Micron May Help Lead Early Rally On Wall Street

US Market

The major U.S. index futures are currently pointing to a higher

open on Thursday, with stocks likely to move back to the upside

following the pullback seen in the previous session.

Technology stocks may help lead an early rally on Wall Street,

as reflected by the 1.5 percent jump by the Nasdaq 100 futures.

The upward momentum for the tech sector comes amid a pre-market

surge by shares of Micron (NASDAQ:MU), which are soaring by 17.4

percent.

Micron is moving sharply higher in pre-market trading after

reporting better than expected fiscal fourth quarter results and

providing strong fiscal first quarter revenue guidance.

Stocks may also benefit from the release of upbeat U.S. economic

data, with a Labor Department report showing first-time claims for

U.S. unemployment benefits unexpectedly edged lower in the week

ended September 21st.

The Labor Department said initial jobless claims slipped to

218,000, a decrease of 4,000 from the previous week’s revised level

of 222,000.

The dip surprised economists, who had expected jobless claims to

rise to 225,000 from the 219,000 originally reported for the

previous week.

With the unexpected decrease, jobless claims fell to their

lowest level since hitting 216,000 in the week ended May 18th.

U.S. stocks closed lower on Wednesday amid uncertainty about the

near-term outlook for the markets following recent gains that

lifted the Dow and the S&P 500 to record highs. Investors

digested the latest set of economic data and assessed the central

bank’s rate cut trajectory.

The Dow ended down 293.47 points or 0.7 percent at 41,914.75,

snapping a four-session winning streak. The S&P 500 settled

lower by 10.67 points or 0.2 percent at 5,722.26, while the Nasdaq

closed up 7.68 points or less than a tenth of percent at

18,082.21.

On the economic front, data from the Commerce Department showed

new home sales pulled back sharply in the month of August, plunging

by 4.7 percent to an annual rate of 716,000, after soaring by 10.3%

to a revised rate of 751,000 in July.

Economists had expected new home sales to tumble by 5.3% to a

rate of 700,000 from the 739,000 originally reported for the

previous month.

Amgen dropped nearly 5.5 percent. Goldman Sachs, Pfizer, Wells

Fargo, Caterpillar, Chevron Corporation, Johnson & Johnson,

Exxon Mobil Corporation and Visa Inc. also ended notably lower.

Nvidia Corporation climbed more than 2 percent, extending gains

from the previous session. Tesla, Walmart, AMD, Salesforce,

T-Mobile, United Parcel Service, Starbucks Corporation and Micron

Technology also posted strong gains.

U.S. Economic News

New orders for U.S. manufactured durable goods were virtually

unchanged in the month of August, according to a report released by

the Commerce Department on Thursday.

The Commerce Department said durable goods orders came in flat

in August after soaring by 9.9 percent in July. Economists had

expected durable goods orders to tumble by 2.6 percent.

Excluding a decrease in orders for transportation equipment,

durable goods orders climbed by 0.5 percent in August after edging

down by 0.1 percent in July. Ex-transportation orders were expected

to inch up by 0.1 percent.

A separate report released by the Labor Department on Thursday

showed first-time claims for U.S. unemployment benefits

unexpectedly edged lower in the week ended September 21st.

The Labor Department said initial jobless claims slipped to

218,000, a decrease of 4,000 from the previous week’s revised level

of 222,000.

The dip surprised economists, who had expected jobless claims to

rise to 225,000 from the 219,000 originally reported for the

previous week.

With the unexpected decrease, jobless claims fell to their

lowest level since hitting 216,000 in the week ended May 18th.

The Commerce Department also released a report on Thursday

showing gross domestic product jumped by 3.0 percent in the second

quarter, unchanged from the previous estimate.

At 9:10 am ET, Boston Federal Reserve Bank Susan Collins is due

to host a fireside chat with Federal Reserve Board Governor Adriana

Kugler on the intersection between bank supervision and financial

inclusion as part of the Boston Fed’s Financial Inclusion and

Banking Supervision Workshop.

Federal Reserve Board Governor Michelle Bowman is scheduled to

speak on the economic outlook and monetary policy before the

Mid-Sized Bank Coalition of America Board of Directors Workshop at

9:15 am ET.

At 9:20 am ET, Federal Reserve Chair Jerome Powell is due to

deliver opening remarks before the 2024 Treasury Market Conference

hosted by the Federal Reserve Bank of New York.

New York Federal Reserve President John Williams is scheduled to

speak before the 2024 Treasury Market Conference at 9:25 am ET.

At 10 am ET, the National Association of Realtors is due to

release its report on pending home sales in the month of August.

Pending home sales are expected to surge by 3.1 percent in August

after plunging by 5.5 percent in July.

Federal Reserve Vice Chair for Supervision Michael Barr is

scheduled to speak before the 2024 Treasury Market Conference at

10:30 am ET.

Also at 10:30 am ET, Federal Reserve Board Governor Lisa Cook is

due to participate in an “Artificial Intelligence and Workforce

Development” roundtable discussion with Community Stakeholders

hosted by the Federal Reserve Bank of Cleveland and Columbus State

Community College.

Minneapolis Federal Reserve Bank Neel Kashkari is scheduled to

host a fireside chat with Federal Reserve Vice Chair for

Supervision Michael Barr for the Boston Fed’s Financial Inclusion

and Banking Supervision Workshop at 1 pm ET.

Also at 1 pm ET, the Treasury Department is due to announce the

results of this month’s auction of $44 billion worth of seven-year

notes.

Federal Reserve Board Governor Lisa Cook is scheduled to give a

lecture on “Artificial Intelligence and the Labor Force” before the

Ohio State University President and Provost’s Diversity Lecture and

Cultural Arts Series at 6 pm ET.

Europe

European stocks have bounced back on Thursday after snapping a

two-day winning streak the previous day. Sentiment was underpinned

by expectations of another big U.S. interest rate cut this year and

optimism over fresh stimulus measures from China.

Meanwhile, the Swiss National Bank reduced its key policy rate

by 25 basis points for the third straight meeting and signaled that

further cuts in the SNB policy rate may become necessary in the

coming quarters to ensure price stability over the medium term.

In economic news, survey data published jointly by GfK and the

Nuremberg Institute for Market Decisions showed that German

consumer confidence will recover moderately in October despite

weaker economic outlook.

The forward-looking consumer sentiment index rose to -21.2 in

October from -21.9 in September. The score was forecast to fall to

-22.4.

Elsewhere, the latest British Retail Consortium (BRC) Consumer

Sentiment Monitor has revealed that U.K. consumer confidence has

fallen in September due to concerns about both the economy and

personal finances.

While the French CAC 40 Index has jumped by 1.6 percent, the

German DAX Index is up by 1.2 percent and the U.K.’s FTSE 100 Index

is up by 0.2 percent.

Miners Anglo American, Antofagasta and Glencore have jumped in

London after China’s politburo pledged strong policy support to

meet this year’s economic growth target of roughly 5 percent.

Sportswear maker PUMA has also spiked as it announced the

appointment of Markus Neubrand, aged 48, as its Chief Financial

Officer and a Board member.

Lender Commerzbank has also surged. The bank, which is the

takeover target of Italian lender UniCredit SpA, confirmed its

strategy, expecting higher net profit and return on equity by

2027.

SMA Solar Technology AG shares have also jumped. The solar

energy equipment supplier said that it has decided to initiate a

company-wide restructuring and transformation program aimed at

increasing efficiency and strategic focusing.

Evotec has also spiked after the drug and development company

entered into a technology development partnership with Novo

Nordisk.

Meanwhile, shares of Hennes & Mauritz AB have slumped in

Stockholm after the Swedish clothing major reported weak profit and

sales in its third quarter.

German chemicals giant BASF has also shown a notable move to the

downside after announcing a reduction in its dividend.

Asia

Asian stocks rose sharply on Thursday as U.S. memory chip maker

Micron forecast higher than expected first-quarter revenue and

China’s politburo vowed to step up fiscal support to stabilize the

beleaguered property sector.

Investor sentiment was also underpinned after the Organization

for Economic Co-operation and Development slightly raised its

global economic growth forecast for 2024 and said it expects more

Fed rate cuts next year.

The dollar index rebounded in Asian trading as focus shifted to

the release of U.S. GDP data and Fed Chair Jerome Powell’s

speech.

Gold hovered near record levels after a handful of Federal

Reserve officials left the door open to another large rate cut.

Oil extended an overnight slide, falling more than 2 percent in

Asian trading after the Financial Times reported that Saudi Arabia

– the de facto leader of OPEC – was prepared to pump more oil to

regain market share.

China’s Shanghai Composite Index surged 3.6 percent to 3,000.95,

marking its highest closing level since June and capping its

seventh straight winning session, buoyed by the politburo’s promise

to step up counter-cyclical adjustments of fiscal and monetary

policy and strive to achieve full-year economic and social

development targets.

A Bloomberg News report citing unnamed sources that China is

considering injecting up to 1 trillion yuan ($142.48 billion) of

capital into its biggest state banks to support the struggling

economy.

Hong Kong’s tech-heavy Hang Seng Index soared 4.2 percent to

19,924.58, driven by Micron Technology Inc.’s after-hours

rally.

Japanese markets rallied as a weaker yen lifted export-related

stocks. The Nikkei 225 Index jumped 2.8 percent to 38,925.63, while

the broader Topix Index settled 2.7 percent higher at 2,721.12.

Automakers Honda Motor and Toyota surged around 3 percent each,

while chip giants Tokyo Electron and Advantest rallied 8 percent

and 5.4 percent, respectively.

The yen fell to a three-week low against the dollar after the

minutes of the Bank of Japan’s July policy meeting showed board

members are split over the future path of interest rates.

Seoul stocks advanced, with the Kospi surging 2.9 percent to

2,671.57 as China ramped up support for its economy.

Semiconductor maker SK Hynix soared 9.4 percent after an

announcement that it began volume production of a 12-layer memory

chip known as HBM3E. Heavyweight Samsung Electronics jumped 4

percent.

Australian markets posted strong gains, with retailers and tech

companies leading the surge. The benchmark S&P/ASX 200 Index

jumped 1.0 percent to 8,203.70, while the broader All Ordinaries

Index closed up 1.1 percent at 8,462.80.

Across the Tasman, New Zealand’s benchmark S&P/NZX-50 Index

rallied 2.2 percent to 12,491.58.

Commodities

Crude oil futures are tumbling $1.57 to $68.12 a barrel after

plunging $1.87 to $69.69 a barrel on Wednesday. Meanwhile, after

rising $7.70 to $2,684.70 an ounce in the previous session, gold

futures are climbing $9.90 to $2,694.60 an ounce.

On the currency front, the U.S. dollar is trading at 144.53 yen

versus the 144.75 yen it fetched at the close of New York trading

on Wednesday. Against the euro, the dollar is valued at $1.1152

compared to yesterday’s $1.1132.

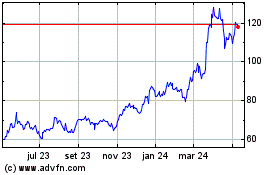

Micron Technology (NASDAQ:MU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

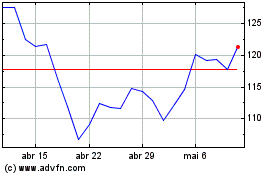

Micron Technology (NASDAQ:MU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024