Nansen acquires StakeWithUs to expand staking services

Nansen has acquired the staking platform StakeWithUs to

diversify its services by offering non-custodial staking for over

20 assets. The transaction value was undisclosed. This acquisition

aims to broaden Nansen’s support for blockchain ecosystems and

integrate new blockchains, such as Berachain, into its platform.

Nansen will also become one of the first validators for the

Berachain mainnet.

Polygon Labs accelerates ZKP development with new encryption chip

Polygon Labs (COIN:MATICUSD) announced the creation of a

zero-knowledge proof (ZKP) optimized encryption chip developed by

Fabric Cryptography for its AggLayer solution. The chip, called the

Verifiable Processing Unit (VPU), was funded with $33 million in a

Series A round. The VPU, used in Polygon’s Plonky2 and Plonky3

systems, is expected to accelerate ZKP development from 3-5 years

to just 6-12 months. According to co-founder Mihailo Bjelic, the

VPU will enable faster, more secure, and cost-effective

transactions, promoting scalability and advancing DeFi applications

globally.

Bitcoin ETFs see positive inflow after a long streak of outflows

On Monday, Bitcoin ETFs recorded an inflow of $28.6 million, the

first positive inflow since August 26, after eight consecutive days

of outflows. However, BlackRock (NASDAQ:IBIT) and Grayscale

(AMEX:GBTC) ETFs experienced outflows of $9.1 million and $22.8

million, respectively. In contrast, Fidelity’s (AMEX:FBTC) and

Bitwise’s (AMEX:BITB) ETFs saw inflows of $28.6 million and $22

million, respectively, bringing total Bitcoin ETF inflows to $16.9

billion.

Ethereum ETFs saw a net outflow of $5.2 million. Grayscale’s ETF

(AMEX:ETHE) led the outflows with $22.6 million, while Fidelity’s

(AMEX:FETH), Bitwise’s (AMEX:ETHW), and Grayscale’s (AMEX:ETH) ETFs

saw inflows of $7.6 million, $1.8 million, and $8 million,

respectively.

Bitcoin stable after recovery, trading volume hits record in 2024

On Tuesday, Bitcoin (COIN:BTCUSD) remained stable at $56,807,

following a recovery on Monday night when the price reached

$57,976.80. Despite the slight rebound, Bitcoin fell 9% over the

previous week, marking its worst weekly performance since August

2023. Analysts suggest that without significant short-term

catalysts, Bitcoin may continue consolidating. Future stability

could depend on the performance of US stock markets and

macroeconomic events, such as the presidential election, which may

influence the cryptocurrency’s price.

According to Kaiko, the Bitcoin market saw a record trading

volume of $2.874 trillion in the first eight months of 2024,

surpassing the $2.424 trillion volume during the 2021 bull market.

This is the highest volume since 2012, driven by high volatility

and strong interest in Bitcoin ETFs. Bitcoin’s annualized

volatility reached 100% in April, reflecting the impact of Fed rate

change expectations and economic uncertainties.

Growing optimism in Web3 workforce despite regulatory uncertainty

Despite regulatory uncertainty ahead of the 2024 US presidential

election, 86% of Web3 professionals remain optimistic about the

sector’s future, according to a Consensys report. This optimism

stems from the transformative impact of Web3 on decentralization,

freedom, and innovation. More than 75% of Web3 professionals remain

employed in the sector, with many opting to receive part of their

salaries in cryptocurrencies, reflecting ongoing enthusiasm for

blockchain’s potential.

Core Scientific sees exponential potential with AI but challenges

remain

Core Scientific (NASDAQ:CORZ) CEO Adam Sullivan anticipates

exponential growth for the Bitcoin miner, driven by its AI data

center services. The company must demonstrate its ability to

deliver large-scale AI data centers to secure additional contracts.

Despite its experience in Bitcoin mining, Core Scientific stands

out for shorter delivery timelines compared to competitors.

Diversifying into AI is crucial for its long-term valuation.

Bitfarms delays shareholder meeting in response to Riot Platforms’

demands

Bitfarms (NASDAQ:BITF) postponed its special shareholder meeting

from October 29 to November 6 after Riot Platforms (NASDAQ:RIOT)

demanded changes to the mining company’s board. In an open letter,

Riot called for Ben Gagnon to be appointed as CEO and board member,

along with the addition of independent directors to improve

governance. Bitfarms proposed a settlement to add a mutually

agreed-upon director and will review Riot’s demands before the

meeting. Riot increased its stake in Bitfarms to 18.9% in

August.

Metaplanet expands Bitcoin treasury with new purchase

Metaplanet (TSX:3350) acquired 38.6 Bitcoins for approximately

$2.2 million (300 million yen), raising its reserves to 398.8 BTC.

This purchase is part of a broader strategy to allocate funds into

Bitcoin, following the model of companies like MicroStrategy

(NASDAQ:MSTR). Metaplanet has invested roughly $27.6 million (3.75

billion yen) in Bitcoin.

Gemini report shows stability in cryptocurrency adoption in the US

and UK, and crypto in elections

According to Gemini’s “Global State of Crypto” report,

cryptocurrency adoption in the US and UK remained stable between

2022 and 2024, with rates of 21% and 18%, respectively. The survey

of 6,000 people across various countries revealed that regulatory

challenges remain a significant barrier, but ETFs are driving

market growth. Most investors plan to allocate more to

cryptocurrencies and consider digital asset policies in

elections.

Additionally, the report revealed that cryptocurrency regulation

will be a key factor in the upcoming US presidential election. The

survey of 6,000 people found that 73% of cryptocurrency owners will

consider candidates’ policies on the sector when voting.

Furthermore, 37% said it would have a “significant impact” on their

decision. Growing regulatory concerns are a significant barrier for

investors, with 38% citing uncertainty as a major investment

obstacle.

DePINs drive decentralization in business sectors

Decentralized Physical Infrastructure Networks (DePINs) connect

the physical and digital worlds, using tokens to incentivize

participation and maintain security. Large companies like Lufthansa

(TG:LHA) and Deutsche Telekom (TG:DTE) are launching nodes on the

Peaq network, integrating blockchain into business operations. With

the potential to become a significant use case in the Web3 sector,

DePINs are being adopted for infrastructure in telecommunications

and aviation, offering new opportunities for integration and

innovation in the decentralized market.

FTX and Emergent finalize agreement over Robinhood shares

Bankrupt FTX has agreed to pay $14 million to Emergent

Technologies to settle disputes over 55 million Robinhood

(NASDAQ:HOOD) shares, valued at $600 million. The agreement aims to

recover funds for creditors and reduce litigation costs, while

helping Emergent resolve its bankruptcy in Antigua. A hearing on

the motion is scheduled for October 22.

FCA charges man for operating illegal crypto ATM network in the UK

The UK’s Financial Conduct Authority (FCA) has charged Olumide

Osunkoya with running an illegal crypto ATM network that processed

$3.4 million (£2.6 million) in transactions without proper

registration. This is the first such charge in the country. The FCA

has ramped up its crackdown, conducting inspections at strategic

locations and emphasizing that no crypto ATMs are legal in the UK

without proper authorization.

FBI reports rise in crypto fraud in 2023

The FBI’s cybercrime report revealed that Americans lost $5.6

billion to crypto fraud in 2023, a 45% increase from the previous

year. The FBI received 69,000 complaints about crypto fraud,

accounting for 10% of all cybercrime complaints. However, these

crypto-related complaints resulted in nearly 50% of the total value

lost to cybercrime in 2023. People over 60 were the most affected,

with $1.6 billion in losses. The FBI also warned about frauds

related to kiosks and investment schemes.

Singapore investigates suspected illegal Worldcoin token trading

Singapore’s Deputy Prime Minister Gan Kim Yong announced that

police are investigating seven individuals for illegally trading

Worldcoin (COIN:WLDUSD) accounts and tokens. These actions may

violate the Payment Services Act of 2019. Yong warned that such

transactions could facilitate crimes like money laundering and

terrorism financing. The Monetary Authority of Singapore does not

recognize Worldcoin as an official payment service, and consumers

are advised to exercise caution when trading these accounts.

North Carolina lawmakers override veto on CBDC bill

On September 9, the North Carolina Senate overrode Governor Roy

Cooper’s veto of a bill blocking the use of a central bank digital

currency (CBDC). The Republican-majority measure prevents the state

from participating in Federal Reserve CBDC trials. Critics praised

the decision, citing privacy and individual sovereignty protection,

while Cooper argued that the bill lacked focus on real threats.

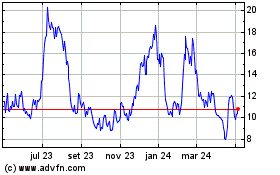

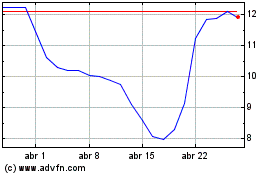

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024