pensions,

frustrating Ortberg’s efforts to stabilize the company financially.

Shares fell 3.0% in pre-market trading, after closing down 1.8% on

Wednesday.

American Airlines (NASDAQ:AAL) – According to

Reuters, the U.S. Department of Transportation fined American

Airlines $50 million for the improper treatment of disabled

passengers, including mishandling wheelchairs and providing

insufficient assistance. This fine is 25 times higher than previous

ones, setting a new standard. American will invest $25 million to

fix these issues. Shares rose 1.2% in pre-market trading, after

closing down 1.0% on Wednesday.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management and Southwest Airlines are nearing a deal to

avoid a proxy fight for board control. The agreement would give the

activist investor some board seats but not a majority. Elliott,

which owns 10% of the company, is seeking to replace eight

directors and influence strategy. Shares rose 0.9% in pre-market

trading, after closing up 0.8% on Wednesday.

Stellantis (NYSE:STLA) – Nearly 80 members of

Congress, including key Senate Democrats, pressured Stellantis to

honor investment commitments agreed upon with the United Auto

Workers (UAW) union. The automaker delayed a $1.5 billion

investment to reopen a factory in Illinois, causing tensions.

Lawmakers are demanding a timeline, and the UAW is threatening a

strike. Shares rose 3.9% in pre-market trading, after closing up

1.5% on Wednesday.

Goldman Sachs (NYSE:GS), Apple

(NASDAQ:AAPL) – Goldman Sachs and Apple will pay $89 million for

violating consumer protection laws with their joint credit card.

The companies faced allegations of mishandling disputes and

misleading consumers about interest-free purchases. Goldman will

also face restrictions on issuing new cards, and both reached a

settlement with authorities.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase is

in talks to resume trading liquefied natural gas (LNG) after a

decade. According to Bloomberg, the bank is seeking long-term

supply deals with Gulf Coast projects, including Commonwealth LNG

and Energy Transfer facilities.

HSBC (NYSE:HSBC) – HSBC’s job cuts following

its recent restructuring are focused on eliminating duplicate

roles. The restructuring, which splits the bank into four units,

will streamline management, reduce costs, and increase

accountability in each business area. Shares rose 1.1% in

pre-market trading, after closing down 1.0% on Wednesday.

Capital One (NYSE:COF) – New York Attorney

General Letitia James is investigating potential antitrust

violations in the $35.3 billion merger between Capital One and

Discover. According to Reuters, James is seeking documents from

Capital One, which has not fully cooperated. The merger could

negatively affect New Yorkers, particularly those with subpar

credit.

KKR (NYSE:KKR) – Italian energy group Eni

announced that U.S. fund KKR will buy a 25% stake in Enilive for

€2.938 billion, valuing the biofuels business at €11.75 billion.

The deal strengthens Eni’s financial position, with Eni retaining

control of Enilive. The transaction includes a capital increase and

share sale. Shares rose 1.1% in pre-market trading, after closing

down 1.2% on Wednesday.

McDonald’s (NYSE:MCD) – As previously reported,

McDonald’s is facing an E. coli outbreak linked to Quarter Pounder

hamburgers, resulting in one death and dozens of illnesses. In the

latest update, McDonald’s U.S. head Joe Erlinger pledged to restore

consumer confidence following the outbreak, and the company

promptly removed the item from menus in several U.S. states.

Investigations are ongoing, focusing on the beef and onions. The

CDC expects more cases but praised McDonald’s for its swift action

to prevent further outbreaks and minimize harm. Shares rose 0.6% in

pre-market trading, after closing down 5.1% on Wednesday.

Peloton (NASDAQ:PTON) – David Einhorn of

Greenlight Capital stated that Peloton stock was undervalued during

the Robin Hood Investors Conference. Peloton announced a

partnership with Costco to sell its Bike+, targeting younger and

wealthier consumers. The company is also searching for a new CEO

following Barry McCarthy’s resignation, focusing now on

profitability. Shares rose 1.1% in pre-market trading, after

closing up 11.0% on Wednesday.

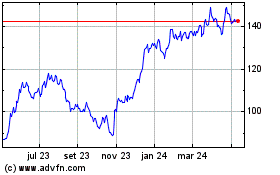

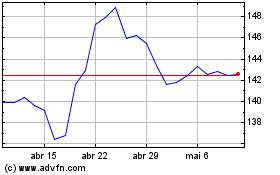

Capital One Financial (NYSE:COF)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Capital One Financial (NYSE:COF)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024