U.S. Stocks May See Further Downside In Early Trading

25 Julho 2024 - 10:05AM

IH Market News

The major U.S. index futures are currently pointing to a

modestly lower open on Thursday, with stocks likely to see further

downside following the sell-off seen in the previous session.

After ending Tuesday’s choppy trading session modestly lower,

stocks showed a more substantial move to the downside during

trading on Wednesday. The tech-heavy Nasdaq showed a particularly

steep drop on the day, tumbling to its lowest closing level in over

a month.

The major averages saw further downside late in the session,

closing near their worst levels of the day. The Nasdaq plunged

654.94 points or 3.6 percent to 17,342.41, the S&P 500 dove

128.61 points or 2.3 percent to 5,427.13 and the Dow slumped 504.22

points or 1.3 percent to 39,853.87.

The sell-off on Wall Street came amid a negative reaction to

corporate earnings news from companies like Tesla (NASDAQ:TSLA) and

Alphabet (NASDAQ:GOOGL).

Shares of Tesla plummeted by 12.3 percent after the electric

vehicle maker reported weaker than expected second quarter

earnings.

Google parent Alphabet also plunged 5.0 percent after reporting

second quarter earnings that beat analyst estimates but missing

expectations for YouTube advertising revenue.

Shares of Meta Platforms (NASDAQ:META) also tumbled by 5.6

percent after the Facebook parent announced a free version of its

Llama artificial intelligence model.

On the other hand, telecom giant AT&T (NYSE:T) jumped by 5.2

percent after reporting second quarter earnings in line with

estimates and stronger than expected phone subscriber growth.

In U.S. economic news, the Commerce Department released a report

unexpectedly showing a continued decrease by new home sales in the

U.S. in the month of June.

The report said new home sales fell by 0.6 percent to an annual

rate of 617,000 in June after plummeting by 14.9 percent to a

revised rate of 621,000 in May.

Economists had expected new home sales to surge by 3.4 percent

to a rate of 640,000 from the 619,000 originally reported for the

previous month.

With the unexpected decline, new home sales slumped to their

lowest level since hitting an annual rate of 611,000 in November

2023.

Semiconductor stocks showed a substantial move to the downside

on the day, with the Philadelphia Semiconductor Index plunging by

5.4 percent to its lowest closing level in two months.

Software, networking and computer hardware stocks also saw

significant weakness, contributing to the steep drop by the

Nasdaq.

Considerable weakness was also visible among airline stocks, as

reflected by the 3.4 percent nosedive by the NYSE Arca Airline

Index.

Housing, oil service and retail stocks also showed notable moves

to the downside, while utility stocks bucked the downtrend, driving

the Dow Jones Utility Average up by 1.7 percent.

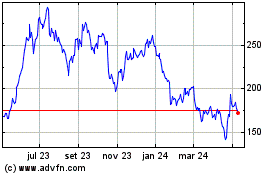

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

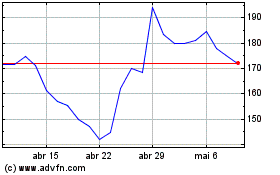

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025