Qualcomm (NASDAQ:QCOM) – Qualcomm, in

collaboration with Samsung and Google, is developing mixed-reality

glasses that connect to smartphones, offering a lighter, more

portable alternative to Apple’s bulky headsets. Qualcomm CEO

Cristiano Amon hopes these glasses will provide new experiences and

expand the mixed-reality market, which is currently smaller than

the smartphone market. Shares rose 0.2% in pre-market after closing

1.3% higher on Wednesday.

Verizon Communications (NYSE:VZ),

Frontier Communications Parent (NASDAQ:FYBR) –

Verizon will increase its quarterly dividend to 67.75 cents per

share, marking its 18th consecutive year of growth. This adjustment

raises its dividend yield to 6.53%, reinforcing its position as the

highest yield in the Dow Jones Index. The payment will be made on

November 1 to shareholders of record by October 10. Verizon is also

in advanced talks to acquire rival Frontier Communications. The

deal could be announced soon and is expected to be an all-cash

transaction. Frontier shares closed 38% higher on Wednesday after

the negotiations were disclosed, boosting its market value to $9.3

billion. Frontier specializes in fiber-optic services. Verizon

shares rose 0.3% in pre-market after closing 3.4% lower on

Wednesday.

Samsonite International SA – Samsonite is

preparing for a dual listing in the US to improve liquidity and

attract global investors. The company is working with JPMorgan and

Morgan Stanley and may consider the US as its primary listing

venue. Already traded in Hong Kong, Samsonite aims to expand its

international presence.

Alphabet (NASDAQ:GOOGL) – The European

Commission will seek feedback next week on Google’s proposals to

comply with fair competition rules. The investigation, launched in

March, examines whether Google favors its own services in search

results, violating the EU’s Digital Markets Act. The company may

face charges and fines if it doesn’t meet the requirements. Shares

rose 0.4% in pre-market after closing 0.6% lower on Wednesday.

Meta Platforms (NASDAQ:META) – Meta’s Oversight

Board ruled that Facebook should not automatically remove the

phrase “From the river to the sea” as it may have various meanings

and is not necessarily harmful. The phrase is often used in

pro-Palestinian protests and has sparked controversy over its

interpretations. Shares rose 0.4% in pre-market after closing 0.2%

higher on Wednesday.

Microsoft (NASDAQ:MSFT) – The UK regulator

approved Microsoft’s acquisition of Inflection AI’s former

employees and partnership with the startup, concluding that the

deal does not harm competition. Inflection, with a small share of

the UK chatbot market, had no significant competitive impact.

Shares fell 0.1% in pre-market after closing 0.1% lower on

Wednesday.

OpenAI – Safe Superintelligence, co-founded by

former OpenAI chief scientist Ilya Sutskever, raised $1 billion to

create a safe, advanced AI system. Investors include Andreessen

Horowitz and Sequoia Capital. Unlike other companies, Safe

Superintelligence focuses exclusively on developing a safe

superintelligence without selling short-term products.

Foxconn (USOTC:FXCOF) – In August, Apple’s

partner Foxconn reported a 33% revenue increase, hitting a record

$17.1 billion, driven by high demand for AI servers. After a

decline in smartphone sales, Foxconn saw a significant rise in

server sales. Growth is expected to continue, with a recovery in

the AI server sector and a rebounding smartphone market.

Nvidia (NASDAQ:NVDA) – Nvidia said it hasn’t

received a subpoena from the US Department of Justice but is

willing to cooperate, according to Bloomberg. Reports suggest the

Department is investigating Nvidia’s business practices, including

hardware bundling, its $700 million RunAI acquisition, and market

activities. Reuters notes the probe may focus on Nvidia’s dominance

in the AI market. Meanwhile, Volvo Cars announced that its future

models, starting with the EX90, will use a single software system

powered by Nvidia chips. The software will enhance safety and allow

remote updates. Shares rose 1.1% in pre-market after closing 1.7%

lower on Wednesday.

Intel (NASDAQ:INTC) – Intel suffered a setback

in its contract manufacturing division after Broadcom tested its

advanced 18A process and found it unsuitable for mass production.

This could hinder Intel’s recovery efforts as it seeks to attract

major clients for expansion. CFO David Zinsner commented that Intel

will start generating significant revenue from its contract chip

manufacturing in 2027. The company is negotiating with 12 clients

and decided to focus on its 18A manufacturing process. For now,

revenue comes from advanced packaging. Shares rose 0.2% in

pre-market after closing 3.3% lower on Wednesday.

ASML (NASDAQ:ASML) – ASML CEO Christophe

Fouquet said that US restrictions on exports to China have become

more about economics than security. He anticipates growing

resistance to these restrictions, although the slowdown in China’s

chip advances continues. Shares fell 1.3% in pre-market after

closing 4% lower on Wednesday.

AeroVironment (NASDAQ:AVAV) – In an interview

with CNBC, AeroVironment CEO Wahid Nawabi emphasized that its

drones are more affordable and effective than competitors. He

highlighted the importance of the company’s drones for Ukrainian

forces and mentioned a $1 billion contract with the Department of

Defense.

Palo Alto Networks (NASDAQ:PANW),

IBM (NYSE:IBM) – Palo Alto Networks acquired IBM’s

cloud security assets for $500 million, including QRadar software.

Palo Alto plans to integrate these customers into its Cortex XSIAM

platform. The deal could boost Palo Alto’s customer base and

strengthen its position in the cybersecurity market.

Logitech International SA (NASDAQ:LOGI) –

Daniel Borel failed in his attempt to remove Wendy Becker as chair

of Logitech. With 86% of shareholders supporting Becker’s

re-election, Borel argued the company has failed to adapt to new

tech trends. He proposed Guy Gecht as a replacement, but Gecht

received only 14% of the vote.

Roblox (NYSE:RBLX) – Roblox is appealing a

decision in Turkey that banned its platform over child safety

concerns. The ban, initiated in August, was prompted by

inappropriate content accessible to children and allegations that

adults could interact inappropriately with minors. Roblox is

working with authorities to reverse the decision.

Alibaba (NYSE:BABA) – Alibaba will allow WeChat

Pay transactions on its Taobao and Tmall platforms, breaking a

barrier between competitors after the regulatory crackdown on

monopolistic practices. Shares fell 0.5% in pre-market after

closing 0.2% higher on Wednesday.

Disney (NYSE:DIS) – The dispute between DirecTV

and Disney over fees and programming bundles is shaping the future

of pay-TV. DirecTV wants cheaper bundles without ESPN, while Disney

defends the traditional structure. The battle may also accelerate

the shift to sports streaming.

US Steel (NYSE:X) – The Biden administration

informed Nippon Steel on Saturday that its $14.9 billion bid for US

Steel could threaten national security by weakening the American

steel industry. The Committee on Foreign Investment in the US

highlighted concerns about reduced domestic production. The

decision is under consideration due to strong political opposition

and US Steel’s warnings about job losses and potential headquarters

changes. The deal faces opposition from politicians, including

Kamala Harris and Donald Trump. Shares rose 2.4% in pre-market

after closing 17.5% lower on Wednesday.

Phillips 66 (NYSE:PSX) – Phillips 66 expects a

favorable refining market next year, with strong global demand and

limited production capacity. High margins and the competitiveness

of US refineries should sustain operations despite a projected

global refining capacity reduction of 700,000 barrels per day.

General Motors (NYSE:GM) – GM will start

producing hybrid-flex vehicles in Brazil, capable of using 100%

ethanol or gasoline, along with batteries. Production is scheduled

for 2025, as part of a R$7 billion investment. GM also plans to

expand its electric vehicle lineup in Brazil. Shares fell 0.1% in

pre-market after closing 0.1% higher on Wednesday.

Stellantis (NYSE:STLA) – Stellantis, Jeep’s

parent company, announced it will resume production at some US

plants after adjusting production levels. The company recently

halted the manufacture of Jeep Wrangler and Grand Cherokee SUVs.

Operations at the Toledo North, Jefferson, and Mack plants will

restart, and Bob Broderdorf was appointed head of Jeep North

America. Shares fell 0.4% in pre-market after closing 1.1% higher

on Wednesday.

Tesla (NASDAQ:TSLA) – Tesla plans to launch its

Full Self-Driving technology in China and Europe in Q1 2025,

pending regulatory approval. The company has already made progress

in China, securing approval for tests in Shanghai and establishing

local partnerships, aiming to maintain its leadership in the EV

market. Shares rose 3% in pre-market after closing 4.2% higher on

Wednesday.

Norfolk Southern (NYSE:NSC) – Norfolk Southern

announced a tentative agreement with the union representing

conductors in 22 US states. Nearly 65% of the company’s unionized

workforce is now covered by tentative agreements.

Boeing (NYSE:BA) – Acting US Labor Secretary

Julie Su urged Boeing and its 30,000 workers to settle their

differences and finalize a fair contract ahead of a vote on

September 12. If unresolved, workers could strike on September 13.

Negotiations still involve issues like job security and wage

increases.

Visa (NYSE:V) – Visa is partnering with major

UK banks to revamp bank transfer payments, aiming to introduce a

formal process for disputing transactions. The initiative seeks to

improve security and direct debit experiences, addressing fraud and

inflexibility issues in the current system.

JPMorgan Chase & Co. (NYSE:JPM) – JPMorgan

downgraded Chinese stocks from “overweight” to “neutral,” citing US

election volatility and China’s weak economic growth. The bank

warns that a new trade war with the US and internal challenges

could negatively affect the market.

Goldman Sachs (NYSE:GS) – Goldman Sachs

predicts the US economy will grow more under a Democratic victory

led by Kamala Harris, due to increased spending and tax credits. A

Republican win, particularly with Donald Trump, would hinder growth

with tariffs and strict immigration policies. Goldman also

forecasts that AI will reduce shale production costs by 30% over

the next decade, potentially lowering oil prices by up to $5 per

barrel. While AI will boost oil supply, it will also modestly

increase demand, raising prices by $2.

Bank of America (NYSE:BAC) – The US election is

becoming a major risk to the global economy, with Bank of America

highlighting uncertainty over candidates’ platforms and their

potential market impact. Although the election is not yet reflected

in market prices, the US economy and Federal Reserve decisions are

dominating attention. Shares rose 0.3% in pre-market after closing

0.5% lower on Wednesday.

Citigroup (NYSE:C) – Citi warns that if OPEC+

doesn’t cut production further, oil prices could drop to $60 per

barrel by 2025 due to increased supply and weaker demand. Without

new cuts, confidence in OPEC+ could erode, leading to even lower

prices.

Robinhood Markets (NASDAQ:HOOD) – Robinhood

Markets will pay $3.9 million to settle claims that it prevented

cryptocurrency withdrawals between 2018 and 2022. The agreement

requires the platform to allow withdrawals to personal wallets and

improve its trading practices. Shares rose 0.4% in pre-market after

closing 1.3% lower on Wednesday.

Blackstone (NYSE:BX) – Blackstone, in

partnership with Canada Pension Plan Investment Board (CPP

Investments), will acquire Australian data center group AirTrunk

for $16.1 billion (A$24 billion). The acquisition, the largest in

Australia this year, requires approval from the Australian Foreign

Investment Review Board.

AstraZeneca (NASDAQ:AZN) – Five AstraZeneca

employees in China were detained for questioning over potential

legal violations, including improper patient data collection and

importing an unapproved drug. The investigation, led by Shenzhen

police, comes amid a crackdown on pharmaceutical smuggling in

China. Shares fell 0.4% in pre-market.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson plans to pay an additional $1.1 billion to settle

lawsuits alleging its talc caused cancer, raising the settlement to

over $9 billion. The company is preparing a subsidiary bankruptcy

to finalize the settlement while still facing objections from some

lawyers. Additionally, J&J must pay $1 billion to Auris Health

shareholders for breaching a 2019 agreement. A judge ruled J&J

failed to support Auris’ iPlatform technology as promised,

hindering milestone achievements and additional payments. The

company plans to appeal.

Coca-Cola (NYSE:KO), PepsiCo

(NASDAQ:PEP) – Coca-Cola and PepsiCo, after decades of investment

in Muslim markets like Egypt and Pakistan, are seeing sales decline

due to boycotts against global brands perceived as symbols of the

US and Israel. Coca-Cola experienced a sales drop in Egypt, while

local brands like V7 and Cola Next are gaining popularity.

Beyond Meat (NASDAQ:BYND) – Beyond Meat is

launching a new plant-based product mimicking the texture of muscle

steak, aiming to attract health-conscious consumers. CEO Ethan

Brown mentioned a partnership with a health-focused restaurant

chain, abandoning the previous strategy of partnering with

fast-food chains. The company is also reformulating existing

products, facing challenges in sales and market conditions. Shares

rose 0.2% in pre-market after closing 0.7% lower on Wednesday.

Unilever (NYSE:UL) – Unilever received Russian

government approval to sell its assets in Russia, valued at around

$400 million. The decision follows criticism for maintaining

operations in the country since the start of the Ukraine war.

Arnest Group may be the buyer. Shares rose 0.3% in pre-market after

closing 0.4% higher on Wednesday.

AMC Entertainment Holdings (NYSE:AMC) – AMC CEO

Adam Aron rejected rumors that the company was “suppressing” ticket

sales for the film “City of Dreams.” He stated that these claims

are false and emphasized that AMC benefits from every ticket sold.

The film, which premiered on August 30, addresses human

trafficking. Shares rose 0.6% in pre-market after closing 1.5%

higher on Wednesday.

Topgolf Callaway (NYSE:MODG) – Topgolf Callaway

Brands plans to separate its operations in 2025, potentially

splitting Topgolf and Callaway. The decision reflects Topgolf’s

struggles to attract customers and the need to better align the

business models of both brands. The split could face challenges due

to the company’s debt.

Earnings

C3.ai (NYSE:AI) – The scalable enterprise AI

company reported a loss of 5 cents per share, better than the

projected loss of 13 cents. Revenue was $87.2 million, beating the

estimate of $86.9 million. However, the drop in subscription

revenue to $73.5 million disappointed investors. Future revenue

projections range from $88.6 million to $93.6 million. Shares fell

18.5% in pre-market after closing 1.9% lower on Wednesday.

Hewlett Packard Enterprise (NYSE:HPE) – The

corporate IT solutions company posted adjusted earnings of 50 cents

per share, beating the estimate of 47 cents. Net income was $512

million. Revenue was $7.7 billion, a 10% increase, in line with

analyst expectations. The revenue forecast for the next quarter is

between $8.1 billion and $8.4 billion, with adjusted earnings per

share between 52 cents and 57 cents, above estimates. Antonio Neri,

CEO of Hewlett Packard Enterprise, said it is the company’s

“fiduciary duty” to seek compensation against the estate of Mike

Lynch after his death last month. Lynch, who faced a $4 billion

civil suit for fraud in the sale of his company, was cleared of

criminal charges before his death.

ChargePoint (NYSE:CHPT) – The electric vehicle

charging infrastructure company reported a loss of 16 cents per

share, worse than analysts’ consensus of a 15-cent loss. Quarterly

revenue was $109 million, down 27.6%, below the $113.5 million

forecast. For the next quarter, the company projects revenue

between $85 million and $95 million, while analysts expected $135.9

million. ChargePoint expects to reach positive EBITDA by fiscal

2026. Shares fell 8.9% in pre-market after closing 0.6% lower on

Wednesday.

Casey’s (NASDAQ:CASY) – The convenience store

chain posted diluted earnings per share of $4.83, a 7% increase,

beating analysts’ estimates of $4.58. Revenue reached $4.2 billion,

in line with expectations. Net income grew 6% to $180 million.

Same-store inside sales increased 2.3%. Operating expenses rose 9%

due to store expansion.

Credo (NASDAQ:CRDO) – The high-performance

connectivity company reported adjusted earnings per share of 4

cents, in line with expectations. Revenue was $59.7 million,

exceeding the $59.48 million consensus and representing 70%

year-over-year growth. For the second quarter, the company

forecasts revenue between $65 million and $68 million, above

analysts’ estimates. Shares fell 13.1% in pre-market after closing

1% lower on Wednesday.

Sprinklr (NYSE:CXM) – The customer experience

management company reported adjusted earnings of 6 cents per share,

below the 7-cent estimate. Revenue was $197.2 million, beating the

$194.51 million forecast. For the third quarter, the company

projects revenue between $196 million and $197 million, above

expectations. However, its earnings per share forecast for the next

quarter of 8 cents fell short of the 12-cent expectation, as did

the full-year EPS forecast.

Copart (NASDAQ:CPRT) – The online vehicle

auction company reported fourth-quarter revenue of $1.1 billion, a

7.2% increase, with net income of $323 million, down 7.3%. Diluted

earnings per share were 33 cents, an 8.3% decrease. For fiscal

2024, revenue grew 9.5% to $4.2 billion, with EPS of $1.40. Shares

fell 5% in pre-market after closing 0.9% lower on Wednesday.

AeroVironment (NASDAQ:AVAV) – The drone and

defense technology company reported adjusted earnings of 89 cents

per share, beating FactSet’s estimate of 62 cents. Revenue grew 24%

year-over-year to $189.5 million, surpassing the $183.2 million

expectation. However, its annual earnings forecast of $3.18 to

$3.49 per share and revenue of up to $820 million disappointed,

falling short of the $3.50 per share and $841.5 million

forecast.

Verint (NASDAQ:VRNT) – The engagement

intelligence company reported second-quarter earnings of $5.5

million, compared to a $6 million loss the previous year. Adjusted

earnings per share were 49 cents, below the 53-cent estimate.

Revenue remained flat at $210.17 million. The company maintains its

full-year EPS forecast of $2.90. Shares fell 14% in pre-market

after closing 1% lower on Wednesday.

Concrete Pumping Holdings (NASDAQ:BBCP) – The

specialty concrete pumping and materials company reported revenue

of $109.6 million, missing estimates of $125.47 million and falling

from $120.7 million the previous year. Net income was $7.6 million,

with GAAP earnings per share of 13 cents, compared to 18 cents last

year. Adjusted EBITDA was $31.6 million, with total debt at $375

million.

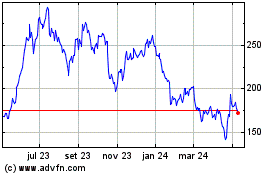

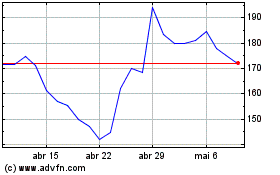

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025