Toronto Dominion Bank (NYSE:TD),

Charles Schwab (NYSE:SCHW) – Canada’s TD Bank

Group has set aside an additional $2.6 billion to cover penalties

from U.S. regulatory investigations into deficiencies in its

anti-money laundering (AML) program. To offset this cost, it will

sell part of its stake in Charles Schwab, reducing its ownership

from 12.3% to 10.1%. The bank has already set aside more than $3

billion in total, including a previous provision. TD Bank shares

rose 0.3% in premarket trading, while Schwab shares fell 4.1%.

WeRide – WeRide has postponed its U.S. IPO as

Chinese regulatory approval is about to expire. The autonomous

vehicle company is still preparing the necessary documentation for

U.S. regulators and may need to reassess its approval or request an

extension.

Halliburton (NYSE:HAL) – Halliburton suffered a

cyberattack that affected systems and networks, especially at its

Houston campus. The company is investigating the issue and working

with external experts to resolve it. Employees were advised to

avoid connecting to internal networks. Shares rose 0.2% in

premarket trading.

McDonald’s (NYSE:MCD) – McDonald’s Instagram

account was hacked and used to promote a cryptocurrency scam called

Grimace. The fraudulent post led users into a pump-and-dump scheme,

promising gains but resulting in losses of up to $700,000. The

company has since resolved the issue and apologized.

Apple (NASDAQ:AAPL) – Apple’s App Store head,

Matt Fischer, is stepping down amid a restructuring aimed at

responding to regulatory pressures. The division will be split into

two teams: one focused on the App Store and another on the

distribution of alternative apps. Apple is making these changes to

adapt to new regulations and market concerns.

Alphabet (NASDAQ:GOOGL) – The UK’s antitrust

regulator has closed its investigation into Google and Apple’s app

stores ahead of new laws coming into effect. The Competition and

Markets Authority plans to focus on app stores under the new

regime, which will grant enhanced powers to fine and regulate large

tech companies. Alphabet shares rose 0.2% in premarket trading.

Microsoft (NASDAQ:MSFT) – Microsoft has

restructured its financial reporting, moving ad and AI revenue from

the cloud division to the productivity unit, which includes Office.

Nuance’s AI services are now under productivity, no longer in the

cloud. The change aims to provide a clearer view of AI’s

contributions to financial results. Expected revenue for

intelligent cloud and personal computing was revised downward,

while the forecast for productivity was raised, better reflecting

AI’s financial contributions.

Paramount Global (NASDAQ:PARA) – Edgar Bronfman

has increased his offer to acquire Paramount Global to $6 billion,

surpassing his initial proposal of $4.3 billion. The new offer

includes $3.2 billion to pay down debt or buy back Paramount

shares, challenging Skydance’s proposal. Paramount extended the

deadline to evaluate the offer until September 5th. Shares rose

3.3% in premarket trading.

Walt Disney (NYSE:DIS) – Walt Disney has

appointed James Gorman, executive chairman of Morgan Stanley, to

lead the succession committee in search of a replacement for CEO

Bob Iger. The decision follows a battle with investor Nelson Peltz

and repeated extensions of Iger’s term. The committee also includes

Mary Barra, CEO of GM, and Calvin McDonald, CEO of Lululemon

Athletica.

FuboTV (NYSE:FUBO) – FuboTV shares closed up

4.1% on Wednesday, continuing a rally after a judge blocked the

launch of Venu Sports, a new sports streaming service. The ruling

favored FuboTV, which argued that Venu, backed by Disney, Warner

Bros., and Fox, would reduce competition. FuboTV has seen a 53%

increase in its stock over the past week. Shares rose 0.5% in

premarket trading.

Walmart (NYSE:WMT) – Walmart is expanding its

operations in China, standing out with the success of Sam’s Club

while other Western giants face challenges. After selling its stake

in JD.com for $3.6 billion, Walmart is now focusing on its own

e-commerce infrastructure and the continued growth of Sam’s

Club.

JD.com (NASDAQ:JD) – According to JPMorgan,

Walmart’s sale of its stake in JD.com is not expected to affect the

company’s positive fundamentals. Despite an initial drop in shares,

they have recovered, helping the Hang Seng Tech Index. JPMorgan

sees a bright outlook for JD.com due to low valuations and expected

growth. Shares rose 0.4% in premarket trading after closing down

4.2% on Wednesday.

American Express (NYSE:AXP) – American Express

shares closed down 2.7% on Wednesday after BofA Securities

downgraded its rating from “Buy” to “Neutral,” maintaining a price

target of $263. BofA cited growth limitations, noting that the

current stock valuation is high and that revenue growth may be

modest.

Deutsche Bank (NYSE:DB) – Deutsche Bank has

reached settlements with more than half of the plaintiffs who

claimed underpayment in the acquisition of Postbank. The

settlements cover 60% of the claims and will reduce the provision

made for litigation by $479.49 million. This adjustment is expected

to positively impact the bank’s third-quarter earnings. Shares rose

1.2% in premarket trading.

Citigroup (NYSE:C) – Citigroup added a new

section on its restructuring in its quarterly report, responding to

an SEC request for improved transparency. The addition addresses

efforts to resolve data management issues and comply with

regulatory orders. The bank also faces a $136 million fine for

making “insufficient progress” and plans to cut 20,000 jobs over

the next two years.

Blackstone (NYSE:BX) – Blackstone is in talks

to buy the Hyatt Regency Clearwater Beach Resort and Spa from

Westmont Hospitality Group for about $200 million. The transaction

is not yet final and could change. Interest in hotels in Florida

remains high following the travel sector’s recovery.

Icahn Enterprises (NASDAQ:IEP) – Borrowing fees

for investors looking to short Icahn Enterprises shares have risen

from 5% to over 25% after the company and Carl Icahn agreed to pay

$2 million in fines over regulatory issues. The increase reflects

growing pressure on the company following Hindenburg Research’s

critical report.

B. Riley Financial (NASDAQ:RILY) – B. Riley

Financial shares closed up 45.7% on Wednesday after Bloomberg

revealed exclusive talks to sell a majority stake in the Great

American Group unit to Oaktree Capital. The deal could bring in

$380 million and increase Oaktree’s stake to up to 55%. Shares fell

8.9% in premarket trading.

Bitfarms (NASDAQ:BITF), Stronghold

Digital Mining (NASDAQ:SDIG) – Bitfarms has agreed to

acquire Stronghold Digital Mining for about $125 million in stock

and assumed debt. The transaction offers a 70% premium over

Stronghold’s average price. The purchase aims to expand Bitfarms’

mining capacity and explore new energy sources, while Bitfarms

faces a hostile takeover attempt by Riot Platforms. Bitfarms shares

fell 1.7% in premarket trading. Stronghold shares fell 5.4% in

premarket trading after rising 82.3% on Wednesday.

Uber Technologies (NYSE:UBER) – Fitch Ratings

has granted Uber a BBB credit rating, two levels above speculative

grade. The decision reflects the company’s strong position in

ride-sharing and food delivery, its expansion into new services,

and a conservative financial policy. The rating could lower Uber’s

borrowing costs and attract more investors. Shares fell 0.2% in

premarket trading.

Ford Motor (NYSE:F) – Ford said it canceled the

production of a three-row electric SUV and delayed the new electric

version of the F-150 truck, focusing on cost-cutting. The automaker

will invest more in hybrids and reduce the share dedicated to pure

electric vehicles. Battery production will be reallocated to cut

costs and qualify for tax incentives. Shares rose 0.6% in premarket

trading.

Stellantis (NYSE:STLA) – Stellantis CEO Carlos

Tavares began a three-day visit to Detroit to address issues in the

automaker’s North American operations. He aims to develop a new

strategy to improve performance in the region and reassure

employees and investors. Tavares, who has previously expressed

dissatisfaction with the company’s results, will focus on reducing

inventories and adjusting production to tackle financial and

operational challenges. Shares fell 0.1% in premarket trading.

Tesla (NASDAQ:TSLA) – The U.S. National

Transportation Safety Board has opened an investigation into an

accident last Monday involving a Tesla electric truck in

California, which resulted in a fire and closed the highway for

several hours. In addition, Tesla issued a recall for 9,100 Model X

2016 SUVs in the U.S. due to an issue with the roof trim that could

detach, increasing the risk of accidents. The automaker will fix

the problem at no cost to owners and has updated the process since

2016. Shares fell 0.3% in premarket trading.

VinFast (NASDAQ:VFS) – VinFast has delayed the

opening of its dealerships in Thailand due to a slowdown in auto

sales in the country. The company will revise the sales schedule

for its electric vehicles in Thailand and focus on adjusting its

infrastructure to global standards.

Canadian National Railway (NYSE:CNI),

Canadian Pacific Kansas City (NYSE:CP) – Canadian

National Railway and Canadian Pacific Kansas City halted their rail

operations in Canada, leaving about 10,000 workers unemployed after

failed negotiations with a major union. The shutdown could severely

impact the Canadian economy and trade with the U.S., disrupting the

transportation of grain, coal, and petroleum products. Canadian

Pacific Kansas City shares are down 1.1% in premarket trading.

Grifols SA (NASDAQ:GRFS) – In the second

quarter of this year, Grifols reduced its net financial debt to

€9.4 billion ($10.46 billion), a decrease of €1.5 billion from the

previous quarter. The company has been dedicated to reducing its

debt since facing significant challenges during the Covid-19

pandemic, which negatively impacted its business due to a shortage

of blood plasma. Shares rose 3.3% in premarket trading after rising

6.7% on Wednesday.

Snowflake (NYSE:SNOW) – The cloud data

warehouse company beat revenue estimates, reaching $868 million,

compared to the $852 million forecast. However, it reported a loss

of $317 million (95 cents per share), up from $227 million (69

cents) a year ago. Adjusted earnings were 18 cents per share,

beating the expected 16 cents. Snowflake failed to reassure

investors with its sales forecasts. The company estimated revenue

of $850-855 million, below some analysts’ expectations. Despite

growth in revenue and new products, the company faces challenges

such as security breaches and increasing competition in the AI

sector. In an interview with CNBC, Snowflake CEO Sridhar Ramaswamy

said the recent cyberattack did not harm the company’s business.

Shares fell 8.3% in premarket trading after rising 2.4% on

Wednesday.

Zoom Video Communications (NASDAQ:ZM) – The

video conferencing and digital communication company reported

adjusted earnings of $1.39 per share, beating the estimate of

$1.21. Revenue grew 2% to $1.162 billion, above the forecast of

$1.149 billion. Enterprise revenue increased 3.5% to $683 million,

surpassing the $675 million expectation. Sales growth slowed for

the tenth consecutive quarter. Shares rose 3.3% in premarket

trading after rising 1.9% on Wednesday.

Wolfspeed (NYSE:WOLF) – Semiconductor company

Wolfspeed reported a loss of 89 cents per share, below the 84-cent

estimate. Quarterly revenue was $200.7 million, slightly below the

forecast of $201.31 million. For the first quarter of 2025,

Wolfspeed projects revenue between $185 million and $215 million,

compared to a consensus of $211.7 million. Shares rose 6.9% in

premarket trading after rising 2.6% on Wednesday.

Synopsys (NASDAQ:SNPS) – Chip design tool

company Synopsys reported adjusted earnings of $3.43 per share and

revenue of $1.53 billion, beating expectations of $3.28 and $1.52

billion. Earnings grew 27%, and revenue increased 13%

year-over-year. For the current quarter, the projection is $3.30

per share and $1.63 billion in sales, above estimates of $3.25 and

$1.62 billion.

Agilent Technologies (NYSE:A) – The scientific

measurement equipment company reported earnings per share of $1.32,

beating the estimate of $1.26. Quarterly revenue was $1.58 billion,

surpassing the forecast of $1.557 billion, despite a 5.4%

year-over-year decline. For fiscal 2024, the company projects

revenue of $6.45 to $6.5 billion and adjusted earnings per share of

$5.21 to $5.25.

Urban Outfitters (NASDAQ:URBN) – The fashion

and lifestyle retailer reported earnings per share of $1.24,

beating the estimate of $1.00. Revenue increased 6% to $1.35

billion, slightly above the forecast of $1.34 billion. Urban

Outfitters reported that comparable sales for its main brand fell

more than 9% year-over-year. In contrast, comparable sales for Free

People and Anthropologie grew about 7%. Shares fell 8.4% in

premarket trading after rising 3.1% on Wednesday.

Nordson Corporation (NASDAQ:NDSN) – The

industrial dispensing equipment company reported third-quarter net

income of $117.3 million, with adjusted earnings per share of

$2.41, beating the estimate of $2.33. Revenue was $661.6 million,

surpassing the forecast of $655.2 million. For the year, Nordson

projects earnings per share between $9.45 and $9.65 and revenue

between $2.67 billion and $2.71 billion.

Lufax Holding Ltd. (NYSE:LU) – The financial

services platform reported second-quarter revenue fell to $822

million, a 36% drop year-over-year. The net loss decreased

year-over-year to $100 million. Shares fell 9.9% in premarket

trading after rising 2.6% on Wednesday.

MDxHealth (NASDAQ:MDXH) – The molecular

diagnostics company for cancer reported a loss of 42 cents per

share, worse than the 26-cent loss estimate. Revenue was $22.16

million, beating analysts’ forecast of $20.22 million.

Corporación América Airports (NYSE:CAAP) – The

global airport operator reported revenues of $366.1 million, with a

slight year-over-year increase of 0.2%. Operating income was $92.9

million, down from $110.4 million a year ago. Adjusted EBITDA fell

8.8% to $136.2 million. Passenger traffic fell 7.8%, while cargo

volume increased 4.7%. Net debt to EBITDA improved to 1.1x.

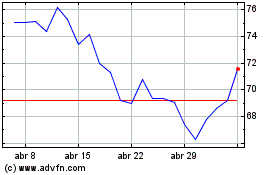

Uber Technologies (NYSE:UBER)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Uber Technologies (NYSE:UBER)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024