U.S. Stocks Close Higher Again; S&P Posts Fresh Record Closing High

24 Setembro 2024 - 5:43PM

IH Market News

U.S. stocks closed higher on Tuesday after a somewhat choppy

ride, and the S&P 500 hit a fresh record high, as investors

made largely cautious moves while awaiting more data for

directional cues.

The Dow, which kept moving in and out of positive territory,

ended with a gain of 83.57 points or 0.2 percent at 42,208.22,

after hitting a fresh record intra-day high of 42,208.22.

The S&P 500 (SPI:SP500) closed up 14.36 points or 0.25

percent at 5,732.93, slightly off the all-time high of 5,735.32,

and the Nasdaq (NASDAQI:COMP) climbed 100.25 points or 0.56 percent

to 18,074.52.

Nvidia Corporation shares climbed about 4 percent. Caterpillar

also gained about 4 percent, and Uber Technologies ended up 3.7

percent.

Tesla (NASDAQ:TSLA), Home Depot, Netflix (NASDAQ:NFLX),

Salesforce, AMD, Comcast Corporation and Nike gained 1 to 3

percent.

Visa Inc. shares declined sharply after U.S. Department of

Justice filed antitrust lawsuit against the payment company

alleging that some of its debit card practices are

anticompetitive.

Starbucks, Citigroup, Amgen, Wells Fargo, Abott Laboratories,

PepsiCo, Bank of America, Costco, Mastercard and Microsoft

Corporation closed notably lower.

On the economic front, consumer confidence in the U.S. has seen

a notable deterioration in the month of September, according to a

report released by the Conference Board on Tuesday.

The Conference Board said it consumer confidence index tumbled

to 98.7 in September from an upwardly revised 105.6 in August.

Economists had expected the index to edge down to 103.0 from the

103.3 originally reported for the previous month.

The S&P CoreLogic Case-Shiller 20-city home price index in

the US rose by 5.9 percent from the previous year in July of 2024,

slowing from the 6.5 percent increase during the previous month

The Federal Reserve Bank of Richmond said the composite

manufacturing index in the US Fifth District edged down to -21 in

September of 2024, from -19 in August, worse than forecasts of -17,

indicating the steepest decline in factory activity since May

2020.

In overseas trading, Asian stocks advanced on Tuesday after

China’s central bank unveiled its biggest stimulus since the

pandemic to support the economy and counter a prolonged downturn in

the property sector.

The central bank said it would lower borrowing costs and inject

more liquidity into the system that would free up more money for

lending. Regulators also unveiled plans to support stable

development of the stock market.

The major European markets closed higher on Tuesday with

investors cheering the stimulus measures announced by the Chinese

central bank to stimulate the world’s second largest economy.

SOURCE: RTTNEWS

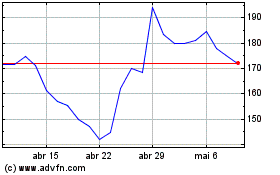

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

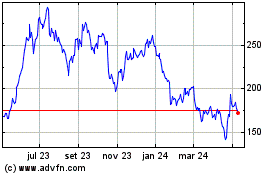

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024