Google Cloud and Solana Labs launch Gameshift for Web3 gaming

Google Cloud and Solana Labs have launched Gameshift, an API

that facilitates the integration of traditional games with Web3

technology, such as NFTs and digital assets. The announcement was

made at the Solana Breakpoint 2024 event, and the tool is available

on the Google Cloud Marketplace. Gameshift aims to reduce

complexity for developers who want to incorporate blockchain into

games, offering a simplified bridge between Web2 and Web3

platforms. Jack Buser, Google Cloud’s head of gaming, highlighted

that Gameshift makes Web3 adoption easier, providing a more

accessible technical and cultural interface.

Bitcoin ETFs see $4.5 million inflows while Ethereum ETFs suffer

$79.3 million outflows

On Monday, Bitcoin ETFs saw mixed flows, totaling $4.5 million

in inflows. Fidelity’s ETF (AMEX:FBTC) led with $24.9 million in

inflows, followed by BlackRock’s (NASDAQ:IBIT) with $11.5 million.

However, $40.3 million outflows from Grayscale’s GBTC cut into the

gains. Other funds remained stable, with no significant

activity.

Ethereum ETFs saw net outflows of $79.3 million, with

Grayscale’s (AMEX:ETHE) responsible for $80.6 million in

withdrawals. Bitwise’s (AMEX:ETHW) was the only one with inflows,

totaling $1.3 million.

Bitcoin ETFs attract billions, but MicroStrategy stays ahead

U.S. bitcoin ETFs, launched in January 2024, attracted $17.7

billion in inflows, with BlackRock’s iShares Bitcoin Trust

(NASDAQ:IBIT) leading the way. However, MicroStrategy

(NASDAQ:MSTR), led by Michael Saylor, outperforms IBIT, with shares

rising 119% this year. The absence of fees and diversified revenue

have made MicroStrategy more attractive to investors, while IBIT

faces more limitations. According to CoinDesk, MicroStrategy’s

financial flexibility allowed it to increase its bitcoin reserves,

something ETFs cannot replicate directly.

Bitcoin and Ethereum consolidate despite new Chinese economic

stimulus

Bitcoin (COIN:BTCUSD) and Ethereum (COIN:ETHUSD) showed slight

variations in the past 24 hours, with prices at $63,860 and $2,250,

respectively, even after the People’s Bank of China announced new

economic stimulus measures. The 50 basis-point reduction in the

banks’ reserve requirement ratio aimed to boost the Chinese economy

but had little impact on the crypto market, which showed price

consolidation. While Asian stocks reacted positively, analysts like

Rick Maeda noted that Bitcoin is more sensitive to U.S. policies,

with strong correlations to U.S. markets. On the other hand, Jamie

Coutts, an analyst at Real Vision, noted that Chinese stimulus

could prompt other central banks to follow suit, increasing

liquidity and the appetite for risk assets like Bitcoin.

Satoshi-era whale moves inactive bitcoins after 10 years

A bitcoin whale (COIN:BTCUSD), who mined the asset just a month

after the network launched in 2009, transferred 5 BTC (about

$300,000) today to the Kraken cryptocurrency exchange. Arkham data

shows that this wallet started moving its assets three weeks ago,

with a total of 10 BTC transferred so far. The latest movement came

after a decade of inactivity, suggesting a potential sale. This

event is part of a series of transactions involving bitcoins from

the “Satoshi era” that have been reactivated in recent years,

including multi-million-dollar transfers.

Celsius token rises after $2.5 billion payout to creditors

Celsius Network’s token saw a monthly rise of over 150% after

the bankrupt company distributed $2.5 billion to 251,000 creditors.

The token price surged from $0.16 to a high of $0.64 over the

month, though it traded at $0.44 in the past 24 hours, still 1,200%

below its all-time high. Celsius paid out 84% of the assets owed,

but many creditors have yet to claim small amounts. The bankruptcy,

which began in 2022, involved fines and the arrest of former CEO

Alex Mashinsky.

Cega launches Vault Token Market for greater flexibility and

liquidity

Decentralized protocol Cega announced the Vault Token Market

(VTM), offering users more flexibility by allowing early exits from

financial positions without waiting 27 days. The VTM increases

investment liquidity by enabling the buying and selling of Cega

vault tokens on the open market. With more than $10 million in

total value locked, Cega is a key player in the exotic derivatives

market. The VTM also allows for multiple uses, such as staking,

collateralized loans, and restaking, expanding financial

opportunities within the ecosystem.

Upbit to migrate user data to U.S. servers via AWS

South Korean crypto exchange Upbit will change its privacy

policy starting October 1, storing user data on Amazon Web Services

(AWS) servers in the U.S. The move aims to improve service

reliability and data security but raises concerns about privacy and

jurisdiction under U.S. laws, such as the CLOUD Act, which allows

U.S. authorities to request user data. Upbit follows in the

footsteps of other exchanges, like Coinbase, which have also

adopted AWS.

Kraken expands in Europe with Dutch brokerage acquisition

Kraken has acquired Coin Meester (BCM), one of the oldest Dutch

brokerages, strengthening its presence in the country and expanding

its services in Europe. With virtual asset service provider (VASP)

licenses in countries such as France and Poland, Kraken seeks to

leverage the new European Union cryptocurrency regulation (MiCA),

which comes into effect in December. The acquisition of BCM by

Kraken is a milestone in the company’s European growth

strategy.

Turkey scraps tax package on stocks and cryptocurrencies

Turkey has decided not to proceed with the proposed tax on stock

and cryptocurrency profits, as announced by Vice President Cevdet

Yilmaz. Although previously discussed, the tax has been removed

from the agenda. In June, the government postponed these plans

after a stock market decline. The focus will now shift to reviewing

tax exemptions.

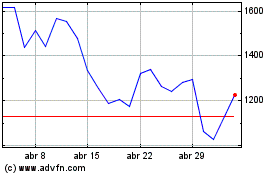

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024