U.S. stock index futures are little changed in pre-market

trading on Wednesday after a strong recovery in stocks on Tuesday.

The indices surpassed the levels seen on August 2, prior to the

global sell-off on August 5. The rapid recovery has prompted

caution among analysts, and today’s CPI report could influence the

market, while concerns about weakening labor markets persist.

As of 05:17 AM ET, Dow Jones futures (DOWI:DJI) rose 46 points

or 0.12%. S&P 500 futures are nearly flat, and Nasdaq-100

futures declined 0.12%. The 10-year Treasury yield stood at

3.85%.

In the commodities market, oil prices edged higher due to a drop

in U.S. crude and gasoline inventories and tension in the Middle

East. The escalating conflict between Israel and Gaza and a

potential response from Iran to the assassination of a Hamas

official are generating uncertainty about global oil supply.

West Texas Intermediate crude for September rose 0.65% to $78.87

per barrel, while Brent for October climbed 0.64% to $81.21 per

barrel.

The U.S. economic calendar for Wednesday includes the release of

the July Consumer Price Index (CPI), expected to rise 0.2%, in

contrast to the 0.1% decline in the previous period. The annual CPI

is expected to remain stable at 3.0%. The July Core CPI is also

expected to rise by 0.2%, slightly above the previous 0.1%, while

the annual Core CPI is expected to decrease from 3.3% to 3.2%.

Asia-Pacific markets closed mixed on Wednesday. The Reserve Bank

of New Zealand cut its interest rate for the first time since March

2020, lowering it to 5.25%, surprising the market and weakening the

New Zealand dollar. The decision, motivated by inflation nearing

its target, signals possible further cuts.

Japan’s Nikkei 225 rose 0.58%, ending at 36,442.43, and the

Topix advanced 1.11% to 2,581.9, both posting gains for the third

consecutive day.

In August, Japanese manufacturers were less confident, with the

sentiment index dropping to +10, impacted by weak demand from China

and the recent interest rate hike by the Bank of Japan. On the

other hand, the service sector saw a slight improvement in

sentiment, reaching +24.

Japanese Prime Minister Fumio Kishida will not seek a second

term, allowing for a new contest for the leadership of the Liberal

Democratic Party. With the LDP dominating parliament, the new

leader will likely become the next prime minister. Kishida cited

frustrations with scandals and economic management as reasons for

his decision.

In South Korea, the Kospi rose 0.88% to 2,644.5, and the Kosdaq

gained 1.56%, closing at 776.83, with the country’s July

unemployment rate falling to 2.5%, the lowest level since October

2023.

Australia saw a modest 0.31% increase in the S&P/ASX 200,

which ended at 7,850.7, while ASX faces legal action for misleading

statements about its CHESS clearing system.

In contrast, Hong Kong’s Hang Seng fell 0.55% near the

close.

Mainland China’s CSI 300 dropped 0.75%, hitting a nearly

seven-month low of 3,309.24. In July, weak economic indicators in

China lowered expectations for 2024 growth, signaling the need for

more stimulus. New bank loans fell, exports slowed, and factory

activity declined. The post-pandemic recovery has not materialized

as expected, and growth may fall short of the 5% target.

European markets are up, driven by cautiously optimistic

sentiment following recent inflation prints from the U.S. and the

UK. In the UK, inflation rose 2.2% in July, below expectations, and

services inflation fell to its lowest level in two years. This

relief could lead the Bank of England to consider a rate cut in

November, though inflation remains a concern.

Additionally, investors are evaluating earnings from major

companies as well as inflation data from France. AstraZeneca

(LSE:AZN) surpassed £200 billion in market value for the first

time, driven by advances in cancer medications, highlighting it as

the most valuable listed company in the UK.

On Tuesday, U.S. stocks closed higher, driven by expectations

that the Federal Reserve might lower interest rates at its next

meeting after the release of lower-than-expected producer price

data. The Dow Jones rose 1.04%, the S&P 500 advanced 1.68%, and

the Nasdaq gained 2.43%, ending the day near session highs.

The U.S. Department of Labor report showed that the Producer

Price Index (PPI) rose 0.1% in July, in line with economists’

expectations, after a 0.2% increase in June. The annual growth rate

slowed to 2.2%.

On the earnings front, UBS

Group (NYSE:UBS), (BOV:UBSG34), Brinker

International (NYSE:EAT), Cardinal

Health (NYSE:CAH), (BOV:C1AH34), CAE

Inc. (NYSE:CAE), Dole Food

Company (NYSE:DOLE), PFGC (Performance

Food Group Company) (NYSE:PFGC), Arcos

Dorados (NYSE:ARCO), Public

Square (NYSE:PSQH), MediWound (NASDAQ:MDWD), uCloudlink (NASDAQ:UCL),

and others will report before the market opens.

After the close, numbers are expected from Cisco

Systems (NASDAQ:CSCO), (BOV:CSCO34), AST

SpaceMobile (NASDAQ:ASTS), dLocal (NASDAQ:DLO), Arcutis

Biotherapeutics (NASDAQ:ARQT), StoneCo (NASDAQ:STNE),

(BOV:STOC31), Canoo

Inc (NASDAQ:GOEV), Geopark (NYSE:GPRK),

(BOV:GPRK34), Dragonfly

Energy (NASDAQ:DFLI), Longeveron (NASDAQ:LGVN), Lulus (NASDAQ:LVLU),

and more.

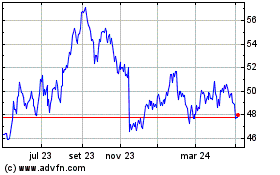

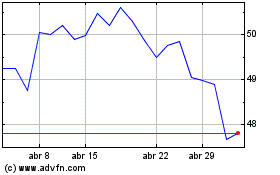

Cisco Systems (BOV:CSCO34)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Cisco Systems (BOV:CSCO34)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024