US Index Futures Rise Amid Earnings Season Optimism, Oil Prices Rebound

07 Agosto 2024 - 6:49AM

IH Market News

US index futures rose in pre-market trading on Wednesday

following a recovery that ended a three-day losing streak. Analysts

question the sustainability of this rebound, predicting continued

volatility but highlighting opportunities in the earnings season,

with major reports from companies like Disney and CVS Health on the

horizon.

At 4:42 AM, Dow Jones futures (DOWI:DJI) rose 221 points or

0.56%. S&P 500 futures gained 0.80%, and Nasdaq-100 futures

advanced 0.94%. The 10-year Treasury yield stood at 3.929%.

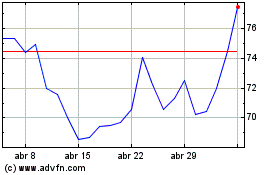

In the commodities market, oil prices recovered due to rising

tensions in the Middle East, though weak demand limited gains. West

Texas Intermediate crude for September rose 0.33% to $73.44 per

barrel. Brent crude for October rose 0.27% to near $76.69 per

barrel.

In the US economic calendar for Wednesday, the June consumer

credit report will be released at 2 PM ET. The market projects an

increase of $9.7 billion in consumer credit, representing a

slowdown from the $11.3 billion increase seen the previous

month.

Asia-Pacific markets extended their gains on Wednesday. The

Nikkei 225 rose 1.19%, closing at 35,089.62. Hong Kong’s Hang Seng

grew 1.3% to 16,866.51, and China’s Shanghai Composite rose 0.09%.

South Korea’s Kospi rose 1.83% to 2,568.41, led by

Samsung (KOSPI:005930), which saw its shares rise

3.03% after positive news about its HBM3E chips. Australia’s

S&P/ASX 200 increased 0.25%, closing at 7,699.8.

Bank of Japan Deputy Governor Shinichi Uchida assured that the

bank would not raise interest rates while markets are unstable. His

comments calmed reactions and strengthened the yen, emphasizing the

need for caution and continuous monitoring.

In July, Japan reduced its holdings of foreign bonds by about

$17 billion, suggesting the government may have sold these bonds to

fund currency intervention. The country spent ¥5.5 trillion ($38.1

billion) to support the yen.

In China, July export growth slowed to 7%, below the 9.7%

expected, due to tariffs and weak external demand. Imports

increased by 7.2%, driven by anticipation of US chip restrictions.

Analysts foresee more pressure on Chinese factories in the coming

months.

Goldman Sachs (NYSE:GS) analysts predict that

China’s production surplus will decrease in the coming years,

except for electric vehicles and steel. Sectors like lithium

batteries and solar modules may adjust production, but the surplus

for EVs and steel is expected to persist until 2028.

European markets are up, driven by the global recovery after

Monday’s fall. The banking and healthcare sectors show divergences,

with banks rising while healthcare falls. However,

Puma (TG:PUM) and Novo Nordisk

(TG:NOV) shares fell -13.7% and 4.3%, respectively, due to

disappointing financial results and forecast revisions.

In Germany, industrial production grew by 1.4% in June,

surpassing the 1% estimate, driven by cars and electrical

equipment. However, exports fell 3.4%, and other economic

indicators were disappointing. The Bundesbank expects slow

improvement in industrial activity and slightly better economic

growth in the third quarter. The UK’s Halifax House Price Index

data is awaited.

On Tuesday, US stocks closed higher, recovering from three days

of losses, with investors buying at reduced prices and reacting

positively to corporate earnings news. The Dow Jones rose 0.76%,

the S&P 500 advanced 1.04%, and the Nasdaq grew 1.03%. The

Commerce Department reported a reduction in the June trade deficit

to $73.1 billion, while the Atlanta Fed raised its GDP growth

projection to 2.9%. Uber (NYSE:UBER) shares soared

11%, and Caterpillar (NYSE:CAT) shares rose

3%.

For Wednesday’s quarterly reports before market open,

Walt Disney (NYSE:DIS), Emerson

Electric (NYSE:EMR), Sony Group

Corporation (NYSE:SONY), Lyft (NASDAQ:LYFT), Shopify (NYSE:SHOP), Novo

Nordisk (NYSE:NVO), CVS

Health (NYSE:CVS), Global

Payments (NYSE:GPN), Aurora

Cannabis (NASDAQ:ACB), Icahn Enterprises

L.P. (NASDAQ:IEP), MannKind (NASDAQ:MNKD), Oscar

Health (NYSE:OSCR), Dynatrace (NYSE:DT), DNOW (NYSE:DNOW), ACM

Research (NASDAQ:ACMR), ODP

Corporation (NASDAQ:ODP), Brink’s

Company (NYSE:BCO), and more will report.

After the market closes, numbers are expected from

Sarepta

Therapeutics (NASDAQ:SRPT), HubSpot (NYSE:HUBS), Occidental

Petroleum (NYSE:OXY), Robinhood

Markets (NASDAQ:HOOD), Fastly (NYSE:FSLY), SolarEdge

Technologies (NASDAQ:SEDG), Magnite (NASDAQ:MGNI),

AppLovin (NASDAQ:APP), Digital

Turbine (NASDAQ:APPS), Energy Transfer

LP (NYSE:ET), Dutch

Bros (NYSE:BROS), Aspen

Aerogels (NYSE:ASPN), Coeur D’Alene

Mines Corp. (NYSE:CDE), among others.

Shopify (NYSE:SHOP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Shopify (NYSE:SHOP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024