Bitcoin surpasses $62K

Bitcoin (COIN:BTCUSD) briefly fell below $59,000 last night

before quickly recovering to $61,000, forming a “V” pattern.

Historical data shows that these 30-minute recoveries often precede

larger gains or stable trading, with few subsequent drops. This

quick recovery has been repeatedly observed since August,

indicating stability or potential upward momentum.

Bitcoin’s price continued to climb, trading at $62,771.01, a

4.1% increase over the past 24 hours. The Producer Price Index

(PPI) remained unchanged in September, with an annual increase of

1.8%, indicating easing inflation. Excluding food and energy, the

PPI rose 0.2%. Although inflation has slowed, it remains above the

Fed’s target, suggesting further interest rate adjustments.

The Fed’s November decision could still impact the market.

Additionally, industry professionals believe that Bitcoin will

continue to surprise investors as global wealth managers allocate

more funds to the asset.

For example, the Japanese company Metaplanet acquired 108.999

BTC on October 11, increasing its total holdings to 748.502 BTC,

valued at $46.8 million. This was the company’s third Bitcoin

purchase in October, part of its aggressive accumulation strategy.

Despite facing a slight loss with an average acquisition price of

$62,504, Metaplanet’s stock has surged 500% this year.

Dylan LeClaire of Metaplanet and Pierre Rochard of Riot

Platforms (NASDAQ:RIOT) state that Bitcoin adoption is still below

1% globally. Rochard mentioned that despite the narrative that

Bitcoin’s gains are a thing of the past, the asset has a promising

future. Both predict a “crazy decade” ahead for BTC, with

increasing institutional acceptance.

Justin Sun elected Prime Minister of micronation Liberland

The founder of Tron (COIN:TRXUSD), Justin Sun, was elected Prime

Minister of Liberland, a micronation located between Croatia and

Serbia, after the October 5 elections. The voting was conducted

entirely algorithmically, ensuring transparency in the results. Sun

will be joined in Congress by entrepreneurs and public figures like

Evan Luthra and Ivan Pernar. Liberland aims to be a pioneering

example of how blockchain can revolutionize electoral processes and

governance in micronations.

Fidelity Investments reports data breach affecting 77,000 clients

Fidelity Investments, a cryptocurrency fund and ETF manager,

reported a data breach that compromised personal information of

77,099 clients between August 17 and 19. While no accounts were

accessed, names and other identifiers were exposed. Fidelity hired

external specialists to resolve the issue and is offering two years

of free credit monitoring. This is the company’s fourth breach in

the last 12 months. The breach was detected and closed on August

19.

FBI uses fake cryptocurrency to catch fraudsters

The FBI created a fake cryptocurrency called NexFundAI (NEXF) as

part of an operation to capture alleged market manipulators. The

fraudsters offered to manipulate the token’s trading volume, making

it appear more popular. With the collected evidence, the FBI

charged them with conspiracy to commit market fraud. Zhou, founder

of MyTrade MM, and two other participants face up to five years in

prison for their fraudulent activities involving wash trading and

market manipulation.

Binance criticizes Nigerian court decision to deny executive bail

Tigran Gambaryan, a Binance executive, was denied bail by a

Nigerian judge, despite his deteriorating health after more than

220 days in detention. Binance expressed disappointment with the

court’s decision, highlighting the urgent need for medical

treatment that cannot be provided in prison. The court rejected the

request citing procedural issues, stating that local hospitals

could manage his health. Gambaryan faces money laundering charges,

and his family fears his worsening condition, including

complications from a herniated disc. Binance insists he is not a

decision-maker and demands his release.

Mt. Gox delays creditor payouts until 2025

The Mt. Gox trustee postponed the deadline for distributing

remaining assets to creditors to October 31, 2025, following delays

in the process. The exchange, which collapsed in 2014, began $9

billion payouts in July but still holds 44,900 bitcoins. The delay

may ease short-term concerns about the market impact, which could

cause volatility once these funds begin moving again

Prosecutors seek 18-month prison sentence for Heather Morgan over

stolen Bitcoin laundering

US prosecutors have requested an 18-month prison sentence for

Heather Morgan, known as “Razzlekhan,” for her role in laundering

120,000 stolen Bitcoins from Bitfinex in 2016. Morgan cooperated

with the investigations and was considered a minor participant

compared to her husband, Ilya Lichtenstein, who admitted

responsibility for the hack. Morgan pleaded guilty to money

laundering and fraud in August 2023 and faces a maximum sentence of

10 years.

FTX client sues Olympus Peak over withheld payments

Alexander Nikolas Gierczyk, a former FTX client, is suing the

Olympus Peak fund for failing to meet payments in a bankruptcy

claim he sold at a 42% discount. The deal included a recovery

clause if the claim paid above face value. Gierczyk alleges that

Olympus Peak refused to honor the agreement, despite expectations

of payments as high as 146% of the claim’s value, as per FTX’s

bankruptcy declaration.

NFT holders sue gallery over unfulfilled promises

A group of 36 NFT holders is suing Eden Gallery and artist Gal

Yosef, alleging that the Meta Eagle Club project failed to deliver

promised perks, such as access to a private metaverse club. The

12,000 NFT collection raised $13 million, but the plaintiffs claim

that the promised benefits, including exclusive events, were not

fulfilled. They seek compensation for fraud and unjust enrichment,

alleging the NFTs have lost value.

Ripple files cross-appeal in battle with SEC

Ripple filed a cross-appeal to challenge parts of the previous

court ruling, aiming to close the legal dispute with the SEC, which

accuses it of selling XRP tokens (COIN:XRPUSD) as unregistered

securities. Despite having an advantage, Ripple seeks to ensure no

legal issues remain. The SEC appealed to overturn the initial

ruling that did not classify XRP sales as investment contracts,

reigniting the legal battle.

UNI token rises 15% after Unichain launch

Uniswap’s (COIN:UNIUSD) governance token rose about 15% on

October 10 following the launch of its layer 2 network, Unichain.

UNI has seen a 20.1% increase in the past week and 16.2% in the

last 30 days. Trading volume surged over 400%, reaching $583.2

million. Unichain aims to provide faster, cheaper transactions and

enhance interoperability between blockchain networks.

Josh Jarrett sues IRS over staking token taxation

Josh Jarrett, known for his involvement with Tezos

(COIN:XTZUSD), has filed a new lawsuit against the IRS, challenging

the rule that treats staking rewards as income in the year they are

accrued. With support from Coin Center, Jarrett seeks an injunction

to have tokens considered property, taxed only upon sale. He also

requests a $12,179 refund for taxes paid on Tezos tokens in 2020.

The lawsuit sets a favorable precedent for proof-of-stake network

participants.

Ethereum needs to rediscover its original focus

Ethereum (COIN:ETHUSD) has evolved as the foundation of

thousands of decentralized applications since 2015, but has lost

focus by trying to compete with Bitcoin (COIN:BTCUSD) and Solana

(COIN:SOLUSD). Although its infrastructure is advancing slowly,

Ethereum must return to its original vision of being the World

Computer. Prioritizing long-term upgrades, like The Purge and

future scalability improvements, will help Ethereum maintain

relevance and ensure the decentralization and scalability necessary

to fulfill its global role.

Blockchain brings transparency to digital advertising

Digital advertising faces a trust crisis, with hidden deals and

limited transparency. Advertisers lose up to 47% of their budgets

in intermediary fees, while publishers sell below fair value.

Blockchain offers a solution by providing transparency, eliminating

fraud and middlemen, and ensuring every transaction is verified.

Additionally, it guarantees fair compensation for publishers and

user participation. Despite hesitance from big brands, blockchain

could revolutionize the advertising sector by enhancing efficiency

and trust.

DePIN: a silent revolution in emerging markets

DePIN decentralizes cloud computing, creating a new economic

model where node operators earn by providing accessible and

transparent services. This innovation is emerging in developing

markets, empowering local startups and enabling small profitable

operators to offer infrastructure solutions. Examples like the

Helium network in Africa demonstrate how DePIN can improve local

lives. Though still unknown to many, this revolution may transform

the global digital economy, starting with local needs.

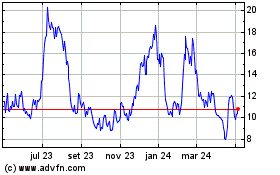

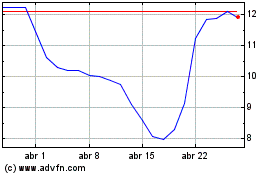

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024