SunPower (NASDAQ:SPWR) – SunPower filed for

Chapter 11 bankruptcy in the US and sold part of its business to

Complete Solaria for $45 million. Complete Solaria will acquire

Blue Raven Solar, New Homes segments, and SunPower’s non-installing

dealer network. The company listed its assets and liabilities

between $1 billion and $10 billion and will continue selling

remaining assets, planning to liquidate operations after the sale.

SunPower also announced a workforce reduction of about 1,000

employees and the closure of its residential installation sites and

direct sales locations. Shares fell 25.9% pre-market.

Alphabet (NASDAQ:GOOGL) – Judge Amit Mehta

ruled that Google violated antitrust laws by spending billions on

exclusive deals to maintain a monopoly in the search market,

dominating 90% of the sector. He stated that Google acts as a

monopoly, hindering true competition and limiting innovation

incentives, maintaining its market dominance. The ruling could lead

to Alphabet’s breakup and marks a major victory for antitrust

authorities. Alphabet plans to appeal, and the legal battle may

last until 2026. Shares rose 0.9% pre-market.

Apple (NASDAQ:AAPL) – Google’s recent antitrust

defeat could impact Apple, which receives about $20 billion

annually from the search giant. The court deemed Google’s payment

to be the default search engine illegal. This threatens Apple’s

revenue stream, as it shifts from traditional searches to investing

in AI, like Apple Intelligence, potentially changing user-device

interaction. Apple may still maintain deals with AI providers, but

significant financial results will take time. Shares rose 0.5%

pre-market.

Meta Platforms (NASDAQ:META) – Meta apologized

for removing posts by Malaysia’s Prime Minister Anwar Ibrahim

honoring a deceased Hamas leader. The posts were restored, and a

live broadcast interruption was fixed. The Malaysian government

criticized the removal as discriminatory and a violation of free

speech. Shares rose 1.1% pre-market.

OpenAI – Elon Musk reopened a lawsuit against

OpenAI and its CEO Sam Altman, alleging the company prioritizes

profits over public good. Musk, who left OpenAI in 2018, argues the

partnership with Microsoft for AI technology violates OpenAI’s

original agreement. The lawsuit seeks to invalidate OpenAI’s

license with Microsoft and questions OpenAI’s transformation into a

for-profit entity.

Tesla (NASDAQ:TSLA) – The National Highway

Traffic Safety Administration is investigating a fatal crash

involving a Tesla Cybertruck in Texas. Tesla began delivering the

Cybertruck in November 2023 and has issued four recalls for the

2024 model. X, formerly Twitter, will close its San Francisco

office and relocate employees to San Jose and Palo Alto. The

decision ends the company’s presence in the city since 2006,

reflecting Elon Musk’s criticism of local culture and market

conditions. The move follows Musk’s plan to transfer headquarters

to Texas. Additionally, Secretaries of State from five US states

asked Musk to correct X’s chatbot Grok after it spread false

information about the November elections. Concerns about

misinformation misleading voters, especially in an election year,

were raised. Tesla shares rose 3% pre-market.

Toyota Motor (NYSE:TM) – Honda and Nissan are

developing vehicle software, and an academic suggests Toyota join

them to better compete with global rivals. Japan aims to dominate

30% of the software-defined vehicle market by 2030. Collaboration

among automakers could help achieve this goal and face competitors.

Toyota shares rose 2.1% pre-market.

Xpeng (NYSE:XPEV) – Xpeng Aeroht, a division of

Xpeng, raised $150 million to develop a flying car in Guangzhou.

The “Land Carrier” is a six-wheel ground vehicle that carries a

two-seat electric aircraft, which takes off and lands vertically.

Pre-sales will begin at the end of 2024. Shares rose 0.8%

pre-market.

Boeing (NYSE:BA), Spirit

AeroSystems (NYSE:SPR) – Executives from Boeing and Spirit

AeroSystems will testify at an NTSB hearing about the mid-air

explosion of an Alaska Airlines Boeing 737 MAX 9. The hearing,

analyzing the plane’s manufacturing and inspection, will start

today and last two days, investigating safety failures like missing

fasteners. Boeing faced fines and production restrictions related

to previous incidents.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management revealed a 7% stake in Southwest Airlines,

composed of shares and derivatives. The fund seeks to reshape the

airline’s management and board, pushing for executive replacement

and proposing new directors. Southwest responded with a defense

plan against acquisitions.

Nvidia (NASDAQ:NVDA) – Analysts downplay the

impact of potential three-month delays in Nvidia’s Blackwell chips,

which could affect clients like Meta and Google. Despite this, AI

chip demand remains high, and Nvidia should offset with sales of

older chips, maintaining its market dominance. CEO Jensen Huang

sold $322.7 million in shares in July and nearly $500 million since

the AI-driven stock peak. Although sales were under a trading plan,

the timing coincided with a 14% stock drop. The crisis affected

markets globally, reducing fortunes, including Huang’s, who fell to

16th on the billionaire list. Shares rose 2.6% pre-market.

Intel (NASDAQ:INTC), ASML Holding

NV (NASDAQ:ASML) – Intel is receiving its second “High NA”

EUV tool from ASML, valued at 350 million euros. These machines are

crucial for manufacturing advanced chips. Intel plans to use the

technology by 2027, while other chipmakers should start using it

between 2025 and 2026. Intel and ASML shares each rose 1.6%

pre-market.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – Morgan Stanley considers TSMC a good choice despite

Monday’s record stock drop. They highlight TSMC’s quality and

defensive nature in downturn cycles. The price target is 50% higher

than the recent close. The stock, valued at 16 times projected 2025

earnings, rose 7.1% in Taiwan on Tuesday. The benchmark gained up

to 4.1% after the biggest fall in 57 years on Monday. New

York-listed shares rose 1.1% pre-market.

Broadcom (NASDAQ:AVGO), Arm

Holdings (NASDAQ:ARM), Intel

(NASDAQ:INTC), Nvidia (NASDAQ:NVDA), Super

Micro Computer (NASDAQ:SMCI) – Some semiconductor and AI

stocks that fell during Monday’s session recovered in pre-market

trading. Broadcom rose 1.9%, Arm rose 2.4%, and Super Micro

Computer rose 1.3%.

CrowdStrike (NASDAQ:CRWD) – CrowdStrike is

being sued by airline passengers due to a global computer outage

caused by a software update failure. The class action lawsuit,

filed in Austin, Texas, accuses the company of negligence and seeks

compensation for those affected by flight delays and cancellations.

Shares rose 3.5% pre-market.

Dell Technologies (NYSE:DELL) – Dell is cutting

jobs and restructuring its sales teams, including a new group

focused on artificial intelligence. The company is streamlining

management and prioritizing AI and high-power server investments.

Despite a 34% stock rise this year, Dell faces challenges with the

PC market and a major job reduction of 13,000 in 2023. Shares rose

1.2% pre-market.

Logitech International (NASDAQ:LOGI) – Logitech

co-founder Daniel Borel urged shareholders to choose a new board

chairman this year, replacing Wendy Becker, who will not seek

re-election in 2025. Borel suggested Guy Gecht as a replacement,

criticizing Becker for not addressing urgent company challenges.

The next general meeting is scheduled for September 4.

Banks – In the second quarter, demand for

commercial and industrial loans in the US remained stable, marking

the first time in two years it did not fall. The Federal Reserve

survey revealed that while credit standards remain tight, demand

for consumer loans and credit cards is improving.

Charles Schwab (NYSE:SCHW) – Charles Schwab and

Fidelity Investments resolved technical issues with their apps

faced by users trying to trade during Monday’s sharp market drop

due to recession fears. The failures, affecting account access,

caused panic and criticism, leading the SEC to monitor the

situation. Shares rose 1.9% pre-market.

JPMorgan Chase (NYSE:JPM) – According to

JPMorgan Chase, the carry trade reversal may continue as the yen

remains undervalued. Arindam Sandilya stated the reversal is

between 50% and 60% complete. The carry trade, involving cheap

loans in Japan to invest in higher-yield assets, was affected by

yen volatility and US recession fears. In other news, investors are

uncertain about who will replace Jamie Dimon as JPMorgan Chase CEO.

Meanwhile, co-CEOs Jennifer Piepszak and Troy Rohrbaugh are focused

on expanding the market and developing future leaders, highlighting

the intense competition in the sector and record growth in

investment banking revenues.

Morgan Stanley (NYSE:MS) – Morgan Stanley

revealed that the SEC is investigating account balance transfers to

affiliate bank deposit programs, in compliance with the Investment

Advisers Act of 1940. The company also announced a conditional

settlement for a 2017 dispute over OW Bunker’s IPO.

Citigroup (NYSE:C) – Citigroup hired Yeo

Wenxian as head of wealth for South Asia and CEO of Citibank

Singapore Ltd. She joins the bank on November 1 from DBS, where she

worked for 13 years. CEO Jane Fraser seeks to expand and improve

performance in wealth management. Shares rose 0.8% pre-market.

Novartis (NYSE:NVS), Viatris

(NASDAQ:VTRS) – Henrietta Lacks’ family sued Novartis and Viatris,

alleging the companies profited from “HeLa” cells used to develop

drugs without permission or compensation. The cells, taken without

her knowledge in 1951, were crucial for medical research. The

family seeks compensation and an order to stop future use of these

cells. Novartis shares fell 1.1% pre-market, while Viatris shares

fell 1.6%.

Eli Lilly (NYSE:LLY), Novo

Nordisk (NYSE:NVO) – Eli Lilly, with its drug Zepbound, is

gaining market share in the US against Novo Nordisk’s Wegovy.

Although Zepbound shows a slight weight loss advantage, shortages

of both drugs force doctors to prescribe what’s available. Lilly

has captured about 40% of the market since December, while Novo

faces similar supply challenges. Eli Lilly shares rose 0.9%

pre-market, while Novo shares rose 2.1%.

Archer-Daniels-Midland (NYSE:ADM),

Bunge Global SA (NYSE:BG) – With increasing

liquidation crop sales, companies like Archer-Daniels-Midland and

Bunge should benefit from lower soybean and corn prices. Farmers

are emptying silos due to low prices, helping processors better

utilize capacity and improve profit margins.

Cemex (NYSE:CX) – Cemex announced the sale of

its operations in the Dominican Republic to Cementos Progreso and

partners for about $950 million. The transaction includes a cement

plant, as well as export businesses to Haiti, and is expected to

close in Q4 2024.

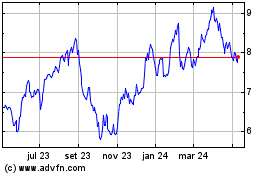

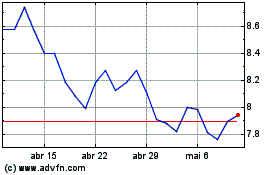

Cemex SaB De Cv (NYSE:CX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Cemex SaB De Cv (NYSE:CX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025