The major U.S. index futures are currently

pointing to a lower open on Friday, with stocks likely to move to

the downside after ending the previous session little changed.

Concerns about the outlook for interest rates may continue to

weigh on Wall Street following the sell-off seen during trading on

Wednesday.

The Fed signaled Wednesday that it expects to lower rates less

than previously estimated next year amid signs progress toward

reducing inflation has slowed.

However, the futures climbed well off their worst levels

following the release of a Commerce Department report showing

consumer prices in the U.S. crept up by slightly less than expected

in November.

The Commerce Department said its personal consumption

expenditures (PCE) price index inched up by 0.1 percent in November

after rising by 0.2 percent in October. Economists had expected

prices to increase by another 0.2 percent.

The annual rate of growth by the PCE price index accelerated to

2.4 percent in November from 2.3 percent in October, slightly

slower than 2.5 percent jump economists had expected.

Excluding food and energy prices, the core PCE price index also

edged up by 0.1 percent in November after climbing by 0.3 percent

in October. Economists had expected core prices to rise by 0.2

percent.

The annual rate of growth by the core PCE price index in

November came in at 2.8 percent, unchanged from October, while

economists had expected an acceleration to 2.9 percent.

The inflation readings, which are preferred by the Federal

Reserve, were included in a report on personal income and

spending.

Following the sell-off seen late in Wednesday’s session, stocks

showed a notable rebound in early trading on Thursday. Buying

interest waned over the course of the trading day, however, and the

major averages eventually ended the day roughly flat.

The Dow still managed to snap its ten-day

losing streak, inching up 15.37 points or less than a tenth of a

percent to 42,342.24, while the Nasdaq slipped 19.92 points or 0.1

percent to 19,372.77 and the S&P 500 edged down 5.08 points or

0.1 percent at 5,867.08.

The initial strength on Wall Street came as some traders looked

to pick up stocks at reduced levels following Wednesday’s steep

losses, which saw the Dow tumble to its lowest closing level in

over a month.

Wednesday’s sell-off on Wall Street came after the Federal

Reserve announced its widely expected decision to lower interest

rates by a quarter point but forecast fewer than previously

estimated rate cuts next year.

However, traders seemed somewhat reluctant to get back into the

markets, as a batch of largely upbeat economic data seemingly

provided support for the Fed’s cautious approach to further rate

cuts.

The Commerce Department released a report showing the pace of

U.S. economic growth unexpectedly surged by more than previously

estimated in the third quarter.

The report said gross domestic product shot up by 3.1 percent in

the third quarter, reflecting an upward revision from the 2.8

percent jump previously reported. Economists had expected the pace

of growth to be unrevised.

A separate report released by the Labor Department showed

first-time claims for U.S. unemployment benefits pulled back by

more than expected in the week ended December 14th.

The Labor Department said initial jobless claims fell to

220,000, a decrease of 22,000 from the previous week’s unrevised

level of 242,000. Economists had expected jobless claims to dip to

230,000.

Interest rate-sensitive housing stocks extended Wednesday’s

sell-off, with the Philadelphia Housing Sector Index tumbling by

2.6 percent to its lowest closing level in over five months.

The continued weakness among housing stocks came even though the

National Association of Realtors released a report showing existing

home sales spiked to an eight-month high in November.

Considerable weakness was also visible among interest

rate-sensitive commercial real estate stocks, as reflected by the

1.6 percent loss posted by the Dow Jones U.S. Real Estate

Index.

Semiconductor stocks also showed another significant another

significant move downside, dragging the Philadelphia Semiconductor

Index down by 1.6 percent.

Micron (NASDAQ:MU) led the sector lower, plummeting by 16.2

percent after reporting better than expected fiscal first quarter

earnings but providing disappointing fiscal second quarter

guidance.

Computer hardware, oil producer and steel stocks also saw

notable weakness on the day, while airline stocks moved sharply

higher.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

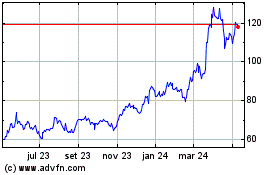

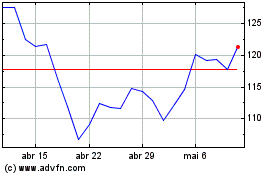

Micron Technology (NASDAQ:MU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Micron Technology (NASDAQ:MU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024