U.S. Index Futures Point to Higher Open, Oil Prices Down

26 Julho 2024 - 7:08AM

IH Market News

U.S. index futures point to a higher open in pre-market trading

on Friday, with investors preparing for the Federal Reserve’s

preferred inflation report. Despite pre-market optimism, the week

promises to be negative, with the S&P 500 and Nasdaq facing

sharp losses due to sell-offs in big tech and a shift to smaller

companies and cyclical sectors. Along with the personal consumption

expenditures report, traders await quarterly results from major

companies including Bristol Myers Squibb, 3M, and

Colgate-Palmolive.

At 5:12 AM, Dow Jones futures (DOWI:DJI) rose 197 points, or

0.48%. S&P 500 futures gained 0.79%, and Nasdaq-100 futures

advanced 1.06%. The 10-year Treasury yield stood at 4.244%.

In the commodities market, oil prices are down for the third

consecutive week due to weak demand in China and hopes of a

ceasefire in the Middle East. West Texas Intermediate crude for

September fell 0.37% to $77.99 per barrel. Brent crude for

September fell 0.33% to near $82.10 per barrel.

On Friday’s economic calendar, the PCE index, which measures

individual spending, and June’s personal income and spending data

will be released at 8:30 AM by the Commerce Department. At 10 AM,

the revised reading of the Michigan/Reuters consumer sentiment

index for July will be published by the University of Michigan and

Thomson Reuters.

Asia-Pacific markets recovered on Friday. China’s Shanghai

Composite rose 0.14%, Hong Kong’s Hang Seng rose 0.1%, Australia’s

S&P/ASX 200 advanced 0.76%, and South Korea’s Kospi grew 0.78%.

Conversely, the Taiwan Weighted Index fell 3.29% after being closed

for two days due to a typhoon, with Hon Hai and

TSMC falling 4.71% and 5.62%, respectively.

Japan’s Nikkei 225 fell 0.53%, continuing its losing streak, with

sharp declines in Renesas Electronics and

automakers.

In July, Tokyo’s core inflation slightly fell to 2.2%, while the

core inflation dropped to 1.5%. The yen strengthened to 153.9

against the dollar. Singapore maintained its monetary policy

stable, controlling the Singapore dollar through exchange rate

settings.

European markets are higher, with the automotive sector falling

in reaction to Mercedes Benz’s (TG:A3LJT7) reduced profit forecast

and a 48% decline in Stellantis’s (BIT:STLAM) first-half net

profit.

In France, ahead of the Paris Olympic Games, train services were

affected by arson and vandalism on the high-speed rail network.

SNCF reported that trains were canceled and rerouted, also

impacting Eurostar and international services, while an

investigation is ongoing.

U.S. stocks faced heavy selling in the last hour of Thursday’s

session due to concerns about big tech earnings. The Dow Jones rose

0.20%, while the S&P 500 and Nasdaq fell, closing down 0.51%

and 0.93%, respectively. Positive U.S. GDP data, which grew 2.8%

versus estimates of a 2% increase in the second quarter, initially

boosted stocks but failed to sustain gains throughout the day.

In Friday’s pre-market earnings, Bristol Myers

Squibb (NYSE:BMY), 3M (NYSE:MMM), Colgate-Palmolive (NYSE:CL), Charter

Communications (NASDAQ:CHTR), Bozz Allen

Hamilton (NYSE:BAH), Saia (NASDAQ:SAIA), Centene

Corporation (NYSE:CNC), First Hawaiian

Bank (NASDAQ:FHB), Gentex

Corporation (NASDAQ:GNTX), Portland

General Electric (NYSE:POR), T.Rowe

Price (NASDAQ:TROW), and more will report.

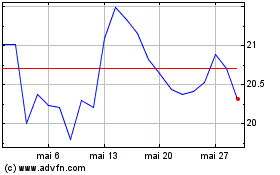

Stellantis NV (BIT:STLAM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Stellantis NV (BIT:STLAM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025