Grayscale launches fund focused on Aave, boosting token

Grayscale launched the Grayscale Aave Trust, a fund dedicated to

the DeFi protocol Aave, providing exposure to the AAVE token

(COIN:AAVEUSD) without needing direct purchase. Following the

announcement, the AAVE token reached $143.51, despite a 15.3% drop

the previous week. The Trust holds $150,000 in assets and aims to

simplify AAVE access for institutional and accredited individual

investors. Aave is the leading lending platform in DeFi, with a

total value locked (TVL) of $20 billion.

Ripple and Mercado Bitcoin launch global payment solution; XRP

declines

Ripple partnered with Mercado Bitcoin to launch an international

payment solution in Brazil, allowing faster, more efficient

transactions, with settlements in minutes, using Ripple’s

blockchain technology. Initially targeting institutional clients,

the solution will facilitate operations between Brazil and

Portugal. The partnership aims to reduce costs and improve customer

experience, enabling direct payments in reais. The launch is

scheduled for late 2024, marking another step in Mercado Bitcoin’s

international expansion.

The XRP token (COIN:XRPUSD) dropped about 12% in the last 24

hours after the SEC filed an appeal notice challenging the

favorable decision for Ripple. The sell-off increased due to

growing market pessimism, with the current price at $0.517, and a

potential return to the two-month low of $0.47. Indicators such as

the Relative Strength Index (RSI) and open interest suggest

continued selling pressure, pointing to a possible further

decline.

Bitcoin ETFs report net outflows of $52.9 million

On October 2, Bitcoin ETFs experienced a net outflow of $52.9

million. Ark’s (AMEX:ARKB) fund saw the largest loss, with $60.3

million in outflows, followed by BlackRock’s (NASDAQ:IBIT), which

recorded $13.7 million in outflows. However, Fidelity’s (AMEX:FBTC)

fund partially offset the losses with a $21.1 million inflow.

Meanwhile, Ethereum ETFs saw a total inflow of $19.8 million, with

BlackRock’s (NASDAQ:ETHA) fund adding $18 million.

Bitcoin drops as traders anticipate October recovery

On Thursday, Bitcoin (COIN:BTCUSD) fell to a low of $59,954,

pressured by geopolitical uncertainty in the Middle East, currently

trading at $60,246.8, down -2.2% in the last 24 hours. Despite the

decline, some traders bought the dip, viewing $60,000 as a crucial

recovery point. Analysts are divided between further drops or a

reversal. While Toni Ghinea targets $56,000, others like CrypNuevo

expect a potential recovery with the return of the “Uptober rally,”

hoping for a surge by month’s end. Data from CryptoQuant shows

whales continue accumulating Bitcoin, signaling optimism for a

potential future rise, while rising tensions between Iran and

Israel limit risk asset recovery.

Franklin Templeton files for index ETF combining Bitcoin and

Ethereum

Franklin Templeton has filed a proposal with the SEC for an ETF

combining Bitcoin (COIN:BTCUSD) and Ethereum (COIN:ETHUSD). If

approved, the fund will allow investors indirect exposure to both

cryptocurrencies without needing to purchase them directly. The

ETF, to be custodied by BNY Mellon (NYSE:BK) and Coinbase

(NASDAQ:COIN), aims to mitigate digital asset volatility.

Vitalik Buterin proposes lowering minimum staking deposit for

Ethereum

Vitalik Buterin suggested in a post on X reducing the minimum

staking deposit from 32 ETH to either 16 or 24 ETH to make solo

staking more accessible on Ethereum (COIN:ETHUSD). He argues the

current threshold is a barrier for many, and reducing it would

expand participation. The co-founder also envisions this

requirement further decreasing to 1 ETH in the future with network

improvements like PeerDAS. The proposal aims to increase

decentralization and reduce staking concentration, currently

dominated by large providers like Lido.

Aptos Labs acquires HashPalette to expand presence in Asia

Aptos Labs (COIN:APTUSD) announced the acquisition of Japanese

NFT provider HashPalette in a strategic move to expand its presence

in Asia. HashPalette will become a wholly-owned subsidiary of

Aptos, with its Palette Chain migrating to the Aptos Network. This

acquisition will enable Aptos to leverage Japanese partnerships and

strengthen its support for local developers and creators.

Metaplanet increases Bitcoin reserves with options strategy

Metaplanet, listed in Tokyo, increased its Bitcoin holdings to

530,717 BTC, valued at $32.4 million, after selling 223 Bitcoin put

options with a strike price of $62,000. The company generated

23,972 BTC ($1.46 million) through this transaction, collaborating

with QCP Capital. CEO Simon Gerovich highlighted that Bitcoin’s

volatility offers opportunities to grow their reserves, using

options strategies to generate yield without increasing financial

risk.

Visa launches VTAP platform for managing digital assets

Visa (NYSE:V) announced the Visa Tokenized Asset Platform

(VTAP), developed to facilitate the issuance and management of

tokenized assets, such as stablecoins and central bank digital

currencies (CBDCs). Currently in testing, with institutions like

BBVA participating, the platform will enable banks and

institutional investors to issue, transfer, and settle digital

assets on public and permissioned blockchains. Visa plans to launch

a live pilot in 2025, using the Ethereum blockchain, aiming to

efficiently and securely integrate blockchain technology into

banking operations.

SWIFT to begin testing digital assets in 2025

SWIFT announced that banks in North America, Europe, and Asia

will participate in digital asset testing in 2025. The tests,

focusing on transactions involving multiple currencies and digital

assets, aim to provide unified access to multiple asset classes.

SWIFT seeks to address fragmentation in the digital asset landscape

by connecting disparate networks and fiat currencies, facilitating

seamless transactions. The goal is to integrate traditional forms

of value with new technologies like blockchain and CBDCs into a

globally interconnected network.

Binance Labs invests in layer 2 network Sophon

Binance Labs invested in Sophon, a layer 2 network based on

ZKsync. The undisclosed investment brings Sophon’s total funding to

over $70 million. Sophon aims to create a consumer-focused web3

ecosystem, encompassing applications like gaming, social networks,

and ticketing. The Sophon mainnet is set to launch soon, along with

its native SOPH token, consolidating its focus on integrated and

engaging experiences.

Perfctl: Stealth malware targets Linux servers for crypto mining

According to The Hacker News, perfctl malware is being used to

attack Linux servers, conducting crypto mining and proxyjacking

stealthily. It exploits the Polkit vulnerability (CVE-2021-4043) to

gain root privileges, avoiding detection by masquerading as

legitimate processes. The malware operates silently, deleting its

binary after execution. Aqua researchers warn it pauses activity

when a user is active on the server but resumes when the system is

idle. To mitigate the risk, systems should be kept up-to-date, and

abnormal CPU spikes should be monitored.

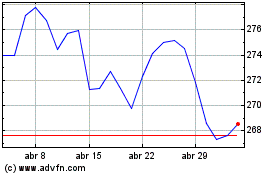

Visa (NYSE:V)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Visa (NYSE:V)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024