Boeing (NYSE:BA) – Workers at Boeing’s West

Coast factories voted in favor of a strike. The walkout, the first

since 2008, will affect 737 MAX production amid the company’s

production challenges and mounting debts. The union argued that the

offer didn’t offset years of stagnant wages and rising health care

costs. A 50-day strike could cost Boeing between $3 billion and

$3.5 billion in cash flow, according to TD Cowen. Boeing stated it

is ready to resume negotiations and expressed a willingness to

reset its relationship with the union and seek a new agreement.

Additionally, NTSB chair Jennifer Homendy warned Boeing CEO Kelly

Ortberg of the urgent need to address safety culture issues within

the company. She stated that the employees’ lack of trust

compromises safety. Shares fell 4.0% in pre-market trading after

closing up 0.9% on Thursday.

RH (NYSE:RH) – RH’s stock jumped 19.7% in

pre-market trading Friday after rising 3.83% in Thursday’s regular

session. The company reported second-quarter earnings of $29

million, or $1.45 per share, compared to $3.36 per share last year.

Revenue increased to $829.7 million, beating the $825 million

estimate. For fiscal 2024, RH forecasts demand growth of 8%-10% and

revenue growth of 5%-7%, slightly below previous projections.

Third-quarter demand growth is estimated between 12%-14%.

OpenAI – OpenAI launched the “Strawberry”

series of AI models, including the o1 and o1-mini. These models

enhance reasoning in complex tasks such as science and math,

surpassing previous models. They use the “chain of thought”

reasoning technique to solve problems more effectively and

autonomously.

Microsoft (NASDAQ:MSFT) – Microsoft resolved an

outage that affected its cloud services, such as Word and Teams,

caused by a change made by a third-party internet provider.

Connectivity was restored after reversing the change. The outage

impacted thousands of users and affected multiple platforms.

Microsoft also announced cutting 650 jobs in its Xbox division, the

third layoff this year, while integrating its Activision Blizzard

acquisition. The cuts will focus on corporate and support roles,

without impacting gaming or studios. Microsoft also appointed

Carolina Dybeck Happe, former CFO of GE, as Chief Operating Officer

to strengthen leadership and drive AI transformation. Dybeck Happe,

who aided GE’s recovery and the spin-off of GE Vernova, will join

Microsoft’s senior leadership team. Shares dipped 0.1% in

pre-market trading after closing up 0.9% on Thursday.

Apple (NASDAQ:AAPL) – Irish Prime Minister

Simon Harris stated that the EU court order requiring Apple to pay

$14.4 billion will allow the government to invest in

infrastructure, housing, and capital projects. Ireland and Apple

have contested the tax since 2016, but the funds will now address

urgent challenges. In other news, Republican vice-presidential

candidate JD Vance criticized Apple, stating that while he doesn’t

consider the company “evil,” it benefits from slave labor in its

supply chains in China and other countries. He advocates for tax

cuts for companies that create jobs in the U.S. and higher tariffs

for those outsourcing jobs abroad. Shares rose 0.1% in pre-market

trading.

Alphabet (NASDAQ:GOOGL) – In 2019, Google

removed a feature allowing publishers to prevent ad sales from

being diverted to competitors, anticipating resistance. Documents

show Google tried to soften the change, which is now central to an

antitrust trial, and reveal that Google knew the removal would

increase its influence and could hurt publisher revenue. Shares

rose 0.7% in pre-market trading after closing up 2.3% on

Thursday.

Micron Technology (NASDAQ:MU) – Micron

Technology’s stock fell 3.8% Thursday after BNP Paribas downgraded

the stock and cut its price target to $67, citing the company’s

expected underperformance against AI competitors. Despite the drop,

some analysts still view the stock as undervalued based on price

metrics. Shares rose 0.2% in pre-market trading.

Adobe (NASDAQ:ADBE) – In the quarter ended

August 30, Adobe reported revenue of $5.41 billion, surpassing the

$5.37 billion estimate. Adobe posted net income of $1.68 billion,

or $3.76 per share, compared to $1.40 billion, or $3.05 per share,

in the prior-year period. On an adjusted basis, the company earned

$4.65 per share, while analysts projected $4.53 per share. However,

Adobe forecast lower-than-expected profits for the fourth quarter

due to strong competition and weak demand for its AI tools. Adobe

expects earnings per share between $4.63 and $4.68, slightly below

the $4.67 estimate. Expected fourth-quarter revenue is $5.50

billion to $5.55 billion, below the $5.61 billion forecast. Shares

dropped 8.1% in pre-market trading after closing up 1.1% on

Thursday.

Oracle (NYSE:ORCL) – Oracle forecasts annual

revenue of at least $104 billion by 2029, driven by its cloud

expansion. The company raised its 2026 revenue forecast to $66

billion. Oracle, whose shares are up 53% this year, is focused on

migrating its database customers to the cloud. Shares climbed 6.2%

in pre-market trading after closing up 2.7% on Thursday.

Fortinet (NASDAQ:FTNT) – Fortinet revealed

yesterday that someone gained unauthorized access to some customer

files stored on a third-party cloud, but it did not affect internal

operations. The company notified customers, and there is no

evidence of malicious activity. Shares fell 2.8% on Thursday,

closing at $74.49.

CrowdStrike (NASDAQ:CRWD) – While it’s common

for companies and their leaders to buy back shares during

significant declines to support the price, CrowdStrike hasn’t done

so. Following a drop in July caused by a global outage, the company

did not purchase shares on the open market. The last recorded

repurchase was just 42 shares in June, before the outage. Shares

rose 1.41% on Thursday.

DigitalBridge (NYSE:DBRG) – DigitalBridge is

considering selling all or part of EdgePoint Infrastructure, in

Southeast Asia, valued at up to $4 billion. The company is

exploring options with financial advisers as investors seek

high-demand telecom assets. Discussions are early and may not

proceed. Shares rose 0.9% in pre-market trading after closing up

5.9% on Thursday.

Ericsson (NASDAQ:ERIC) – Ericsson launched a

new company and a joint venture with multiple telecom operators to

offer network API software. These APIs will help prevent fraud,

improve entertainment, and offer various capabilities. The new

company will have 50% ownership by Ericsson and 50% by the

operators. Shares fell 0.3% in pre-market trading after closing up

0.3% on Thursday.

Verizon Communications (NYSE:VZ) – Verizon will

face an expense between $1.7 billion and $1.9 billion in Q3 due to

4,800 planned layoffs. The company also expects charges of up to

$380 million related to asset and business streamlining. Verizon

plans to reduce office space and certain non-core business

operations. Additionally, the company intends to sell assets and

mobile towers to raise capital and improve its position in the

fiber optics market.

Vodafone Group Plc (NASDAQ:VOD) – The UK

questioned whether the $19.7 billion merger between Vodafone and

Three would benefit competition, despite promises to improve mobile

networks. The CMA raised concerns over price hikes and service

reductions but sees potential if the deal is adjusted. The final

decision is due in December. Shares rose 0.5% in pre-market trading

after closing down 0.1% on Thursday.

Amazon.com (NASDAQ:AMZN) – Amazon will invest

$660 million to increase compensation for Delivery Service Partners

(DSPs) next year, raising drivers’ average income to nearly $22 per

hour. The investment, part of a $12.3 billion total over six years,

includes a new app and AI-powered safety measures. Shares fell 0.1%

in pre-market trading after closing up 1.3% on Thursday.

FuboTV (NYSE:FUBO) – The antitrust trial

between FuboTV and Walt Disney, Fox, and Warner Bros Discovery,

regarding the new sports streaming service, is set to begin on

October 6, 2025, according to a court document released Thursday.

Shares fell 1.1% in pre-market trading after closing up 4.1% on

Thursday.

Charter Communications (NASDAQ:CHTR) – Charter

Communications and Warner Bros Discovery renewed their deal,

allowing Max and Discovery+ to be included at no additional cost in

Spectrum TV Select packages. This addition may expand Charter’s

customer base. Shares closed up 3.6% on Thursday.

Warner Bros Discovery (NASDAQ:WBD) – Warner

Bros Discovery expects to add more than 6 million Max subscribers

in Q3, highlighting international growth and new releases. CEO

David Zaslav stated that subscriber growth will drive revenue. The

service, relaunched in May, expanded to Europe and Latin America.

Shares fell 0.4% in pre-market trading after closing up 10.4% on

Thursday.

Roku (NASDAQ:ROKU) – Roku shares rose 5.7% on

Thursday after Wolfe Research stated the company is expected to see

accelerated sales growth. Wolfe Research upgraded the stock from

Peer Perform to Outperform and set a price target of $93 after

increasing sales and free cash flow estimates for 2025. Despite a

19% drop this year, recovery is seen as promising. Shares closed up

5.7% on Thursday.

Sony (NYSE:SONY) – Sony Music is close to

securing a deal to acquire the rights to Pink Floyd’s recordings

for approximately $500 million, according to the Financial Times.

Negotiations have been complicated by disputes between band

members, particularly Roger Waters and David Gilmour. Shares fell

0.3% in pre-market trading after closing down 0.2% on Thursday.

Amazon, Walmart (NYSE:WMT) –

India’s antitrust investigation found that Amazon and Walmart’s

Flipkart violated local laws by favoring certain sellers on their

platforms. Reports indicate these preferred sellers were given

better search placement and additional benefits, harming

competition. Both companies deny wrongdoing and are reviewing the

findings. Walmart shares rose 0.2% in pre-market trading after

closing up 1.0% on Thursday.

Petco (NASDAQ:WOOF) – Investors are focusing

more on meme stocks than financial fundamentals in 2024. Keith

Patrick Gill, known as Roaring Kitty, didn’t mention Petco on

social media, but a subreddit post boosted the stock by 44% in two

days. Despite weak financials, the appointment of a new CEO offers

hope. Shares, up 74.95% this week, closed up 11.3% on Thursday.

McDonald’s (NYSE:MCD) – McDonald’s extended its

$5 meal promotion in the U.S. through December to attract

budget-conscious customers. Launched in June and extended in

August, the offer aims to sustain demand amid competitor

promotions. The company also announced other deals to lure

customers. Shares rose 0.7% on Thursday.

American Airlines (NASDAQ:AAL) – American

Airlines flight attendants approved a new five-year contract with

87% of the vote. The deal includes wage increases of up to 20.5%,

retroactive pay, and compensation for boarding and waiting time.

It’s the first contract to guarantee boarding pay. Shares rose 0.2%

in pre-market trading after closing up 1.0% on Thursday.

Delta Air Lines (NYSE:DAL) – Delta Air Lines

forecasted an improvement in Q3 revenues due to high demand and

moderate industry capacity. The company expects positive unit

revenue growth and earnings per share between $1.70 and $2.00, and

reduced revenue expectations due to a cyberattack that impacted

flights.

Southwest Airlines (NYSE:LUV) – Teamsters Local

19 and Southwest Airlines reached a tentative four-year agreement,

providing a 23% wage increase for flight simulator technicians. The

package includes enhanced retirement and parental leave benefits,

along with ratification bonuses. Member voting will take place

soon.

United Airlines Holdings (NASDAQ:UAL) – United

Airlines postponed its investor updates day, originally scheduled

for May. CFO Mike Leskinen stated that the industry faces financial

challenges and prefers to present better results rather than

promising future improvements while margins remain low. Shares fell

0.3% in pre-market trading after closing up 2.4% on Thursday.

Norfolk Southern (NYSE:NSC) – Norfolk Southern

replaced CEO Alan Shaw with Mark George, the company’s CFO,

following Shaw’s resignation due to an inappropriate relationship

with the chief legal officer. While George brings stability, there

are concerns over the board’s governance, which could lead to

further changes.

Union Pacific (NYSE:UNP) – Union Pacific

announced it has restored all its rail lines following Hurricane

Francine but warned of potential delays for shipments in the

affected area. The railway completed inspections and installed

generators in locations without power. Francine, now a tropical

depression, still poses risks.

General Motors (NYSE:GM) – General Motors is

negotiating to buy batteries from CATL, with the technology

assembled at a new U.S. factory managed by TDK Corp. This aims to

cut costs and avoid tariffs, creating over 1,000 jobs. Ford also

plans to use similar technology in Michigan despite legislative

concerns. Additionally, GM and Hyundai Motor agreed to explore

collaborations in strategic areas, including joint vehicle

development, supply chain cooperation, and clean energy

technologies. The companies signed a memorandum of understanding to

combine forces, reduce costs, and accelerate the delivery of new

technologies and vehicles to the market. Shares rose 0.4% in

pre-market trading after closing up 3.3% on Thursday.

Ford Motor (NYSE:F) – Ford plans to reopen a

factory in Tamil Nadu, India, for export purposes, returning to the

market it exited in 2021. The company sent a letter of intent to

the state government, focusing on production for global markets

rather than domestic sales. Details about the vehicles to be

manufactured will be announced later.

Stellantis (NYSE:STLA) – Stellantis will

suspend production of the electric Fiat 500 for four weeks due to

low demand and challenges in the European electric vehicle market.

The Mirafiori plant in Turin, Italy, will be revamped with a $110

million investment to produce a hybrid version of the model

starting in 2025. Shares rose 0.3% in pre-market trading after

closing down 1.4% on Thursday.

Mastercard (NYSE:MA) – Mastercard will acquire

Recorded Future for $2.65 billion, as announced Thursday. The

acquisition aims to expand Mastercard’s threat intelligence

capabilities, with the company having processed $9 trillion in

transactions last year. With the acquisition, Mastercard will

enhance its ability to detect fraud and cyber threats. Shares rose

0.1% in pre-market trading after closing up 0.8% on Thursday.

Blackstone (NYSE:BX) – Blackstone is

considering selling its majority stake in VFS Global after

receiving interest from investors. The asset manager is evaluating

whether to pursue a full or partial sale, which could value the

company at around $7 billion. Preliminary discussions with advisers

are underway, but no final decision has been made. Shares rose 2.3%

on Thursday.

Lazard (NYSE:LAZ) – In August, Lazard faced

$7.5 billion in net outflows from asset management, as a client

switched to a passive investment strategy. This reduced its total

assets under management to $244.34 billion. Despite this, the bank

saw year-over-year growth and second-quarter profits. Shares closed

up 1.2% on Thursday.

Berkshire Hathaway (NYSE:BRK.B) – Ajit Jain, a

former Berkshire Hathaway insurance executive, sold more than half

of his Class A shares this week, totaling $139.1 million. Jain sold

200 shares, including 104 directly and 96 through family trusts.

The sale followed a peak in share prices and may reflect personal

motives, according to analysts. Jain still holds significant shares

in Berkshire. Shares rose 0.1% in pre-market trading after closing

down 0.5% on Thursday.

Carlyle Group (NASDAQ:CG) – Carlyle Group opted

for an IPO of StandardAero after offers for a sale did not meet

valuation expectations. StandardAero, a major aircraft maintenance

services provider, recently posted profits, reversing previous

losses. The IPO could still change, and terms will be set

later.

Wells Fargo (NYSE:WFC) – Wells Fargo shares

fell 4% on Thursday after the Office of the Comptroller of the

Currency (OCC) identified anti-money laundering control failures

and limited the bank’s expansion in risk areas. The bank pledged to

address the deficiencies, though there are no financial penalties.

Shares rose 0.1% in pre-market trading.

Goldman Sachs (NYSE:GS) – Goldman Sachs hired

Melissa Goldman as a partner and global head of technology

engineering. With 30 years of experience, she returns after having

worked at Google and JPMorgan Chase. Goldman Sachs has brought

other former employees back as partners this year, including Robert

Kaplan.

Deutsche Bank (NYSE:DB) – Deutsche Bank raised

its forecast for the S&P 500 from 5,500 to 5,750 points due to

strong earnings growth, robust stock buybacks, and AI optimism. The

new target reflects a 2.75% increase over the index’s recent close

and is driven by positive economic expectations. Shares rose 0.1%

in pre-market trading after closing up 1.0% on Thursday.

Bank of Montreal (NYSE:BMO) – The Bank of

Montreal won a U.S. appeals court ruling overturning a $564 million

judgment against its subsidiary related to a $3.65 billion Ponzi

scheme run by Tom Petters. The court ruled that the subsidiary was

not liable, following precedents in similar cases. Shares rose 0.1%

in pre-market trading after closing up 0.9% on Thursday.

Navient (NASDAQ:NAVI) – The U.S. Consumer

Financial Protection Bureau barred Navient from managing federal

student loans and imposed a $120 million penalty for errors and

deceptive practices. Navient will permanently exit the student loan

servicing business, including $100 million in restitution and a $20

million fine. Shares closed up 5.5% on Thursday.

ExxonMobil (NYSE:XOM) – Mitsubishi agreed in

principle to buy a stake in ExxonMobil’s Texas hydrogen facility

and acquire low-carbon ammonia. The facility will produce up to 1

billion cubic feet of hydrogen daily and 1 million tons of ammonia

annually starting in 2029. Shares rose 0.4% in pre-market trading

after closing up 1.4% on Thursday.

Occidental Petroleum (NYSE:OXY) – Occidental

Petroleum’s 1PointFive carbon capture unit received up to $500

million from the U.S. Department of Energy for its Direct Air

Capture Center in Texas. This project, already funded by BlackRock,

is crucial for testing the economic viability of this

decarbonization technology. Shares rose 0.7% in pre-market trading

after closing up 0.7% on Thursday.

Dow Inc (NYSE:DOW) – Dow lowered its Q3 revenue

forecast to $10.6 billion from $11.1 billion due to a partial

shutdown of a Texas plant following Hurricane Beryl. The financial

impact could range between $125 million and $150 million. Shares

fell 0.9% on Thursday.

Vale (NYSE:VALE) – Vale aims for 10% of its

iron ore production to come from mining waste by 2030. In 2024, the

miner expects to recover about 7 million tons of tailings, reducing

the storage of hazardous material. Annual iron ore production is

expected to rise to more than 360 million tons after 2030. Shares

fell 0.1% in pre-market trading after closing up 1.5% on

Thursday.

Moderna (NASDAQ:MRNA) – On Thursday, Moderna

delayed its breakeven target to 2028 and forecasted 2025 sales

below market expectations after vaccine development delays. Revenue

projections for 2025 range from $2.5 billion to $3.5 billion, below

analysts’ expectations of $3.74 billion. Shares dropped 3.3% in

pre-market trading after closing down 12.4% on Thursday.

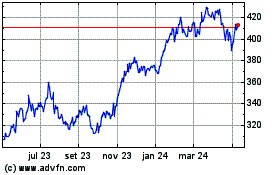

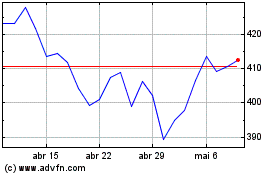

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Microsoft (NASDAQ:MSFT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024