Worldcoin integrates World ID with Solana via Wormhole

On Friday, Worldcoin (COIN:WLDUSD) announced the integration of

World ID with the Solana blockchain through Wormhole Foundation’s

cross-chain protocol. The World ID, based on Ethereum layer 2,

allows privacy-focused identity verification for decentralized

applications (DApps). This integration enables Solana developers to

implement secure, Ethereum-compatible authentication. The Wormhole

Foundation completed the bridge between platforms just two months

after receiving a community grant, strengthening trust in

decentralized ecosystems and expanding World ID’s usage.

Coinbase’s cbBTC surpasses $100M in 24 hours but faces criticism

Coinbase’s (NASDAQ:COIN) cbBTC, a wrapped Bitcoin, quickly

surpassed $100 million in market cap within its first 24 hours.

With 1,720 tokens circulating, 43% are on the Base network, and 57%

on Ethereum. Analysts believe cbBTC could boost DeFi on Base,

Coinbase’s layer 2 network, with potential to integrate large BTC

holdings. However, Justin Sun, founder of TRON, criticized the

token, calling it “central bank BTC” due to the lack of audits and

risk of government intervention, raising decentralization

concerns.

SEC expands lawsuit against Binance, adding new tokens as

securities

The SEC expanded its lawsuit against Binance, including new

tokens as securities, such as Axie Infinity (COIN:AXSUSD), Filecoin

(COIN:FILUSD), Cosmos (COIN:ATOMUSD), Sandbox (COIN:SANDUSD), and

Decentraland (COIN:MANAUSD). Binance and its affiliate, BAM

Trading, are accused of facilitating the trading of unregistered

securities and promoting these assets to customers. The SEC also

reiterates that Binance illegally operated as an unregistered

broker and exchange, failing to provide proper disclosures on the

risks and legality of these tokens.

UK court recognizes Tether’s USDT as property

The UK’s High Court of Justice ruled that Tether’s

(COIN:USDTUSD) stablecoin can be considered property, allowing for

its tracing and treatment as fiduciary. The decision came during a

case filed by Fabrizio D’Aloia, who alleged a $3.3 million loss in

a crypto scam involving USDT and USD Coin (COIN:USDCUSD). The UK

government also introduced a bill to regulate the legal status of

cryptocurrencies, reinforcing stablecoins as property under English

law. Tether also hired Jesse Spiro, former PayPal and Chainalysis

blockchain executive, to lead its government relations team.

Bitcoin nears $60,000, fueled by Fed expectations and gold surge

On Friday afternoon, Bitcoin’s (COIN:BTCUSD) price neared

$60,000, up 3.1% at $59,920 at the time of writing. Meanwhile, gold

(PM:XAUUSD) rose 0.95% to $2,582.21 per ounce, hitting a record

high of $2,586.03 earlier. BTC rebounded after U.S. macroeconomic

data hinted at potential Federal Reserve interest rate easing.

Traders’ optimism fueled the price action, with predictions of a

significant breakout if Bitcoin holds critical support levels like

$58,150. U.S. stocks also saw marginal gains, reflecting positive

sentiment in risk markets, with the Dow Jones, S&P 500, and

Nasdaq up 0.90%, 0.71%, and 0.83%, respectively.

On September 12, U.S. Bitcoin spot ETFs saw net inflows of

$39.02 million, reversing outflows from the previous day. ARK

21Shares (AMEX:ARKB) led the day’s inflows with $18.3 million after

facing $54 million outflows on Wednesday. Fidelity’s ETF

(AMEX:FBTC) attracted $11.5 million in new inflows and was the only

ETF to record net inflows for four consecutive days, totaling an

impressive $115.9 million during the period.

In contrast, Ether ETFs suffered their second consecutive day of

outflows, with $20.14 million on Thursday and $542,000 on

Wednesday. Ether spot ETFs had a cumulative net outflow of $582.74

million.

Anatoly Yakovenko criticizes ZKsync governance

Anatoly Yakovenko, co-founder of Solana (COIN:SOLUSD),

criticized ZKsync, an Ethereum layer 2, for still operating with

multisig, despite claiming decentralized governance. Multisig

requires multiple signatures from different parties to authorize

blockchain transactions. Yakovenko argued that the network’s

control could be legally compromised, as token holders and the

security council could be forced to act under court orders. Matter

Labs, creators of ZKsync, responded, stating that the network is

progressing toward full decentralization with a new governance

structure involving Token Assembly, the Security Council, and

Guardians, to prevent unilateral control.

Polygon’s POL token rises after migration and Binance listing

Polygon’s POL token saw an 11.6% increase at the time of

writing, trading at $0.4192, after reaching an intraday high of

$0.4467, driven by the addition of spot and perpetual contracts for

the token on Binance. The update marked the migration from the old

MATIC to POL. The rebranding, accompanied by a new 2% annual

issuance, attracted traders’ attention. “The full spot migration

from MATIC to POL has occurred, but new charts are more important.

This is the first successful migration of a large token we’ve seen

in a while, and we expect other projects to follow,” DeFiyst

analyst highlighted.

TON and Tada partnership enables crypto payments for rides in

Singapore

The TON Foundation announced a partnership with ride-hailing app

Tada, enabling users to book rides and pay with cryptocurrencies

such as Toncoin (COIN:TONCOINUSD) and Tether (COIN:USDTUSD). Using

a Telegram Mini App, users can schedule rides directly on the

platform in Singapore. 4,000 free rides were offered to

participants. Tada, operating in multiple countries with a

zero-commission policy, also offers competitive pricing. The

collaboration was promoted during the Token2049 event and could

accelerate Web3 solutions adoption.

MicroStrategy buys 18,300 Bitcoins for $1.11 billion

MicroStrategy (NASDAQ:MSTR) acquired 18,300 Bitcoins for

approximately $1.11 billion between August 6 and September 12,

marking its largest purchase since 2021. The company now holds

244,800 Bitcoins, valued at around $14 billion. Led by Michael

Saylor, the company’s strategy aims to hedge against inflation,

using capital raised through stock issuance. MicroStrategy’s shares

rose 6.4% during Friday’s trading after the announcement.

Kraken requests jury trial in response to SEC lawsuit

Kraken requested a jury trial after the SEC’s lawsuit accusing

it of operating an unregistered securities exchange. The exchange

denied any wrongdoing and criticized the SEC’s approach,

emphasizing its attempts to cooperate with the regulator. Kraken

challenges the classification of certain digital assets as

securities and argues that the SEC provided no clear warning

regarding the illegality of its actions, contesting the

Commission’s authority and interpretation of the law.

HTX integrates Bitcoin Lightning Network for fast, cheap

transactions

HTX, one of the largest exchanges globally, announced its

partnership with IBEX to integrate the Bitcoin Lightning Network.

HTX plans to use Lightning to accelerate transactions and reduce

costs for its more than 45 million users. The second-layer protocol

will allow near-instant payments and withdrawals with lower fees,

reinforcing Bitcoin as an efficient solution for global

transactions.

North Carolina Senate bans payments with CBDCs

The North Carolina Senate overruled the governor’s veto, passing

a law prohibiting the state from accepting central bank digital

currencies (CBDCs). The law also prevents the Federal Reserve from

testing a digital dollar in the state. This measure is symbolic,

highlighting concerns about privacy and sovereignty. Critics argue

that the ban raises questions about its impact on financial

innovation and its legality.

Odds of Donald Trump launching a token before election rise to 84%

on Polymarket

Bets on Polymarket about Donald Trump launching a token before

the election rose to 84% after he confirmed the launch date for the

World Liberty Financial project. Chances of a “yes” in the betting

market jumped from 40% to 84% in just one day. For the market to

resolve as “yes,” a real token must be issued and verified on a

blockchain by November 4, 2024.

Coinbase backs Creator Defense Fund with $6 million to tackle

regulatory challenges

Stand With Crypto Alliance, supported by Coinbase (NASDAQ:COIN),

launched the Creator Defense Fund, raising $6 million from

Andreessen Horowitz (a16z) and OpenSea to support blockchain

creators. The fund provides legal assistance to face regulatory

threats, such as the recent SEC Wells Notice to OpenSea. The

initiative aims to protect artists using NFTs to monetize their

creations, ensuring that technological innovations can thrive

without fear of legal repercussions.

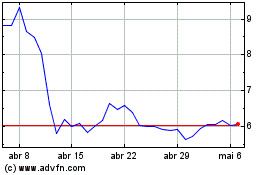

Filecoin (COIN:FILUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Filecoin (COIN:FILUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025