Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC is planning new factories in Europe focused on AI

chips after starting construction on its first plant in Dresden,

Germany. According to Wu Cheng-wen of TSMC, the company is

considering further expansion in Europe, but there is no specific

timeline. TSMC is already investing $65 billion in three factories

in Arizona, but most of its production will remain in Taiwan. TSMC

is set to release its earnings report on Thursday morning.

According to LSEG, TSMC is expected to report a 40% increase in

third-quarter profit due to high demand for AI chips, with

estimated net income of $9.27 billion (T$ 298.2 billion). The stock

rose 0.3% in pre-market trading after closing 2.7% higher on

Friday.

Boeing (NYSE:BA) – Boeing will cut 17,000 jobs,

about 10% of its global workforce, due to the ongoing strike. The

company will also delay the delivery of the 777X jet until 2026 and

record a $5 billion loss in the third quarter, facing financial and

production challenges. Under new leadership from Kelly Ortberg, the

company is restructuring but faces financial hurdles, including

potential credit downgrades. The stock dropped 1.5% in pre-market

trading after closing down 3% on Friday.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway increased its stake in Sirius XM, purchasing 3.6 million

shares for $87 million, raising its total stake to 32%. Although

Sirius XM shares have fallen 55% this year, Berkshire continues to

invest despite concerns over subscribers, stagnant revenue, and

high company debt. BRK.B shares rose 0.4% in pre-market trading

after closing 1.2% higher on Friday.

Alphabet (NASDAQ:GOOGL) – Google has requested

a federal judge in California to suspend a court order requiring

greater competition in its Play app store. The tech giant argues

that the measure, which takes effect on November 1, would harm the

company and pose security and privacy risks on Android. Shares rose

0.1% in pre-market trading after closing 0.7% higher on Friday.

Nvidia (NASDAQ:NVDA),

Accenture (NYSE:ACN) – Nvidia made two significant

moves: it launched a 72-billion-parameter large language model,

NVLM, and formed a strategic partnership with Accenture for AI

services. The NVLM puts Nvidia in the open-source AI game, directly

competing with models from OpenAI, Meta, and Alphabet. Nvidia

shares rose 0.6% in pre-market trading after closing flat on

Friday.

Netflix (NASDAQ:NFLX) – Netflix shares have

surged 48.5% this year as the company cut costs, introduced ads,

and cracked down on password sharing. Analysts expect a

subscription price hike, driven by content releases like the second

season of “Squid Games” and events like live NFL games. Analysts

predict an 8% to 15% increase in the Standard plan. Shares rose

0.4% in pre-market trading after closing down 1.0% on Friday.

JFrog (NASDAQ:FROG) – JFrog has attracted

preliminary acquisition interest from private equity firms,

including Permira and Hellman & Friedman. However, there are no

guarantees this will result in a deal. JFrog has denied being in

any merger or acquisition talks, and its stock closed 4.5% higher

on Friday after news of the interest. Shares are stable in

pre-market trading.

Tesla (NASDAQ:TSLA) – Tesla shares closed down

8.8% on Friday after Elon Musk unveiled the Cybercab, a two-seater

sports robotaxi from Tesla, causing confusion among analysts and

investors. They questioned the limited design and lack of financial

details. With production set for 2026, the model may not meet

market demand, as two-door vehicles are unpopular in the U.S.

Shares rose 1.6% in pre-market trading.

Stellantis NV (NYSE:STLA) – Carlos Tavares, CEO

of Stellantis, will be actively participating in the Paris Auto

Show with a busy schedule of public events. Tavares faces

challenges following a profit warning and a 45% drop in shares in

2024. The company is dealing with operational issues in the U.S.,

such as high prices and accumulated stock. Tavares aims to turn

things around before his retirement in 2026, amid growing

competition and internal reorganization. He recently stated that

France’s planned corporate tax hike will hurt investments in the

country, costing Stellantis “millions of euros,” though the company

can absorb the impact. Tavares also warned that tax hikes for the

wealthy could cause skilled talent to leave. Shares are stable in

pre-market trading after closing down 2.2% on Friday.

Fisker (USOTC:FSRNQ) – Electric vehicle startup

Fisker received court approval for its liquidation plan after

securing the sale of 3,000 Ocean SUVs for $46 million. Fisker filed

for bankruptcy in June due to cash flow problems, halting

production. American Lease will buy the fleet and pay $2.5 million

for support services.

Plug Power (NASDAQ:PLUG) – Plug Power shares

closed 7.6% higher on Friday after Norway’s central bank, Norges

Bank, increased its stake to 88 million shares, about 8% of the

total. The bank’s interest, known for investing in sustainability,

boosted confidence in the hydrogen fuel cell maker, which faces

challenges in developing low-cost technology. Shares dropped 1.4%

in pre-market trading.

Kinder Morgan (NYSE:KMI) – A U.S. appeals court

has suspended approvals for the construction of a 32-mile pipeline

in Tennessee by Kinder Morgan after a request from environmental

groups. The decision was made to give the court time to assess

claims that the project could cause environmental harm, with new

arguments in December. Shares dropped 0.2% in pre-market trading

after closing down 4.1% on Friday.

Honeywell (NASDAQ:HON) – Private equity firm

Odyssey is in advanced talks to acquire Honeywell’s face mask unit,

according to Bloomberg News. The deal could value Honeywell’s

personal protective equipment (PPE) division at approximately $1.5

billion.

Mitsubishi UFJ Financial Group (NYSE:MUFG) –

Mitsubishi UFJ Financial Group’s trust banking arm plans to launch

three funds worth up to $670.6 million (100 billion yen) in 2024 to

offer loans to businesses, according to Nikkei. These funds will

seek financing from insurers and pension funds for mergers,

acquisitions, and infrastructure projects, meeting the growing

demand for alternative financing. Shares closed 3.2% higher on

Friday.

Bain Capital (NYSE:BCSF) – Bain Capital made a

binding offer of 9,450 yen per share to buy Fuji Soft, valuing the

company at $4 billion, outbidding KKR’s offer by 7%. Bain plans to

launch the offer soon, while KKR argues its proposal is more

advantageous for the company.

Charles Schwab (NYSE:SCHW), Ally

Financial (NYSE:ALLY), UMB Financial

Corp. (NASDAQ:UMBF), KeyCorp (NYSE:KEY) –

The Federal Open Market Committee cut the federal funds rate in

September, but the effects on banks will take time to appear. By

2025, banks like Charles Schwab, Ally Financial, UMB Financial, and

KeyCorp are expected to improve their net interest margins as

interest rates decline and bond yields rise. Schwab shares rose

0.5% in pre-market trading after closing up 1.6% on Friday.

Citigroup (NYSE:C) – Citigroup has hired two

senior bankers from JPMorgan for its markets team in Asia. Anand

Goyal was appointed head of institutional FX sales for several

Asian regions and will be based in Singapore. Hooi Wan Ng was named

head of markets for Malaysia, reporting to Citi’s regional

leaders.

CVS Health (NYSE:CVS) – CVS Health announced

that it is exiting the infusion services business and plans to

close or sell 29 regional pharmacies in the coming months. The

company stopped accepting new patients on October 8, transferring

current ones to other providers. The move does not affect its

corporate job cut forecast. Shares rose 0.3% in pre-market trading

after closing down 0.3% on Friday.

Pfizer (NYSE:PFE) – Pfizer received approval

for hympavzi, the first anti-tissue factor inhibitor authorized for

hemophilia A or B without inhibitors. Administered weekly via

autoinjector pen, it significantly reduces bleeding and the need

for constant infusions, benefiting especially hemophilia B

patients, who have fewer treatment options available.

GSK Plc (NYSE:GSK) – GSK’s experimental drug,

depemokimab, showed promising results in advanced trials for

treating chronic rhinosinusitis with nasal polyps, a condition that

affects up to 4% of the population. The drug reduced nasal

obstruction and polyp size, boosting GSK’s growth prospects, with

launches expected by 2027. Shares rose 0.9% in pre-market trading

after closing down 1.0% on Friday.

Unilever (NYSE:UL) – Elon Musk’s X platform has

dropped Unilever from a lawsuit alleging a conspiracy to boycott

the platform, causing revenue loss. The two companies reached a

settlement, with Unilever stating that X would meet its

responsibility standards. X continues to pursue its claims against

other defendants in the case.

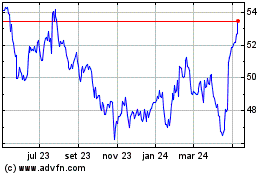

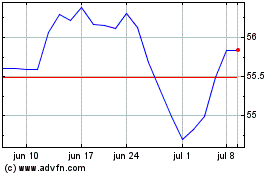

Unilever (NYSE:UL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Unilever (NYSE:UL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024