Alphabet (NASDAQ:GOOGL) – A U.S. judge plans to

force Google to allow Android users to download apps from sources

other than the Play Store after a favorable antitrust ruling for

Epic Games. The decision will be clear but won’t detail daily

management. Google argues this will harm security and competition.

Shares fell 2.3% pre-market.

Apple (NASDAQ:AAPL) – Apple is developing an

innovative home device that combines a large screen with a robotic

arm, seeking new revenue sources. The product, codenamed J595, can

rotate 360 degrees and tilt, functioning as a command center and

videoconferencing hub. Expected to launch between 2026 and 2027, it

could be priced around $1,000. Additionally, Apple will allow banks

and services to use the iPhone’s payment chip starting from iOS

18.1, enabling transactions with third-party apps. This includes

in-store payments, transit fares, and ID cards. The change responds

to regulatory pressures and may impact Apple Pay’s revenue. Shares

rose 0.2% pre-market.

Spotify (NYSE:SPOT) – Spotify will update its

app for Apple devices in the European Union, including plan prices,

after Apple rejected the initial request. Spotify will accept

Apple’s music streaming terms but won’t include external links for

payments, avoiding commissions. The change follows an EU fine

against Apple. Spotify shares fell 0.1% pre-market.

MercadoLibre (NYSE:MELI) – Marcos Galperin,

co-founder and CEO of MercadoLibre, sold 100,000 shares, raising

about $188.4 million following a strong quarterly report. His stake

remains around 7% in the company. MercadoLibre, now the most

valuable company in Latin America, saw its shares rise nearly 50%

in the last year. Shares fell 0.9% pre-market.

Victoria’s Secret (NYSE:VSCO) – Victoria’s

Secret is hiring Hillary Super, former CEO of Savage X Fenty, to

lead the company’s recovery. Super will replace Martin Waters, who

was recently fired. The company faces ongoing challenges with

competition and declining demand. Shares rose 16.4% pre-market.

Kellanova (NYSE:K) – Mars, the maker of

M&M’s, is buying Kellanova for nearly $36 billion, bringing

brands like M&M’s and Pringles under its portfolio. Mars plans

to absorb costs and invest in healthy products, avoiding price

increases for consumers, and Kellanova will be integrated into

Mars’ snacks division by 2025. In McLean, Virginia, the joke is

that the real secret organization isn’t the CIA but Mars Inc.,

according to Reuters. Mars, one of the wealthiest families in the

U.S., is known for its privacy and large acquisitions. Kellanova

shares rose 7.8% pre-market.

Intel (NASDAQ:INTC), Taiwan

Semiconductor Manufacturing Co (NYSE:TSM) – SoftBank

withdrew from a partnership with Intel to develop an AI chip,

citing Intel’s inability to meet volume and speed demands. SoftBank

is now focusing on negotiating with TSMC. Intel shares fell 2.7%

pre-market, while TSMC shares fell 1.4%.

Dell Technologies (NYSE:DELL) – The Delaware

Supreme Court ruled that five law firms are to receive $267 million

in fees for a $1 billion settlement for Dell Technologies

shareholders. This fee is one of the largest ever paid in

shareholder litigation in the U.S. and has sparked debates about

the appropriateness of the amount. Shares rose 3% pre-market.

T-Mobile (NASDAQ:TMUS) – The U.S. Committee on

Foreign Investment (CFIUS) fined T-Mobile $60 million for failing

to protect and adequately report unauthorized access to sensitive

data. The fine, the largest ever imposed by the committee, resulted

from violations of an agreement made during T-Mobile’s acquisition

of Sprint. Shares rose 0.6% pre-market.

Booking Holdings (NASDAQ:BKNG), Expedia

Group (NASDAQ:EXPE), Airbnb (NASDAQ:ABNB)

– Short-term rental companies like Booking Holdings, Expedia Group,

and VRBO are ramping up efforts to influence lawmakers and avoid

restrictions on short-term rentals. With slowing growth in several

major North American cities, these companies have increased their

lobbying spending, with Expedia investing $380,000 and Booking

Holdings $570,000 in the first half of 2024. While Airbnb has

reduced its lobbying spending, it continues to monitor regulations

affecting the market. Booking shares rose 0.1% pre-market, while

Expedia and Airbnb shares fell 1.2% and 0.6%, respectively.

Squarespace (NYSE:SQSP) – A Squarespace

shareholder criticized the $6.9 billion acquisition by Permira,

claiming the $44 per share price undervalues the company. Glazer

Capital, which owns 5.4% of the shares, argues that omitted

analyses indicate a true value of $49.30 per share. The shareholder

opposes the sale. Shares rose 0.7% pre-market.

Social Media – A study by the Stanford

Deliberative Democracy Lab shows that most American teenagers

reject restrictions on social media platforms despite acknowledging

potential mental health harms. Over 60% of new voters oppose

requiring parental consent for minors under 16, and 85% do not want

time limits on notifications.

Playtech Plc (LSE:PTEC), Flutter

Entertainment (NYSE:FLUT) – Playtech Plc shares surged on

Wednesday after confirming exclusive talks with Flutter

Entertainment to sell its Italian unit Snaitech for about $2.6

billion (£2 billion). Flutter aims to expand its global presence

through acquisitions, including the purchase of Sisal and Tombola.

Flutter shares rose 8.1% pre-market.

Starbucks (NASDAQ:SBUX) – Starbucks’ new CEO,

Brian Niccol, could earn up to $98 million in stock and annual

awards, plus a base salary of $1.6 million and a $10 million bonus.

According to Bloomberg, Niccol won’t need to relocate to Seattle,

instead working remotely from Newport Beach, California, where

Starbucks will pay for an office. Niccol will commute to Seattle as

needed. Shares fell 2.1% pre-market.

Shake Shack (NYSE:SHAK), Serve

Robotics (NASDAQ:SERV), Uber Technologies

(NYSE:UBER) – Shake Shack and Serve Robotics partnered to deliver

orders made on Uber Eats using autonomous robots in Los Angeles.

Serve aims to expand its robot fleet by 2025, and the partnership

will help Uber explore more U.S. regions. Shake Shack shares rose

0.7% pre-market, while Serve Robotics and Uber shares rose 9.6% and

1.2%, respectively.

Alaska Air Group (NYSE:ALK), Hawaiian

Holdings (NASDAQ:HA) – Alaska Air postponed the DOJ’s

review of its $1.9 billion acquisition proposal of Hawaiian

Holdings by one day. The extension runs until August 16. The deal,

aimed at increasing Alaska’s market share in Hawaiian flights,

faces strict regulatory scrutiny. Additionally, Alaska Airlines

flight attendants rejected a three-year tentative labor agreement

offering a 32% wage increase. The union, Association of Flight

Attendants-CWA, will survey members to identify issues and resume

negotiations, highlighting worker participation’s importance.

Alaska Air shares fell 2% pre-market, while Hawaiian Holdings

shares rose 6.1%.

Boeing (NYSE:BA) – El Al Israel Airlines has

signed an agreement with Boeing to acquire up to 31 737 MAX

aircraft, valued at up to $2.5 billion. The contract includes

purchasing 20 aircraft for $1.5 billion, with options for 11 more.

Deliveries are expected to begin in 2028, though they could start

in 2027 through leasing. Additionally, the U.S. Department of

Justice is expected to approve a settlement with Boeing over fraud

charges related to two fatal 737 MAX crashes. Boeing will pay at

least $243.6 million in fines and invest $455 million in safety and

compliance improvements. However, the victims’ families deemed the

fine insufficient. Moreover, NASA is deciding by the end of August

how to bring astronauts Butch Wilmore and Suni Williams back to

Earth after issues with Boeing’s Starliner capsule. Launched on

June 5, the Starliner was supposed to return in eight days, but the

astronauts have been on the ISS for over 60 days. In response, NASA

is considering using a SpaceX Crew Dragon for the return, possibly

in February 2025. Lastly, the astronauts do not receive additional

compensation for their extended stay. Boeing shares fell 0.2%

pre-market.

Tesla (NASDAQ:TSLA) – The National Highway

Traffic Safety Administration (NHTSA) closed an investigation into

74,918 Tesla vehicles due to front suspension failures. Although it

found no evidence of significant issues affecting drivability,

NHTSA noted that Tesla has had problems with suspension and

steering components in several recalls. The agency recommended

expanding the component replacement for all affected vehicles.

Shares fell 3.1% pre-market.

Toyota Motor (NYSE:TM) – The National Highway

Traffic Safety Administration (NHTSA) closed an investigation into

1.8 million Toyota RAV4 SUVs from 2013-2018 models after concerns

over battery short circuits. The investigation revealed that the

fires occurred in vehicles with replaced batteries or those older

than expected. Shares rose 2.7% pre-market.

Polestar Automotive (NASDAQ:PSNY) – Polestar

began manufacturing the Polestar 3 SUV in the U.S. to avoid tariffs

on Chinese-made electric vehicles. Assembled at Volvo’s Ridgeville,

South Carolina plant, the $73,400 model will be sold in America and

Europe. The company faces operational challenges and job cuts to

reduce costs. Shares fell 2.7% pre-market.

DR Horton (NYSE:DHI) – Buying a home is

challenging due to high prices and mortgage rates, currently around

7%. However, DR Horton shares stand out, with an average annual

return of 25% over the past 10 years. The company, with shares at

$174, has a stock of 43,000 homes and a land portfolio of 630,000

lots. Its shares are expected to rise to $210 by 2025, with

earnings growth around 10% annually and a quarterly dividend of 30

cents, yielding 0.7%. Shares fell 0.5% pre-market.

Equinor ASA (NYSE:EQNR), Dominion

Energy (NYSE:D) – Equinor and Dominion won leases in a

U.S. offshore wind energy auction, with Equinor offering $75

million for 101,443 acres and Dominion $17.65 million for 176,505

acres. The sale generated less than $93 million, reflecting

challenges in the wind sector, such as high costs and supply chain

issues. Equinor shares rose 0.3% pre-market, while Dominion shares

rose 0.8%.

Eli Lilly (NYSE:LLY) – Eli Lilly sent

cease-and-desist letters to U.S. healthcare providers to stop

promoting compounded versions of its Zepbound and Mounjaro drugs.

With the growing availability of original drugs, Lilly wants to

prevent the sale of copies made by pharmacies, which offer lower

prices. Shares fell 2.6% pre-market.

Medtronic (NYSE:MDT) – Weight-loss drugs like

Ozempic and Wegovy are impacting Medtronic in two ways. First,

there’s concern that these drugs could reduce demand for Medtronic

products like stents and insulin pumps. The company’s shares fell

to $81.74, despite the healthcare sector rising more than 10% in

the same period. Investors fear that the impact on bariatric

procedures and demand for medical devices could negatively affect

revenues. However, Medtronic believes the impact will be temporary

and that new products and growing demand due to an aging population

could offset these concerns. Shares fell 0.6% pre-market.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson is preparing to announce that 75% of cancer claimants

linked to its talc have accepted a $6.48 billion bankruptcy

settlement. The company plans to use a subsidiary to seek

bankruptcy protection and end the lawsuits, despite objections from

some attorneys and previously rejected bankruptcies. Shares rose

0.1% pre-market.

UBS Group AG (NYSE:UBS) – UBS Fund Management

decided to liquidate the Credit Suisse Real Estate Fund

International starting Thursday. The decision was made after a

detailed assessment of options to protect investors’ interests, as

reported by the bank. Shares rose 5.6% pre-market.

NatWest (NYSE:NWG) – Texas added NatWest to its

list of companies boycotting the energy sector for limiting oil and

gas financing. This could restrict the bank’s business with state

public entities. The measure is part of a political backlash

against ESG policies. Shares fell 0.1% pre-market.

Klarna Bank AB – Klarna Bank AB is close to

choosing Goldman Sachs to lead its U.S. IPO next year. The Swedish

fintech is also negotiating a sale of existing shares ahead of the

IPO, seeking a valuation of around $20 billion. The bank’s

valuation has already fallen from $45.6 billion to $6.7 billion due

to rising interest rates.

Barclays (NYSE:BCS) – Barclays decided to

withdraw from future Israeli government bond auctions after

pressure from pro-Palestinian activists. The bank will still act as

a primary dealer alongside major international banks but faced

criticism for its involvement with defense companies supplying

equipment to Israel. Shares fell 0.5% pre-market.

Citibank (NYSE:C), Julius Baer

(USOTC:JBAXY) – Singapore charged two former bankers, Wang Qiming

and Liu Kai, in the country’s largest money laundering scandal,

totaling S$3 billion. Wang, formerly with Citibank, forged

documents to deceive his bank, while Liu, formerly with Julius

Baer, facilitated account openings with forged documents. Both are

awaiting trial on bail. Citigroup shares rose 1.9% pre-market.

Goldman Sachs (NYSE:GS), Morgan

Stanley (NYSE:MS) – The variety of institutional investors

in bitcoin ETFs is growing. Goldman Sachs and Morgan Stanley bought

more than $600 million in bitcoin ETFs in the second quarter of

2024. Goldman Sachs invested about $418 million, while Morgan

Stanley acquired $188 million in bitcoin-related ETFs. Goldman

shares rose 1.4% pre-market, while Morgan Stanley shares rose

2.8%.

Investment Portfolios

Alibaba (NYSE:BABA), Shift4

Payments (NYSE:FOUR) – Michael Burry’s Scion Asset

Management, known for betting against the U.S. housing market in

2008, increased its stake in Alibaba to $11.2 million, while

halving its overall portfolio in the second quarter. It also bought

Shift4 Payments shares and built new positions in various sectors.

Alibaba shares fell 2% pre-market, while Shift4 shares rose

5.5%.

Pershing Square Capital Management (LSE:PSH),

Nike (NYSE:NKE), Alphabet

(NASDAQ:GOOGL) – Investor William Ackman of Pershing Square

acquired new stakes in Nike, holding 3.04 million shares, as

disclosed in a regulatory filing. Additionally, Pershing Square

reduced its stake in Alphabet by 19.5%, retaining 7.55 million

class C shares.

Berkshire Hathaway (NYSE:BRK.B), Ulta

Beauty (NASDAQ:ULTA), Heico (NYSE:HEI),

Snowflake (NYSE:SNOW) – Berkshire Hathaway’s 13F

report shows that Warren Buffett’s conglomerate bought a small

stake of $266 million in beauty and care products company Ulta

Beauty. Berkshire held Heico shares worth $185.4 million and also

bought Chubb and Sirius XM shares. Additionally, Berkshire

completely sold its position in cloud data storage company

Snowflake and Paramount Global. The company halved its stake in

Apple and also reduced shares in Bank of America, T-Mobile, among

others. Ulta shares fell 0.8% pre-market.

Apple (NASDAQ:AAPL), Broadcom

(NASDAQ:AVGO), Micron (NASDAQ:MU), Texas

Instruments (NASDAQ:TXN), Super Micro

Computer (NASDAQ:SMCI), Qualcomm

(NASDAQ:QCOM), Ambarella (NASDAQ:AMBA),

Block (NYSE:SQ) – In the quarter ended June 30,

George Soros’ fund bought Apple shares valued at over $160 million

and made new investments in Broadcom, Micron, Texas Instruments,

and Super Micro Computer. On the other hand, it sold stakes in

Qualcomm and Ambarella, and divested in Block. It also reduced

positions in 3M and Chemours.

Unilever (NYSE:UL) – Nelson Peltz’s Trian Fund

Management sold 3.8 million Unilever shares for about $232 million,

reducing its stake to 32.6 million shares. The fund had acquired

Unilever shares in 2022 and still maintains collaboration with the

company’s board. Shares rose 0.1% pre-market.

CVS Health (NYSE:CVS), US

Foods (NYSE:USFD) – Sachem Head Capital acquired 2.45

million CVS Health shares during the second quarter when the

company’s shares fell 25%. The stake represents 0.20% of CVS. The

fund also reduced its position in US Foods. The acquisition may

signal a potential activist investment to improve CVS’s stock

performance. CVS shares rose 0.3% pre-market, while US Foods shares

rose 3.9%.

Trump Media & Technology Group (NASDAQ:DJT)

– In the second quarter, institutional investors like Vanguard,

BlackRock, and State Street took large positions in Trump Media

& Technology Group before its inclusion in the Russell indexes.

These funds bought shares in advance, reflecting the company’s

inclusion in the indexes and causing significant stock volatility.

Trump Media & Technology shares fell to near-record levels on

Wednesday after weak financial results and Trump’s return to

platform X. The decline in Trump’s poll numbers and focus on X

instead of Truth Social affected investor confidence. The company’s

valuation fell to $4.73 billion, less than half its initial

value.

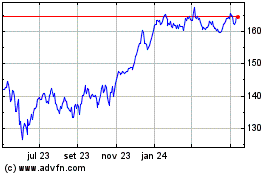

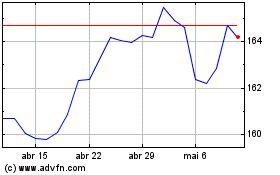

T Mobile US (NASDAQ:TMUS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

T Mobile US (NASDAQ:TMUS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024