U.S. Index Futures Climb Pre-Market as Tech Earnings, Fed Meeting Loom

29 Julho 2024 - 7:25AM

IH Market News

U.S. index futures point to a higher open in pre-market trading

on Monday. This week will feature quarterly results from tech

giants including Microsoft (NASDAQ:MSFT),

Meta (NASDAQ:META), Apple

(NASDAQ:AAPL), and Amazon (NASDAQ:AMZN), along

with the anticipated Federal Reserve meeting on Wednesday.

Economists indicate a 96% chance that the central bank will keep

interest rates unchanged at this meeting, according to the CME Fed

Watch tool.

At 05:37 AM, Dow Jones futures (DOWI:DJI) rose 98 points, or

0.24%. S&P 500 futures gained 0.26%, and Nasdaq-100 futures

advanced 0.43%. The 10-year Treasury yield stood at 4.166%.

In the commodities market, West Texas Intermediate crude for

September fell 0.31% to $76.92 per barrel. Brent crude for

September fell 0.27% to $80.91 per barrel.

Asia-Pacific markets advanced. Japan’s Nikkei 225 rose 2.13%,

ending an eight-day losing streak. The Japanese yen appreciated

0.31% against the dollar, trading at 153.26. Mitsubishi

Motors gained over 5% after joining the Honda-Nissan

alliance, while Eisai shares fell 13% due to the

rejection of its Alzheimer’s treatment.

Hong Kong’s Hang Seng advanced 1.28%, while South Korea’s Kospi

and Kosdaq increased 1.23% and 1.31%, respectively. The S&P/ASX

200 gained 0.86%. The Shanghai Composite rose 0.03%, pressured by

real estate stocks.

In Asia’s economic agenda, notable events include the Bank of

Japan’s monetary policy meeting, which could result in a 10 to 15

basis points increase in interest rates. Additionally, China’s July

PMI and Australia’s latest inflation data will be released ahead of

the Australian central bank’s policy meeting on August 6.

European markets show mixed variations, with the FTSE 100 and

DAX rising, while the CAC 40 fell. The utilities sector performed

well, while the household goods sector declined. Among individual

stocks, Philips (EU:PHIA) shares rose 11.2% after

strong earnings, while Heineken (EU:HEIA) fell

7.3% due to disappointing results. Reckitt

Benckiser (LSE:RKT) shares fell 9.3% following a $500

million verdict against Abbott (LSE:0Q15) related

to infant formula. As the earnings season progresses in Europe,

investors are monitoring Federal Reserve and Bank of England

meetings for indications on future interest rate adjustments.

U.S. stocks rose sharply on Friday, with the Nasdaq and S&P

500 rebounding from their lowest levels in over a month. The Dow

Jones rose 1.64%, the S&P 500 advanced 1.11%, and the Nasdaq

increased 1.03%. The strength came from inflation data boosting

confidence about the Federal Reserve’s interest rate decision in

September.

The personal consumption expenditures (PCE) price index rose

0.1% in June, as expected. The annual growth rate slowed to 2.5%

from 2.6%. The core PCE rose 0.2%, with the annual rate steady at

2.6%. Personal income increased 0.3% while personal spending rose

0.4%, both in line with estimates.

In Monday’s quarterly earnings reports before the market opens,

McDonald’s (NYSE:MCD), On

semiconductor (NASDAQ:ON), Philips (NYSE:PHG), Bank

of Marin (NASDAQ:BMRC), Hope

Bancorp (NASDAQ:HOPE), Affiliated

Managers Group (NYSE:AMG), CNA Financial

Corporation (NYSE:CNA), Oil States

International (NYSE:OIS), Provident

Financial

Holdings (NASDAQ:PROV), Civista

Bancshares (NASDAQ:CIVB), and more will report.

After the market closes, results from Tilray

Brands (NASDAQ:TLRY), Sprouts Farmers

Market (NASDAQ:SFM), Symbotic (NASDAQ:SYM), F5 (NASDAQ:FFIV), Lattice

Semiconductor (NASDAQ:LSCC), Chesepeake

Energy (NASDAQ:CHK), Element

Solutions (NYSE:ESI), Rambus (NASDAQ:RMBS), SBA

Communications

Corporation (NASDAQ:SBAC), Beyond

Inc (NYSE:BYON), and others are expected.

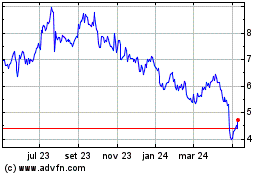

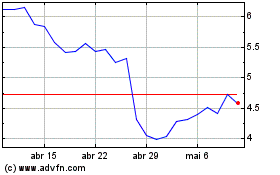

Oil States (NYSE:OIS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Oil States (NYSE:OIS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024